How Did The Irs Know Where To Send My Check

The IRS used the information it already had to issue stimulus payments.

If you had direct deposit information on file with the IRS, you should have received your payment via direct deposit.

If you didn’t have direct deposit information on file with the IRS, you should have received your payment as a check or debit card in the mail.

How To Claim Your Money

The easiest way for a taxpayer to get a stimulus payment, or additional payment, if they are, in fact, due more, is to apply on their 2020 tax return, explained Mark Steber, chief tax officer for Jackson Hewitt Tax Services.

There will be a schedule and line on the tax return to reconcile what they have received so far, and the amount actually due to them based on their 2020 tax return, continued Steber.

The IRS says that eligible individuals can claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit.

If you are, indeed, due more money, it will show up on the 2020 tax return as an additional refund. Conversely, however, if you received too much cash via a stimulus payment, you do not have to pay it back.

And for those concerned about how this might complicate the filing process this year, Greene-Lewis tells filers not to worry.

TurboTax has guidance related to stimulus payments and other impacts of Covid-19, explained Greene-Lewis. It will ask up front if the filer received a stimulus payment and then calculate the recovery rebate credit based on actual 2020 income.

Read Also: Who Qualified For 3rd Stimulus Check

Can You Use The Portal If You Didn’t File A Tax Return

You couldn’t use the “Get My Payment” tool to track the status of your first stimulus check if you didn’t file a 2018 or 2019 federal income tax return. However, there was another online tool that non-filers could use to give the IRS with the information it needed to process a payment.

The non-filers tool wasn’t used for second stimulus checks, though. Instead, if you didn’t file a 2019 tax return, and you didn’t use the non-filers tool to get your first-round payment, then you have to wait to claim your second stimulus check money as a Recovery Rebate credit on your 2020 return.

The IRS is not using the non-filers tool for third-round stimulus checks, either. As a result, if you don’t file a 2019 or 2020 tax return, you’ll have to claim any money you’re owed as a Recovery Rebate credit on your 2021 return, which you won’t file until next year. However, you can avoid having to wait until next year by filing a 2020 return before the May 17, 2021, deadline.

You May Like: Do I Have To Claim Stimulus Check On 2021 Taxes

Wondering Where The Latest Economic Impact Payment Is Heres How To Track Your Stimulus Check And What To Do If You Have Problems

Almost everyone who is eligible has received the first and second rounds of the U.S. governmentâs economic impact payments, or âstimulus funds.â But the third roundâpart of the American Rescue Plan Act of 2021âmay provide additional relief to eligible individuals.

The IRS started processing payments in mid-March. Your payment might already be in your account or on its way. But if itâs not, donât worry. The funds could take time to roll out. Hereâs how you can check the status of your payment.

Recommended Reading: Someone Stole My Stimulus Check

Can My Stimulus Check Be Garnished

In most cases, no. Most individuals and families should have received a stimulus payment, even if you owe back taxes or other debts to the government or creditors. Ohio law also protects your stimulus check from being garnished by creditors and private debt collectors.

If you owe back child support, the CARES Act allowed a reduction or offset to your first stimulus payment for back child support. However, your second and third stimulus payments can’t be garnished for back child support.

Also Check: Pa.gov Stimulus Check Status

What If You Have Changed Your Address Or Bank Account

The IRS will use the data already in its systems to send the new payments:

- If your direct deposit information is on file, you will receive the payment that way.

- If your direct deposit information is not on file, you will receive the payment as a check or debit card in the mail.

Some payments may have been sent to an account that may be closed or no longer active. By law, the financial institution must return the payment to the IRS, they cannot hold and issue the payment to an individual when the account is no longer active.

The IRS cannot change payment information, including bank account or mailing information. If an eligible taxpayer does not get a payment or it is less than expected, it may be claimed on the 2020 tax return as the Recovery Rebate Credit. Remember, Economic Impact Payments are an advance payment of what will be called the Recovery Rebate Credit on the 2020 Form 1040 or Form 1040-SR.

