How Can You Check On The Status Of A Missing Stimulus Payment

It’s easy to check the status of your third stimulus check through the Get My Payment tool. You’ll need to request a payment trace if the IRS portal shows your payment was issued but you haven’t received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

Wheres Your $1400 Stimulus Check Heres How To Claim It

The IRS is working to get the checks out, but they also overwhelmed and so are unable to take most calls immediately.

In a mammoth effort to provide much-needed cash to millions of financially struggling Americans, the Internal Revenue Service and U.S. Treasury have confirmed that they have disbursed one hundred fifty-six million coronavirusstimulus checks worth approximately $372 billion under the $1.9 trillion American Rescue Plan.

While millions of Americans already have seen the latest round of payments direct deposited into their respective accounts, there are still plenty of taxpayers who have yet to see a dime from the first two stimulus checks.

Those who fit into this unfortunate category can still try to claim the money that theyre entitled to from the U.S. government. For this tax season, a Recovery Rebate Credit has been added to all returns, so that people mired in this particular situation can eventually get their hands on the overdue payments.

According to the IRS website, it states that if you didnt get any payments or got less than the full amounts, you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you dont normally file.

The agency advises that individuals keep the form they receive regarding their stimulus payment and refer to it when filing their tax returns.

Image: Reuters.

A Fourth Stimulus Check In 2022 To Deal With Inflation Pressures

There has plenty of talk of a fourth stimulus check in 2022, originally as a relief payment in Bidens build Back Better Bill and now as a way to offset higher costs many consumers are seeing due to record inflation.

However progress on a 4th stimulus check has stalled in Congress due to lack of agreement among Democrats and Republicans and what they can sell to their constituents ahead of the upcoming mid-term elections.

A 2022 Gas Stimulus?

With rising gas prices, many states are providing gas tax holidays which save drivers a few cents at the pump. Some states and even Congress are also considering a 2022 gas relief stimulus check which will pay families up to $400 p/month through 2022.

With the economy rebounding strongly, higher inflation and unemployment claims falling, it was hard for most Democrats in Congress to justify spending billions of dollars on even more stimulus payments.

Some states like California however, are making state specific stimulus payments to provide inflation relief for lower income workers which may be replicated in other states.

There is also the expanded monthly Child Tax Credit stimulus payment for families who have qualifying dependents. While this is not technically a fourth dependent stimulus and rather more of an advanced tax credit it will act like a stimulus payment because it is being paid directly by the IRS to nearly 70 million dependents and their families. This has provisions for another 12 month extension under the BBB.

You May Like: Amount Of Third Stimulus Check

When Should You Request An Irs Payment Trace

Since the third stimulus checks are still being sent, you could hold out a little longer before taking action. If you didn’t get your first or second check at all, though, it’s time to do something. This chart shows when you can and should request an IRS payment trace, which is designed to hunt down a stimulus check the agency says it sent. More below on exactly how a payment trace works, how to get started and when to use it.

How To Claim Your $1400 Stimulus Check In 2022

- 10:37 ET, Dec 29 2021

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but haven’t yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

Don’t Miss: When Did The Second Stimulus Checks Go Out

Who’s Eligible For The Payment

Those eligible for the money could include people whose tax situation changed in 2021, but the change was not reflected in their latest tax return.

For example, parents who welcomed a child in 2021 may be eligible for the $1,400 payments as long as they meet income requirements.

Eligibility for the third round of stimulus checks, issued earlier this year as part of President Joe Biden‘s American Rescue Plan, was based on a family’s last tax return filed.

Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian’s 2021 tax return.

Others may be eligible for more money as well due to a change in income or the addition of a dependent.

Payments begin to phase out for people who make more than those income limits.

They completely phase out for individuals who make more than $80,000 and couples who make more than $160,000.

The number of families still owed a $1,400 stimulus check is not yet known but it is estimated to be in the millions.

The figure wont be known until the total number of births for 2021 is revealed.

