How Do I Know The Payment Arrived

We encourage you to use Capital One online or mobile banking to check your transaction history. The payment will appear as âIRS TREAS 310â or something similar in your transaction history. You can visit the Get My Payment application on IRS.gov/GetMyPayment to check the status of your Economic Impact Payment.

State Stimulus Checks In 2022

Although the federal government isn’t sending out stimulus checks this year, some states are sending similar tax rebate payments in 2022. These state “stimulus checks” are designed to help residents battle rising inflation and deal with other economic difficulties. Funding for the state payments typically comes from a budget surplus or federal COVID-relief aid. To see if your state is sending a rebate this year, see State “Stimulus Checks” in 2022.

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

You May Like: When Do The 4th Stimulus Check Come Out

What Does The Stimulus Check Portal Do

The updated Get My Payment tool lets you:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

For first-round stimulus payments, you could also use the portal to enter or change your bank account information to have your payment directly deposited into your account. However, that feature isnt included in the current tool . The IRS already has bank account information for millions of Americans from recent tax returns, tax payments, the original Get My Payment tool, the non-filers tool used last year, other federal agencies that regularly send out benefit payments , and federal records of recent payments to or from the government. So, the tax agency is generally limiting direct deposit payments to bank accounts that they already have on file. As a result, you cant change your bank information using the Get My Payment tool.

If your payment isnt deposited directly into your bank account, then youll get either a paper check or a debit card in the mail . You could also receive a payment by mail if your bank rejected a direct deposit. This could happen because the bank information was incorrect or the bank account on file with the IRS has since been closed.

Use The Irs Get My Payment Tool To Track Stimulus Money

For the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail. If the Get My Payment tool doesn’t give you information you can understand or says your check is on the way and you haven’t received it, you may need to eventually request a payment trace or file for a recovery rebate credit.

For the first or second payment: If you can’t find the letter sent by the IRS, you’ll need to create an online profile with the IRS to see your status. For any problems, you may need to issue a payment trace or file for a recovery rebate credit, even if you don’t normally submit a tax return. Here’s more information about finding the amount of your first and second payments.

Recommended Reading: Set Up Direct Deposit For Stimulus Check

Unsure If Youre Owed Stimulus Payments How To Find Out

AMERICANS have just days left to see if they are owed up to $1,400 in stimulus payments from last year.

While the extended deadline to file your taxes for 2021 was on October 17, the IRS’s Free File program will stay open until

Qualifying Americans can grab the maximum payment as long as their income is $75,000 and below, or $150,000 for couples.

Past those thresholds, the $1,400 check starts to phase out and then capped at $80,000 and $160,000 respectively.

An estimated 165million Americans have received a cumulative $931billion worth of payments under three stimulus rounds from April 2020 through 2021, according to a report from the Government Accountability Office .

While most Americans have received their third stimulus payments, there are millions that may still be owed money.

Stimulus Check 1 And 2

If you did not receive your first or second stimulus check, you will need to file a 2020 tax return to obtain it. The IRS is accepting returns for the 2020 tax year so you can submit your forms as soon as you are able.

When you submit your 2020 tax return, you will be able to claim unpaid funds from your first and second stimulus check through the “Recovery Rebate Credit.” You can claim this credit if you did not receive any stimulus money at all. If you received the incorrect amount, you can claim a partial credit and get any additional funds you’re owed.

It’s possible to claim your payment by filing your tax return because the stimulus checks were an advance on a tax credit. Unfortunately, since the IRS is no longer sending out these advances, the only way to claim unpaid stimulus money is to file a tax return. This means individuals who ordinarily wouldn’t submit one will have to this year to get their funds.

E-filing your 2020 return and requesting a refund via direct deposit is the fastest way to claim any unpaid stimulus funds. You can file your return electronically for free if your income is under $72,000. The IRS has instructions on how to do that on its Free File website.

Recommended Reading: Stimulus For Healthcare Workers 2021

Im A Representative Payee For A Social Security Or Supplemental Social Security Beneficiary What Do I Need To Know About The Economic Impact Payments

The beneficiarys Economic Impact Payment will arrive in the same way they either receive their monthly benefits or their tax return for 2019 or 2018.

- If the beneficiary didnt file a 2019 or 2018 tax return, theyll receive their EIP payments the same way they receive monthly Social Security or SSI payments. This may be through direct deposit to their banking account or Direct Express card, or a mailed paper check.

- If the beneficiary did file a 2019 or 2018 tax return, the payment will be deposited to the same bank account or debit card as the most recent tax refund or mailed to the address on the beneficiarys last tax return.

How To Check Your Stimulus Payments History

In order to see which Economic Impact Payments you have received and for how much, you can have a look at Your Online Account on the IRS website.

You will have to sign in first before you can access any information, but once you have entered the system, you will be able to see the first, second and/or third payment amounts from the Economic Impact Payments under the Economic Impact Payment Information, which can be located on the Tax Records page.

