Why Did I Receive Irs Letter 6475

According to the IRS, Economic Impact Payment letters include important information that can help you quickly and accurately file your tax return, including the total amount sent in your third stimulus payment.

This could include “plus-up” payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

Even though it is not taxable income, you still need to report any stimulus money on your IRS return. In 2020, the IRS received over 10 million returns that incorrectly reported stimulus money, according to IRS Commissioner Charles P. Retting, resulting in manual reviews and significant refund delays.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but that’s not what you want to use to prepare your 2021 return.

What’s The Recovery Rebate Credit

If you didn’t get a third stimulus check, or you didn’t get the full amount, you may be able to claim the recovery rebate credit on your 2021 tax return to make up the difference.

If you didn’t get a third stimulus check or you only got a partial check then you certainly want to check out the recovery rebate tax credit when you file your 2021 tax return.

The recovery rebate tax credit and stimulus checks are joined at the hip. In fact, third stimulus checkswere simply advance payments of the credit. So, if the combined total of your third stimulus check and any “plus-up” payment is less than your allowed recovery rebate credit amount, you may be able to get the difference back on your 2021 tax return in the form of a larger tax refund or a lower tax bill. If your third stimulus check exceeded the amount of the credit, you don’t have to repay the difference. Either way, you win!

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Read Also: 4th Stimulus Check For Ssdi

You May Like: Amount Of Stimulus Checks 2021

What You Need To Know About Your 2020 Stimulus Check

OVERVIEW

In response to the challenges presented by Coronavirus , the government is taking several actions to bolster the economy, such as offering expanded unemployment, student loan relief, sending stimulus checks and more.

For information on the third coronavirus relief package, please visit our American Rescue Plan: What Does it Mean for You and a Third Stimulus Check blog post.

How Can I File For Free

As you likely know, most tax software charges you a fee to file your state and federal returns. But there are a couple of free options out there.

If your adjusted gross income, or AGI which is your income less some deductions, like 401 or IRA contributions is less than $73,000, you qualify for IRS Free File, a partnership between the government and several tax prep companies.

One thing to note: TurboTax and H& R Block, two of the most popular tax prep services, are no longer part of the Free File program. But there are eight other services available, including TaxAct and TaxSlayer. Just make sure you access Free File through the IRS website so it’s truly free. In the past, people have reported finding a service advertised as free via a Google search, only to owe money once they actually used it.

If you earn more than the income threshold, or have more complicated taxes, it can be difficult to find a free service. In the past, I’ve used Credit Karma Tax, now Cash App Taxes, to file for free and found it easy to use . You can also fill out the IRS’ Free File Fillable Forms on your own.

That said, it is easy to get upsold with these products, so watch out. If you had income from freelancing , rental properties or investments like stocks, you’ll have to upgrade at a cost.

Recommended Reading: When Is The 3rd Stimulus Check Coming

What Does Letter 6475 Look Like

The letter says, Your Third Economic Impact Payment in bold lettering at the top and you’d find the terms “Letter 6475” on the bottom at the very right-hand corner.

These letters started going out in late January.

If you received the advance child tax credit payments and a stimulus payment in 2021, as many families did, you’re going to need to hold onto two types of different letters from the IRS Letter 6419 for the child tax credit and Letter 6475 for the third stimulus payment.

Earlier in the program, the IRS sent out a “Notice 1444-C” that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, though, you might have more than one notice. Again, Letter 6475 gives you a total dollar amount.

Who Qualifies For A Stimulus Check And How Much Will I Receive

According to the IRS, approximately 80% of Americans will be eligible to receive full or partial stimulus payments through the CARES Act. If you have an adjusted gross income of up to $75,000 , you should be eligible for the full amount of the recovery rebate.

For tax filers with income above these amounts, the stimulus payment decreases by $5 for each $100 above the thresholds. The stimulus check rebate completely phases out at $99,000 for single taxpayers, $136,500 for those filing as Head of Household and $198,000 for joint filers with no kids. Your eligibility will be based on information from your most recent tax filings .

Use our Stimulus Check Calculator to see if you qualify and how much you can expect.

