What Steps Do I Need To Take To Receive An Economic Impact Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money. You will do this using one of two different IRS portals. It is important that you provide this information using the right IRS portal so that the IRS can process your information quickly.

- If you already filed your 2018 or 2019 taxes, go to the IRS Get My Payment portal to check the status of your payment. This portal will let you know if your payment has been processed and let you know if the IRS needs more information before sending you your payment.

- If your payment has already been processed, the IRS does not need any more information from you at this time.

- If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you dont provide it to them, your payment will be sent to you by check to the address they have on file.

Minnesota: $488 Payments For Frontline Workers

Some frontline workers received a one-time payment of $488 in October, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020, and June 30, 2021, and werent eligible for remote work.

Workers with direct Covid-19 patient-care responsibilities must have had an adjusted gross income of less than $175,000 between December 2019 and January 2022 workers without direct patient-care responsibilities must have had an adjusted gross income of less than $85,000 annually for the same period. Applications for the payment are now closed.

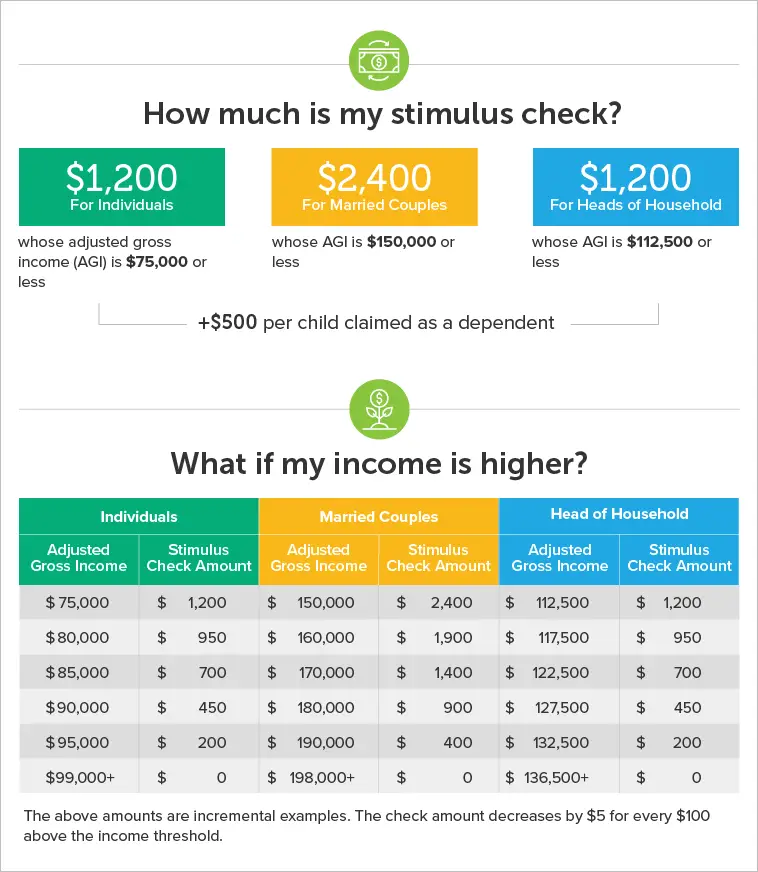

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Also Check: When Were The Stimulus Checks Issued

Stimulus Blamed For High Inflation

The final round of $1,400 direct payments which started in March 2021 along with the massive amounts of covid-19 relief funds injected into the US economy have been blamed for the higher-than-normal inflation afflicting the nation. The Federal Reserve Bank of San Francisco looked at the effect of the American Rescue Plan specifically on inflation.

It found that Bidens stimulus is temporarily ratcheting up inflation, but not causing overheating as has been suggested. Their analysis found that the ARP, is expected to cause inflation to increase by about 0.3 percentage point in 2021 and by a bit more than 0.2 percentage point in 2022. The impact in 2023 is negligible.

