What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Also Check: Get My 2nd Stimulus Payment

You Receive Social Security Benefits

Unfortunately, for now at least, the Get My Payment app cannot track payments for people who receive Social Security, Social Security disability benefits, Railroad Retirement benefits, or veterans benefits. In the words of the IRS on the Get My Payments page, If you are an SSA or RRB Form 1099 recipient or SSI or VA benefit recipient, your information is not yet available in this application.

You May Like: Are There Any More Stimulus Payments Coming

I Got My Stimulus Check On A Debit Card And Lost It Or Threw It Out How Can I Get A New One

You can request a replacement by calling 800-240-8100. Select option 2 from the main menu. Your card will arrive in a plain envelope which displays the U.S. Treasury seal and Economic Impact Payment Card in the return address. It will be issued by Meta Bank, N.A. The envelope will include instructions to activate the card, information on fees, and a note from the U.S. Treasury.

Also Check: Will Social Security Get The Fourth Stimulus Check

Ways To Find The Amount Of Your First And Your Second Stimulus Checks

Hint: If you lost the letter on your payment the IRS sent you, you have options. We’ll tell you what you need to know.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps, operating systems and devices, as well as mobile gaming and Apple Arcade news. Shelby oversees Tech Tips coverage and curates the CNET Now daily newsletter. Before joining CNET, she covered app news for Download.com and served as a freelancer for Louisville.com.

The first and second stimulus payments still haven’t arrived for some folks. If this is the case for you, you can claim a Recovery Rebate Credit when you file your 2020 tax return — oh, and don’t worry, the IRS extended the filing deadline. Taxes are now due on May 17, so you — and the IRS — have a bit more time.

If you want to check the amount of your first and second payments — for a jog to your memory, your records or for taxes — you can no longer view it in the Get My Payment tool. But we can help. Here are two ways to find out the amounts of your first two stimulus checks.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Read Also: How Much Was The First And Second Stimulus Check

What Will The Status Report Look Like

For third-round stimulus checks, the “Get My Payment” tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that “mail” means either a paper check or a debit card. If you don’t recognize the bank account number displayed in the tool, it doesn’t necessarily mean your deposit was made to the wrong account or that there’s a fraud. If you don’t recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesn’t have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, you’ll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you don’t provide any account information, the IRS can’t reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, there’s no reason to check the portal more than once per day.

Whether To File Another Irs Form

As was the case with the first and second check, if you filed a 2018, 2019 or 2020 tax return or receive government benefits, the IRS should automatically send your third check without you having to do anything.

If, however, you’re a nonfiler, a US citizen or permanent resident, had a gross income in 2019 under $12,200 — or $24,400 as a married couple — and didn’t file a return for 2018 or 2019, you may need to give the IRS a bit of information before it can process your payment. Since the IRS’ Non-Filers tool is now closed, you may need to file for that money on a 2021 tax return in the form of a recovery rebate credit, described above.

Here’s more information about who should file an amended tax form and who shouldn’t.

Receiving your stimulus check money isn’t always easy.

Recommended Reading: Irs Gov Stimulus Payment Status

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

Payment Status Not Available: What Should You Do

The IRS Get My Payment tool will only let you input new direct deposit or bank account information if youre seeing a Need More Information status, breaking with tradition from previous stimulus check rounds. That works either by submitting a financial product that includes a routing and account number with it, whether it be a bank account or prepaid debit card.

The easiest way to make sure that the IRS has the most accurate picture of your financial situation and personal whereabouts is by submitting your 2020 tax return. You now have until May 17 to submit your 2020 tax return, after the IRS on March 17 announced it was delaying the deadline by a month.

However, given the unprecedented and unconventional nature of the current tax season, the Treasury Department and IRS may have already attempted to send out your payment before your tax information was processed.

You could also update your mailing address by submitting a Form 8822, Change of Address, or notifying the IRS orally of your move. But be prepared: You might experience delays waiting for confirmation, given that the IRS has already begun distributing these stimulus checks. As always, a direct deposit is the fastest way to guarantee you receive a payment.

