Can I Still Use ‘get My Economic Impact Payment’ Tool To Check My Covid

Eligible federal benefit recipients who do not usually file a tax return will be able to use Get My Payment to check their payment status for their own payment when its been issued.

The IRS is working with Federal agencies to get updated information for recipients to ensure we are sending automatic payments to as many people as possible. More information about when these payments will be made is provided in the news release issued on March 30, 2021.

If you are eligible for the Third Economic Impact Payment and have not filed a 2020 return, you still have time to file so you can provide us with the information needed to issue a payment to you, or a qualifying spouse and any qualifying dependents you may have.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July 1, 2022.

The Oregon Department of Revenue website contains FAQs for residents with concerns about receiving their payment.

Learn Howto Find Unclaimed Stimulus Checks Today In Your Name

Create an accountto get your guide on how you can find unclaimed money and other offers

By clicking Get Started: 1) I represent that I am 18+ years of age and agree to receive emails from OpenFinancial 2) I understand and acknowledge that this site uses site visit recording technology 3) I represent that I have read and agree to the Terms of Use and Privacy Policy 4) I understand this website is not affiliated with, nor endorsed by any government agency.

Read Also: How To Fill Out Non Filers Form For Stimulus Check

Learn Howto Find Unclaimed Assets Today In Your Name

Create an accountto get your guide on how you can find unclaimed money and other offers

By clicking Get Started: 1) I represent that I am 18+ years of age and agree to receive emails from OpenFinancial 2) I understand and acknowledge that this site uses site visit recording technology 3) I represent that I have read and agree to the Terms of Use and Privacy Policy 4) I understand this website is not affiliated with, nor endorsed by any government agency.

How Do I Get Help Filing A 2020 Tax Return To Claim My Eip

The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

Also, you can find Form 1040 and Form 1040 instructions on the IRS website. The instructions for the “Recovery Rebate Credit” are found on pages 57 – 59.

Read Also: Is Texas Giving Stimulus Money

Checks Started Arriving On October 7

Funds began arriving on Friday, Vigliotti noted, with people receiving either a debit card in the mail or a direct deposit to their bank account.

But it could take a few days or weeks for the money to arrive. Still, about 90% of people who receive direct deposits will get their payments by the end of October, according to the California Franchise Tax Board.

On social media, some people said they had received their checks via direct deposit on Friday, while others said they were still waiting.

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Residents To Receive Tax Rebate Of Up To $500

Also Check: Will Social Security Get Stimulus Check

I Receive Social Security Retirement Disability Survivors Ssi Or Veterans Benefits Do I Automatically Qualify For An Economic Impact Payment

In some cases, if you receive certain benefits, you will automatically receive an Economic Impact Payment. Make sure you read further to know if this applies to you and to know if you need to send the IRS any additional information, and how you will be receiving your payment.

The IRS is working to make it easier for certain beneficiaries to receive the Economic Impact Payment by using information from benefit programs to automatically send payment.

You will qualify for this automatic payment only if:

- You were not required to file taxes in 2018 or 2019 because you had limited income and

- You receive one of the following benefits:

- Social Security retirement, survivors, or disability from the Social Security Administration

- Supplemental Security Income from the Social Security Administration

- Railroad Retirement and Survivors from the U.S. Railroad Retirement Board

- Veterans disability compensation, pension, or survivor benefits from the Department of Veterans Affairs

If you qualify for an automatic payment, you will receive $1200 . You will receive this automatically the same way you receive your benefits, either by direct deposit or by check. You will not need to take any further action to receive this.

No matter how you receive your payment, the IRS will send you a letter in the mail to the most current address they have on file about 15 days after they send your payment to let you know what to do if you have any issues, and contact information for any questions.

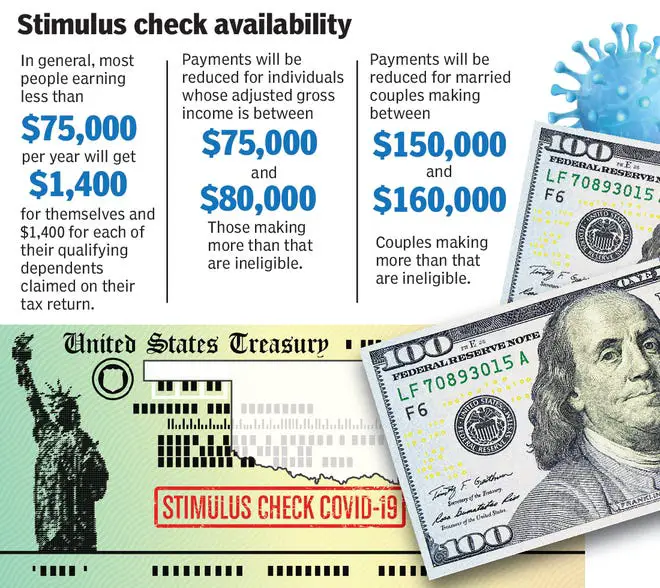

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Don’t Miss: I Never Got My California Stimulus Check

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050

Discuss The Economic Impact Payment With The Beneficiary

A representative payee is only responsible for managing Social Security or SSI benefits. The Economic Impact Payment is not an SSA benefit and belongs to the beneficiary. Discuss the payment with the beneficiary, and if they request access to the funds, youre obligated to provide it.

