Can I Track My California Inflation Relief Check

The short answer: no. But you can probably narrow down your timeline a bit.

If you filed your taxes online and also received the Golden State Stimulus you may have already gotten your relief. If you dont meet both of those criteria, youre going to have to wait longer.

Remember, debit cards are being dispersed based off order of last names, so if youve been blessed with an A-B-C name, you wont have to wait as long as the X-Y-Z crowd.

And if youve changed your banking info since your 2020 return was filed youre in for a long wait. That group will be the last to get their payment.

For a more detailed breakdown, .

The state hopes to have everyones payments sent out by mid-January.

Copyright 2022 Nexstar Media Inc. All rights reserved. This material may not be published, broadcast, rewritten, or redistributed.

Amount Based On 2019 Or 2020 Tax Return

For third-round stimulus payments, eligibility and amounts were based on either your 2019 or 2020 return. If your 2020 tax return wasn’t filed and processed by the IRS by the time the tax agency started processing your third stimulus payment, then the IRS used information from your 2019 tax return. If your 2020 return was already filed and processed when the IRS was ready to send your payment, then your stimulus check eligibility and amount was based on the information on your 2020 return. If your 2020 return was filed and/or processed after the IRS sent you a third stimulus check, but before December 1, 2021, the IRS sent you a second “plus-up” payment for the difference between what your payment should have been if based on your 2020 return and the payment actually sent based on your 2019 return. As a result, your third stimulus check may have been higher or lower depending on when you filed your 2020 tax return.

Eligibility For A ‘plus

You can estimate how much money the IRS owes your household for the third stimulus check. Just make sure to triple-check that you meet the qualifications, including the income limits.

Because of the overlap with tax season 2020, many people may receive some, but not all, of their allotted amount. If your income changed in 2020, in some cases, the IRS may owe you more money than you received if the income figure used to calculate your payment from your tax returns in 2018 or 2019 is less in 2020. Likewise, if you now have a new dependent, such as a new baby, you may be owed more money.

The IRS is automatically sending “plus-up payments” to make up the difference. If you don’t get one, you may need to claim the missing money another way later in 2021 or even in 2022, since tax season is officially over now.

You May Like: How To Check Stimulus Payment History

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Will There Be A Fourth Stimulus Check

Probably not. Although a group of more than 60 Democratic lawmakers have signed a letter urging Biden to consider sending more direct payments to individuals, there has been no indication from him that he is considering more direct relief to Americans.

Instead, Biden has released his plans for trillions in spending for other priorities through the American Jobs Plan and American Families Plan, which provide funding for paid family leave, housing, child care, infrastructure improvements and more. We will be following the situation closely and updating you every step of the way.

Read Also: Do You Pay Taxes On Stimulus Checks 2021

Can You Get A Recovery Rebate Credit If You Got Your Third Check

In a very specific circumstance, people who receive the third stimulus check may still be able to claim the Recovery Rebate Credit on their taxes. The amount of money each taxpayer received in their Economic Impact Payment was calculated based on the number of dependents in their household on their 2019 taxes. If the household gained a new dependent by the 2020 tax filing season, the taxpayer would be eligible to receive a plus-up payment. This would bring their original check amount in line with what they wouldve been eligible for if their new dependent had been accounted for initially.

For example, a married couple who had a baby in 2020 may have initially received a $2,800 third stimulus check $1,400 for each spouse. They wouldve become eligible for a plus-up payment of $1,400 due to the 2020 birth of their baby. If they didnt receive a plus-up payment by the end of December 2021, they could claim a $1,400 Recovery Rebate Credit on their 2021 taxes.

Many Americans didnt receive third stimulus checks. In some cases, it was because they filed their 2020 taxes late. In other cases, the IRS simply didnt get to them in time. Either way, all eligible taxpayers who havent received third stimulus checks can take action by claiming the 2021 Recovery Rebate Credit on their 2021 taxes.

What To Do About A Missing Or Stolen Eip Debit Card

At least 5 million people will receive their third stimulus check on a prepaid debit card called the Economic Impact Payment Card, instead of a paper check. For the third payment, the EIP card arrives in a white envelope sent from “Economic Impact Payment Card.” The letter will have a US Department of the Treasury seal.

The card has the Visa name on the front and the issuing bank, MetaBank®, N.A., on the back. Information included with the EIP Card explains that this is your Economic Impact Payment. If you receive an EIP Card, visit EIPcard.com for more information.