What If I Am Married To Someone Who Owes Child Support Will My Tax Return Be Applied To The Child Support Arrears They May Owe

-

Yes,unless you are eligible for relief. If youdo not owe child support butyouare married tosomeonewhoowes child support,you may need to file an Injured Spouse Claim and Allocation -Form 8379

-

In some instances, the IRS offsets a portion of the payment sent to a spouse who filed an injured spouse claim if it has been offset by the non-injured spouses past-due child support. The FAQ on the IRS stimulus FAQ www.irs.gov/coronavirus/economic-impact-payment-information-center website states: The IRS is aware that in some instances a portion of the payment sent to a spouse who filed an injured spouse claim with his or her 2019 tax return has been offset by the non-injured spouses past-due child support. The IRS is working with the Bureau of the Fiscal Service and the U.S. Department of Health and Human Services, Office of Child Support Enforcement, to resolve this issue as quickly as possible. If you filed an injured spouse claim with your return and are impacted by this issue, you do not need to take any action. The injured spouse will receive their unpaid half of the total payment when the issue is resolved.

Also Check: What Does The Stimulus Debit Card Look Like

How To Claim Stimulus Funds In Your 2021 Tax Return

The third round of stimulus payments is worth up to $1,400 per person if your adjusted gross income is $75,000 or less as a single filer, or $160,000 or less as a joint filer. Families are entitled to $1,400 per dependent for dependents of any age.

Before claiming the funds, make sure they weren’t sent to you already. You can confirm the amount of the third payment and whether it was sent to you by logging into your IRS online account or the Get My Payment app. You can also refer to a letter sent to you by the IRS, known as Notice 1444-C, which will tell you how much is owed to you.

If you lost your stimulus check or suspect it was stolen, you can request the IRS to trace your payment and get the amount automatically reimbursed to you as a tax refund. If you’re filing your 2021 tax return before your trace is complete, do not include the payment amount on the Recovery Rebate Credit Worksheet, the IRS says.

Otherwise, you’ll need to complete the Recovery Rebate Tax Credit worksheet and submit it as part of your 2021 tax return. The worksheet will help you calculate how much you can claim. Then, claim it on line 30 in Form 1040 or Form 1040-SR of your 2021 tax return.

Tax software will also guide you through this process and automatically add all the information to your tax return.

And remember, you can file your tax return for free if your income is $73,000 or less, using the IRS Free File Program.

How Can I Get The Right Amount Of Stimulus Money For My Dependents

The third stimulus check changes the rules and makes dependents of all ages eligible for up to $1,400 each toward the households total payment. That includes older adult relatives and college-age children. However, some beneficiaries with dependents will need to file a 2020 tax return to receive the $1,400 per dependent, so that the IRS knows how many dependents you claim.

People in this group should file a 2020 tax return to be considered for an additional payment for their dependent as quickly as possible, the IRS said in a March 22 press release.

There are ways you could get more money with the third check and things to know if you had a baby in 2020. There are also tax breaks for anyone caring for children and older adults, and details on whom the IRS counts as an adult to receive their own stimulus check.

For the first stimulus check approved under the CARES Act in March 2020, qualified people with dependents age 16 or younger were eligible for up to $500 per child dependent, but not everyone actually received that extra money. For the second stimulus check, as long as your children were 16 years old or younger, they contributed $600 toward the final total of your households second stimulus check.

Read Also: Is A 4th Stimulus Check Coming

Read Also: I Still Haven’t Gotten My First Stimulus Check

What Can You Do If You Did Not Get The First Or Second Stimulus Payments

If you did not receive payment for the first or second round of economic impact payments or believe you did not receive the full amount to which you were entitled there is a way to resolve it. You must file a 2020 tax return and claim the 2020 recovery rebate credit for the amount you are owed.

