Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Penalty Relief For Certain 2019 And 2020 Returns

To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36PDF, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. To qualify for this relief, eligible tax returns must be filed on or before September 30, 2022. See this IRS news release for more information on this relief.

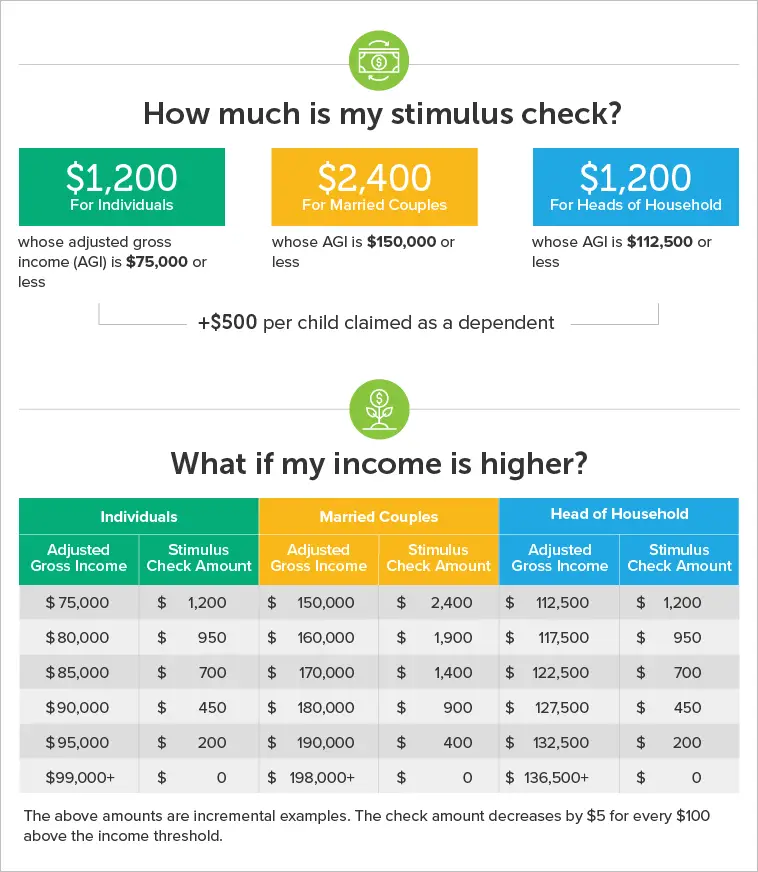

How Much Should My Payment Be

The amount of the payment depends on your income.

- For the third round of stimulus checks: Most individuals earning $75,000 or less received a payment of $1,400. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $2,800. Families were eligible to receive an additional $1,400 per dependent. For this round of stimulus checks, the eligible dependent did not need to be under the age of 17. For example, a family of 4 could have received $5,600. Use our stimulus check calculator to see how much your family could expect from the third round of stimulus checks.

- For the second round of stimulus checks: Most individuals earning $75,000 or less received a payment of $600. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $1,200. Families were eligible to receive an additional $600 per child. For example, a family of 4 could have received $2,400.

- For the first round of stimulus checks: Most individuals earning $75,000 or less received a payment of $1,200. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $2,400. Families were eligible to receive an additional $500 per child. For example, a family of 4 could have received up to $3,400.

Individuals and married couples that made more than the amounts above may still have been eligible for a payment. Use our stimulus check calculator to see if you were still eligible for a payment.

Don’t Miss: Nc $500 Stimulus Check Update

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

Also Check: Will Social Security Get The Fourth Stimulus Check

What If I Already Filed My Taxes

An amended return may be needed to claim the credit if IRS records show no payment was issued.

For eligible people who didnt claim a recovery rebate credit on their 2021 tax return , they will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return to claim the remaining amount of stimulus money if IRS records dont show that they were issued a payment.

This includes people who think they didnt get the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

People trying to figure out if they should amend their original tax return can use this online tool.

More details on claim the 2021 Recovery Rebate Credit can be found here.

You May Like: Total Stimulus Payments In 2021

How Do I Find My Stimulus Money What To Do About A Missing $1400 Check

Your third stimulus payment could be delayed for a variety of reasons. Well help you track down your IRS payment.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland As.

To date, the IRS has made 169 million payments for the third round of stimulus checks for $1,400. The agency continues to send weekly batches of payments, so there is still time if you are waiting for your money. However, there could actually be an issue with your payment and the IRS doesnt want you to call them with problems related to a missing check.

