State Stimulus Checks In 2022

As mentioned earlier, many states are sending payments to their residents in 2022 to help with high inflation and other economic woes. For the most part, these payments come from a budget surplus or federal COVID-relief funds. To see if your state is sending a payment this year, see State “Stimulus Checks” in 2022.

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Also Check: Can You Still Claim Stimulus Check

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

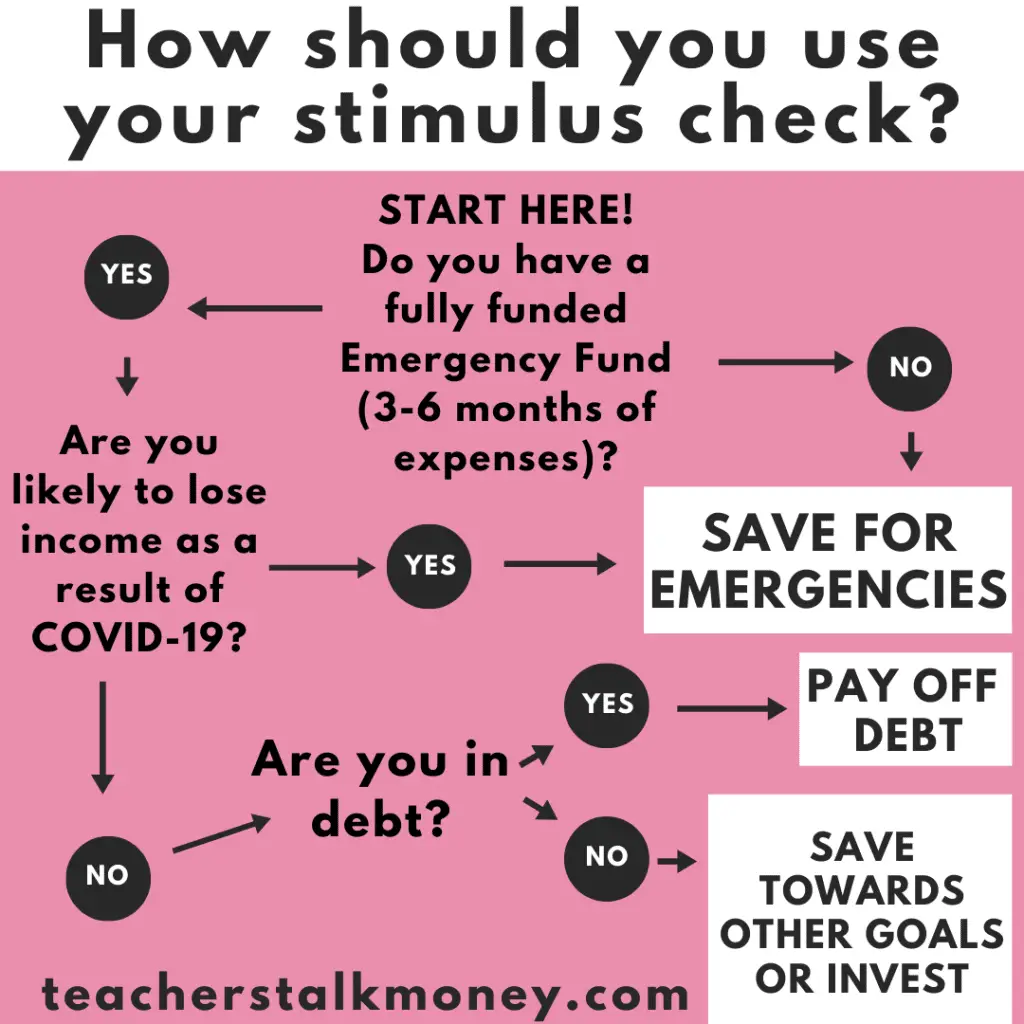

Paying Down Debts 25%

The MoneyDoneRight.com survey indicates that this will be the most popular use of our stimulus checks in 2020. As a nonprofit credit counseling agency, we always recommend the acceleration of debt elimination as part of every personal household spending plan. For this reason, many might find it surprising that we do not place debt reduction in the top priority spot. In advance of recessions and during both economic emergencies and natural disasters, saving money for near-term needs will always take precedence. In full-on, lock-down emergencies, we might even recommend making only minimum payments to your debt accounts while focusing all available cash on saving for present and future necessities.