Don’t Miss: Washington State Stimulus Checks 2022

Can You Use The Portal If You Didn’t File A Tax Return

You couldn’t use the “Get My Payment” tool to track the status of your first stimulus check if you didn’t file a 2018 or 2019 federal income tax return. However, there was another online tool that non-filers could use to give the IRS with the information it needed to process a payment.

The non-filers tool wasn’t used for second stimulus checks, though. Instead, if you didn’t file a 2019 tax return, and you didn’t use the non-filers tool to get your first-round payment, then you have to wait to claim your second stimulus check money as a Recovery Rebate credit on your 2020 return.

The IRS is not using the non-filers tool for third-round stimulus checks, either. As a result, if you don’t file a 2019 or 2020 tax return, you’ll have to claim any money you’re owed as a Recovery Rebate credit on your 2021 return, which you won’t file until next year. However, you can avoid having to wait until next year by filing a 2020 return before the May 17, 2021, deadline.

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

You May Like: Can International Students Get Stimulus Check

How To Check Your Stimulus Payments History

In order to see which Economic Impact Payments you have received and for how much, you can have a look at Your Online Account on the IRS‘ website.

You will have to sign in first before you can access any information, but once you have entered the system, you will be able to see the first, second and/or third payment amounts from the Economic Impact Payments under the ‘Economic Impact Payment Information‘, which can be located on the Tax Records page.

Alternatively, you might not even have to go onto the IRS‘ website in order to have a look. If you have your mailed checks from the IRS, you will find that Notice 1444 was in relation to the first Economic Impact Payment that was sent in the 2020 tax year Notice 1444-B was in relation to the second Economic Impact Payment that was sent in the 2020 tax year and Notice 1444-C was in relation to the third Economic Impact Payment that was sent in the 2021 tax year.

The other letter that you are likely to received – this has only begun to be sent out since March 2022, so it might not have arrived yet – is Letter 6475, which confirms the total amount of the third Economic Impact Payment and any plus-up payments you were sent in the 2021 tax year.

How Many Stimulus Checks Did Americans Receive

- Jennifer Roback

- 16:56 ET, May 13 2021

- Jennifer Roback

MANY AMERICANS suffered financially during the Covid-19 pandemic.

In order to help Americans during the financial difficulties resulting from the pandemic, the government sent out stimulus checks.

Read our stimulus checks live blog for the latest updates on Covid-19 relief…

Don’t Miss: How To Check Eligibility For Stimulus Check

The Irs Has Distributed Three Rounds Of Economic Impact Payments To Date But Not Everyone Has Had The Full Entitlement Here’s How To Check How Much You Have Received

During 2020 and 2021 the federal government sent out three rounds of stimulus check payments for eligible households, with a maximum of $3,200 available per person.

Previously it was possible to claim any missing payments using the IRS Get My Payment online portal, but that option has now expired. To request payment of any outstanding stimulus check money you must now claim a Recovery Rebate Credit on your federal tax returns.

If you did not receive the Economic Impact Payments issued in 2020 or 2021, you may be able to claim a Recovery Rebate Credit from #IRS by filing a tax return. Learn more at

Heres how to work out how much you are owed

How to find your stimulus check history online

The easiest way to check which Economic Impact Payments, also known as stimulus checks, you have received is by heading over to the IRS website.

You can view your Online Account using your IRS username or ID.me account, giving you access your payment history. As well as information about the stimulus checks, you can also find your history of advance Child Tax Credit payments and data from your most recently filed tax return.