What Will The Status Report Look Like

For third-round stimulus checks, the Get My Payment tool will display one of the following:

1. Payment Status. If you get this message, a payment has been issued. The status page will show a payment date, payment method , and account information if paid by direct deposit. Note that mail means either a paper check or a debit card. If you dont recognize the bank account number displayed in the tool, it doesnt necessarily mean your deposit was made to the wrong account or that theres a fraud. If you dont recognize the account number, it may be an issue related to how information is displayed in the tool tied to temporary accounts used for refund loans/banking products.

2. Need More Information. This message is displayed if your 2020 return was processed but the IRS doesnt have bank account information for you and your payment has not been issued yet. It could also mean your payment was returned to the IRS by the Post Office as undeliverable. As mentioned above, if your payment is returned, youll have the opportunity to provide the IRS your bank account or debit card information so they can issue a direct deposit payment . If you dont provide any account information, the IRS cant reissue your payment until they receive an updated address.

The portal is updated no more than once daily, typically overnight. As a result, theres no reason to check the portal more than once per day.

Don’t Miss: Direct Express Stimulus Check Deposit Date 2021

What If I Am Eligible For The Stimulus Checks But I Didnt File A 2019 Or 2020 Tax Return And Didnt Use The Irs Non

File your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

You can file a tax return even if you dont have a filing requirement to get other tax credits, such as the Earned Income Tax Credit.

If you didnt get your first or second stimulus check or didnt get the full amount that you are eligible for, file a 2020 federal tax return and claim them as part of your tax refund or use GetCTC.org if you dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Who Is Eligible For The Recovery Rebate Credit

According to the IRS, most people who were eligible for the third round of payments have already received their stimulus checks but there are a few situations why someone might not have received it or received the wrong amount. For example:

-

Youre claiming a new dependent in 2021 .

-

Your marital status changed in 2021.

-

Your adjusted gross income from 2019 or 2020 was high enough to make you ineligible for a stimulus check, but your 2021 AGI is now lower and within the qualifying threshold.

-

You did not have a Social Security number but received one by the 2021 tax deadline.

Recommended Reading: Will There Be Another Stimulus Package

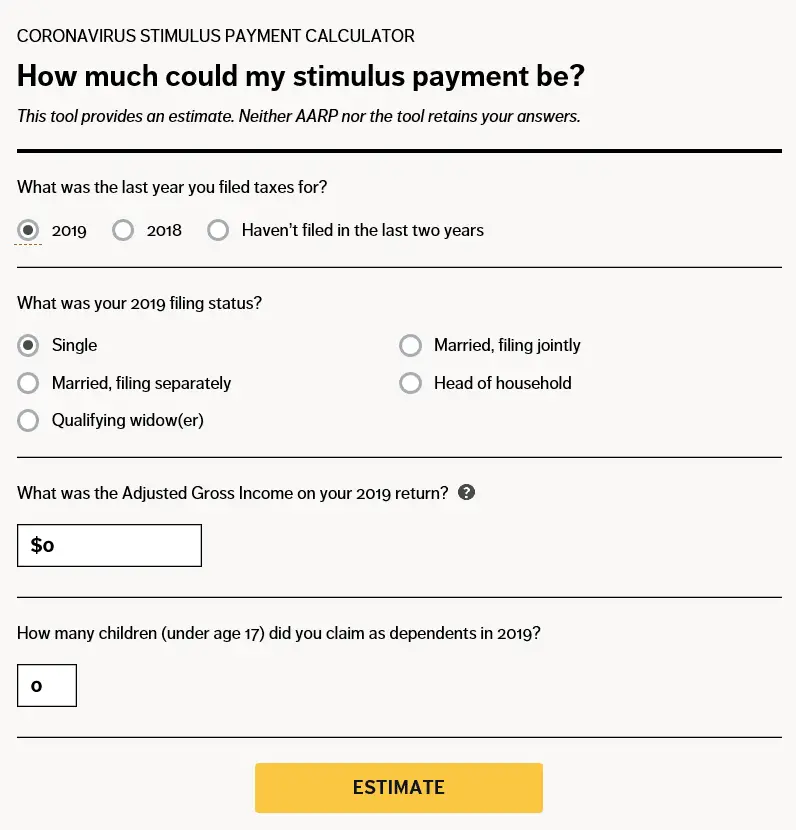

Income Tax Calculator: Estimate Your Taxes

Your adjusted gross income

Its important to understand the income thresholds to receive a stimulus check. First, there is no minimum adjusted gross income threshold. However, there is a maximum income threshold. The stimulus check amount phases out by $5 for every $100 above certain income levels based on your tax filing status:

- Single Filer: $75,000

If your adjusted gross income is less than these amounts, you can receive the full stimulus check amount of $1,200 for single taxpayers, $2,400 for married couples filing jointly and $500 for each dependent child age 16 or younger. If you are a single tax filer who has adjusted gross income greater than $99,000 or a married couple filing jointly with no children that earns more than $198,000, then you wont qualify for a stimulus check.

You didnt provide banking information to the IRS

So, you didnt provide any banking information to the IRS? No worries. First, you can receive a paper check. The IRS will start sending paper stimulus checks to taxpayers on April 24. Taxpayers with the lowest annual adjusted gross income will receive their stimulus check first, beginning with those who earn less than $10,000. Each week, approximately 5 million paper stimulus checks will be sent at increasing income increments. For example, stimulus checks will be sent to those who earn $10,001 $20,000 on May 1. This process will continue each week from May to September until all stimulus checks have been distributed.

Helpful Resources

How Do I Know If I Received The Third Stimulus Check

Use the IRS Get My Payment tool to track stimulus money For the third stimulus check: It’s worth visiting the IRS’ online portal designed to track the status of your 2021 payment. Generally, it should tell you when your check will be processed and how you’ll receive it: for example, as a paper check in the mail.

Don’t Miss: File For The First Stimulus Check

Checking For Your Stimulus Payments From The Irs

You can check to see which checks you received and how much they were online.

This can be done with your online account direct through the IRS website.

Once signed in, you can view information.

The first, second, and third stimulus payments will be viewable.

Youll find this under the Economic Impact Payment Information tab.

This is under the Tax Records page.

You may also check your stimulus check history by looking at the letters sent out by the IRS detailing your stimulus history.

In 2020, letters sent regarding the first and second economic impact payments were Notice 1444 and Notice 1444-B.

In 2021, Notice 1444-C was sent for that stimulus payment.

Additionally, Letter 6475 went out ahead of tax season to show taxpayers what they could claim on their refund.

How You Can Get Your Stimulus Money If You Never Received A Check Or Payment

How you can get your stimulus money if you never received a check or payment

Q13s AJ Janavel reports

SEATTLE If you have not received a previous stimulus payment, you can still get those dollars into your pocket through your tax return.

While most Americans wait to hear when they will receive $1,400 from a new stimulus package, some are still waiting for one of the first two checks.

It was crushing it was devastating. Everyone around was getting their money, said Zach Hudson.

Hudson said he got his first payment with no issue but still has not received a second stimulus check.

Hes reached out to the IRS. He said he sat on hold for hours, but still got no information.

Q13 News reached out to experts to get answers for you.

The recovery rebate credit is available to people who have not received stimulus payments who qualify for them, said Isaiah Gresham.

RELATED: This is not about him: Bidens name will not be on COVID-19 stimulus checks, White House says

Gresham is a tax expert and president of Gresham Financial. This year, hes asking clients directly if they received their stimulus payments because those dollars are there for you if you know how to get them.

Once we have that information when were filing their tax return, there is an opportunity for us to claim that credit for them. If they have not received the stimulus but they qualify, He said.

Gresham said you should be prompted with a similar question if you file your taxes online.

Don’t Miss: Sign Up For Fourth Stimulus Check

Missing A Stimulus Payment Heres How To Claim It

Most Americans who received stimulus money from the government received a check or direct deposit. However, those who were eligible but didn’t receive one or more payments for whatever reason are eligible to receive the money via a Recovery Rebate Credit. This tax credit is for people who are missing a stimulus payment or got less than the full amount but were eligible for it.

The IRS instructs, Your Recovery Rebate Credit will reduce the amount of any tax you may owe for 2021 or be included in your tax refund, and can be direct deposited into your financial account. You can use a bank account, prepaid debit card or alternative financial products for your direct deposit. You will need to provide routing and account numbers.

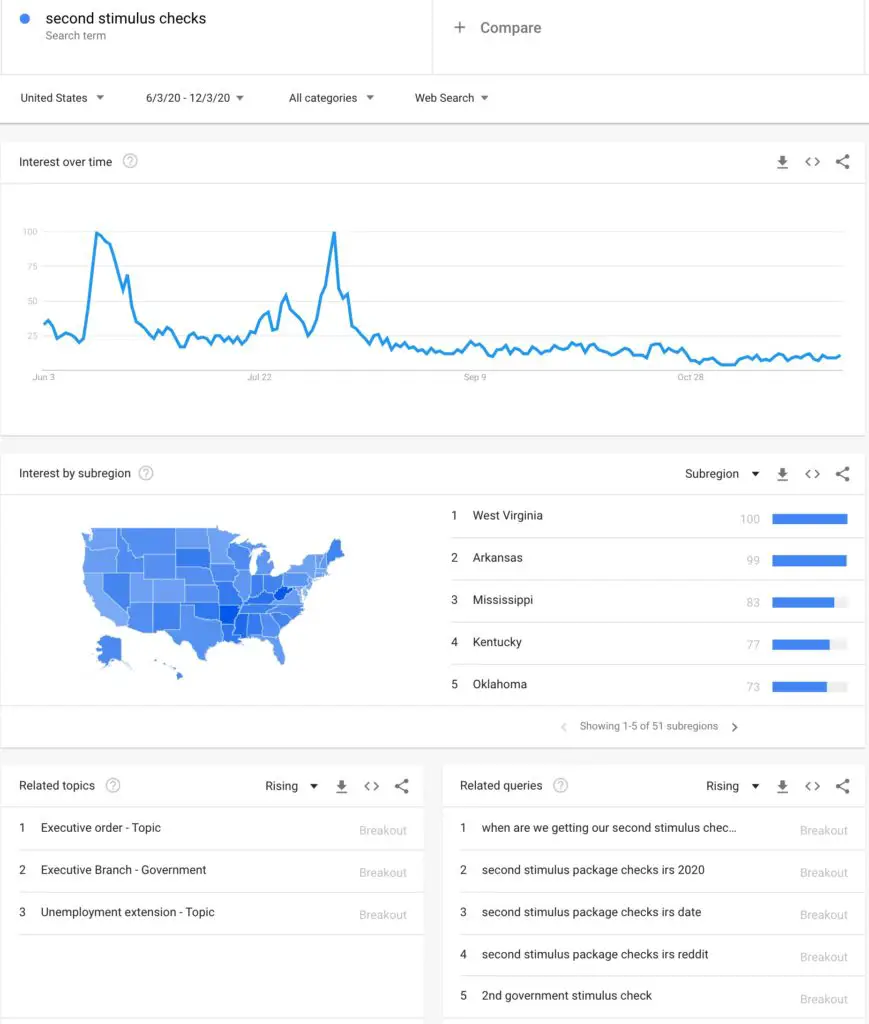

How Do I Know If My 2nd Stimulus Check Has Been Sent

30. As with the first round of stimulus checks from the CARES Act, Americans can check the status of their payments at https://www.irs.gov/coronavirus/get-my-payment. The Get My Payment tool was reopened on Monday, and will confirm if the IRS has sent your second stimulus check, as well as your first payment.

Also Check: Total Stimulus Payments In 2021

How Much Should My Payment Be

The amount of the payment depends on your income.