How much will twenty-five percent of your stimulus check be for paying down your debts? Heres the breakdown:

-

Individual adult: $300

-

Single Parent of One Child: $425

-

Couple with One Child: $725

-

Couple with Two Children $850

While $300 may not seem like much if you have thousands or tens of thousands of dollars of consumer debt, consider this. Your $300 additional payment on a $5,000 credit card account with a 15% annual interest rate could save you over $200 in interest payments in the future. That is a 67% return on that payment!

If your interest rate is 25%, that $300 could save you over $600 in interest payments, or a 200% return. That sort of savings should matter to virtually all households.

Don’t Miss: Who Qualifies For Stimulus Check 2021

Your Stimulus Check Is Formally Called A Recovery Rebate Credit

The stimulus checks handed out to combat the financial effects of the pandemic are technically an advance tax credit called the Recovery Rebate Credit.

A tax credit reduces your tax bill on a dollar-for-dollar basis. It’s like having store credit at your favorite clothing shop when you apply it to your total bill, it reduces what you owe. Often it can result in a refund.

Because of the severity of the national crisis, the government gave eligible Americans their tax credit early the amount was based on their latest tax return filed or their federal benefits profile. People who don’t normally file taxes were asked to submit their personal information to the IRS online by November 21 to claim their payment. If they didn’t, they will need to file a tax return for 2020, even if they don’t owe taxes.

Most stimulus payments were initially based on 2018 or 2019 income, since those were the most recent tax returns filed. In some cases, that means people who lost their job, had their pay reduced, or even had a baby since then weren’t given their full credit based on financial need in 2020.

