What Should I Do

The refund check information is in the upper right section of the notice. The taxpayer should review this information and take one of the actions below:

Court Bars Monroe Man From Working As A Tax Preparer In Louisianacontinue Reading

BATON ROUGE A Monroe man who pleaded guilty to a tax fraud-related felony is barred permanently from working as a tax preparer in Louisiana.

Courtney C. Blockson was arrested in Dec. 2019 for a tax fraud scheme involving state child care tax credits. According to the charging document, Blockson improperly claimed the credits of behalf of hundreds of clients by falsely identifying them as day care center operators. None of the taxpayers involved were aware of Blocksons scheme. The illegitimate credits initially cost the state $131,000 in fraudulent income tax refunds, which the Louisiana Department of Revenue recovered through the collection process.

Blockson pleaded guilty to Filing False Public Records. As a condition of the plea, the court issued an injunction prohibiting him permanently from participating directly or indirectly in the preparation or filing of any Louisiana tax return except his own.

Irs Sending Letters To 9 Million Americans With Unclaimed Stimulus Checks

by: Dave Thomas, Stuart Price, Alix Martichoux, Nexstar Media Wire

Posted: Oct 18, 2022 / 10:05 AM PDT

by: Dave Thomas, Stuart Price, Alix Martichoux, Nexstar Media Wire

Posted: Oct 18, 2022 / 10:05 AM PDT

An unexpected letter in the mail from the IRS isnt always a good sign, but more than 9 million Americans are about to get some good news from the tax agency.

The Internal Revenue Service is sending letters to millions who did not claim stimulus payments, earned income tax credits, child tax credits, or other benefits.

That money can go unclaimed when people with very little or no income, who arent required to pay taxes, dont file a simplified tax return. That form is required in order to get a stimulus check.

Its not just COVID-19 stimulus checks being left on the table. Some families are missing out on the expanded child tax credit, leaving up to $3,600 per child unclaimed.

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some people especially those with lower-incomes, limited internet access, or experiencing homelessness, the Government Accountability Office, an internal government watchdog, said.

In addition to people not required to pay taxes, the GAO believes people experiencing homelessness, as well as families with mixed immigration status, were likely to have missed out on stimulus payments, despite being eligible.

Recommended Reading: Never Received 3rd Stimulus Check

Claim Missing Stimulus Money Even If You Don’t Usually File Taxes Here’s How

Last fall, the IRS sent letters to 9 million Americans who may have qualified for a payment but perhaps didn’t know they needed to register to claim it. This group — which the IRS categorizes as “nonfilers” — includes people who didn’t file a tax return in 2018 or 2019, such as older adults, retirees, SSDI or SSI recipients and individuals with incomes less than $12,200. People in this group needed to file a claim using the Non-Filers tool by Nov. 21. The IRS said if you missed the deadline you can claim the payment through the Recovery Rebate Credit when you file a 2020 federal income tax return:

When you file a 2020 Form 1040 or 1040SR you may be eligible for the Recovery Rebate Credit. Save your IRS letter — Notice 1444 Your Economic Impact Payment — with your 2020 tax records. You’ll need the amount of the payment in the letter when you file in 2021.

That means even if you don’t usually file taxes, you will have to do so this year to claim any missing stimulus money. If you meet the requirements, you can get started with your claim using the IRS’ free tax-filing service. We have more detailed instructions for how nonfilers can file a tax return to claim missing stimulus money here.