Reasons for a delay could include a lag in mail delivery , if the IRS has incorrect direct deposit information for you or if the agency suspects identity theft. There might be other problems if youre a recipient of SSI, SSDI or veterans benefits. Or maybe you received a letter from the IRS saying that your $1,400 payment was sent, but the check never arrived. Then what?

Are Stimulus Checks Considered Taxable Income

The stimulus checks were paid based on information from your most recent tax return and will be reconciled in tax year 2020 to ensure you received the correct rebate amount.

- If you are underpaid based on your 2020 income you may receive more tax credit when you file your 2020 taxes.

- If you are overpaid, you dont have to pay it back.

For example, if you received $700 as an individual based on your 2019 return but when you file your 2020 tax return, it shows your income took a hit and you should have received a $1,000 stimulus check. You would receive an additional $300 credit on your 2020 return.

Let TurboTax keep you informed on the latest information on how taxes are impacted by COVID-19 relief including the most up-to-date information on tax filing deadlines, visit our Coronavirus Tax Center.

Remember, with TurboTax, we’ll ask you simple questions about your life and help you fill out all the right tax forms. With TurboTax you can be confident your taxes are done right, from simple to complex tax returns, no matter what your situation.

Read Also: Car Insurance ‘stimulus Check 2021

Are My Dependents Eligible With This Check

As a rule, dependents are not eligible for their own checks, but they do contribute to the total your household can receive. In many cases, it can multiple your familys total.

In the third stimulus check, dependents of every age count toward $1,400. If youre a parent of a baby born in 2020, you could be entitled to $1,100 if you never received the first two payments for your new dependent last year. You can also get $1,400 for a baby born in 2021. Note that if your household exceeds the strict income limits, you wont receive any stimulus check money, even if you have dependents.

With the second stimulus check approved in December, each child dependent age 16 and younger added $600 each to the household payment. There was no cap on how many children you could claim a payment. That was an increase in the amount per child from the $500 that was part of the first check approved last March as part of the CARES Act, even as the per-adult maximum decreased from $1,200 per adult to $600 in the December stimulus plan.

The final qualifications for a third stimulus check have been settled.

Read Also: Did Not Receive Stimulus Check

Things To Know About The 2021 Stimulus Payments

> > > To find out the status of your third stimulus , use the IRS Get My Payment tool .

Note: This post has been updated to reflect how people can still claim the 2021 stimulus payments if they havent received themeven though the standard timeframe for filing 2021 tax returns has passed.

On March 11, 2021, President Biden signed the American Rescue Plan into law, which provided essential financial relief to individuals and families along with COVID-19 relief to states and localities. One component of the package is a third round of stimulus payments. Despite wide news coverage about these payments, many have questions about whos eligible and how to receive them. The third round also has different eligibility rules than the first and second rounds of payments, which were distributed earlier.

Below are ten things to know about the third round of paymentsincluding information on filing your 2021 taxes if you missed any or all of your payment:

4. You dont need to have earned income to qualify. The full payment is available to those with little to no income. Even if you are making $0, you can still receive the full payment. The payments phase out starting at $75,000 for single filers. The phase-out rates are more restrictive than for the first and second round of payments, with individuals making $80,000 per year ineligible for any payment

*updated on May 2022

Recommended Reading: Haven’t Got My Stimulus

‘payment Status Not Available’: Why

The IRS says that millions of taxpayers have successfully used the new Get My Payment app to track their stimulus checks and, if needed, add their direct deposit information to get payment faster. So why are countless people complaining on social media that they entered their information at the app only to receive a frustrating “Payment Status Not Available” message?

In some cases, there could be glitches with the Get My Payment app itself that are preventing people from adding direct deposit information or finding out the expected date for their payments to arrive. Among other quirks, the system may give you a “Payment Status Not Available Message” if you owed $0 in taxes and received no refund on your most recent tax return, the Washington Post reported, because the IRS form gave an error message for people entering “0” in those corresponding spots.

The Get My Payment app went offline during certain late-night hours on Thursday, April 23, through Saturday, April 25, for “planned maintenance.” On April 26, the IRS announced “significant enhancements” to the app, though the agency did not specify which glitches had been fixed. “We urge people who havent received a payment date yet to visit Get My Payment again for the latest information,” IRS Commissioner Chuck Rettig said in a statement. “IRS teams worked long hours to deliver Get My Payment in record time, and we will continue to make improvements to help Americans.”