Alternatively, you might not even have to go onto the IRS website in order to have a look. If you have your mailed checks from the IRS, you will find that Notice 1444 was in relation to the first Economic Impact Payment that was sent in the 2020 tax year Notice 1444-B was in relation to the second Economic Impact Payment that was sent in the 2020 tax year and Notice 1444-C was in relation to the third Economic Impact Payment that was sent in the 2021 tax year.

The other letter that you are likely to received this has only begun to be sent out since March 2022, so it might not have arrived yet is Letter 6475, which confirms the total amount of the third Economic Impact Payment and any plus-up payments you were sent in the 2021 tax year.

Don’t Miss: Where’s My Stimulus Check 2021 Tracker

You Are Locked Out Of Using Get My Payment

The IRS says that data in Get My Payment is updated only once per day. If you’ve already checked with the app and received a “Payment Status Not Available” message, there is no need to try to use it again on the same day. If you do, you may see a message saying “Please Try Again Later,” and be locked out of using the site for 24 hours.

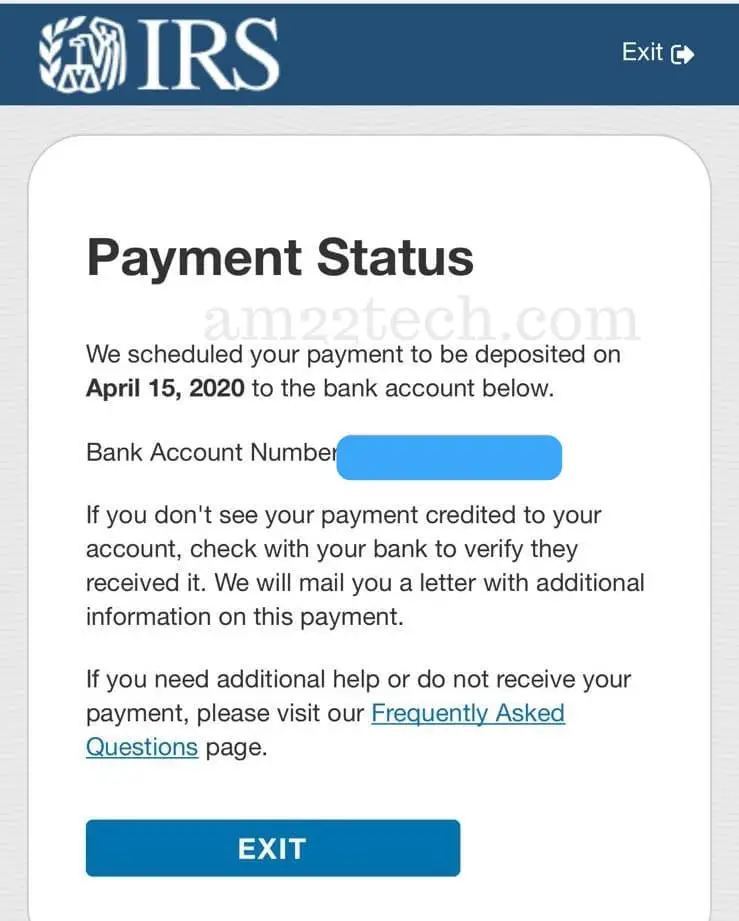

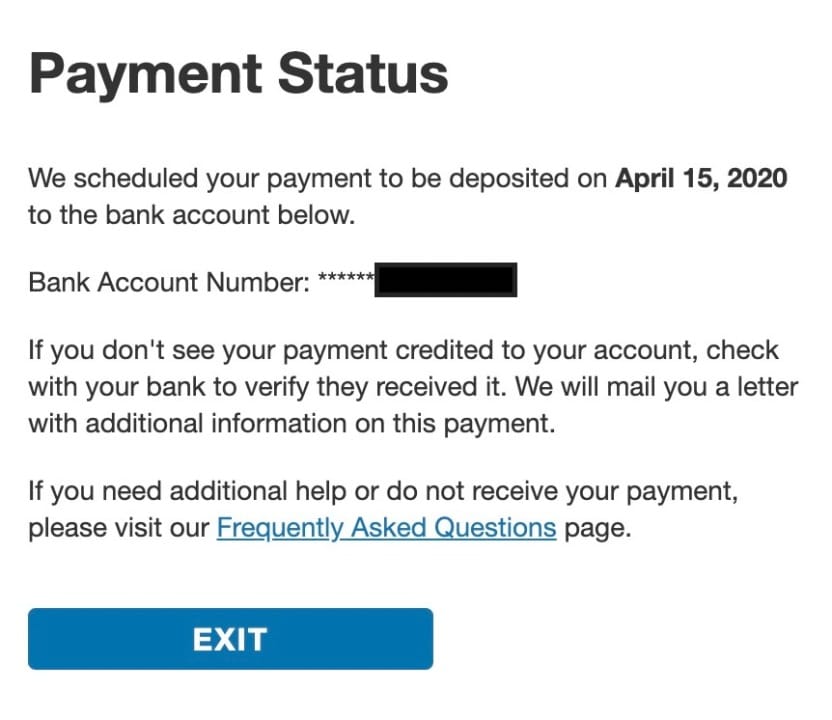

Checking For Your Stimulus Payment: What You Can Expect

The IRSâs Get My Payment application is the only official way to find out when youâre scheduled to receive your stimulus payment. In fact, the IRS has asked people not to call about stimulus payments.