If you’ve misplaced or thrown away your card, the EIP card service has an FAQ on what to do if your card is lost or stolen. You can also call 800-240-8100 to request a replacement. It’s free, according to a spokesperson for the Treasury Department. To request a new card, press option 2 when prompted.

However, the EIP card website says, “Your Card will be deactivated to prevent anyone from using it and a new replacement Card will be ordered. Fees may apply.” We recommend calling the above number for a lost or stolen card and speaking to a representative. If you may have lost or thrown away a paper check, read the mail fraud section below.

Recommended Reading: When Did The Stimulus Checks Go Out In 2021

My Stimulus Payment Went To The Wrong Bank Account

If the Get My Payment tool tells you your check will be direct-deposited, it will also provide the last four digits of the number of the bank account into which your stimulus payment will be deposited. For the initial checks, some individuals saw that their deposit was going to an old bank account, or they even saw bank account numbers that they didnt recognize. Heres what to do:

- If the tool says that your payment was deposited into your bank account but you havent seen it yet, your bank may still be processing it.

- You wont necessarily get the third check direct deposited, even if the first or second one was direct deposited.

- If your third stimulus payment is sent to a closed bank account, the bank is required to transfer the money back to the IRS. The IRS will not redeposit it to you or mail you a paper check. Instead, you will have to file your 2021 tax return to claim your Recovery Rebate Credit. See below for instructions on claiming the rebate on your tax return.

- If H& R Block submitted your last tax return and you signed up for a refund transfer, the IRS might deposit your stimulus payment with H& R Block . H& R Block should transfer the money to your bank account within 24 hours.

- Those who submitted their last tax return with Turbo Tax should receive their payments in the same bank accounts through which they received their tax refunds.

Dont Miss: Amount Of Third Stimulus Check

Requirements To Receive The Third Stimulus Check

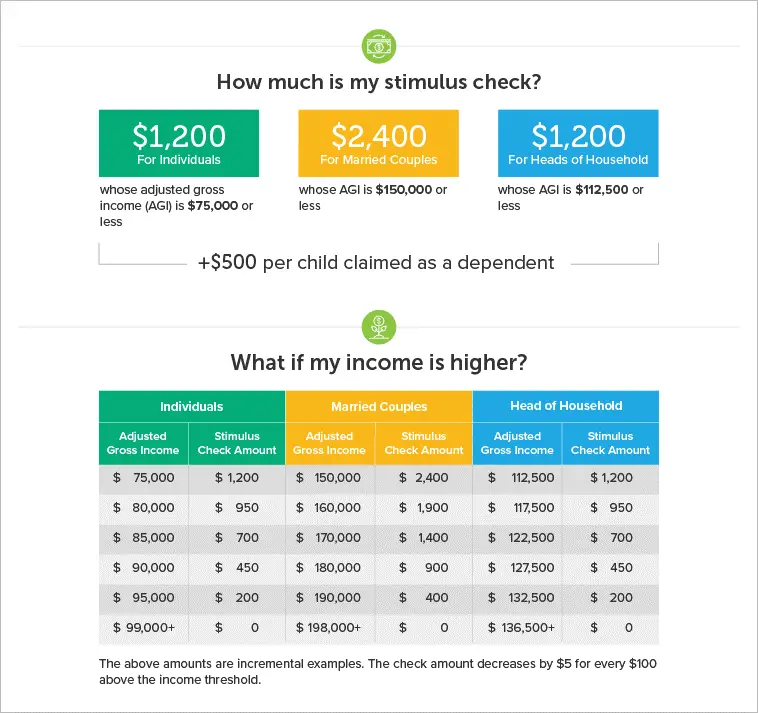

In general, low- and middle-income US citizens are eligible. As established by the IRS, this help is intended for people who earn less than $75,000 of adjusted gross income, heads of households who earn less than $112,500 and married couples who file jointly who earn less than $150,000 . The amount is $1,400 per person plus $1,400 per dependent.

If you will be filing your return with the IRS, we recommend having your IRS 144-C notice, IRS letter 6475 handy, or logging into your IRS account.

Don’t Miss: How To Find Stimulus Check History

When Will Your Stimulus Check Arrive

The stimulus payments are being distributed to taxpayers either by direct deposit or by paper checks or debit cards arriving by mail. If youve been paying your taxes via direct deposit, the IRS should already have your banking information on file and will make the payment directly to your bank account.

