My Third Stimulus Payment Was Too Low

Many individuals and families will find that their third stimulus checks are lower than they thought. That could be because people who make over a certain amount have part of the $1,400 payment taken away. For example, single people who make over $75,000 in adjusted gross income will have their second stimulus checks reduced by 28% of the income over $75,000. Married people filing jointly and heads of household will have their payments reduced by a similar amount.

The third stimulus payment is technically based on your 2021 income, but the IRS is using your 2020 tax return to estimate it. If your income goes down in 2021, making you eligible for a payment, or a higher payment, you’ll be able to file a tax return for your 2021 taxes and you’ll receive the stimulus money you didn’t getâit’s called a recovery rebate credit.

Still Waiting For Your $1400 Stimulus Payment Here’s How To Request An Irs Trace To Track It

We’ll show you how to find your missing stimulus check from the IRS.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

Is it time to start worrying about the missing stimulus check that you qualify for? The IRS has made more than 167 million payments since March — with a new batch of checking going out each week. If you think your $1,400 payment is lost or never sent — maybe you received a letter telling you the IRS sent your payment but you’ve not received it — you may need help trying to track it down. The same goes for the first and second payments from 2020.

It’s possible there’s an issue with your check, or the IRS could have the wrong mailing address on file. Another reason why you may want to track down your payment is if you received less than the amount expected and you’re owed a “plus-up” payment. By the way, in that case, you do not need to file an amended tax form.

Do You Need To Apply For The Rebates

If you filed your state taxes, primarily done through a 2021 IL-1040 form, then no further action is needed and the combined rebates will automatically be sent to you.

If you did not file a 2021 IL-1040, including those who were not required to, you have until October 17 to get it to the Illinois Department of Revenue .

- For the income tax rebate, if you have dependents, you must also complete / have completed a Schedule E/EIC.

- For the property tax rebate, you needed to have filed both the 2021 IL-1040 and a Schedule ICR. In lieu of those two documents, a special Property Tax Rebate form can be filed either electronically or through a paper submission. Instructions for the IL-1040-PTR can be found here.

Read Also: Irs.gov Stimulus Check 4th Round

You Won’t Get Any Payment If

If your adjusted gross income was $250,001 or higher as an individual, or $500,001 or higher as a couple.

A May Public Policy Institute of California survey of over 1,700 Californians found that 62% supported the state’s $18 billion inflation relief plan, the majority of which is going towards relief payments.

What If You Have Trouble With The Tool

To use the Get My Payment tool, you must first verify your identity by answering security questions. If the information you enter does not match IRS records, you will receive an error message. To avoid this:

- Double-check the information requested

- Make sure what you enter is accurate

- Try entering your street address in a different way and

- Use the US Postal Services ZIP Lookup tool to look up the standard version of your address, and enter it into exactly as it appears on file with the Postal Service.

If your answers do not match the IRS records three times, youll be locked out of Get My Payment for security reasons. If that happens, you must wait 24 hours and try again. If you cant verify your identity, you wont be able to use Get My Payment. Unfortunately, theres no fix for that: the IRS says not to not contact them.

However, if you verified your identity and received Payment Status Not Available, this means that the IRS cannot determine your eligibility for a payment right now. There are several reasons this could happen, including:

- You didnt file either a 2018 or 2019 tax return or

- Your recently filed return has not been fully processed.

Again, the IRS says theres no fix for that and you should not contact them.

Recommended Reading: Update On 4th Stimulus Check For Ssi

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Whether To File Another Irs Form

As was the case with the first and second check, if you filed a 2018, 2019 or 2020 tax return or receive government benefits, the IRS should automatically send your third check without you having to do anything.

If, however, you’re a nonfiler, a US citizen or permanent resident, had a gross income in 2019 under $12,200 — or $24,400 as a married couple — and didn’t file a return for 2018 or 2019, you may need to give the IRS a bit of information before it can process your payment. Since the IRS’ Non-Filers tool is now closed, you may need to file for that money on a 2021 tax return in the form of a recovery rebate credit, described above.

Here’s more information about who should file an amended tax form and who shouldn’t.

Receiving your stimulus check money isn’t always easy.

Recommended Reading: Are There Any More Stimulus Payments Coming

Get My Payment Says Payment Issued But I Haven’t Received It

The IRS says that it may take three to four weeks to receive a check after it’s mailed. If it has been weeks since the Get My Payment tool says the payment was mailed, and you haven’t received it, you can request a payment trace. The IRS will research what happened to your check if the check wasn’t cashed, you will need to claim the “Recovery Rebate Credit” on your next tax return. If the IRS finds that the check was cashed, you’ll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

Similarly, if the Get My Payment tool says your payment was direct-deposited, but the money doesn’t show in your bank account after five days, first check with your bank. If the bank says it hasn’t received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.