Who Qualifies For A Stimulus Check And How Much Will I Receive

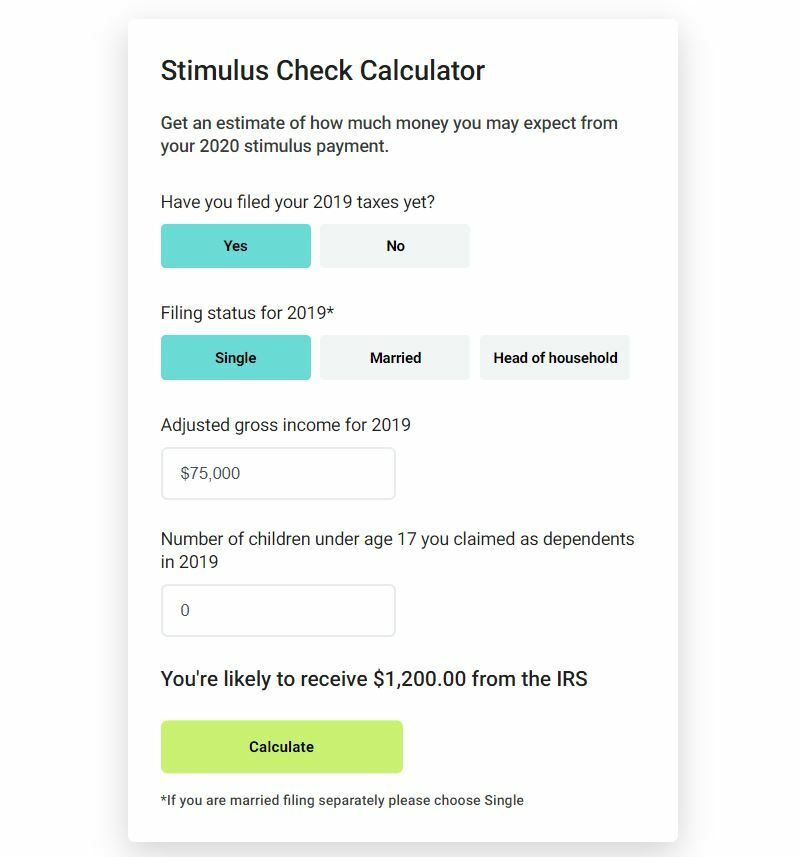

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Also Check: Direct Express Pending Deposit Stimulus Check

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the Recovery Rebate Credit are found on pages 57 59.

Read Also: Is Texas Giving Stimulus Money

Stimulus Checks: Children And Dependents

Q. I had a baby in late 2020. Am I eligible for the child stimulus payments?A. If you had a baby in 2020, you are eligible for the $1,400 credit in 2021. This will be paid in an advance third stimulus payment if you filed your 2020 return by the time the payments were issued. If you didnt receive the first or second stimulus payment for your baby, you can claim the recovery rebate credit when you claim the child on your 2020 return.

Q. I have joint custody of my daughter with my ex-spouse, and I claimed her on my 2019 taxes . What do we need to know when my husband claims her?A. For the first and second payments, the spouse claiming the child in 2020 will claim the children and could receive the recovery rebate credit on the 2020 return.

However, for the third payment, divorced parents who alternate claiming their dependents each year, if an advance payment is received by one spouse for the dependent, no additional payment can be made for the same dependent on the other spouses return.

For example, if the payment is issued to Parent 1 because they claimed the child on their 2020 return, Parent 2 cannot claim the credit on their 2021 return even though they didnt receive the payment from Parent 1.

The second way is claiming the Recovery Rebate credit on your 2020 taxes, which you can do for the first or second payments. Youll receive the correct amount in the form of a tax credit that either lowers your tax bill or gets added to your refund.

Recommended Reading: Stimulus Checks For Seniors On Social Security

Do I Need To File My Taxes To Get A Stimulus Payment

If you are required to file a tax return, the IRS will use information from your most recent filed tax return to issue your stimulus payment.

Here are the reasons you are required to file a tax return for tax year 2020:

- Taxpayers who earn income more than the IRS income filing threshold .

*Note: If you are single and 65+, thresholds are bumped up to $14,050 for 65+ or blind. If you are married filing jointly, 65+ thresholds are $13,700 for 65+ or blind.

- Self-Employed whose net income is $400 or more since they need to pay self-employment taxes on income of $400 or more

- Dependents with unearned income more than $1,100 and earned income more than $12,400

- You received an advance payment of the health coverage tax credit

- You owe taxes on an IRA or Health Savings Account

If are not required to file, you can use the TurboTax free Stimulus Registration Product to provide the IRS information needed so that you can receive a stimulus payment.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: Get My 2nd Stimulus Payment

What You Need To Know About Your 2020 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

Why Is The Irs Sending Me Letter 6475

The Economic Impact Payment letters include important information that can help people quickly and accurately file their tax return,the IRS said in a January release, including personal information like your name and address and the total amount sent in your third stimulus payment.

This could include plus-up payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but thats not what you want to use to prepare your 2021 return.

Read Also: Is It Too Late To File 2020 Taxes For Stimulus

Recommended Reading: When Did The Stimulus Checks Go Out In 2021

How Can I Get My Money Faster

The IRS is first sending money to those for whom it has bank account information on file. That might not be you if you havent received a tax refund over the past two years or if you received a refund by a check in the mail, rather than by a direct deposit.

But the Get My Payment tool, which launched Wednesday, will also allow taxpayers to input their bank account information so that they can receive the money electronically rather than by a paper check which could take weeks, or even months.

To do so, a taxpayer will need to submit their adjusted gross income from their most recent tax return, the refund or amount owed that year, as well as the account and routing numbers for their bank account.