Eligibility For The Covid

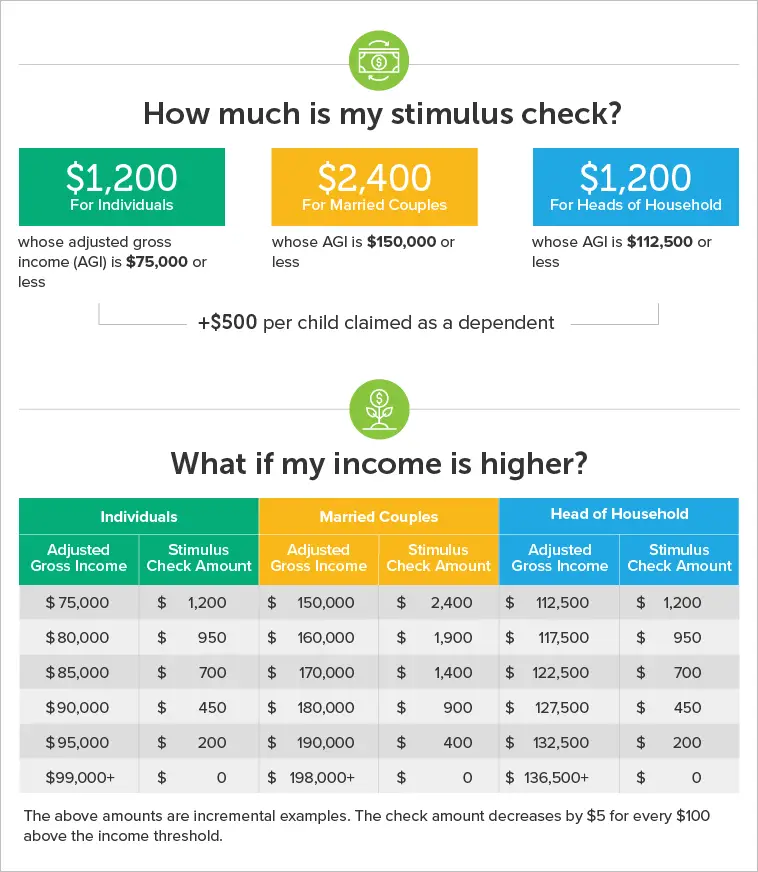

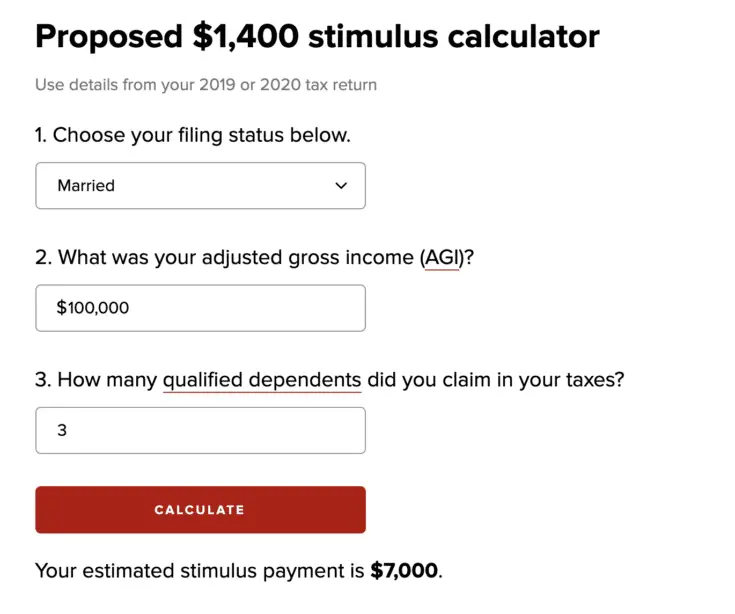

Every individual making $75,000 or less will receive a check for $1,200. Couples making less than $150,000 and that file taxes jointly should each receive $1,200 for a total of $2,400, with an additional $500 for each child. Those making between $75,000 and $99,000 a year should receive reduced checks on a sliding scale. Those making more than $99,000 individually or $198,000 jointly are ineligible.

Eligibility is being determined by 2019 and 2018 tax returns, but for those that are not required to file taxes, the IRS has set up a separate tool. Follow the link in these instructions for non-filers. The government will verify your income for those years and, if you qualify and have a bank account registered for tax refunds, you should receive a direct deposit. If you dont have a bank account registered with the IRS for direct deposits, you should receive a stimulus check in the mail.

Read Also: Credit Card Debt Stimulus Program

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Read Also: Apply For Stimulus Check Indiana