How Do I Receive The Illinois Tax Rebate

Those who filed a 2021 IL-1040 and Schedule ICR will automatically receive the property tax rebate, while a filing of the IL-1040 is all that is needed for an income tax rebate. Those who have dependents, however, will also need to complete a Schedule Illinois Exemption and Earned Income Credit for the income tax rebate.

The rebates are paid automatically to taxpayers and will be distributed in the same way as the original income tax refunds. However, if a taxpayer did not receive an income tax return, the rebate will be sent via paper check to their most current address.

While the rebates are being distributed, the deadline for these forms has not passed. Until Oct. 17, taxpayers can submit their IL-1040 either electronically or by paper and mailing it to the Illinois Department of Revenue.

Contact Patrick Keck: 312-549-9340, [email protected], twitter.com/@pkeckreporter

Don’t Miss: When Do We Get The Next Stimulus Checks

What If You Have Changed Your Address Or Bank Account

The IRS will use the data already in its systems to send the new payments:

- If your direct deposit information is on file, you will receive the payment that way.

- If your direct deposit information is not on file, you will receive the payment as a check or debit card in the mail.

Some payments may have been sent to an account that may be closed or no longer active. By law, the financial institution must return the payment to the IRS, they cannot hold and issue the payment to an individual when the account is no longer active.

The IRS cannot change payment information, including bank account or mailing information. If an eligible taxpayer does not get a payment or it is less than expected, it may be claimed on the 2020 tax return as the Recovery Rebate Credit. Remember, Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR.

If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

Read Also: What Was The 2021 Stimulus Check

What Ssi Ssdi And Veteran Beneficiaries Need To Know

The IRS began sending out stimulus checks for Social Security beneficiaries, including those who are part of the SSI and SSDI programs, on April 7. It began sending payments to people who receive veteran benefits and don’t typically file taxes on April 14. If you’re part of one of these groups and haven’t gotten your check yet, it may be on the way soon.

The Social Security Administration has also advised people not to contact the SSA about problems. It’s possible you may need to use one of the strategies above, depending on what the trouble is.

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If you’re eligible and didn’t get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but you’ll need to file a tax return.

Don’t Miss: Irs Fourth Stimulus Checks Update

Have You Received Your Money How To Check The Status Of Your Illinois Tax Rebate

Illinois’ rollout of property and income tax rebates, where millions of Illinois taxpayers are eligible, began earlier this month and is expected to continue in the weeks to come.

My office will be working diligently to get these rebates into the hands of taxpayers,” Illinois Comptroller Susana Mendoza said in a statement once rebates began to be sent on Sept. 12. “After all, it’s your money. A total of $1.2 billion dollars will be released over the next six to eight weeks to nearly six million taxpayers.

So far two million have received their rebates as of Thursday, according to the state comptroller’s office leaving 4 million Illinoisans still waiting.

Who Will Get A Debit Card In The Mail

Taxpayers who included their addresses but no bank account data will receive a debit card. Others who will receive a debt card include:

- People who filed paper returns

- Those who owed taxes from their 2020 returns

- Taxpayers received a direct deposit for their 2020 refunds but who have since changed their bank accounts or switched banks

- People who received an advance payment from their tax service provider, or who paid their tax preparer fees using their tax refund.

Don’t Miss: How Are Stimulus Checks Distributed

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

I Received A Second Payment But My Spouse Didn’t

There have been cases where a couple submit their tax returns as “married filing jointly,” and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRS’s part. Unfortunately, the spouse who didn’t receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Don’t Miss: Are They Sending Out Stimulus Checks

How Can You Request An Irs Trace For Missing Stimulus Money

To request a payment trace, call the IRS at 800-919-9835 or mail or fax a completed Form 3911, Taxpayer Statement Regarding Refund . Note: If you call the number, you’ll have to listen through the recorded content before you can connect with an agent.

To complete Form 3911 for your third stimulus check, the IRS provides the following instructions:

1. Write “EIP3” on the top of the form

2. Complete the form answering all refund questions as they relate to your payment.

3. When completing item 7 under Section 1:

- Check the box for “Individual” as the Type ofreturn.

- Enter “2021” as the TaxPeriod.

- Do not write anything for the DateFiled.

- Sign the form. If you’re married and filing together, both spouses must sign the form.

You should not mail Form 3911 if you’ve already requested a trace by phone. And the IRS said you should not request a payment trace to determine if you were eligible to get a check or confirm the amount you should have received.

How Can You Check On The Status Of A Missing Stimulus Payment

It’s easy to check the status of your third stimulus check through the Get My Payment tool. You’ll need to request a payment trace if the IRS portal shows your payment was issued but you haven’t received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

Also Check: Who Can I Call To Get My Stimulus Check

Can I Track My Stimulus Check

Yes. Just like the IRS typically allows you to track your tax refund, you can now know where your stimulus payment is.

On April 15, the IRS launched the Get My Payment application. With Get My Payment, people are able to check their payment status, confirm whether they’re getting it via direct deposit or check, and enter their bank account information. In order to track the payment, you’ll need to input your Social Security number, date of birth, street address and zip code.