- For the third round of stimulus checks: Most individuals earning $75,000 or less received a payment of $1,400. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $2,800. Families were eligible to receive an additional $1,400 per dependent. For this round of stimulus checks, the eligible dependent did not need to be under the age of 17. For example, a family of 4 could have received $5,600. Use our stimulus check calculator to see how much your family could expect from the third round of stimulus checks.

- For the second round of stimulus checks: Most individuals earning $75,000 or less received a payment of $600. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $1,200. Families were eligible to receive an additional $600 per child. For example, a family of 4 could have received $2,400.

- For the first round of stimulus checks: Most individuals earning $75,000 or less received a payment of $1,200. Married couples who filed taxes jointly and earned $150,000 or less received a payment of $2,400. Families were eligible to receive an additional $500 per child. For example, a family of 4 could have received up to $3,400.

Individuals and married couples that made more than the amounts above may still have been eligible for a payment. Use our stimulus check calculator to see if you were still eligible for a payment.

Some Americans Could Get A $1400 Stimulus Check In 2022

The $1.9 trillion aid package signed into law this March by Biden sent most American households a third stimulus check. But some households are owed another check of up to $1,400: Reporting by Insider and Fortune discovered earlier this year that a stimulus check would indeed go out to eligible parents of 2021 newborns once they file their tax returns next year.

See, those $1,400 checks were sent out based on the last tax return on fileso they didnt include 2021 newborns. Thats why the check will get applied to parents and guardians 2021 tax returns. Of course, taxpayers would still need to meet the income requirements. You can find those eligibility details at this link.

Don’t Miss: Federal Mortgage Relief Stimulus Program

How Will Taxpayers Receive Their Stimulus Payment

Taxpayers with direct deposit information on file with the IRS will receive the payment that way. For those without direct deposit information on file with the IRS, the IRS will use federal records of recent payments to or from the government, where available, to make the payment as a direct deposit. This helps to expedite payment delivery. Otherwise, taxpayers will receive their payment as a check or debit card in the mail. If the direct deposit information is sent to a closed bank account, the payment will be reissued by mail to the address on file with the IRS. The IRS encourages taxpayers to check the Get My Payment tool for additional information.

Where Is My 3rd Stimulus Check

Check for your status at www.irs.gov/coronavirus/get-my-payment. The third round of Economic Impact Payments will be based on a taxpayer’s latest processed tax return from either 2020 or 2019. That includes anyone who used the IRS non-filers tool last year, or submitted a special simplified tax return.

You May Like: Contact Irs About Stimulus Check

What Va Payment Information Can I View When I Sign In

If youre a Veteran, youll see a history of your past VA payments for:

- Disability compensation

- Pension benefits

- Education benefits

If youre the survivor of a Veteran or service member, youll see a history of your past VA payments for:

- Survivors pension benefits

- Survivors and Dependents Educational Assistance

- Dependency and Indemnity Compensation

When Will Your Stimulus Check Arrive

The stimulus payments are being distributed to taxpayers either by direct deposit or by paper checks or debit cards arriving by mail. If youve been paying your taxes via direct deposit, the IRS should already have your banking information on file and will make the payment directly to your bank account.

For direct deposit, the IRS uses data already in its system to determine which bank account to send the payment to. That most likely happens by attaching a routing and account number to your 2020 or 2019 tax filing, as well as inputting one earlier in 2020 for receiving your first stimulus check. Those receiving payments by mail will have to wait a little longer.

This round, the Treasury Department is also working with the Bureau of the Fiscal Service to identify federal records of recent payments to and from the government to find a possible bank account alternative for delivering stimulus payments as a direct deposit. The move helped accelerate the stimulus check delivery timeline, the IRS said in a statement.

In most cases, individuals arent required to take action to receive their checks and are discouraged from contacting the IRS, according to a Treasury Department release.

The IRS and Treasury Department anticipate sending out more tranches on a weekly basis moving forward.

Also Check: Is Texas Giving Stimulus Money