Whats The Difference Between A Stimulus Payment And A Recovery Rebate

The stimulus payment was an amount of up to $1,400 that was paid directly to the account of qualified individuals. However, the rebate works slightly differently, in that it wont get paid to your account. Instead, it will be removed from the amount of taxes you owe or increase the tax refund amount that you receive after you put in your tax return.

Although this may not seem quite as attractive as a one-off payment to your bank account, it still equates to money in your pocket, as its removed for the total amount that you owe back to the IRS at the end of the fiscal year.

Stimulus Checks Update: The Child And Dependent Care Credit

The biggest difference between this and other stimulus checks is that you need to ask for this once. The check will not arrive automatically, unlike the child tax credit stimulus checks.

The IRS said, The child and dependent care tax credit is a credit allowed for a percentage of work-related expenses that a taxpayer incurs for the care of qualifying persons to enable the taxpayer to work or look for work. This benefit was another that resulted from the $1.9 trillion stimulus law earlier this year, the same one that provided the new round of stimulus checks for $1,400.

You need to complete Form 2441, Child and Dependent Care Expenses, to claim the credit. And include the form when you file your federal income tax return. If your dependents are not being able to take care of themselves, it will be reflected in your records. Records that you need to maintain to support your claim for this stimulus check are in IRS Publication 503, Child and Dependent Care Expenses, and Q3.

For the time being, this benefit is only available for the 2021 tax year, for which youll file your return in 2022. The benefit can get you as much as 50% of up to $8,000 of the cost of child care and similar expenses tied to the care of children under 13. Or a spouse, parent, or another dependent who you take care of who cant care for themselves.

Stimulus Checks Are Being Sent Out In January Find Out If You Will Get A $1400 Payment

- 18:10 ET, Dec 30 2021

STIMULUS checks are being sent out in January with Americans urged to find out if they are eligible for a $1,400 payment.

The third stimulus checks, officially known as Economic Impact Payments, were sent to Americans who earned less than $75,000 as an individual, or $150,000 for a married couple.

Americans who could see a $1,400 payment in 2022 include parents who welcomed a new baby in 2021.

Read Also: Senior Citizens Stimulus Check 2021

What To Know About Adding Your Direct Deposit Details

You can’t use the Get My Payment tool to sign up for a new account or correct details about your payment. Even if the IRS is unable to deliver your payment to a bank account and the money is returned to the government, you won’t be able to correct the details online — the IRS says it will send the money again by mail.

The extended tax deadline was May 17. With the agency’s delay in processing tax returns, trying to register for a new direct deposit account with your 2020 tax return won’t get you into the system quickly enough. However, if you haven’t submitted your taxes yet, signing up for a new direct deposit account could still get you IRS money faster in the future, such as tax refunds or the upcoming child tax credit.

File 100% Free With Expert Help

Get live help from tax experts plus a final review with Live Assisted Basic.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Where Is My Stimulus Refund

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

Also Check: When Will I Get My Stimulus

What To Do With Your Stimulus Check

When you receive a check from your state government, its tempting to blow it immediately. And if youre in need, expenses come first.

For instance, you may pay more toward high-interest debts like loans or credit cards, catch up on your mortgage or even buy school supplies. And if your emergency fund is a little bare, it might be worth stashing some of your cash away for a rainy day.

But if you dont need the money for urgent bills, we have another proposition. Thats right: investing.

Also Check: What Was The Third Stimulus Check Amount

Recommended Reading: Will Social Security Get The Fourth Stimulus Check

How Will I Get My Third Stimulus Check

You dont need to do anything to get your stimulus check. The IRS will determine eligibility based on the last tax return that you filed, either 2019 or 2020, and will likely send your payment to the bank account where your tax refund was deposited.

As part of the income tax filing, the IRS receives accurate banking information for all TurboTax filers who received a tax refund, which the IRS is able to use to quickly and effectively deposit stimulus payments.

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

Don’t Miss: Stimulus Checks And Social Security

Checks Are Rolling In Rhode Island

Rhode Island started issuing child tax rebates of $250 per child to eligible families at the start of this month.

There is a cap of $750 for each family.

In order to qualify, individuals must have filed taxes as either single, married filing separately, head of household, or qualifying widow/widower with an adjusted gross income of $100,000 or less.