If the Get May Payment app returns a message about how your payment status is not available, it may not have your information uploaded, the IRS may not have processed your 2019 tax return, or you may not be eligible for a stimulus check.

Get My Payment is updated once a day with fresh data.

Wondering Where The Latest Economic Impact Payment Is Heres How To Track Your Stimulus Check And What To Do If You Have Problems

Almost everyone who is eligible has received the first and second rounds of the U.S. governmentâs economic impact payments, or âstimulus funds.â But the third roundâpart of the American Rescue Plan Act of 2021âmay provide additional relief to eligible individuals.

The IRS started processing payments in mid-March. Your payment might already be in your account or on its way. But if itâs not, donât worry. The funds could take time to roll out. Hereâs how you can check the status of your payment.

You May Like: Irs.gov Stimulus Check Deceased Person

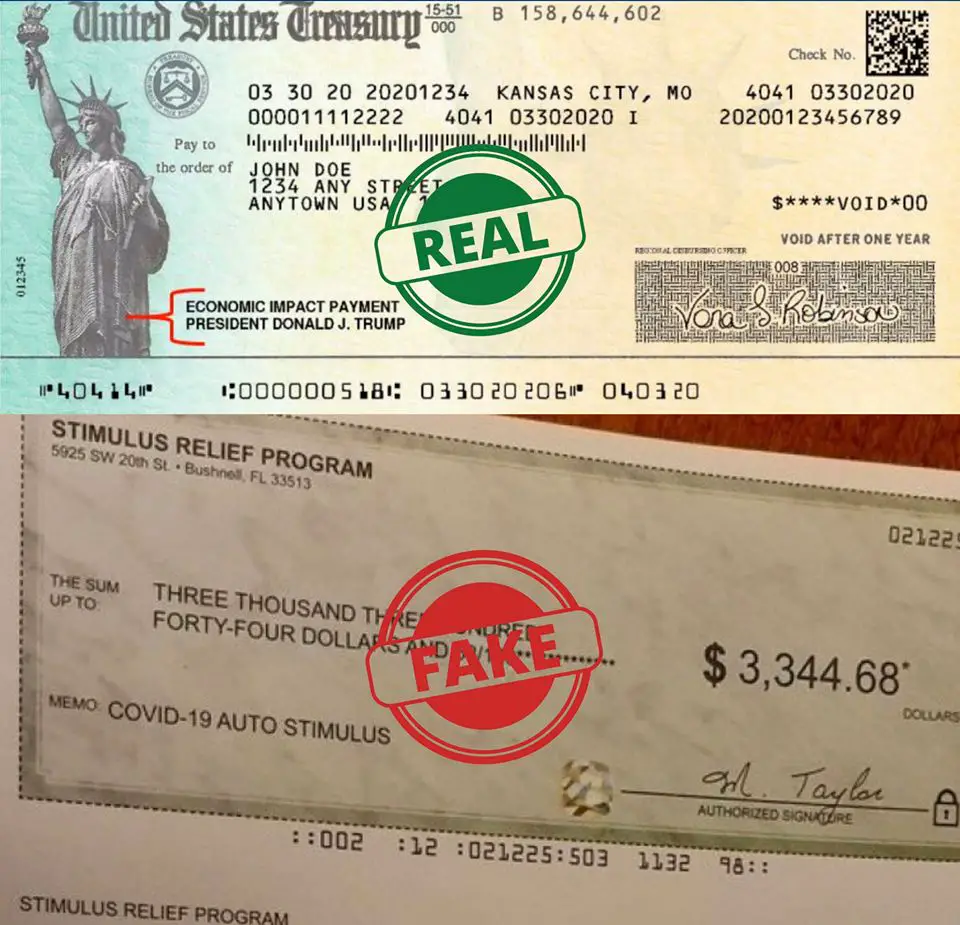

What If You Got An Irs Letter In The Mail But No Payment

About 15 days after the IRS sends your third stimulus check , you should get a letter from the agency confirming your payment. The IRS is still sending these letters for the third payment.

If you received this letter — also called Notice 1444, Your Economic Impact Payment — but you never got your payment, you’ll need to request a payment trace. Make sure you keep the letter because you’ll need the information to file your claim. The same is true for the first and second stimulus checks as well.

When Are Stimulus Checks Being Sent Out

Here’s the rough schedule so far, courtesy of a House Committee on Ways and Means memo:

- week of April 13: the IRS will send out 60 million payments to taxpayers for whom it has direct deposit information from their 2018 or 2019 tax returns

- late April: the IRS will do a “second run of payments” to Social Security beneficiaries who didn’t file tax returns in 2018 or 2019 but do have direct deposit on file

- week of May 4: the IRS will start mailing paper checks at a rate of 5 million per week â a process that could last up to 20 weeks

Also Check: Irs Social Security Stimulus Checks Direct Deposit