Irs Stimulus Payment: What To Do If You Have A Missing Stimulus Payment

There are four reasons why you may be due more stimulus check money in 2022

Following the outbreak of the coronavirus pandemic, both Donald Trump and Joe Biden‘s administrations organised stimulus checks, officially called Economic Impact Payments. Three different stimulus checks were sent out to low- and medium-income families, with a check of $1,200 in April 2020, one of $600 in December 2020 and one of $1,400 in March 2021.

However, some people haven’t yet claimed the full amount of stimulus money that they were entitled to. It isn’t too late, though, as these people might still be able to backdate their stimulus checks.

“People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return,” the Internal Revenue Service explains.

St And 2nd Rounds Of Stimulus Payments

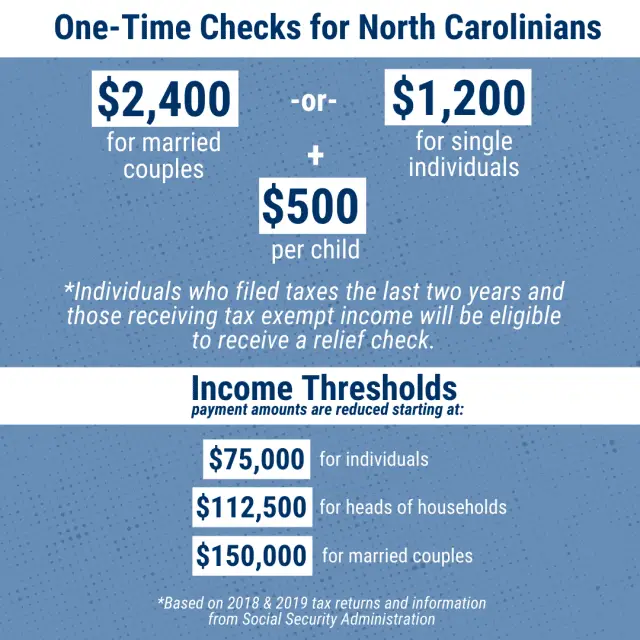

The first two payments were based on your 2018 or 2019 tax information. Individuals qualified for full stimulus payments if their adjusted gross income , which is income minus certain deductions, was $75,000 or less . The IRS reduced the stimulus payments by $5 for every $100 earned above the income thresholds.

The first full stimulus payment was $1,200 for single individuals, $2,400 for married couples and $500 per qualified dependent. The second full stimulus payment was $600 for single individuals, $1,200 for married couples and $600 per dependent.

If you earned more than $99,000 , you got no first stimulus payment. With the second stimulus check, your payment was reduced to $0 once your AGI reached $87,000 for individuals and $174,000 for married couples.

How Can You Check On The Status Of A Missing Stimulus Payment

It’s easy to check the status of your third stimulus check through the Get My Payment tool. You’ll need to request a payment trace if the IRS portal shows your payment was issued but you haven’t received it within the time frame outlined in the chart above.

To use the tool, you need to plug in your Social Security number or Individual Taxpayer Identification Number, date of birth, street address and ZIP or postal code. The portal will show your payment status, if your money has been scheduled and the payment method and date. You might also see a different message or an error.

Also Check: Is There Another Stimulus Check Coming Out Soon

Stimulus Check: Check Your Status With The Irs Get My Payment App

If youre not sure whether your stimulus check has been sent out, the easiest way to check is by using the IRSs own online tracker. Alternatively, you can use the IRS stimulus check phone number.

If you meet the eligibility requirements for the third stimulus check, the status of your payment should be visible from the IRSS Get My Payment Portal. That includes people who are not eligible for the full stimulus-check amount. Heres how:

- Just head over to the IRS Get My Payment website , and click Get My Payment to enter the portal.

- Fill out your Social Security number or Individual Tax ID along with your date of birth, address, and ZIP code. Then click Continue.

You should then see your stimulus-check-payment status. If it hasnt been sent yet, you have nothing to worry about.

If it says Payment Status Not Available it means that youre either not eligible, or that the IRS hasnt finished processing your tax return yet, assuming you have already filed it.

