When Should I Receive The Stimulus Check

For those who have e-filed tax returns with the IRS in the past or otherwise provided the IRS with their direct deposit information, the IRS started to direct-deposit stimulus money last weekend.

Other individuals will receive their payments by mail. The IRS will start mailing some checks in mid-March. If you received the first or second stimulus check by direct deposit, theres no guarantee youll receive the third check by direct deposit, especially if you filed your tax return after your first or second stimulus payment and didnt use direct deposit for your tax refund.

Dont Miss: Stimulus For 65 And Older

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Its Not Too Late To File Your Tax Return

Although the regular tax season is over, you can still file a late tax return until October 15, 2022. If you do not file you may miss out on a refund or any tax credits for which you may be eligible.While theres no penalty for filing late if you do not owe taxes, you could face fees and penalties if you do owe for 2021. The information below can help you navigate this process and complete your return before the final deadline.

You May Like: Amount Of All Stimulus Checks

How Much Is The Recovery Rebate Credit For 2021

This tax season, you want to make sure that you’ve received the full amount of the third stimulus that you’re entitled to receive. You need to file a 2021 federal income tax return to claim the Recovery Rebate Credit if you’re owed more money.

The maximum Recovery Rebate Credit on 2021 returns amounts to $1,400 per person, including all qualifying dependents claimed on a tax return. A married couple with no dependents, for example, could qualify for up to $2,800.

Access Your Tax Refund Quickly And Safely

If you think you may receive a refund, here are some things to think about before you file your return:

- If you already have an account with a bank or credit union, make sure you have your information ready — including the account number and routing number — when you file your tax return. You can provide that information on the tax form and the IRS will automatically deposit the funds into your account.

- If you have a prepaid card that accepts direct deposit, you can also receive your refund on the card. Check with your prepaid card provider to get the routing and account number assigned to the card before you file your return.

Read Also: How Much Was The Stimulus Check In March 2021

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Will The Amount Of My Stimulus Checks Be Reduced If I Have Overdue Prison Debts Or Other Unpaid Debts

Yes, if you are claiming the first, second, and/or third stimulus check as part of yourRecovery Rebate Tax Credit, the payments are not protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . This means that if you receive your stimulus checks as part of your tax refund instead of as direct checks, they arenotprotected from garnishment and may be reduced.

There used to be protections on stimulus checks, but they no longer apply when claiming them on your tax return.

Read Also: Haven’t Got My Stimulus

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

TAX SEASON DELAYS:Mistakes with child tax credit, stimulus can trigger refund tax delays, IRS warns

Don’t Miss: Are The Stimulus Checks For 2021 Taxable

This Article Talks About:

Andy Meek is a reporter who has covered media, entertainment, and culture for over 20 years. His work has appeared in outlets including The Guardian, Forbes, and The Financial Times, and hes written for BGR since 2015. Andys coverage includes technology and entertainment, and he has a particular interest in all things streaming. Over the years, hes interviewed legendary figures in entertainment and tech that range from Stan Lee to John McAfee, Peter Thiel, and Reed Hastings.

In total, Americans received three stimulus checks since 2020.

The first round of checks was authorized under the Coronavirus Aid, Relief, and Economic Security Act, that President Donald Trump signed on March 27, 2020.

The payments for the first checks were $1,200 per person, or $2,400 for those filing jointly, plus $500 per qualifying child.

In December 2020, the second round of stimulus checks was sent out as part of the Consolidated Appropriations Act.

The payments for the second checks were $600 per person, or $1,200 for married individuals, plus $600 for each qualifying child.

One year following the first checks, the third round of stimulus checks was sent out earlier in March under the American Rescue Plan.

The payments for the third checks was $1,400 per person, or $2,800 for married couples, plus an additional $1,400 per eligible child.