Recommended Reading: Small Business Stimulus Check 2021

You Must File A Return To Claim The Credit

Its worth pointing out that the only way you can claim the recovery rebate credit is to file a 2021 tax return. This is true even if youre not otherwise required to file a return . So, if you qualify for the credit, make sure you file a tax return this year.

For most people, tax returns for the 2021 tax year are due by April 18, 2022. If you cant file by that date, request an extension to file your tax return, which will push your filing deadline to October 17. Depending on your income, you may even be able to file your tax return for free.

If you dont remember how much you actually received last year as a third stimulus check, look at Notice 1444-C, which the IRS sent you last year. If you didnt keep that notice , dont worry there are other ways to get the information. The IRS should have sent you a Letter 6475 earlier this year that contains your third stimulus check amount. You can also get the amount through an IRS online account or by requesting a 2021 account transcript .

You May Like: Where Do I Put Stimulus Money On Tax Return

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If youve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, call us at , and we can mark it as an invalid account. Youll receive your rebate by paper check in the mail.

Recommended Reading: How To Sign Up For The Stimulus Check

Unemployment Benefits And Form 1099

If you claimed unemployment benefits in 2021, then you should receive a Form 1099-G, Certain Government Payments from your state unemployment office by the end of January 2022. Your Form 1099-G will show the total amount of unemployment benefits you have received, along with any state and federal taxes you had withheld.

Unemployment benefits are considered taxable income, so you will need to report unemployment on your federal tax return.

If you received a Form 1099-G, but didnt claim unemployment benefits, then you may be a victim of identity theft and fraud. Contact your state unemployment office to report and correct this issue.

Do I Need To Claim My Stimulus Check On My 2021 Taxes

Stimulus checks are not taxable, but they still need to be reported on 2021 tax returns, which need to be filed this spring. The 2021 stimulus checks were disbursed to eligible recipients starting in March of last year. They are worth up to $1,400 per qualifying taxpayer and each of their dependents.

You May Like: Irs.gov 2nd Stimulus Check

How To Enter Stimulus Payment Received In Turbotax

When you go through the federal review tab it will ask how much you got if any. Enter a 0 in the box if you didn’t get one. Or to enter your stimulus payment in TurboTax, type “stimulus” in the Search box, then click the link that says “Jump to stimulus.”

After you have entered your tax information and are ready for the Federal Review, it will be the first question.

If you are trying to trigger it, you can go to Other Situations, answer any questions and click Done. The next automatic selection is Federal Review and it will ask about payments received.

If you didn’t get one or both of the Stimulus payments or qualify for more it will be the Recovery rebate credit on 1040 line 30. It either adds to your refund or reduced a tax due.

If you are a dependent or your 2020 income is too high you won’t get prompted for the Stimulus section since you can’t qualify for any more. And you don’t have to enter what you already got and don’t have to pay it back. 1040 line 30 is only if you qualify for more not what you already got.

Why Does This Matter

The third stimulus payment was viewed as money you received in advance of the Recovery Rebate Credit that you might be eligible to claim on a 2021 federal income tax return.

This tax season, you want to make sure that you’ve received the full amount of the third stimulus that you’re entitled to receive. You need to file a 2021 federal income tax return to claim the Recovery Rebate Credit if you’re owed more money.

Plenty of things could have changed in your life since you filed 2019 or 2020 federal income tax returns.

If a new baby was born in your family in 2021, for example, you’d want to claim the Recovery Rebate Credit to claim up to $1,400 owed for that child.

The parents would need to be able to claim the child as a dependent on their 2021 income tax return and qualify based on income limits for the credit.

The Recovery Rebate Credit is found on page two, Line 30 of the 1040 tax form for 2021.

The income phaseout for the Recovery Rebate Credit will mean that many people who were working in higher paying jobs in 2021 won’t qualify. The 2021 credit heads to $0 more quickly than on last year’s return.

A single person, for example, cannot claim any credit with an adjusted gross income of $80,000 or more.

A married couple filing a joint return cannot claim any money for the Recovery Rebate Credit with an adjusted gross income of $160,000 or more.