If you signed up to USPSs informed delivery tool, you can track your stimulus check through the mail and will get a notification when it arrives in your mailbox. You can read more about that here. But if you dont receive your payment, thats when you want to escalate things.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

Answer simple questions about your life and TurboTax Free Edition will take care of the rest.For simple tax returns only

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Don’t Miss: How To Find Stimulus Check History

The Irs Doesnt Have Your Direct Deposit Info

The fastest way to get your stimulus check is via bank direct deposit from the IRS. If the IRS doesnt have your direct deposit info on file, you can still get paid, but itll come via paper check â and getting a check in the mail could delay your payment by weeks or even months. Treasury Secretary Steve Mnuchin told CNN that it was his idea that paper check stimulus payments have President Donald Trumps signature on them, and that reports saying that the signature would add further delay to the arrival of paper checks is incorrect.

The checks have not gone out yet, Mnuchin said to CNNs Jake Tapper on Sunday, April 19, and the reason they have not gone out yet is that were hoping that more people, as I said, will go to IRS.gov. Its much safer to send out direct deposits.

Most taxpayers provide the IRS with their bank account details, for the purposes of making a payment or receiving a tax refund. If the agency does not have your direct deposit details, you can provide the IRS with that information at the Get My Payment appâ which also lets you track the status of your check. However, the last day to give your direct deposit info to the IRS was May 13 if you missed the deadline, are eligible, and havent received your payment already, it will come as a paper check. You can still use the Get My Payment app to reveal how you will receive your payment , and give a scheduled arrival date, if the payment has been processed.

Dont Miss: Update On The Stimulus Package

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: How Many Stimulus Checks Should I Have Received

Your Stimulus Checks Arent Taxable

Its essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people dont entirely grasp how stimulus payments affect their taxes.

The part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit, says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than youre entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you dont have to pay any stimulus money back.

What Can The Irs Do For A Missing Stimulus Check

The IRS will do the following to process your claim, according to its website:

- If you didn’t cash the check, the IRS will issue a replacement. If you discover the original check among your belongings, you’re expected to return it as soon as possible.

- If you did cash or deposit the check, expect a claim package from the Bureau of the Fiscal Service, which will include a copy of the cashed check. Follow the included instructions. The bureau will review your claim and the signature on the canceled check before deciding whether it will issue a replacement. This is presumably to guard against stimulus check fraud.

Also Check: How Many Irs Stimulus Payments In 2021

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit. This is the case if you received a partial amount or didnt previously qualify for the third stimulus payment.

Lets say you are single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings have fallen below the threshold. Families that added dependents may also be able to claim the credit.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If youre using a tax software program, it should guide you through the process. Keep in mind the IRS predicts a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

If youre unsure of the amount of your third stimulus payment, you should review your IRS online account or use the Get My Payment app. You can also refer to your Notice 1444-C, a letter sent by the IRS to recipients, which shows the third stimulus payment amount for 2021.

Some Stimulus Checks Remain Uncashed

More than a million Americans failed to cash the first round of stimulus checks provided by the March 2020 CARES Act, according to the Boston Herald. The IRS has said that the number includes funds paid back or left uncashed.

The Herald did not specify who received those payments, but its possible that some of those checks went to people who moved without leaving forwarding addresses or who had passed away since filing their 2018 tax returns.

The uncashed checks are less than 1% of the estimated 130 million stimulus payments provided by the CARES Act, but they may end up being a talking point for politicians and pundits opposed to a fourth round of stimulus checks.

Read Also: Can You Get A Stimulus Check At 18

Read Also: North Carolina Stimulus Check 2022

Start By Reading The Guide To Uber And Lyft Taxes

As a rideshare driver, you are self-employed, which means you are a small-business owner. Youll pay self-employment taxes in addition to your regular income taxes. Learn how to maximize your driving income and file taxes correctly.

All information on this site is provided for educational purposes only and does not constitute legal or tax advice. The Center on Budget & Policy Priorities and the CASH Campaign of Maryland are not liable for how you use this information. Please seek a tax professional for personal tax advice.