How Do I Claim These Benefits

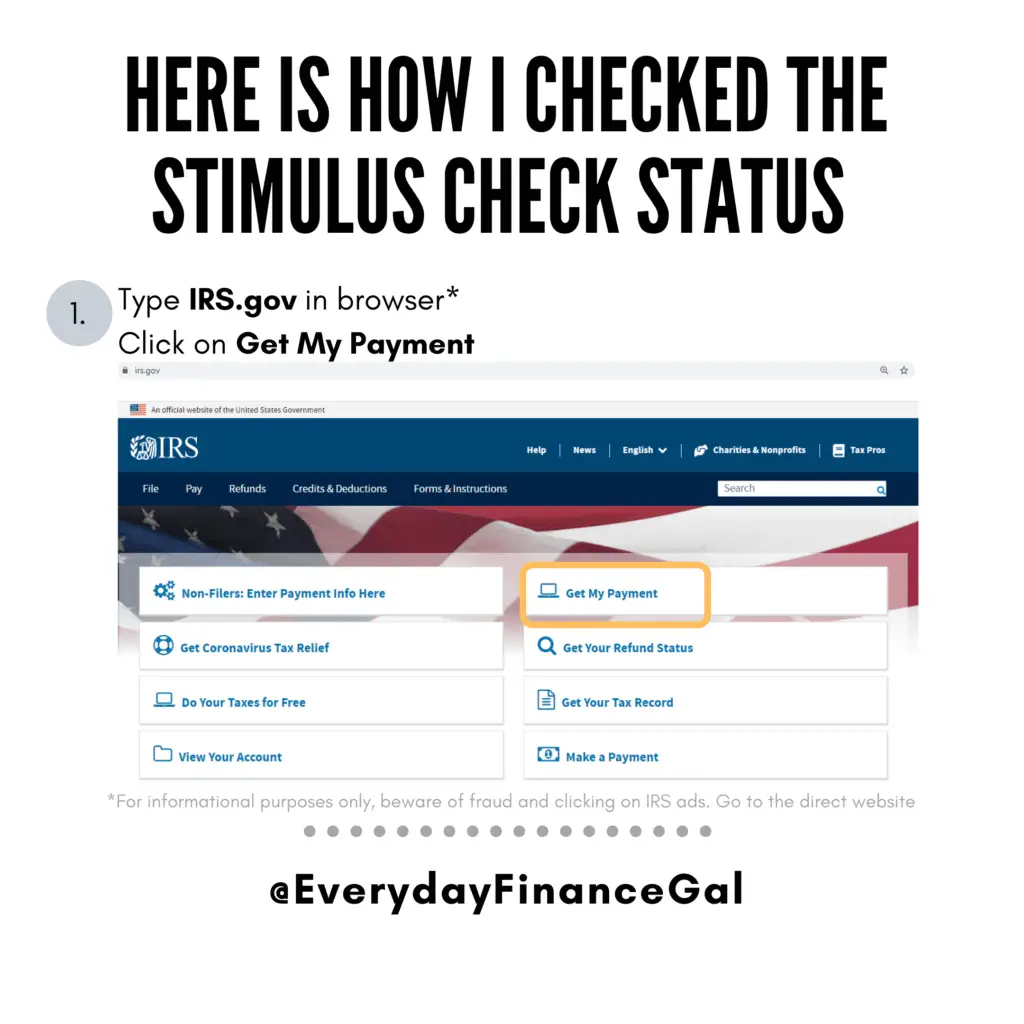

The IRS is urging people who believe they are eligible for the tax credits but haven’t filed a tax return to go ahead and file a return with the tax agency, even if they haven’t yet received a letter from the IRS. But the deadline for filing a return to claim these benefits is Thursday, November 17.

“The IRS reminds people that there’s no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline,” the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

- In:

Read Also: File For The First Stimulus Check

Looking For More Stimulus Information

Find out about stimulus checks/payments for Social Security and railroad retirement beneficiaries.

Visit the IRS economic income payment information center for additional situations not covered here.