The phaseout for a smaller credit begins above $75,000 for singles and $150,000 for a married couple filing a joint return.

Don’t Miss: Ssi Ssdi Fourth Stimulus Check

Will I Keep Getting The Expanded Credit Amounts And The Advance Payments Next Year

The American Rescue Plan enacted these historic changes to the Child Tax Credit for 2021 only. That is why President Biden and many others strongly believe that we should extend the increased Child Tax Credit for years and years to come. President Biden proposes that in his Build Back Better agenda.

Golden State Stimulus Taxation

While individual states that offered stimulus checks may have different rules, the California Franchise Tax Board confirms on its website that the Golden State Stimulus payments are not subjected to state tax.

As with the federal stimulus payments, the Golden State Stimulus cannot be claimed as income.

Therefore, it cannot be claimed on an income tax return.

Read Also: Irs Disability Form For Stimulus Check

Who Is Not Eligible For The Recovery Rebate Credit

If you received your full amount in advance through the third stimulus payment, you would not qualify for any more money when you filed the return and you do not claim the Recovery Rebate Credit. Filing incorrectly for the credit could also delay your tax refund.

TAX SEASON DELAYS:Mistakes with child tax credit, stimulus can trigger refund tax delays, IRS warns

How Do I Know If I Get A Stimulus Check 2021

Use the IRS Get My Payment tool to track stimulus moneyFor the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail.

Recommended Reading: How Do I Apply For The 4th Stimulus Check

If I Am Experiencing Homelessness Or Do Not Have A Permanent Address How Can I Get A Stimulus Check

The IRS is working to help those without a permanent address get stimulus checks and tax credits. The IRS cant issue a payment to eligible Americans when information about them is not available in the IRS system. If eligible, you dont need a permanent address, a bank account, or even a job to get a stimulus payment or check . Individuals may qualify for this money if they have a Social Security number and are not being supported by someone else who can claim them as a dependent.

Eligible people who havent received these payments should file a 2020 tax return, even if they dont usually file. Filing a 2020 tax return will give the IRS information needed to send a payment. Those experiencing homelessness may list the address of a friend, relative or trusted service provider, such as a shelter, drop-in day center or transitional housing program, on their tax return.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

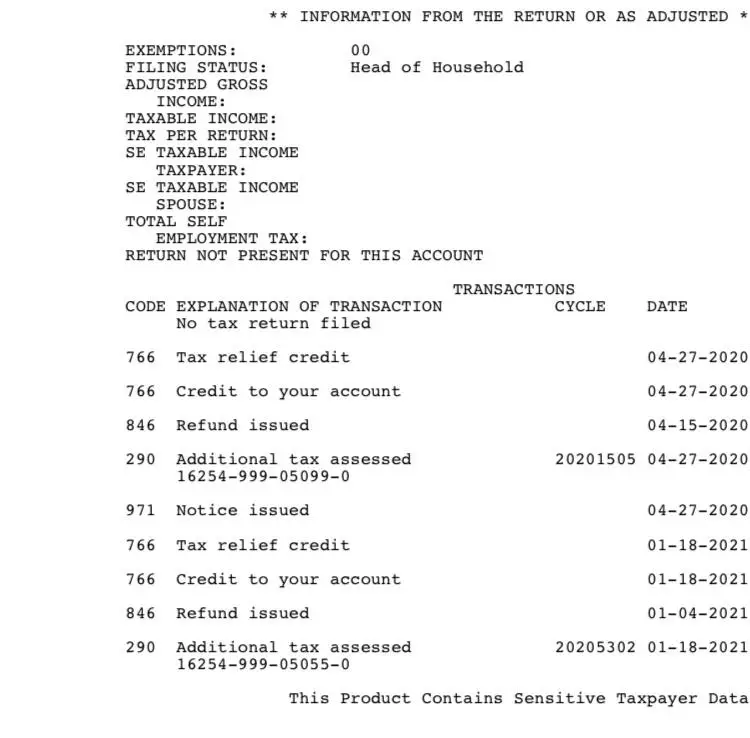

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Don’t Miss: Stimulus Check 2021 Irs Status

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit