What To Do If Youre Still Waiting For A Stimulus Check

The IRS has created a specific tax credit for eligible taxpayers who didnt get the stimulus money that was owed to them according to legislation that passed in 2020 . Its called the Recovery Rebate Credit. Youll find it on line 30 of your 2020 tax return.

For the fastest processing, the IRS encourages citizens to file 2020 tax returns electronically. The agency has not yet announced when you can start filing 2020 tax returns. As the situation unfolds, more information may become available.

You May Like: How Do I Change My Address For The Stimulus Check

Missed The Deadline To Claim Your Child Tax Credit Or Stimulus Money What To Know

If you didn’t claim your child tax credit money or third stimulus check by last night’s cutoff, we’ll explain what you need to do.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

The deadline for claiming your missing stimulus or child tax credit payments this year has passed — but that doesn’t mean you’ll never get that money. While the IRS Free File form is indeed closed, you can still claim any money owed to you when you file your taxes in 2023.

Some 9 million people who haven’t received their payments never filed a tax return this year, either because they’re not required to file or because they need more time. The IRS used tax returns to determine eligibility for both of these payments.

Keep reading to find out what you can do to receive any stimulus payments or child tax credit money owed to you. For more, see if your state is mailing out stimulus checks this month.

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

Recommended Reading: How Do I Get The Second Stimulus Check

Read Also: How Do I Get The 3rd Stimulus Check

I Had A Problem With The First Or Second Payment

Some individuals had too much income in 2019 to qualify for the first or second stimulus payment , but their income decreased enough in 2020 for them to qualify. If you fall into this category, you can file a tax return for your 2020 taxes and youll receive a recovery rebate credit as part of your refund .

In other cases, families received stimulus payments by direct deposit but the IRS neglected to add money for one or more of their children. Sometimes there didnt seem to be a reason for this . For other families, it seems the IRS did not update the number of children that taxpayers have, even for families who claimed new children on their 2019 tax returns. Youll be able to claim the rest of the stimulus payment when you file your next tax return.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

You May Like: When Did Americans Receive Stimulus Checks

Can I Still Get A Stimulus Check

If you think youre eligible for a COVID stimulus payment or the 2021 child tax credit, and didnt already receive those funds, you can file a simple tax return by visiting ChildTaxCredit.gov.

But youll need to move quickly. Thats because if youre not required to file a tax return, this years deadline to file a simplified return is November 15. If you are required to file, but missed the April 18 filing deadline, you have until on ChildTaxCredit.gov and see if youre eligible to receive a stimulus payment or child tax credit.

However, if you dont owe taxes to the IRS, the IRS has said that you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. But because that can get confusing, its probably best to file for the 2021 tax year as soon as you can.

According to the Government Accountability Office, groups that were most likely to have missed out on pandemic relief stimulus payments or the child tax credit , were people who never filed a tax return or who filed for the first time during the pandemic. The federal government also had difficulty getting stimulus checks and child tax credits to people without bank accounts or reliable internet access, and people who were experiencing homelessness in 2020 and 2021.

Second Stimulus Check: How You Can Track When Youll Get Your Payment

The $600 stimulus checks that are going out to millions of people can now be individually tracked through the IRSGet My Paymentwebsite, which reopened on Monday afternoon. The site informs people about the date of their payment and whether they will receive it via direct deposit or the mailed payment date.

Still, there are some glitches that are delaying the payments of the stimulus money and creating confusion and questions for consumers. Chief among them: Some people who had their 2020 tax returns filed through tax preparers like H& R Block may have had their stimulus check sent directly to the tax firm, rather than their bank account.

This echoes a glitch that impacted payment of the first stimulus check for some people who used tax prep services and for whom the IRS didnt have direct-deposit information. With the second round of stimulus checks, a similar issue may impact some people, with H& R Block warning its customers who used a service called a refund transfer that they might see an account number you dont recognize on the Get My Payment website. Refund transfers are offered to allow people to tap their refund to pay their tax prep fees, according to H& R Block.