Lost payments from any of the three rounds can be traced by the IRS. If you find that the IRS records indicate payment being made to you, you can request that it trace the payment. Tracing takes time and will not begin immediately. Depending on how the payment was made to you by the IRS, the following waiting periods apply:

1). Five days from the date of a direct deposit that your bank did not receive.

2). Four weeks for mailed checks.

3). Six weeks for a check mailed but forwarded to another address because you moved.

4). Nine weeks when a check was mailed to a foreign address.

If you filed a tax return within the past three years, check with your tax preparer to verify the address on the return and the method you chose to receive any tax refund that may have been due before initiating a trace through the IRS.

How Much Is The Third Stimulus Check

If you are eligible, you could get up to $1,400 in stimulus payments for each taxpayer in your family plus an additional $1,400 per dependent. That means that a family of four with two children could receive up to $5,600.

Remember, just because you are eligible, does not mean you are eligible for the full $1,400.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Don’t Miss: Didnt Get Any Stimulus Checks

How We Make Money

You have money questions. Bankrate has answers. Our experts have been helping you master your money for over four decades. We continually strive to provide consumers with the expert advice and tools needed to succeed throughout lifes financial journey.

Bankrate follows a strict editorial policy, so you can trust that our content is honest and accurate. Our award-winning editors and reporters create honest and accurate content to help you make the right financial decisions. The content created by our editorial staff is objective, factual, and not influenced by our advertisers.

Were transparent about how we are able to bring quality content, competitive rates, and useful tools to you by explaining how we make money.

Bankrate.com is an independent, advertising-supported publisher and comparison service. We are compensated in exchange for placement of sponsored products and, services, or by you clicking on certain links posted on our site. Therefore, this compensation may impact how, where and in what order products appear within listing categories. Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range can also impact how and where products appear on this site. While we strive to provide a wide range offers, Bankrate does not include information about every financial or credit product or service.

What To Do About Payment Scams

Though itâs uncommon, you may believe youâve been scammed out of your payment or had it stolen. The Federal Trade Commission has a website where you can report a stolen stimulus check. If youâre worried about theft, you can sign up for a free USPS service that will send you a picture of every piece of mail coming your wayâ including your stimulus payment.

Also Check: Who Qualifies For Stimulus Check

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Read Also: $600 Stimulus Check Not Received

Stimulus Payments: How Can I Get My 2021 Check For Up To $1400

Let0s take a look at the way you can get the 2021 Stimulus Payment

Everybody is wondering if their 2021 Stimulus Payments arrived in time or if they are still owed any check from that year. We got you covered on how to check on this and probably enjoy a new check you might’ve missed on that can go up to $1,400. Americans might not even be aware they are still due to another Stimulus pauyment that they missed back in 2021.

The process to find out is relatively simple. This guide applies to the latest round of stimulus checks that are worth up to $1,400 in many cases. Let’s take a look at what qualifications you need to have in order to get that payment or if you are even owed that. We are talking a certain part of the population, these checks are not for everybody.