The app will ask you to enter your Social Security number or Individual Taxpayer Identification Number, your date of birth, your street address and your ZIP code.

If youâre eligible for a payment, it should show your payment has already been made or that itâs scheduled to be made. You also should see how and where it will be delivered.

If you have account information on file with the IRS, you should get your payment by direct deposit. If you donât receive a direct deposit, you can watch your mail for either a paper check or a prepaid debit card.

If your third stimulus payment arrives in the mail, it might come in a different form than your first two. Like the first and second payments, it should be followed by an IRS notice or letter that includes the amount of the payment. The IRS says you should keep this for your tax records.

Also Check: Are There Any Stimulus Checks Coming

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2022. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Don’t Miss: How Much Stimulus Did We Get In 2021

Dont Lose The Irs Letter That Confirms Your Stimulus Payment

If the IRS issues you a stimulus check, it sends a notice by mail to your last known address within 15 days after making the payment to confirm delivery. The letter contains information on when and how the payment was made and how to report it to the IRS if you didnt receive all the money youre entitled to. Youll need to reference this information if you dont receive your full payment and need to claim your money later. Heres how to recover the information if you lost or tossed the letter.

Recommended Reading: Claiming Stimulus Check On Taxes 2021

The Economic Impact Payment Doesnt Affect Eligibility For Income

The Economic Impact Payment is a tax credit. That means it shouldnt be counted as income and shouldnt affect the beneficiarys eligibility for income-tested benefits. As long as the payment is spent down within 12 months of the date it was received, it also wont count against resource limits for Medicaid, Medicare Savings Programs, SSI, SNAP, or Public Housing benefits.

Recommended Reading: Is North Carolina Getting Another Stimulus Check

If I Still Need To File My 2018 And 2019 Taxes Can I Still Receive The Economic Impact Payment

Yes. The IRS urges anyone with a tax filing obligation and who hasnt yet filed a tax return for 2018 or 2019, to file as soon as they can to receive an Economic Impact Payment. When you file your taxes, include your direct deposit information on the return so that the IRS can send you your payment quickly.

If you are required to file a tax return, there may be free or low-cost options for filing your return. If you need someone to help you to file, its important to choose a reputable tax preparer that will file an accurate return. Mistakes could result in additional costs and complications in the future.

If your 2019 adjusted gross income was less than $69,000, you may be able to find one or more online tools to file your taxes for free. Review each company’s offer to make sure you qualify for a free federal return. Some companies offer free state tax returns, but others may charge a fee.

Keep in mind that the IRS has extended the deadline for filing your 2019 taxes until July 15, 2020. If you are concerned about visiting a tax professional or local community organization in person to get help with your tax return, the IRS indicates the Economic Impact Payments will be available throughout the rest of 2020.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Also Check: Where Do I Put Stimulus Money On Tax Return

What To Know About Adding Your Direct Deposit Details

You cant use the Get My Payment tool to sign up for a new account or correct details about your payment. Even if the IRS is unable to deliver your payment to a bank account and the money is returned to the government, you wont be able to correct the details online the IRS says it will send the money again by mail.

The extended tax deadline was May 17. With the agencys delay in processing tax returns, trying to register for a new direct deposit account with your 2020 tax return wont get you into the system quickly enough. However, if you havent submitted your taxes yet, signing up for a new direct deposit account could still get you IRS money faster in the future, such as tax refunds or the upcoming child tax credit.

You May Like: Contact Irs About Stimulus Check

How Can I Get My Stimulus Payment Faster

The quickest way to get your payment is through direct deposit. Beware of scams! The IRS will not contact you by phone, email, text message, or social media to request personal information especially banking details or ask you to provide a processing fee. They will send written correspondence with instructions on steps to take and the timeframe for action. Remember, you do not need to pay to get this money.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Hang up on phone calls you receive and delete email or text messages that seem too good to be true. You can report scams to the Better Business Bureau to helps protect others.

Read Also: Track My Golden State Stimulus 2

Can I File My Taxes With A Paper Return

Yes, however it is not recommended. If you have not filed your taxes yet and still need to, file electronically if possible. IRS processing of paper returns is delayed due to COVID-19. You can use GetCTC.org if you arent normally required to file taxes, and get support from the chat function on the site, where you can communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

If you must file a paper return, you can download the tax forms from IRS.gov or use an online tax software program to complete your return and print it instead of filing electronically. If you need to file a paper return and do not have internet access, ask a trusted friend or relative for help.