As many as 13 million people may experience a delay in receiving their money after the IRS sent the funds to closed or invalid bank accounts, according to tax-prep company Jackson Hewitt.

Read Also: How To Check If Received Stimulus Check

Your Payment Hasnt Been Sent Out Yet

The third round of stimulus checks is being sent out in batches, and as with other rounds of stimulus payments, payments made via direct deposit to bank accounts on file with the IRS are prioritized. That said, the IRS has also been mailing out paper checks and debit cards with each batch of direct deposit payments, and it will continue to mail them out in the coming weeks.

If your bank account information was not on file with the IRS, chances are good that youre going to have to wait slightly longer to receive a paper check or prepaid debit card, which will have to be processed through USPS before it hits your mailbox. This can add significant delays to the time it takes to receive your payment.

You May Like: Is There A Second Stimulus Check

My Stimulus Payment Went To The Wrong Bank Account

If the Get My Payment tool tells you your check will be direct-deposited, it will also provide the last four digits of the number of the bank account into which your stimulus payment will be deposited. For the initial checks, some individuals saw that their deposit was going to an old bank account, or they even saw bank account numbers that they didn’t recognize. Here’s what to do:

- If the tool says that your payment was deposited into your bank account but you haven’t seen it yet, your bank may still be processing it.

- You won’t necessarily get the third check direct deposited, even if the first or second one was direct deposited.

- If your third stimulus payment is sent to a closed bank account, the bank is required to transfer the money back to the IRS. The IRS will not redeposit it to you or mail you a paper check. Instead, you will have to file your 2021 tax return to claim your “Recovery Rebate Credit.” See below for instructions on claiming the rebate on your tax return.

- If H& R Block submitted your last tax return and you signed up for a “refund transfer,” the IRS might deposit your stimulus payment with H& R Block . H& R Block should transfer the money to your bank account within 24 hours.

- Those who submitted their last tax return with Turbo Tax should receive their payments in the same bank accounts through which they received their tax refunds.

Don’t Miss: Who Qualifies For Stimulus Check

Didn’t Get Your First Or Second Stimulus Here’s What To Do If You Must File A Tax Return For Them

Still crossing your fingers that a second stimulus payment will show up soon?

Unfortunately for those who haven’t received money yet, the latest relief rollout will not stretch out like we saw last year when some people received stimulus money in April and others saw it in May or June.

We’ve got a very short window in January to spot much of that stimulus money now.

As a result, a second stimulus check might never arrive for some struggling families. Eventually, they will see relief but it won’t be the kind of help many expect. And they’ll have to file a 2020 tax return to see the money.

For some people, it won’t be extra cash that arrives out of the blue and can be easily spent tomorrow.

This time around, the Internal Revenue Service, by law, must issue the latest Economic Impact Payments by Jan. 15. The Coronavirus Response and Relief Supplemental Appropriations Act of 2021 set the cutoff date for sending the latest payments.

The latest stimulus has a short window to arrive via direct deposit, paper check or a government-related debit card.

Payments started going out the last week of December and will continue through early January, according to Luis D. Garcia, an IRS spokesperson.

The IRS said Friday that more than 100 million stimulus payments have been direct deposited into bank accounts.

“For those who have not yet received direct deposits,” the IRS said Friday, “they should continue to watch their bank accounts for a deposit in coming days.”

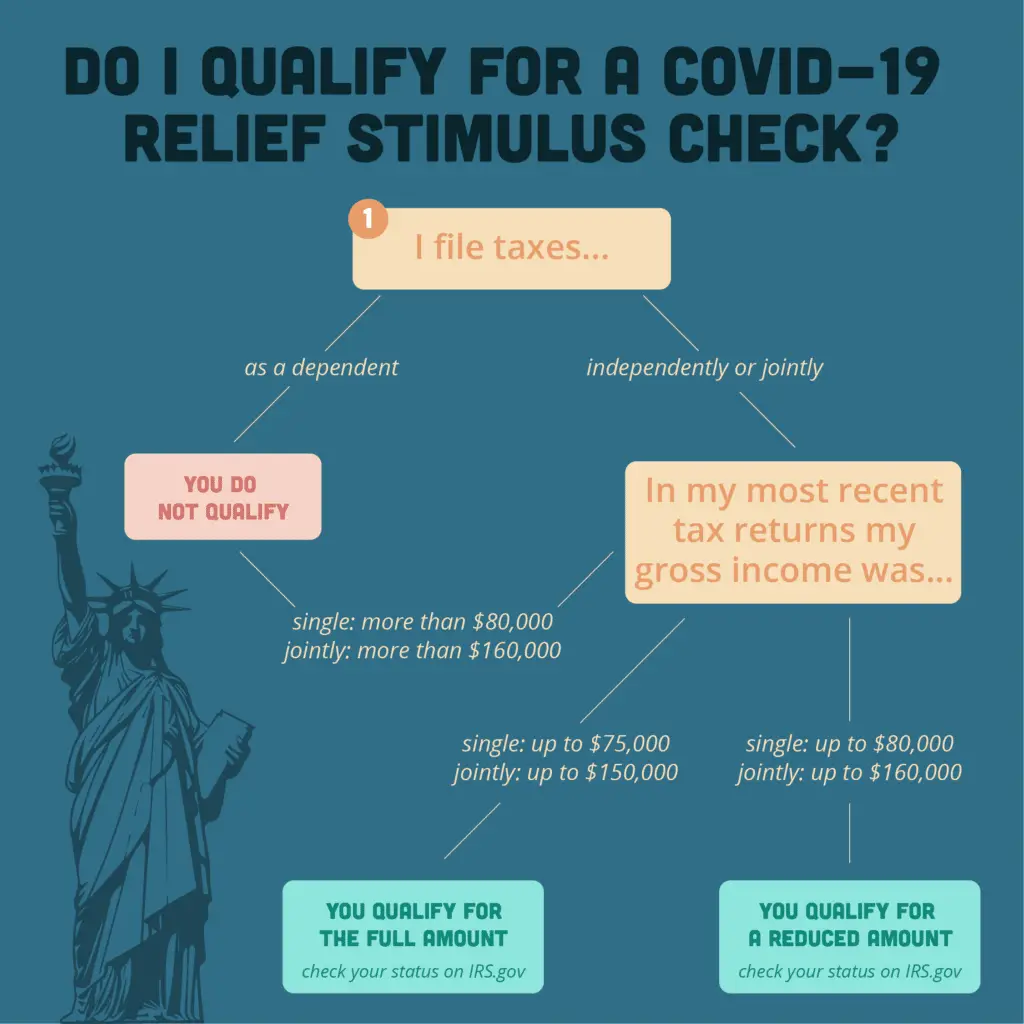

You Dont Qualify For A Stimulus Check

Like the first stimulus check and second stimulus check, not everyone qualifies for an Economic Impact Payment. Here is the adjusted gross income threshold for the third stimulus check to get the full $1,400 stimulus payment :

Single: $75,000

Head of Household: $112,500

$150,000

If your adjusted gross income is higher than these amounts, you wont get any stimulus payment:

$160,000

Don’t Miss: Who Sends The Stimulus Checks

You Might Not Get Your Payment By Jan 15

Use the IRS Get My Payment tool to track the status of your payment. If you receive a Payment Status #2 Not Available notice, you should prepare for a longer wait: your payment will likely not be processed by Jan. 15.

Instead, youll need to claim the Recovery Rebate Credit on your 2020 tax returns. If you end up owing money on your 2020 taxes, it will reduce the amount you owe, Cagan says. If you get a refund, youll get a bigger refund. If you have zero income, youll just get the full amount back.

There are several reasons why your payment may not arrive, but here are a few common issues:

Who Qualifies To Receive The Stimulus Payment For Minor Children When Parents Are Divorced

Divorce decrees may include a decision about who can claim the minor children as dependents on their tax returns. Parents may take turns claiming children. The parent who claims the children qualifies to receive the stimulus payment. If you believe the other parent received stimulus money in error, you may have to file a tax return to claim the full amount of the stimulus, or you might have to work this out in domestic relations court.

Recommended Reading: How Can I Check For My Stimulus Payment

Also Check: How To Know If You’re Eligible For Stimulus Check

What Ssi Ssdi And Veteran Beneficiaries Need To Know

The IRS began sending out stimulus checks for Social Security beneficiaries, including those who are part of the SSI and SSDI programs, on April 7. It began sending payments to people who receive veteran benefits and dont typically file taxes on April 14. If youre part of one of these groups and havent gotten your check yet, it may be on the way soon.

The Social Security Administration has also advised people not to contact the SSA about problems. Its possible you may need to use one of the strategies above, depending on what the trouble is.

How Can I Get My Stimulus Check

The IRS says people will automatically get their payments in the second round of stimulus checks. One way to track the status of your payment is to visit the Get My Payment site.

As with the first round, you will need to enter a few pieces of personally identifiable information, such as your Social Security number, date of birth and address. The site will then provide you with the status of both your first and second stimulus payments.

Also Check: Is The 1400 Stimulus Taxable

What To Do About A Missing Or Stolen Eip Debit Card

At least 5 million people will receive their third stimulus check on a prepaid debit card called the Economic Impact Payment Card, instead of a paper check. For the third payment, the EIP card arrives in a white envelope sent from Economic Impact Payment Card. The letter will have a US Department of the Treasury seal.

The card has the Visa name on the front and the issuing bank, MetaBank®, N.A., on the back. Information included with the EIP Card explains that this is your Economic Impact Payment. If you receive an EIP Card, visit EIPcard.com for more information.

If youve misplaced or thrown away your card, the EIP card service has an FAQ on what to do if your card is lost or stolen. You can also call 800-240-8100 to request a replacement. Its free, according to a spokesperson for the Treasury Department. To request a new card, press option 2 when prompted.

However, the EIP card website says, Your Card will be deactivated to prevent anyone from using it and a new replacement Card will be ordered. Fees may apply. We recommend calling the above number for a lost or stolen card and speaking to a representative. If you may have lost or thrown away a paper check, read the mail fraud section below.

Recommended Reading: Is It Too Late To File 2020 Taxes For Stimulus

First Round Of Cares Act Stimulus Checks: What Expats Should Know

Q. What did the CARES Act 2020 Coronavirus stimulus check mean for U.S. expats?

A. The CARES Act stimulus check expats got in 2020 was technically a 2020 tax credit in advance.

It was part of the CARES Act Coronavirus stimulus package, which was designed to help get the economy back on its feet while we navigate the COVID-19 pandemic. In it are a variety of benefits for both individuals and corporations to ease the financial burden of the shutdowns and shelter-in-place orders. For the average American, the main benefits are cash payments and a variety of other debt relief options. The amount each taxpayer got depends on a variety of factors.

Q. Did I qualify for a CARES Act stimulus check if I live overseas?

A. Yes, expats qualified for the CARES Act stimulus checks. You qualified if you fell within the income threshold, had a social security number, and filed taxes even if you lived overseas. If you didnt get it, you can still apply for it retroactively as a tax credit on your 2020 tax return.

Q. What is the Recovery Rebate Credit?

A. If you didnt get the full amount you were owed, you may be able to apply for the Recovery Rebate Credit. Any eligible individual who did not receive the full amount of the recovery rebate as an advance payment, also known as an Economic Impact Payment, can claim the Recovery Rebate Credit on a 2020 Form 1040 or Form 1040-SR.

Q. How much was the CARES Act stimulus check for?

Q. Did I have to pay back the amount I got?

A. No

Also Check: How Much Stimulus Did We Get In 2021