How Can I Request Stimulus Money I Didn’t Receive

To find out if you are owed a stimulus payment, you’ll have to create an online account with Social Security here using your Social Security number. You should be able to see where the payments were deposited or when they were mailed.

You won’t be able to get a new stimulus check, but you can get your stimulus money through a tax refund by claiming the 2021 “Recovery Rebate Credit.” To claim the credit, you’ll have to file a simplified tax return, even if you don’t usually file taxes. You can file your tax return electronically for free on the IRS website, and the tax software will help you calculate your Recovery Rebate Credit. Your Recovery Rebate Credit will be included in a tax refund that the IRS will send to you . You have until November 15, 2022 to file the tax return.

For more information, go to the IRS’s web page for Economic Impact Payments.

Read Also: When Is The 3rd Stimulus Check Coming

Why You May Not Have Gotten All Your Stimmy Money

The third-round stimulus payments, authorized by the American Rescue Plan Act of 2021 and signed into law on March 11, 2021, were sent from March through December last year. Round 3 of the so-called stimmies provided a maximum credit of $1,400 per person, including all qualifying dependents claimed on a tax return.

A married couple with two qualifying dependents, for example, are eligible to receive a maximum credit of $5,600, depending on income limits. And if you brought a baby into the world last year, youll be able to file for up to $1,400 that youre owed for your new family member if you claim the child as a dependent.

The size of the credit, however, gets reduced for single filers with adjusted gross income of more than $75,000 and for married couples filing jointly with earnings of more than $150,000. For heads of household, the credit is reduced between $120,000 and $112,500.

The credit disappears entirely for individuals with AGI above $80,000 and for married couples filing jointly who earn more than $160,000. Heads of household with incomes of more than $120,000 also dont get the stimulus check. Most eligible Americans have already received the payments, according to the IRS.

Is The Third Stimulus Check Considered Income

No. The Economic Impact Payment is not considered to be taxable income. And you shouldnt report it as income on your 2021 federal income tax return, according to Letter 6475.

You also do not need to repay any of the third stimulus payment money that you received. Thats true even if youd qualify for a smaller payment based on what youd calculate for your 2021 Recovery Rebate Credit.

Also Check: Amount Of The 3rd Stimulus Check

Recommended Reading: Irs Gov 3rd Stimulus Check

How To Find Unclaimed Money

If a business, government office, or other source owes you money that you dont collect, it’s considered unclaimed. Unclaimed property can include many things, including cash, checks, money orders, security deposits, or the contents of safe deposit boxes.

The federal government doesnt have a central website for finding unclaimed money. But you dont need to hire a company to find unclaimed money for you. You can find it on your own for free, using official databases.

Court Bars Monroe Man From Working As A Tax Preparer In Louisianacontinue Reading

BATON ROUGE A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.

Courtney C. Blockson was arrested in Dec. 2019 for a tax fraud scheme involving state child care tax credits. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. None of the taxpayers involved were aware of Blocksons scheme. The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.

Blockson pleaded guilty to Filing False Public Records. As a condition of the plea, the court issued an injunction prohibiting him permanently from participating directly or indirectly in the preparation or filing of any Louisiana tax return except his own.

You May Like: How Much Was The First Stimulus Check

Your Stimulus Checks Aren’t Taxable

Its essential to understand that a stimulus payment is not taxable. The IRS has issued guidance stating that you do not need to include the amount in your gross income or pay taxes on the money.

Still, many people dont entirely grasp how stimulus payments affect their taxes.

The part that I think most do not necessarily understand is that the payment is technically an advance refundable tax credit, says Hawkins.

The stimulus payments were advance tax credits because the IRS gave you money in advance of filing your tax return. The recovery rebate credit is considered a refundable credit, meaning it can reduce the amount of taxes you owe or generate a refund to you.

One final important point: Typically, if you receive more money from the IRS than you’re entitled to, you must repay the excess amount. But the recovery rebate credit works differently. If you received a stimulus payment based on your previous tax information but no longer qualify, based on your current tax return, you don’t have to pay any stimulus money back.