Why Your Stimulus Check May Be Missing

Although the stimulus payments have provided some much-needed relief, the delivery process has not been without its flaws. In some cases, payments have been deposited into old, inactive bank accounts or checks mailed to the wrong address other individuals have received a payment for themselves, but not for their dependents and folks who dont typically file taxes may have slipped through the cracks entirelyparticularly those who missed the deadline to use the IRS non-filers tool to claim payment. Bottom line: There are a whole host of reasons why your Economic Impact Payment might have missed the mark, or just gone missing. Whatever the case may be, theres a fairly straightforward solution, and it comes down to filing your 2020 taxes.

Timing Of Third Stimulus Checks

Question: When will I get my third stimulus check?

Answer: Millions of Americans have already received their third stimulus check. And the IRS will be sending out more over the next several weeks. So, if you havent received your payment yet , it should arrive relatively soon.

How long it will take to send all payments is not known yet. The IRS has a lot on its plate right now. Were in the middle of tax return filing season, so the IRS is already busy processing tax returns. The tax agency also has to send refunds for people who reported unemployment compensation on their 2020 return and come up with a way to send periodic child tax credit payments later this year. All of this could very well slow down the processing and delivery of third-round stimulus checks.

If the IRS already has your bank account information either from a recent tax payment that you made, a tax refund it sent you, or some other source then expect to get your third stimulus check faster. Thats because the IRS will be able to directly deposit the payment into your bank account. The IRS can also make a third stimulus payment to a Direct Express debit card account, a U.S. Debit Card account, or other Treasury-sponsored account. Otherwise, youll get a paper check in the mail.

If you already have a prepaid debit card from the IRS , youll get a new card if the IRS decides to send your third stimulus payment to you in that form.

Here Are Some Questions And Answers Around This New Stimulus Payment:

If I didnt file taxes in 2019/2020 will I receive the stimulus ? Unlike the first stimulus payment where those who didnt need to file a tax return could update the IRS non-filer tool, this time around due to the speed of roll-out of the second stimulus check and with tax season around the corner the IRS has said the non-filer tool is closed for updates.

The IRS will be using information they have as of Nov 21, 2020 or from your first stimulus check payment . Otherwise they are encouraging you to the stimulus by filing a 2020 1040 or 1040-SR tax return. Free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

How will I get paid? Like the first stimulus payment in 2020, the IRS will facilitate payment of these checks based on your 2019 tax information. You will also get the dependent stimulus payment for eligible dependents claimed on your tax return. For other groups who dont file taxes the IRS will work with other government departments or the Get My Payment tool. Direct deposit will still be the fastest way to get your payment.

Dependents in 2020? Households who added dependents in 2020 might not qualify for full payments immediately, since based on 2019 tax return information. But they can request additional money as part of the 2020 tax returns they will file in early 2021. See more in this articles for dependent qualification income thresholds.

Recommended Reading: When We Getting Stimulus Checks

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full.

The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

What About People With Itins

You still need a work-authorizing Social Security Number to be eligible for this stimulus. However, there are important changes since the first round of stimulus checks.

- In the first stimulus rollout, any non-SSN holder on a joint return made everyone on that return ineligible. Big change: The new rounds of stimulus has corrected this problem. If you filed a joint return with a non-SSN holder, you are still eligible for the stimulus. See the below hypotheticals.

- Situation: A single tax filer has an Individual Taxpayer Identification Number but no Social Security number .

- This person is ineligible for the stimulus.

Recommended Reading: Where Is My Stimulus Refund

You May Like: Is There Going To Be Anymore Stimulus Checks

When Is The Deadline For Claiming Stimulus Or Child Tax Credit Money

The deadline for claiming your money depends on if youre required to file a tax return or not. Youre generally not required if you file single and earn less than $12,550 per year.

You have until Tuesday, Nov. 15, to complete a simplified tax return to claim your missing stimulus or child tax credit money if youre not typically required to file taxes. Thats roughly one month away. To help, the IRS is keeping the free file site open available until .

If you filed a tax extension earlier this year or havent filed yet, your deadline to submit your tax return if youre required to file was . That was also the last day to file Form 1040 to avoid a late-filing penalty.