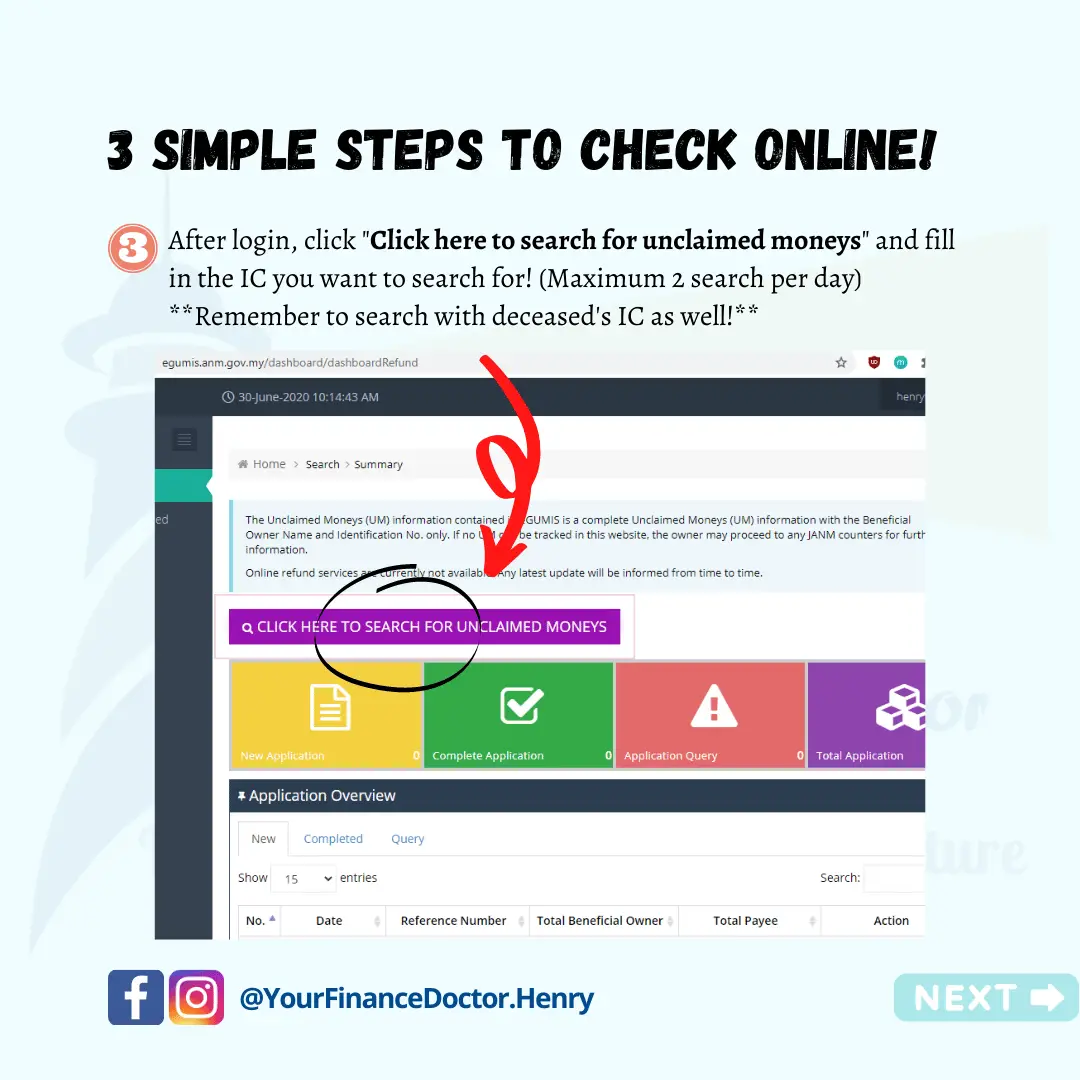

How To Find Unclaimed Money

If a business, government office, or other source owes you money that you dont collect, it’s considered unclaimed. Unclaimed property can include many things, including cash, checks, money orders, security deposits, or the contents of safe deposit boxes.

The federal government doesnt have a central website for finding unclaimed money. But you dont need to hire a company to find unclaimed money for you. You can find it on your own for free, using official databases.

Also Check: Get My Stimulus Payment For Non Filers

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

How To Claim A Missing Payment

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

You May Like: How To Sign Up For The Stimulus Check

Stimulus Checks: How To Find And Claim Your Unclaimed Money If The Payments Are Not Enough

In light of Donald Trump’s executive order and all the updates via Senate Majority Leader, Mitch McConnell, lawmakers are finally putting together a second stimulus package amid the ongoing coronavirus pandemic. But will it be enough for millions of Americans? The previous stimulus package also known as the CARES Act entitled eligible Americans to a one-time check of $1,200 to help get them through this difficult time. Republicans proposed their own plan, the HEALS Act, which would grant Americans an additional, one-time check of $1,200. For many Americans, these payments are not enough to get them through one of the worst economic crises of this nation’s history. So, if you need extra funds, you may want to check out whether your family is entitled to money that previously went unclaimed.

What exactly are unclaimed funds? They are accounts in financial institutions or companies that have had no activity or contact with the owner for a year or longer, and they are most commonly in savings or checking accounts, stocks, uncashed dividends, security deposits, IRS refunds, and more. The National Association of Unclaimed Property Administrators has said that there are billions in unclaimed funds floating around the United States.

Check Your Mailbox For A Letter From The Irs About This Stimulus Check

The IRS urges low-income, no-income and homeless people to register for stimulus checks by November 21. By Forbes calculation, approximately $10 billion has been left on the table because nearly nine million people have not claimed their stimulus checks. To remedy this situation, the IRS is conducting an outreach campaign to get the word out to some of the most disadvantaged individuals with information about how they can claim their $1,200 stimulus check.

As part of this outreach effort, the IRS sent out a special mailing this month to millions of people it believes may be eligible for the $1,200 stimulus check though they have yet to register for it. Be on the lookout for this special letter. Heres a copy of what the IRS mailed out.

Also Check: Veterans To Receive Stimulus Payment

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

The Latest On $1400 Stimulus Checks

This tax season, the government is also issuing a third tranche of third stimulus checks for up to $1,400 per individual, plus $1,400 per eligible dependent.

Last week, the IRS and other agencies said about 127 million checks have been sent to date, for a total of approximately $325 billion.

Those $1,400 payments are generally based on 2019 or 2020 tax returns, whichever was most recently filed and processed by the IRS. Those who used the IRS non-filer tool last year should also automatically get their payments.