How To Check If You’re Still Owed Stimulus Money

The IRS issued the third stimulus payment — which was worth a maximum of $1,400 per qualifying adult and dependent — to more than 160 million people in early 2021. And, while most people received the full stimulus payment they qualified for, not everyone did.

If you think you’re still owed the money from the third stimulus payment, the good news is that you can still take steps to receive the money. You’ll just need to claim it as a Recovery Rebate Credit when you file your 2021 taxes this year. After your tax return is processed, the missing stimulus money will be issued along with the money sent to you as part of your refund.

But before you claim the third stimulus payment on your taxes, you may want to check to see if you’re entitled to the money. Doing so is simple: All you have to do is check to see if you’ve received Letter 6475 from the IRS.

These letters, which have already been issued by the IRS, were sent out to help you determine whether you can claim the money for the third stimulus on your taxes. In addition to helping you determine whether you can qualify for the Recovery Rebate Credit, this letter also includes instructions on how to claim the money on your taxes.

Read Also: How Many Stimulus Payments Were There In 2021

Ways To Find The Amount Of Your First And Your Second Stimulus Checks

Hint: If you lost the letter on your payment the IRS sent you, you have options. We’ll tell you what you need to know.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps, operating systems and devices, as well as mobile gaming and Apple Arcade news. Shelby oversees Tech Tips coverage and curates the CNET Now daily newsletter. Before joining CNET, she covered app news for Download.com and served as a freelancer for Louisville.com.

The first and second stimulus payments still haven’t arrived for some folks. If this is the case for you, you can claim a Recovery Rebate Credit when you file your 2020 tax return — oh, and don’t worry, the IRS extended the filing deadline. Taxes are now due on May 17, so you — and the IRS — have a bit more time.

If you want to check the amount of your first and second payments — for a jog to your memory, your records or for taxes — you can no longer view it in the Get My Payment tool. But we can help. Here are two ways to find out the amounts of your first two stimulus checks.

Who Is Running Into Problems

If you do your own taxes, things might be pretty easy if you know you received a flat dollar amount, say $1,200 for a single person in 2020 and $600 for a single person in 2021.

A problem can come into play, though, because everyone did not get the exact same amount for their stimulus payments. The stimulus payment reflects your income, as well as how many children you have age 16 or younger.

You could easily receive more or less than those often quoted amounts.

The amount of the stimulus was reduced, for example, after you hit a certain income threshold.

Take the first stimulus payout, which some taxpayers began receiving last April.

A single person who had more than $75,000 in adjusted gross income saw the size of his or her stimulus check drop by $5 for every $100 of income above that threshold. Individuals who earned more than $99,000 did not receive the first round of stimulus money.

What started out at $1,200 might have turned into $800 or $650 or some other number for single higher income earners who don’t have children.

The threshold for reduced payments hit married couples filing jointly with income above $150,000. Couples who earned more than $198,000 and file a joint return did not qualify for stimulus cash.

More:What to do if you must file a tax return for missing stimulus check

The first stimulus payment was up to $1,200 for individuals $2,400 for married couples and $500 for qualifying children ages 16 and younger.

Recommended Reading: Who Will Receive The Next Stimulus Check

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and youll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didnt seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. Youll be able to claim the rest of the stimulus payment when you file your next tax return.

Your Stimulus Checks Arent Taxable

Itâs essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people donât entirely grasp how stimulus payments affect their taxes.

âThe part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit,â says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youâre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you donât have to pay any stimulus money back.

Read Also: Will Social Security Get Stimulus Check

What To Do About A Missing Or Stolen Eip Debit Card

At least 5 million people will receive their third stimulus check on a prepaid debit card called the Economic Impact Payment Card, instead of a paper check. For the third payment, the EIP card arrives in a white envelope sent from Economic Impact Payment Card. The letter will have a US Department of the Treasury seal.

The card has the Visa name on the front and the issuing bank, MetaBank®, N.A., on the back. Information included with the EIP Card explains that this is your Economic Impact Payment. If you receive an EIP Card, visit EIPcard.com for more information.

If youve misplaced or thrown away your card, the EIP card service has an FAQ on what to do if your card is lost or stolen. You can also call 800-240-8100 to request a replacement. Its free, according to a spokesperson for the Treasury Department. To request a new card, press option 2 when prompted.

However, the EIP card website says, Your Card will be deactivated to prevent anyone from using it and a new replacement Card will be ordered. Fees may apply. We recommend calling the above number for a lost or stolen card and speaking to a representative. If you may have lost or thrown away a paper check, read the mail fraud section below.

Recommended Reading: When Did The Stimulus Checks Go Out In 2021