If you were affected by one of the recent natural disasters, such as Hurricane Ian, you have until Feb. 15, 2023, to file. If you live in an area covered by Federal Emergency Management Agency disaster declarations, like Kentucky or Missouri, you have until to file.

You could soon miss out on your stimulus and child tax credit money.

Federal Stimulus Checks Won’t Be Coming Before The Election

The current Congress is not going to provide another stimulus check. The last payment, authorized by the American Rescue Plan Act, was passed along party line votes through a special process called reconciliation. There is no further opportunity to pass legislation this way until after the election, and there is not broad enough support to get a bill through that would authorize a fourth payment.

Recommended Reading: Sign Up For Stimulus Check

If I Am Incarcerated Am I Eligible For The Stimulus Checks

Yes, if you are incarcerated you are eligible to receive the stimulus checks if you meet the other eligibility criteria.

Eligibility for first stimulus and second stimulus checks:

Eligibility for third stimulus check:

Parents Are More Likely Than Non

Although there’s little appetite in Washington D.C. for a fourth stimulus check to be distributed to everyone, there is some bipartisan support for an expanded Child Tax Credit.

The last stimulus bill, the American Rescue Plan Act, made more money available to parents by changing the current rules for the existing Child Tax Credit. Parents were eligible to receive up to $3,600 for children under age 6 and up to $3,000 for kids aged 6 to 17.

While Republicans aren’t in favor of doing exactly what the American Rescue Plan Act did for parents, those on the right have put forth various proposals to also expand this tax credit. And there’s broad support on the left for more financial help to parents.

Also Check: Will There Be Another Federal Stimulus Check

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Recommended Reading: Set Up Direct Deposit For Stimulus Check

Get Free Individualized Tax Help

If you earn less than $66,000 and dont own rental property or a farm, you may be eligible for free tax help through Code for Americas Get Your Refund program: www.GetYourRefund.org. The website allows you to check EITC and CTC eligibility, as well as get connected to free online filing or a volunteer tax preparer for additional help. If you havent filed taxes any time in the last three years, the team can also help you claim past tax refunds.

You may also be eligible to have your taxes prepared for free by nonprofit organizations participating in the IRS Volunteer Income Tax Assistance program. To find your nearest VITA site, visit .

Recommended Reading: Amount Of 3rd Stimulus Check

Stimulus Update: Will There Be A Stimulus Check For Inflation

Hey, weve all felt the pain of high prices on gas, groceries and just about everything else. To combat inflation, nearly 20 states have decided to give out inflation stimulus checks.

Each state has different guidelines for its inflation stimulus plans. Some states are offering tax rebates while others are sending direct payments that range from $50 up to more than $1,000.

Congress is also considering sending out a $100 gas rebate check to everyone in every month the national average gas price is $4 or more. But so far, the Gas Rebate Act of 2022 hasnt picked up much speedand neither has the idea for a federal gas tax holiday.

How To Get Your Fourth Stimulus Check

December 31, 2021 By john

As 2021 comes to a close, tax season approaches. Thats good news for some of you, because a fourth economic stimulus check may be on the way. This round of checks will only go out to certain individuals, so how do you know if youre on the list?

Youll need to meet some requirements to qualify for the $1,400 stimulus check in addition to your tax refund. The new stimulus check is for parents who had a child born during 2021 or those who have a new dependent.

This is because the 2021 Economic Impact Payments were based on 2020 and 2019 tax returns. This didnt include dependents added in 2021. Since the impacts of COVID have continued throughout 2021, a fourth round of checks is due. This is part of the American Rescue Plan, which aims to help families with children.

If you fall into this category you may receive the check before December 31st, 2021. If youre eligible but dont receive the check, youll need to apply for the Recovery Rebate Credit. You can apply when you file your 2021 taxes. If eligible, youll receive the money along with your tax return.

Is the fourth stimulus check available in every state?

Every state will be issued a budget by the federal government to cover the distribution of the checks. Each State Administration will be in charge of deciding how to spend the funds they receive. That means different benefits may be available from state to state.