Other factors are helping push up prices on just about everything, a major source has been disruptions to supply chains caused by the pandemic. This caused manufacturers to scramble to secure scarce supplies of inputs to make their products. Americans in turn have been scooping up consumer goods with excess savings they acquired during the lockdown increasing demand on limited supplies.

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

You May Like: How Are Stimulus Checks Distributed

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Recommended Reading: What To Do If I Never Got My Stimulus Check

Wheres My Third Stimulus Check

OVERVIEW

The American Rescue Plan, a new COVID relief bill, includes a third round of stimulus payments for millions of Americans. Get updated on the latest information as it evolves.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

A third round of stimulus checks is on the way for millions.

The American Rescue Plan, a new COVID relief bill, was signed into law on March 11, 2021. The bill includes a third round of stimulus payments for millions of Americans. We know these funds are important to you, and we are here to help.

If you are eligible, you could get up to $1,400 in stimulus checks for each taxpayer in your family plus an additional $1,400 per dependent. This means a family with two children could receive $5,600.

The IRS began issuing the first batch of stimulus payments, and they could arrive as early as this weekend , with more arriving over the coming week. Further batches of payments will arrive during the following weeks. If youre eligible, check the status of your stimulus payment and the way itll be sent to you by going to the IRS Get My Payment Tool, which will be live on March 15th.

To find out if you are eligible and how much you can expect, visit our stimulus calculator.

Recommended Reading: Are Stimulus Checks Part Of The Cares Act

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2022.

Recommended Reading: Irs Social Security Stimulus Checks Direct Deposit 2022

How Much Were The Stimulus Checks

The first round of stimulus checks were paid to people beginning in April 2020. Those checks were up to $1,200 per eligible adult and up to $500 for each dependent child under 16.

The second round of stimulus checks were paid to people beginning in December 2020. Those checks were up to $600 per eligible adult and up to $600 for each dependent child under 17.

The third round of stimulus checks were paid to people beginning in March 2021. Those checks were up to $1,400 per eligible adult and up to $1,400 for each dependent child, regardless of age.

What Can The Irs Do For A Missing Stimulus Check

The IRS will do the following to process your claim, according to its website:

- If you didnt cash the check, the IRS will issue a replacement. If you discover the original check among your belongings, youre expected to return it as soon as possible.

- If you did cash or deposit the check, expect a claim package from the Bureau of the Fiscal Service, which will include a copy of the cashed check. Follow the included instructions. The bureau will review your claim and the signature on the canceled check before deciding whether it will issue a replacement. This is presumably to guard against stimulus check fraud.

Don’t Miss: Filing For Stimulus Check 2021

Consumer Protections And Scams: What Should I Know About The Economic Impact Payment Or Stimulus Check If I Do Not Regularly File Taxes

Who does NOT regularly have to file taxes and is considered a non-filer for purposes of the stimulus payments?

Non-filers include all of the following groups of people:

- Anyone who receives IRS Form SSA-1099

- Anyone who receives Form RRB-1099

- Anyone whose only income is Supplemental Security Income

- Anyone who receive veterans disability compensation, pension or survivor benefits from the Department of Veterans Affairs and did not file a tax return for the 2018 or 2019 tax years

- Anyone who earned income under $12,200 if single or $24,400 if married during the 2019 tax year

What is the purpose of the economic impact payment, also knows as a stimulus check?

On March 27, 2020, the Coronavirus Aid, Relief and Economic Stimulus CARES Act became law. This law created a one-time payment to many people in the United States from the federal government. The reason for the payment is to help people financially who face economic hardships caused by the coronavirus pandemic. The government also wants to boost spending power and spur economic activity.

Who is eligible for the economic impact payment?

Any individual in the United States is eligible for the payment except someone who is a nonresident alien or a person who can be claimed as someone elses dependent.

How much is the payment?

- Individuals who report adjusted gross income up to $75,000 on their tax returns will receive $1,200.

- Parents or caregivers may receive up to $500 for each qualifying child claimed as a dependent.

