Ways To Claim The Money

GetCTC.org, which is available in English and Spanish, provides a simplified filing process with questions to prompt users to input their information. The tool allows for people to claim the $1,400 stimulus checks, child tax credit and earned income tax credit for the 2021 tax year.

“Taxes can be intimidating GetCTC has prompts built into it,” Caines said.

Notably, if you want to claim the earned income tax credit using GetCTC.org, you will have to have a W-2 demonstrating your income handy.

For people who have earned income they can show through 1099 forms or self-employment income, other filing tools may let them claim the 2021 enhanced earned income tax credit, Caines said.

IRS Free File, which will stay open until Nov. 17 for the 2021 tax year, lets people whose incomes are $73,000 or less file online. Free fillable forms are available for any income level.

Individuals and families who miss both the GetCTC.org and IRS Free File deadlines still have up to three years to file their tax returns and claim the 2021 tax credits for which they may be eligible.

People who miss this week’s deadlines may want to try to find a Volunteer Income Tax Assistance site near them that will handle prior year returns, Caines said.

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

How To Get Your Stimulus Check And Eligibility

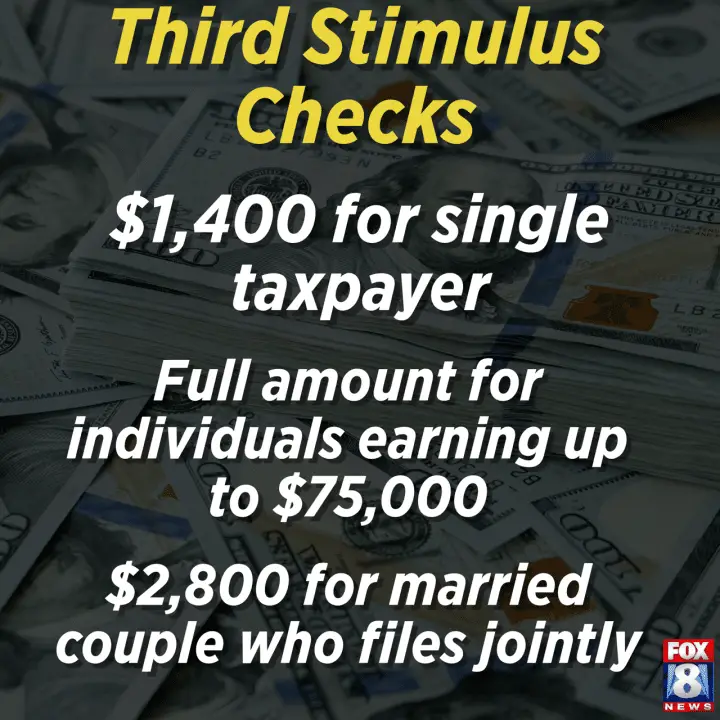

To receive your stimulus payment, and other missed tax credits, youll need to file a 2021 tax refund. To be eligible for payment, you dont need to have earned any income. However, you will need to make sure that if you did, your income is below a certain level.For individual filers to receive full payment, their adjusted gross income will need to have been $75,000 or less. For married couples to receive the whole $2,8000 payment, their income will need to be less than $150,000. The income limit for heads of household is $112,500.

Additionally, if you have any dependents, they could qualify for $1,4000 payments as well.

Individuals with little resources who therefore didnt file taxes are still entitled to the stimulus payments and can claim them by going to GETCTC.com. Here youll also be able to claim the Child Tax Credit and the Earned Income Tax Credit, which will earn you potentially thousands of dollars if you qualify.

The deadline for free filing using this site is November 15, so dont let that money go to waste if you have yet to file. You can also file with the IRS Free File tool , which is available until November 17.

Recommended Reading: Status On 4th Stimulus Check

How Do I Get It

- The stimulus payments will be processed by the IRS.

- If you have already filed a 2019 tax return, you will get the stimulus payment automatically. You will receive it in the same form as your tax refund. If you requested direct deposit, then the stimulus will be direct deposited. If you requested a paper check, then the stimulus will be mailed to the same address on your 2019 tax return.