There are also advantages to filing a 2020 return in order to receive the $1,400 payment, according to the IRS.

If your income dropped from 2019 to 2020, you could be eligible for a larger payment. The IRS has said it may potentially send follow-on payments to those people after their 2020 tax returns are processed.

Filing a 2020 tax return also lets you update your direct deposit information.

This tax season, non-filers are also required to file a tax return in order to get their payment, provided they have not already submitted their information to the government.

Of note, people who receive federal benefits such as Social Security, Supplemental Security Income, Railroad Retirement Board and Veterans Affairs will generally receive their stimulus checks automatically, though there have been delays in processing some of those payments.

Recommended Reading: I Never Received Any Stimulus Check

What If My Bank Account Information Changed How Will I Get My Second Stimulus Check

Unfortunately, if your second stimulus check is sent to an account that is closed or no longer active, the IRS will not reissue the payment to you by mail. Instead, if you are eligible to get a payment, you can claim the stimulus check on your 2020 tax return as the Recovery Rebate Credit or use GetCTC.org if you dont have a filing requirement.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

Don’t Miss: Didnt Get Any Stimulus Checks

Irs Reveals List Of Ways To Get Unclaimed Stimulus Checks How To Make Sure You Get Your Cash

THE IRS has revealed a list of ways to get unclaimed stimulus checks here’s how to make sure you get your cash.

If you’re a lower-income taxpayer, the Internal Revenue Service has released a list of resources that could help you claim their unpaid stimulus money.

Some of the resources can be found in Publication 4134, which was shared in February 2022 as the Lower Income Taxpayer Clinic List.

The IRS explains how the free taxpayer services can contact in the four-page PDF.

“If you are a low-income taxpayer who needs help in resolving a tax dispute with the Internal Revenue Service and cannot afford representation, you may qualify for free or low-cost assistance from a Low Income Taxpayer Clinic ,” the PDF reads.

It adds: “This publication includes contact information for LITCs and is available online at: www.irs.gov or by calling the IRS at: 1-800-829-3676.

“For the most current information, please see the Find your local clinic search tool at the bottom

of the LITC page at: www.taxpayeradvocate.irs.gov/litc.

Anyone included in the lower-income taxpayers group can also get help with preparing their tax returns, according to The Ascent.

Meanwhile, millions of Americans may have unclaimed cash or property from an old bank account or previous employer and are a number of ways to find unclaimed cash you could be owed.

According to the National Association of Unclaimed Property Administrators , nearly 1 in 10 Americans has unclaimed money or property.

Recovery Rebate Credit Topic B: Claiming The 2021 Recovery Rebate Credit If You Arent Required To File A Tax Return

These updated FAQs were released to the public in Fact Sheet 2022-27PDF, April 13, 2022.

If you didn’t get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don’t usually file taxes – to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card or mobile app and will need to provide routing and account numbers.

If you didn’t get the full amounts of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t usually file taxes – to claim it. DO NOT include any information regarding the first and second Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

Q B1. I used the Non-Filers tool last year and don’t usually file a tax return. What should I do to claim a 2021 Recovery Rebate Credit?

Q B3. What information do I need to provide to claim the 2021 Recovery Rebate Credit?

Read Also: Irs Phone For Stimulus Checks

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

For Your Protection Banks Insurance Companies Utilities Investment Companies And Many Other Businesses Are Required By State Law To Surrender Inactive Accounts To The State These Accounts Are Known As Lost Abandoned Or Unclaimed Funds

The Unclaimed Property Unit serves as custodian of this money. If you can prove you are entitled to the money, we will gladly return it to you, at any time, without charge. Until the money is claimed, it is used by the States General Funds, serving the citizens and taxpayers of the State of New Mexico.

To search for unclaimed property in New Mexico visit .

For specific eligibility requirements and site links, see Filing a Claim.

Read Also: Irs.gov Stimulus Check Deceased Person

Here’s Why Your Tax Refund Or Missing Stimulus Money Could Have Been Seized

Stimulus checks are technically considered a tax credit, no matter how you get them. Typically, the IRS can reduce a taxpayer’s refund to repay outstanding debts like past-due child support, unpaid student loans and certain other federal and state liabilities. The CARES Act stated that the first stimulus check could not be garnished for these purposes, except for overdue child support.

The went a step further and protected the second round of stimulus checks from all garnishment, including child support. However, it also limited that exception only to advance payments, and retroactively revised the CARES Act’s rules as well — meaning that your Recovery Rebate Credit that arrives on your tax refund for missing stimulus money is treated differently from the stimulus money that arrived for others in the mail, according to the Taxpayer Advocate Service, an independent organization within the IRS.

For the third check, because of the way it was passed, it’s open to garnishment from private debt collectors, but not child support payments.

Bottom line: If you’re eligible for a stimulus payment through a Recovery Rebate Credit, but you have certain outstanding debts, some or all of your credit could be withheld to pay those debts, the Taxpayer Advocate Service wrote in a blog post.