Economist Expectations Remain Mixed

Following the jobs report, some economists noted that low unemployment points to a strong economy and overblown talk of recession.

On the other hand, sinking unemployment coupled with high prices is consistent with an inflationary boom. And the labor markets unusual tightness has remained a focus for Fed policymakers, since the disparities between job openings and worker availability continues to place upward pressure on wages.

Ironically, as these positive factors continue to contribute to inflation, which may force the Fed to remain on its current rate hike schedule, a fact that feeds the recession debate.

While the unemployment rate is low and dropping, GDP which measures the price tag of an economys output has fallen two quarters in a row. Though that meets the technical definition of a recession, both the White House and Fed have indicated that other metrics dont yet add up to recession.

Don’t Miss: $600 Stimulus Check Not Received

If States Do Administer 2023 Stimulus Checks Be Smart With How You Spend It

Although there is no official confirmation that states will be administering any relief checks in the new year, its best to be prepared with the smartest moves to make in case you are in for a financial boost in the coming months.

Americans must be very wise in how they choose to spend any financial assistance given to them by their government, said Jake Hill, CEO of DebtHammer. I think the best way to spend stimulus checks is to either pay down debts or put away for future savings opportunities. Contribute to an i-bond, or put money away for your childrens future education. There are plenty of smart ways to go about spending your stimulus checks, but the key is to not spend it frivolously.

More From GOBankingRates

How The Third Stimulus Check Works For Nonfilers

For the third round of payments, in many cases, you shouldnt need to take an additional step to receive your money if youre part of a federal program like SSDI or SSI, because these should have been issued automatically. However, if the IRS doesnt know how many dependents you currently have, you may need to file a free, simple tax return for 2020 so it can pay you $1,400 for each.

If the IRS has your up-to-date 2019 records available, itll use those to account for payments, including anyone who used the IRS nonfiler tool to claim a first or second stimulus check. Nonfilers who received a previous stimulus check might also get a check through direct deposit , or in the mail as a paper check or EIP card. Some beneficiaries of federal programs, like SSDI and SSI recipients, may receive their stimulus money through their Direct Express card. Heres how to track your payment schedule with the IRS.

Read Also: How To Check For Stimulus Checks

You May Like: Ssi Get Stimulus Check 2022

State And City Stimulus Checks

Congress has yet to agree on a fourth federal stimulus check, leaving many states to come up with their own programs to help eligible residents.

In California, the Golden State Stimulus II program offers residents over $568million in extra funding through the end of the year.

The program is for residents who have been financially impacted as a result of the pandemic.

Over half a million residents received $285 checks in Maine. In Maryland, qualifying residents can receive a check worth between $300 to $500.

How To Claim Your $1400 Stimulus Check In 2022

SOME Americans can claim a $1,400 stimulus check in the new year.

However, there is specific criteria to follow to receive the cash in 2022.

The new payment will go out to people who were eligible for the third round of stimulus checks that went out earlier this year, but haven’t yet received them.

The last lot of checks are due to go out when eligible taxpayers file their 2021 tax return next year.

Recommended Reading: How To Check For Stimulus Checks

When Can I Expect To Receive My Payment

The IRS began rolling out Economic Impact Payments in April 2020. For most people, you wont have to do anything the payment will be directly deposited into your bank account or sent to you by check or prepaid debit card. Be aware, however, that if its sent by check, it might take a little longer.

Indiana: $325 Rebate Payments

Indiana found itself with a healthy budget surplus at the end of 2021, and it authorized two rebates to its residents.

In December 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by January 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to the state.

Taxpayers who filed jointly could receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit and the second payments started rolling out in late August. If you changed banks or didnt have direct deposit information on file, you should have received a paper check.

Individuals who are only eligible for the $200 payment will not receive them at this time. They will have to file a 2022 tax return before January 1, 2024 to claim the credit.

For more information, visit the state Department of Revenue website.

Don’t Miss: Monthly Stimulus Checks For Adults