Don’t Miss: Is There Another Stimulus Check Coming For Seniors

What If I Didnt Get Some Or All Of My Stimulus Checks

If you think you are eligible and you did not get a check for you or your dependents, you can still get the money by filing your 2020 or 2021 taxes. You may be eligible for free tax preparation help from Maines CA$H Coalition.

If you do not usually file a tax return and didnt get your stimulus checks, you may still be able to file a tax return this year to get your stimulus checks. You should check with a tax professional. The IRS website also provides information about how to claim your stimulus checks if you didnt get them in 2020 or 2021. You can also call Pine Tree Legal Assistance.

There’s Still Time To Claim

There is some good news: There’s still time for people who missed out on their stimulus checks to claim them, the report noted.

“Individuals with little or no income, and therefore not required to pay taxes, have until November 15 to complete a simplified tax return to get their payments,” the GAO said.

There’s also still time for people to claim the expanded Child Tax Credit, which was provided last year to eligible families. That credit provided as much as $3,600 to families with children under 17, but parents who didn’t receive the payments last year have only until November 15 to claim them.

To claim a missing stimulus payment, people should go to the IRS website for “Economic Impact Payments,” the official name for the program, and follow the instructions there. You’ll have to file a simplified tax return to receive the money.

Parents who still have missing Child Tax Credits from 2021 can go to the GetCTC.org website to claim them.

However, people who are required to file taxes due to their income and who missed the April 15 tax filing deadline have until October 17 to claim the payments, the GAO said. October 17 is the deadline for filing 2021 tax returns if you requested an extension from the IRS.

Read Also: How To Check For Stimulus Checks

Stimulus Check 2 2021

The timeline for the distribution of the second stimulus check was much shorter. Congress approved the coronavirus relief bill on Dec. 21, 2020 and it was signed into law on Dec. 28. The first direct deposits were made Dec. 29, and the first paper stimulus checks were put in the mail on Dec. 30.

The deadline for the IRS to provide the second check via mail, direct deposit, or debit card was Jan. 15, 2021. Anyone who did not receive their second check by Jan. 15 will have to file a tax return to get it.

How To Get Your Stimulus Checks If You Still Haven’t Received Payment

While Congress considers whether to issue a fourth round of stimulus checks, some people haven’t received their older checks.

The first and second stimulus check amounts were for $1,200 and $600, respectively. The third was for $1,400. Here’s how to get your stimulus checks if you haven’t received them yet.

Firstly, some people haven’t received checks because not everyone qualifies for them. You aren’t eligible if your previous IRS tax filings show that you’re a single person who makes over $75,000 annually, a head of household who makes over $112,500 annually, or a married couple who jointly reports over $150,000 annually.

Some are also ineligible due to restrictions on age and dependent status. If someone claimed you as a dependent in their previous tax returns and you were 17 years old or older on January 1, 2020, then you weren’t eligible for the first two checks, according to CNBC.

The IRS and the Social Security Administration have also said that people may not have received stimulus checks because they didn’t file their 2020 taxes. They urged them to file for 2019 and 2020 even if they’re not legally required, in order to ensure that all eligible people receive their payments.

Even if you owe the IRS money, you should still receive your stimulus checks or the aforementioned 2020 Recovery Rebate Credit. The IRS won’t withhold those funds.

Recommended Reading: Where My Second Stimulus Check

Blog Post What To Expect With Your Upcoming Tax Rebate

- Office of Consumer Affairs and Business Regulation

Last month the Baker Administration announced that eligible Massachusetts taxpayers will receive a tax rebate connected to their 2021 filings. For the second time since 1986, the Commonwealth experienced a surplus of almost $3 billion. Therefore, under Chapter 62F any money that exceeded allowable revenue must be returned to those who filed. Individuals should start seeing funds by check or direct deposit in November.

In anticipation of the tax rebates, the Office of Consumer Affairs and Business Regulation compiled details on what to expect.

For more information about the tax rebate, visit the Governors Office official press release: Baker-Polito Administration Announces Details for Return of $2.941 Billion in Excess Tax Revenue to Taxpayers | Mass.gov. You can check out the audit that made the tax return happen at: Determination of Whether Net State Tax Revenues Exceeded Allowable State Tax Revenues — Fiscal Year 2022 | Mass.gov.

If you have questions about the Chapter 62F refund, you can reach a call center dedicated to answering there questions at 877-677-9727. The Administration also compiled a of frequently asked questions available here: www.mass.gov/62frefunds

Who’s Eligible For The Payment

Those eligible for the money could include people whose tax situation changed in 2021, but the change was not reflected in their latest tax return.

For example, parents who welcomed a child in 2021 may be eligible for the $1,400 payments as long as they meet income requirements.

Eligibility for the third round of stimulus checks, issued earlier this year as part of President Joe Biden‘s American Rescue Plan, was based on a family’s last tax return filed.

Since babies born in 2021 were not factored in, the $1,400 checks will be applied to their parent or guardian’s 2021 tax return.

Others may be eligible for more money as well due to a change in income or the addition of a dependent.

Payments begin to phase out for people who make more than those income limits.

They completely phase out for individuals who make more than $80,000 and couples who make more than $160,000.

The number of families still owed a $1,400 stimulus check is not yet known but it is estimated to be in the millions.

The figure wont be known until the total number of births for 2021 is revealed.

You May Like: Irs.gov Refund Stimulus Check

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Also Check: Who’s Eligible For The Third Stimulus Check

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.