However, taxpayers wont be able to update their bank information once the payment is already scheduled for delivery, and it wont allow you to update bank information already on file, the Treasury Department said.

Rd Round Of Stimulus Payments

The third stimulus checks were based on your 2019 or 2020 tax information. Individuals qualified for the full stimulus payment if their AGI was $75,000 or lower . The full payment was $1,400 for single individuals, $2,800 for married couples, and an additional $1,400 for each dependent.

If you earned more than the threshold but not more than $80,000 , you received a partial third stimulus payment.

You May Like: How Many Irs Stimulus Payments In 2021

Rebate Credits Available For Some

Those who haven’t received full stimulus benefits can apply for a Recovery Rebate Credit on Form 1040 on their 2020 federal tax returns, according to Colorado tax specialist Kari Brummond.

She highlights a key caveat for full eligibility: Adjusted gross income last year must be below $75,000 for single filers and $150,000 for joint filers.

To claim this credit, you need to note the amount of the payment you received so that the government can determine how much it owes you,” adds Brummond, a tax preparer at Trumbull, Conn.-based TaxDebtHelp. Unfortunately, you cannot use your 2018 or 2019 income to qualify for the Recovery Rebate Credit. This is solely based on your 2020 income.”

About the Author

Chris Casacchia

Chris Casacchia is an award-winning journalist, editor, and media consultant based in Los Angeles specializing in busineRead more

Read More On Payments

For the third tranche, generally, you were sent a check if you filed a 2020 tax return and met the income restrictions.

The following information was needed for the return:

- Step 1: Full name, current mailing address and email address

- Step 2: Date of birth and valid Social Security number

- Step 3: Bank account number, type and routing number, if you have one

- Step 4: Identity Protection Personal Identification Number you received from the IRS earlier this year, if you have one

- Taxpayers who previously have been issued an Identity Protection PIN but lost it, must use the Get an IP PIN tool to retrieve their numbers

- Step 5: Drivers license or state-issued ID, if you have one

- Step 6: For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number and their relationship to you or your spouse

Filers cannot be claimed as a dependent of another taxpayer and must have an adjusted gross income of $75,000 or less if single to claim the full stimulus payment.

You May Like: Did I Get The 3rd Stimulus

What Qualifies Someone As An Adult Dependent

An important piece of the puzzle, the IRS has a five-part test for determining which adults can be claimed as dependents.

Adult children have to be older than age 17 but younger than 19 to be considered an adult dependent from a tax perspective. If an adult dependent is a full-time student for at least five months of the year, the individual has to be under the age of 24. Most of the time, they have to be related to the adult taxpayer whos claiming them and share the same permanent address. Perhaps even more important: Adult dependents can work a full-time job, as many college students or adult-aged children do, but they cannot have provided more than half of their own support to be considered a dependent. Elderly parents and adults with disabilities who a taxpayer cares for also count.

Vast Majority Of Americans Want More Stimulus Checks In 2023 What Are The Chances Youll Get One

While the COVID-19 pandemic began in early 2020, the aftermath of the virus and the rise in inflation rates post-pandemic is still affecting Americans today. The government started sending stimulus payments of up to $1,200 to eligible tax-paying adults in April 2020, followed by a second round of up to $600 between December 2020 and January 2021. Almost immediately following the second round of stimulus checks, President Biden came into office and launched his American Rescue Plan that provided eligible taxpayers a check of up to $1,400.

Although discussions of a fourth stimulus check have simmered down in the halls of Congress, Americans continue to advocate for another round of relief.

According to a recent survey conducted by GOBankingRates, 62% of Americans are in favor of more stimulus or inflation relief checks in 2023. In light of this data, lets take a look at which states are likely to offer stimulus checks this upcoming year and how much relief they might be offering.

You May Like: What’s The Latest News On Stimulus Check