When Will Your Stimulus Check Arrive

The stimulus payments are being distributed to taxpayers either by direct deposit or by paper checks or debit cards arriving by mail. If youve been paying your taxes via direct deposit, the IRS should already have your banking information on file and will make the payment directly to your bank account.

For direct deposit, the IRS uses data already in its system to determine which bank account to send the payment to. That most likely happens by attaching a routing and account number to your 2020 or 2019 tax filing, as well as inputting one earlier in 2020 for receiving your first stimulus check. Those receiving payments by mail will have to wait a little longer.

This round, the Treasury Department is also working with the Bureau of the Fiscal Service to identify federal records of recent payments to and from the government to find a possible bank account alternative for delivering stimulus payments as a direct deposit. The move helped accelerate the stimulus check delivery timeline, the IRS said in a statement.

In most cases, individuals arent required to take action to receive their checks and are discouraged from contacting the IRS, according to a Treasury Department release.

The IRS and Treasury Department anticipate sending out more tranches on a weekly basis moving forward.

Recommended Reading: Ssi Payment Schedule 2021 Stimulus

When Can You Expect The Money

People could start seeing the payments hit their bank accounts within days of Biden signing the bill which is expected to happen soon after the House votes on Wednesday on the $1.9 trillion Covid relief package.

For the previous pandemic stimulus bill, the IRS started sending out the second round of payments three days after then-President Donald Trump signed that legislation in late December. But its possible that tax filing season, which is underway, could slow down the process this time.

The payments do not all go out at once. Those whose bank information is on file with the IRS would likely get the money first, because it would be directly deposited into their accounts. Others may receive paper checks or prepaid debit cards in the mail.

The IRS is building on lessons learned from previous rounds to increase the households that will get electronic payments, which are substantially faster than checks, Psaki said.

Wheres My Second California Stimulus Check The Latest Round Could See 803000 More Payments

It has been close to 2 months since the Golden State started giving out their second round of stimulus check payments of up to $1,100 to eligible residents. Millions have received their payment but for many residents, they have this one common question. Wheres my second California stimulus check?

The Golden State Stimulus Check II began to roll into individual accounts after it was signed into law by Governor Gavin Newsom in the second week of July. Most residents have received their initial stimulus check, but many are eager to know wheres my second California stimulus check?

Over half a billion dollars has been paid under the second round of the Golden State Stimulus payment. It has been a holiday bonus for many to end the year.

On December 10, 2021, alone, around $6.1B were sent out as per the figure released by the tax board.

The latest round has shown that around 794,000 payments were sent that were worth another $568M. they were mailed starting December 13 and went on through December 31, 2021.

You May Like: When Can Social Security Recipients Expect The Stimulus Check

Don’t Miss: How To Get California Stimulus

Who Is Eligible For The Third Economic Impact Payment And What Incomes Qualify

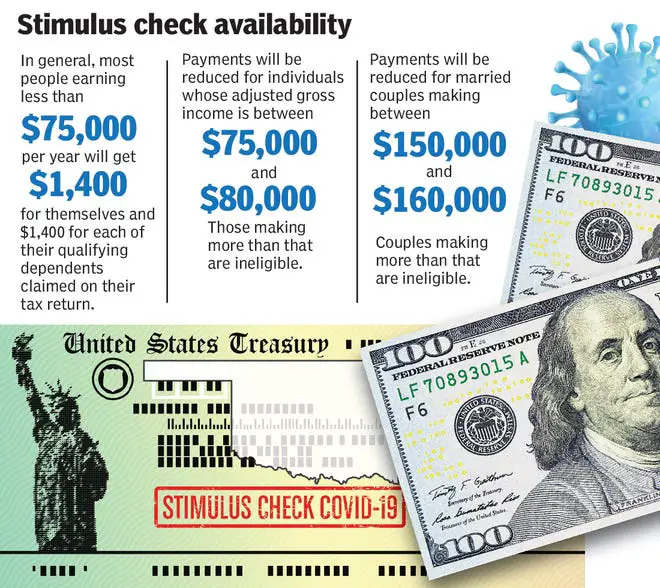

Generally, if you are a U.S. citizen or U.S. resident alien, you are eligible for the full amount of the third Economic Impact Payment if you are not a dependent of another taxpayer and have a valid Social Security number and your adjusted gross income on their tax return does not exceed:

- $150,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $112,500 if filing as head of household or

- $75,000 for eligible individuals using any other filing statuses, such as single filers and married people filing separate returns.