How To Get Your Stimulus Check And Eligibility

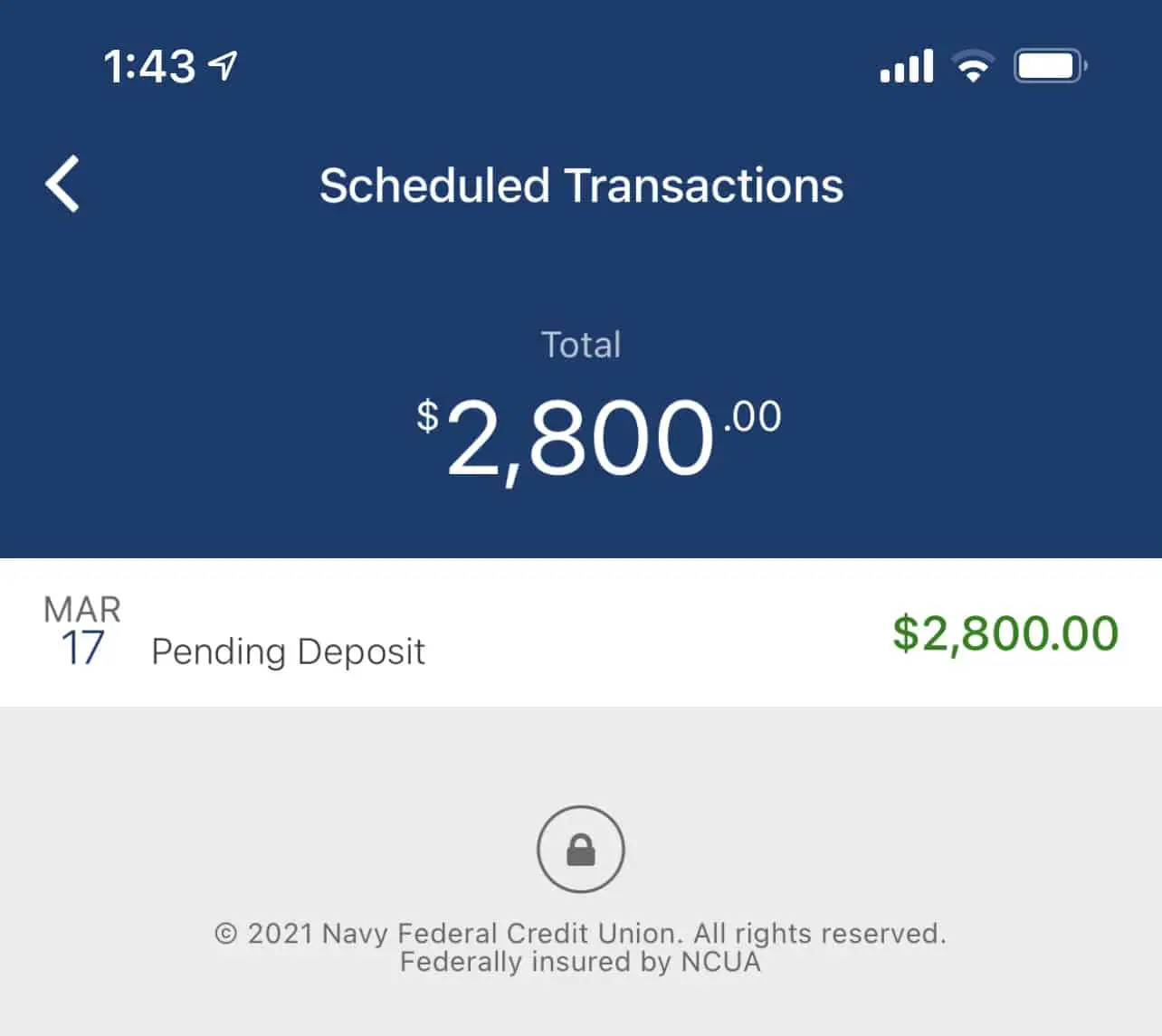

To receive your stimulus payment, and other missed tax credits, youll need to file a 2021 tax refund. To be eligible for payment, you don’t need to have earned any income. However, you will need to make sure that if you did, your income is below a certain level.For individual filers to receive full payment, their adjusted gross income will need to have been $75,000 or less. For married couples to receive the whole $2,8000 payment, their income will need to be less than $150,000. The income limit for heads of household is $112,500.

Additionally, if you have any dependents, they could qualify for $1,4000 payments as well.

Individuals with little resources who therefore didnt file taxes are still entitled to the stimulus payments and can claim them by going to GETCTC.com. Here you’ll also be able to claim the Child Tax Credit and the Earned Income Tax Credit, which will earn you potentially thousands of dollars if you qualify.

The deadline for free filing using this site is November 15, so don’t let that money go to waste if you have yet to file. You can also file with the IRS Free File tool , which is available until November 17.

You May Like: Are We Getting Another Stimulus Pay