Stay up-to-date with our coronavirus resources

We know theres a lot of information to take in these days. To help keep you informed, we created a Coronavirus Tax Resource Center where you can find the latest news and details regarding tax extension dates, stimulus relief and more.

Related Topics

Getting married? Having a baby? Buying a house? Go through your life events checklist and see how each can affect your tax return with the experts at H& R Block.

Filing A Full Tax Return

Depending on your circumstances, you may want to consider filing a full tax return. There are a few reasons to consider this option:

To file a full tax return online go to MyFreeTaxes.com.

Recommended Reading: Irs Stimulus Check Sign Up

Fill Out Filing Status Claim Dependents And Provide Banking Information

For STEP 1. Fill Out Your Tax Forms, there is required and optional information to complete. Skip the optional fields if they do not apply to you.

Required:

- First name, middle initial, and last name

- Social Security Number or Individual Identification Number

- Dependents in 2020: First and last name, SSN, relationship to you. Check the box if they qualify for the CTC.

Note: these fields are required for both you and your spouse if you are married filing jointly. If you have a new qualifying child in 2021, you will be able to provide their information in a separate tool this summer.

Optional info:

- Check the box if you or your spouse can be claimed by someone else as a dependent

- Recovery Rebate Credit amount: If you didnt get the full first or second stimulus check, you can enter the amount you are owed

- Bank account routing info: If you leave this blank, your payments will be mailed.

- Identity Protection PIN: only include if the IRS provided you a number because youve experienced identity theft.

After entering all the information that relates to you, click Continue to Step 2.

If you didnt receive your full first or second stimulus check, you can enter your Recovery Rebate Credit amount to get your money. Be sure you know the exact amount you received. If you dont enter the right amount, your CTC and stimulus checks may be delayed.

Heres how you calculate how much you are owed.

First stimulus check: $1,200 OR $2,400 + $500 per dependent

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

Don’t Miss: How Do I Apply For The 4th Stimulus Check

Who Is Eligible For The Child Tax Credit 2021

Eligible Americans with income below $75,000, or married couples with income below $150,000, were eligible for the full amount of three rounds of stimulus payments that were made by the federal government in 2020 and 2021. Those stimulus income limitations also applied to the enhanced child tax credit although partial child tax credits were available for people with higher incomes.

Advance payments of the enhanced child tax credits were sent to people from July to December 2021. The monthly payments were up to $250 or $300 per child, for a period of six months.

Will There Be Income Restrictions

Yes. Your adjusted gross income will be used to determine whether you qualify, and if so, how much you will get.

- If your AGI for 2019 or 2020 is $75,000 , then you will get the full amount. For AGIs above those amounts, your payment will be reduced proportionately until it reaches zero at $80,000 and $160,000, respectively.

- For Heads of Households, the amounts will be $112,500 and $120,000.

You May Like: How Much Stimulus Check Are We Getting

If I Am Incarcerated Am I Eligible For The Stimulus Checks

Yes, if you are incarcerated you are eligible to receive the stimulus checks if you meet the other eligibility criteria.

Eligibility for first stimulus and second stimulus checks:

Eligibility for third stimulus check:

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Also Check: Where Is My3rd Stimulus Check

Requesting A Filing Extension

If youre unable to file a 2021 tax return by the April 18 deadline , theres an easy way to buy some more time. Simply request an automatic six-month extension to file your return. That will give you until October 17 to submit your Form 1040 but youll still have to pay any tax that you expect to owe by April 18.

To get a filing extension, either submit Form 4868 or make an electronic tax payment to the IRS before the tax return filing deadline. There are also special rules that apply to Americans living abroad and people serving in a combat zone. See How to Get More Time to File Your Tax Return for more information about federal tax filing extensions.

If youre getting an extension for your federal tax return, you might want to get one for your state tax return, too . Check with your states tax agency for information about state tax return filing extensions.

Dont Miss: Telephone Number For Stimulus Check

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Don’t Miss: Irs Gov Non Filers Form For Stimulus Check