For direct deposit, the IRS uses data already in its system to determine which bank account to send the payment to. That most likely happens by attaching a routing and account number to your 2020 or 2019 tax filing, as well as inputting one earlier in 2020 for receiving your first stimulus check. Those receiving payments by mail will have to wait a little longer.

This round, the Treasury Department is also working with the Bureau of the Fiscal Service to identify federal records of recent payments to and from the government to find a possible bank account alternative for delivering stimulus payments as a direct deposit. The move helped accelerate the stimulus check delivery timeline, the IRS said in a statement.

In most cases, individuals arent required to take action to receive their checks and are discouraged from contacting the IRS, according to a Treasury Department release.

The IRS and Treasury Department anticipate sending out more tranches on a weekly basis moving forward.

Incarcerated Individuals And Mixed Status Families Eligibility For Third Stimulus Checks

For the third stimulus check, anyone with a Social Security number can receive the stimulus check for themselves and their family members. This is different from the last bill and ensures that mixed families will receive the third stimulus checks too.

Its important to note that if you are incarcerated, you can still receive your check. And if you lost work or wages in 2020, you could get a higher amount than you did with the first or second stimulus checks.

And if you normally arent required to file taxes, either because of your income level or for other reasons, you are probably eligible for a stimulus payment.

Reminder: File your taxes by April 15!

Tip: If you havent yet filed your taxes, read about how to file your taxes for free and whether you should take a Refund Anticipation Loan.

The intention behind this stimulus check, as with the last two, is to support Americans during this difficult time. This may also be a good time to consider establishing savings habits to create a financial buffer for you and your family.

At SaverLife, our mission is to make saving money easier and more rewarding. We receive donations to give you cash rewards and prizes for building up your rainy day fund.

We invite you to visit our Forum, where you can raise questions, share experiences, and connect with SaverLife members. And !

Don’t Miss: Is There Anymore Stimulus Checks Coming

When Will I Get My November Social Security Check

Here’s the for when you could get your Social Security check and/or SSI money.

- Payment for those who receive SSI.

- Social Security payment for those who receive both SSI and Social Security, or have received Social Security since before May 1997.

- 9: Social Security payment for those with birthdays falling between the first and 10th of any given month.

- 16: Social Security payment for those with birthdays falling between the 11th and 20th of any given month.

- 23: Social Security payment for those with birthdays falling between the 21st and 31st of any given month.

Note that was the final payment date for October.

What Is The 2021 Stimulus Based On

The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

You May Like: Why I Didn’t Get My Stimulus Check

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Don’t Miss: What Were The Three Stimulus Payments

What If I Already Filed My Taxes

An amended return may be needed to claim the credit if IRS records show no payment was issued.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return , they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return to claim the remaining amount of stimulus money if IRS records dont show that they were issued a payment.

This includes people who think they didnt get the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

People trying to figure out if they should amend their original tax return can use this online tool.

More details on claim the 2021 Recovery Rebate Credit can be found here.

How To Check How Much I Received For My 3rd Stimulus Check Using Irs Website

Hello! I don’t think I ever received my third payment. But I’m not entirely sure.

I received my 1st and 2nd stimulus check with my 2020 tax return because I submitted a recovery rebate credit.

When I log into my IRS account, go to tax reports, and click on 2021, It says Economic Impact Payment 3 – $1,400.00.

And when I click on 2020,Economic Impact Payment 1 and 2 says $0. What does this mean?

I’m checking my bank account and I never received my 3rd stimulus check.

Read Also: When Will We Get 4th Stimulus Check

What Information Will You Need

To access the tool, you’ll be asked to provide a:

- Street address and

- Five-digit ZIP or postal code.

If you file a joint tax return, either spouse can typically access the portal by providing their own information for the security questions used to verify a taxpayer’s identity. Once verified, the same payment status is shown for both spouses. In some cases, however, married couples who file a joint tax return may get their third stimulus payment as two separate payments half may come as a direct deposit and the other half will be mailed to the address the IRS has on file. If that case, each spouse should check the “Get My Payment” tool separately using their own Social Security number to see the status of their payments.

If you submit information that doesn’t match the IRS’s records three times within a 24-hour period, you’ll be locked out of the portal for 24 hours . You’ll also be locked out if you’ve already accessed the system five times within a 24-hour period. Don’t contact the IRS if you’re shut out. Instead, just wait 24 hours and try again.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Also Check: Is Texas Giving Stimulus Money