Payments will be phased out or reduced — above those AGI amounts. This means taxpayers will not receive a third payment if their AGI exceeds:

- $160,000 if married and filing a joint return or if filing as a qualifying widow or widower

- $120,000 if filing as head of household or

- $80,000 for eligible individuals using other filing statuses, such as single filers and married people filing separate returns.

For example, a single person with no dependents and an AGI of $77,500 will normally get a $700 payment . A married couple with two dependents and an AGI of $155,000 will generally get a payment of $2,800 . Filers with incomes of at least $80,000 , $120,000 and $160,000 will get no payment based on the law.

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

To learn more about your options if you think you owe taxes, read Filing Past Due Tax Returns and What to Do if I Owe Taxes but Cant Pay Them.

You May Like: How Much Stimulus Did We Get In 2021

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

You May Like: Status On 4th Stimulus Check

How The Third Stimulus Check Works For Nonfilers

For the third round of payments, in many cases, you shouldnt need to take an additional step to receive your money if youre part of a federal program like SSDI or SSI, because these should have been issued automatically. However, if the IRS doesnt know how many dependents you currently have, you may need to file a free, simple tax return for 2020 so it can pay you $1,400 for each.

If the IRS has your up-to-date 2019 records available, itll use those to account for payments, including anyone who used the IRS nonfiler tool to claim a first or second stimulus check. Nonfilers who received a previous stimulus check might also get a check through direct deposit , or in the mail as a paper check or EIP card. Some beneficiaries of federal programs, like SSDI and SSI recipients, may receive their stimulus money through their Direct Express card. Heres how to track your payment schedule with the IRS.

You May Like: Ssi Get Stimulus Check 2022

Read Also: Did I Get The Third Stimulus Check

How To Get Your Stimulus Checks If You Still Haven’t Received Payment

While Congress considers whether to issue a fourth round of stimulus checks, some people haven’t received their older checks.

The first and second stimulus check amounts were for $1,200 and $600, respectively. The third was for $1,400. Here’s how to get your stimulus checks if you haven’t received them yet.

Firstly, some people haven’t received checks because not everyone qualifies for them. You aren’t eligible if your previous IRS tax filings show that you’re a single person who makes over $75,000 annually, a head of household who makes over $112,500 annually, or a married couple who jointly reports over $150,000 annually.

Some are also ineligible due to restrictions on age and dependent status. If someone claimed you as a dependent in their previous tax returns and you were 17 years old or older on January 1, 2020, then you weren’t eligible for the first two checks, according to CNBC.

The IRS and the Social Security Administration have also said that people may not have received stimulus checks because they didn’t file their 2020 taxes. They urged them to file for 2019 and 2020 even if they’re not legally required, in order to ensure that all eligible people receive their payments.

Even if you owe the IRS money, you should still receive your stimulus checks or the aforementioned 2020 Recovery Rebate Credit. The IRS won’t withhold those funds.

Stimulus Update: Fourth Stimulus Check

11 Minute Read | September 24, 2021

By now, youve heard the history of how a third stimulus happened: Just as most Americans received their $600 second stimulus check from the U.S. Treasury in early January, then president-elect Joe Biden unveiled his $1.9 trillion American Rescue Plan that includedyou guessed itthe third stimulus payment.

But there have been a few new twists and turns since March 2021 when all the details of legislation were worked out, passed, and signed into law. The latest stimulus update is thissome states in America are giving out a fourth stimulus check. Curious? Yep, we are too. Lets dive in.

Dont Miss: What If My Address Changed For Stimulus Check

Don’t Miss: How Many Stimulus Checks Were Issued In 2021

How Do I Claim These Benefits

The IRS is urging people who believe they are eligible for the tax credits but havent filed a tax return to go ahead and file a return with the tax agency, even if they havent yet received a letter from the IRS. But the deadline for filing a return to claim these benefits is Thursday, November 17.

The IRS reminds people that theres no penalty for a refund claimed on a tax return filed after the regular April 2022 tax deadline, the IRS said.

There are a few ways people can claim the benefits:

- File a return with Free File before November 17, 2022. Free File is available to people who earn less than $73,000.

- File a simplified 2021 tax return through GetCTC before November 15, 2022.

The IRS said it urges people to file their tax form electronically and to choose direct deposit in order to get their tax credits as soon as possible.

- In: