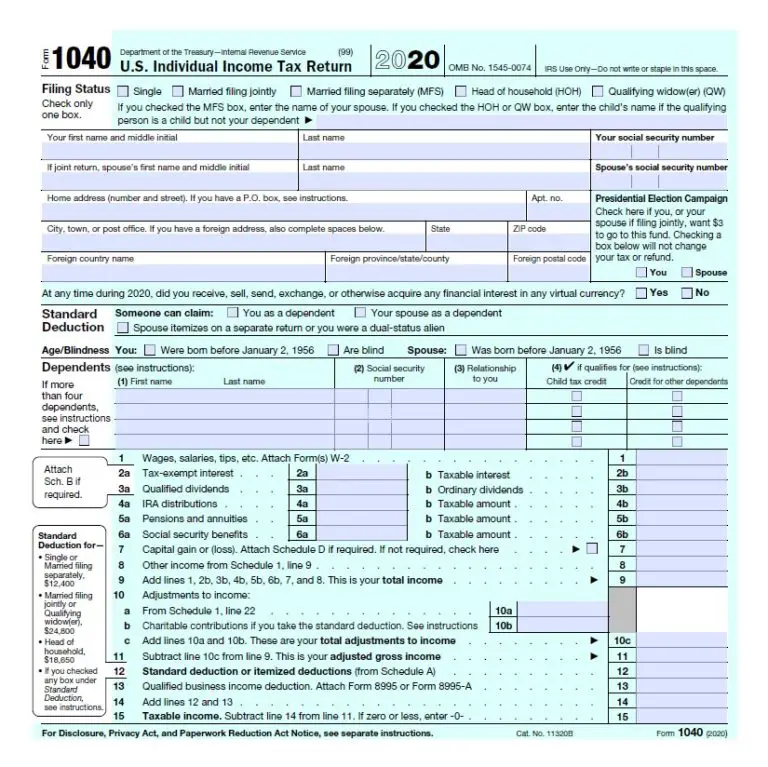

What Is An Irs 1040 Form

OVERVIEW

The IRS Form 1040 is one of the official documents that U.S. taxpayers can use to file their annual income tax return. IRS Form 1040 comes in a few variations. There have been a few recent changes to the federal form 1040. Well review the differences and show you how file 1040 form when it comes to tax time.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive. Depending on the type of income you need to report, it may be necessary to attach additional forms, also known as schedules.

Here’s a guide to all of the 1040 variations you may come across. to begin preparing your tax documents.

No Matter How You File Block Has Your Back

Need Funds To Help Manage During The Covid

To help people cope with the impact of the coronavirus pandemic, the federal government is providing stimulus checks. These are worth up to $1,200 for individuals and $2,400 for couples. And if you have eligible dependent children, you’ll get an additional $500 per qualifying child.

The amounts described above are the maximum you’ll receive, and you need to make under $75,000 as a single person or $150,000 as a married joint filer to get that amount. If your income exceeds these limits, the amount of your payment drops by $5 for each $100 in additional earned income.

The IRS needs to know your income information and how many dependents you have in order to get your money to you. Most people don’t have to do anything to provide these details because the IRS can get them from 2018 or 2019 tax returns.

But for some people, more information is needed. If you’re one of them, you can fill out a simple form on the IRS website. You can find out below if you need to complete that form.

Image source: Getty Images.

Recommended Reading: Status On 4th Stimulus Check

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

With tax season approaching, those who have not received their stimulus payments or think the IRS deposited the wrong amount can finally take action to get the money they’re owed.

The IRS has already distributed the vast majority of economic impact payments to households without issue. But some people either fell through the cracks or received the wrong amounts. Those people can claim their missing money on their 2020 tax returns.

If you believe you’re owed money from the IRS, here’s what to know about stimulus payments and your taxes.

Calculating The Credit For Recovery Rebate

You must first determine your eligibility for the Recovery Rebate Credit before you can submit a claim for it. Your last years stimulus payment will determine how much you get. For instance, you might still be eligible to collect the credit on your 2020 return if you received a $7,500 stimulus check in the summer of 2010 but did not claim it on your tax return.

If you are single, you may be eligible for the recovery rebate credit of up to $1,200 each year. You may submit up to one additional RRC claim worth $600 if you are married. You may be eligible for up to 75% of the credits overall value if you have a qualified child.

You must know your income for the current year and the prior year in order to calculate your recovery rebate credit. Numerous Americans were able to survive the coronavirus outbreak thanks in large part to the stimulus funds. You can be qualified for an additional $1,400 if you have a second kid. The best tax preparation software will compute the credit automatically for you as part of your tax return.

Don’t Miss: How To Check Eligibility For Stimulus Check

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Filling Out The Filing Status And Exemptions Sections

Recommended Reading: Get My Stimulus Payment 1400

How To Fill Out Stimulus Rebate Form

How To Fill Out Stimulus Rebate Form Youve come to the right site if youre unsure how to complete a stimulus rebate form. You will learn more about this forms requirements in this post, along with instructions on how to determine your recovery rebate credit. Samantha Hawkins, a certified public accountant and the owner of Hawkins CPA Solutions in Upper Marlboro, Maryland, is the author of this article.

Fill Out Filing Status Claim Dependents And Provide Banking Information

For STEP 1. Fill Out Your Tax Forms, there is required and optional information to complete. Skip the optional fields if they do not apply to you.

Required:

- First name, middle initial, and last name

- Social Security Number or Individual Identification Number

- Dependents in 2020: First and last name, SSN, relationship to you. Check the box if they qualify for the CTC.

Note: these fields are required for both you and your spouse if you are married filing jointly. If you have a new qualifying child in 2021, you will be able to provide their information in a separate tool this summer.

Optional info:

- Check the box if you or your spouse can be claimed by someone else as a dependent

- Recovery Rebate Credit amount: If you didnt get the full first or second stimulus check, you can enter the amount you are owed

- Bank account routing info: If you leave this blank, your payments will be mailed.

- Identity Protection PIN: only include if the IRS provided you a number because youve experienced identity theft.

After entering all the information that relates to you, click Continue to Step 2.

If you didnt receive your full first or second stimulus check, you can enter your Recovery Rebate Credit amount to get your money. Be sure you know the exact amount you received. If you dont enter the right amount, your CTC and stimulus checks may be delayed.

Heres how you calculate how much you are owed.

First stimulus check: $1,200 OR $2,400 + $500 per dependent

Recommended Reading: I Never Received Any Stimulus Check

Look Through Possible Taxes And Credits

Once youve made necessary adjustments and found your AGI, there are some other taxes and credits to consider. First of all, you need to enter on Line 9 either your standard deduction or the amount of your itemized deductions. If you have a qualified business income deduction, you will enter that on Line 10.

Lines 11 through 14 allow you to enter the amounts of certain credits if you qualify for them. For instance, you can enter the amount of your child tax credit on Line 13a.

If you already had some federal tax withheld from your income, you can enter that amount on Line 17. You will also need to attach Schedule 4 if you have paid other taxes.

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Also Check: When Will South Carolina Receive Stimulus Checks

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What Else It Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.

Don’t Miss: How Much Was The 3rd Stimulus Check Per Person

Get A Transcript Of A Tax Return

A transcript is a computer printout of your return information. Sometimes a transcript is an acceptable substitute for an exact copy of your tax return. You may need a transcript when preparing your taxes. They are often used to verify income and tax filing status when applying for loans and government benefits.

Contact the IRS to get a free transcript . There are two ways you can get your transcript:

-

Online – To read, print, or download your transcript online, you’ll need to register at IRS.gov. To sign-up, create an account with a username and a password.

What Do I Need To Fill Out Form 1040

You’ll need a lot of information to do your taxes, but here are a few basic items that most people have to collect to get started:

-

Social Security numbers for you, your spouse and any dependents.

-

Dates of birth for you, your spouse and any dependents.

-

Statements of wages earned .

-

Proof of any tax credits or tax deductions.

-

A copy of your past tax return.

-

Your bank account number and routing number .

Don’t Miss: I Havent Received My Stimulus Check

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Who Should File A 1040 Tax Form

If you receive these types of income or losses, you may need to file a 1040 tax form:

- Self-employment income of $400 or more

- Income you receive as one of these:

- Partner in a partnership

- Beneficiary of an estate or trust

You must file a Form 1040 if you have any of these:

- Tips you didnt report to your employer.

- Youre eligible for the premium tax credit.

- Your employer didnt withhold Social Security and Medicare taxes from your pay.

- Youre repaying the first-time homebuyer credit.

- You have a foreign account.

- You received distributions from a foreign trust.

- You qualify for the foreign earned income exclusion.

- You qualify to exclude income from sources in Puerto Rico or American Samoa since you were a bona fide resident of either.

Also Check: Second And Third Stimulus Checks

Stimulus And Child Tax Credit Payments: You Have 5 Days Left To Claim Your Money

The deadline to claim your missing stimulus or child tax credit payments is coming next week.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

You have five days left to claim any stimulus or child tax credit money owed to you. Millions of eligible families haven’t claimed their payments from the IRS yet. If you haven’t received your money, you’ll want to take action before the deadline next week.

For many who are still waiting on payments, it’s because they never filed a tax return, either because they’re not required to file or because they needed more time. The IRS used tax returns to determine eligibility for both of these payments. And if you fall into one of these categories, the final deadline for getting your money is coming up.

Keep reading to find out the deadline for when you need to submit your tax return to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Don’t Miss: Irs Stimulus Check Sign Up