Donât Miss: When Did The First Stimulus Check Come Out

Recommended Reading: Stimulus Payment For Ssi Recipients

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Where Is My 2nd Stimulus Check

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Read Also: How To Apply For Stimulus Check Online

You May Like: Spectrum Stimulus Internet Credit Application

Th Stimulus Check 202: These 4 States Sending Payments Up To $600

Through March, lump sum payouts of $600 will still be made in Idaho. In December, the Massachusetts municipality of Chelsea began the second stage of its universal essential income initiative by distributing stimulus payments of around $400 to 700 citizens.

One hundred forty families in Coachella, California, will begin receiving $400 payments each month for two years in the context of a universal basic income experiment . The $400 payments to 170 Alexandria, Virginia residents come with no conditions. As a part of another UBI initiative, the payouts will continue for another two years.

Calculating Your Stimulus Payment

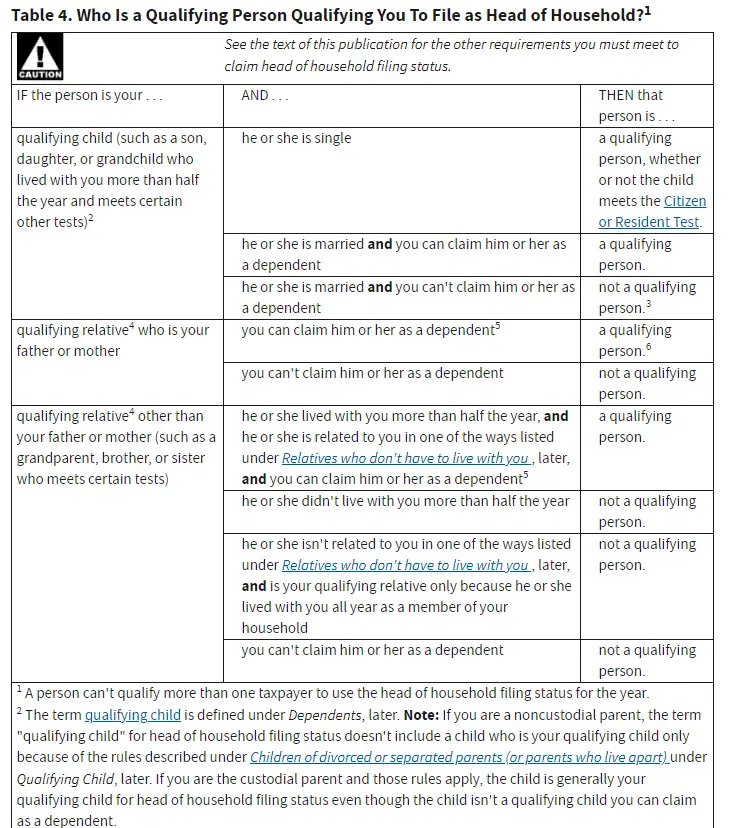

Those eligible for a full stimulus payment include individuals earning up to $75,000, or $112,500 as head of household and $150,000 as a married couple filing jointly.

But again, it is also possible to qualify for a partial stimulus payment.

For every $100 you earn over the income thresholds outlined above, payments are reduced by $5. The money phases out completely if your adjusted gross income, or AGI, is more than $99,000 for individuals, $136,500 for head of household and $198,000 for married filing jointly.

When filing a 2020 return, Greene-Lewis also advises you check to see whether the additional $500 per dependent child under 17 was received. If not, you can also claim that as a credit.

Whatever your circumstances, tax experts agree that filing early will be an especially good idea this year.

Also Check: How Can I Check My Stimulus Payment History

You May Like: Federal Mortgage Relief Stimulus Program

How Do I Claim My Stimulus Check Step By Step Guide

WHILE some Americans are still owed a stimulus payment, there are a couple of ways for them to claim.

The Treasury Inspector General for Tax Administration has shared a report, revealing several factors as to why payments may be delayed.

Most folks received their stimulus checks by check or direct deposit while others received them in the form of prepaid debit cards.

Some actually mistook these cards as junk mail and threw them out.

The report by TIGTA also said that manually verifying the stimulus claims and debit card policies has delayed the payments for as many as 10million people.