- If you entered your information into the IRS non-filer portal earlier in 2020, you will get the stimulus payment automatically. You do not have to do anything.

- If you receive one of the following benefits, you will get the stimulus payment automatically. You do not have to do anything.

- Social Security

Ive Never Filed Taxes Before Can I Get The Third Stimulus Check

Yes, but youll need to file a 2020 tax return, even if youre not required to. You can use the IRS website to file for free as long as your income is less than $72,000, or you can use free tax filing software. The important thing is to file online instead of submitting a paper return. The IRS is facing an enormous backlog of mail due to COVID-19. Submitting by mail could add months to your wait time.

Also Check: What’s The Latest News On Stimulus Check

When Will Those $1400 Stimulus Checks Go Out

Lets not get ahead of ourselves right now, Bidens proposal is merely that. For those $1,400 payments to get the green light, lawmakers will have to approve Bidens bill. However, now that Democrats have a majority in the Senate, thats more likely to happen, and once it does, Americans could see their additional stimulus cash within weeks.

As was the case with the last round of $600 checks, those with direct deposit details on file with the IRS will get their money the soonest. Those who didnt register bank account details will have to wait for either a paper check or debit card to arrive in the mail with their stimulus funds.

Biden has made a point of stating that he wants to send out additional aid to the public within his first 100 days of office. As such, theres reason to believe hell be pushing for an early vote on his proposal to get that stimulus round out as quickly as possible.

Also Check: Do I Have To Claim Stimulus Check On 2021 Taxes

What Is The Recovery Rebate Credit

The recovery rebate credit is a refundable tax credit that can be claimed on your 2021 return if you did not receive your third stimulus check or received the wrong amount.

An important thing to understand about the third stimulus payment is that it was technically an advance on the 2021 tax credit. Because the IRS did not yet have access to your 2021 tax information when the advance payments were sent out, the agency relied on the most recent information they had on file for you to determine how much to send you based on that year’s income, number of dependents and other qualifying information.

You May Like: Is Texas Giving Stimulus Money

You Can Still Claim $1400 Stimulus Checks And Child Tax Credits For Free

You can still claim $1,400 stimulus checks and child tax credits for free. This is to all United States residents, that means you North Carolina. So, keep reading if you want to find out how you can score this deal before its too late.

How To Get Your Claim

The stimulus payments we received were much needed and appreciated. I know for me, it helped a lot with bills that were piling up. But many people are unaware that money is still out there for them to claim. Nearly 10 million eligible individuals havent yet received Stimulus payments or 2021 child tax credits. This funds are still available and just waiting to be claimed. To determine if you qualify for stimulus payments, child tax credits, or earned income tax credits, you can still file a 2021 tax return.

So how do you know if you can still get a stimulus check?

At ChildTaxCredit.gov, you can file a simple tax return if you think youre eligible for a COVID stimulus payment or the 2021 child tax credit. Time is of the essence if you think this applies to you. The simplified return deadline for this year is November 15. In the event you missed the April 18 filing deadline, youll need to file a tax return on ChildTaxCredit.gov by October 17, in order to find out if you qualify for a stimulus payment or child tax credit. However, according to the IRS you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. So there is a bit of time there.

Didn’t Get Your $1400 Coronavirus Stimulus Check The Irs Can Help

Your first stop: the IRS’ helpful online tool.

Here’s What You Need To Know: Many people may not be aware, but U.S. taxpayers can actually speak to a live human regarding their missing stimulus checks.

With the disbursement of the latest much-anticipated sixth batch of coronavirus stimulus checks to two million more Americans, the Internal Revenue Service and the Treasury Department have sent out a total of one hundred sixty-one million payments worth more than $379 billion.

To date, the figures represent more than 85 percent of the $450 billion total earmarked for stimulus fundsbut know that despite this achievement, there appears to be thousands of Americans who are still struggling to get their hands on the stimulus cash.

There is, however, good news that may lower some anxiety levels. For those who are missing one or more stimulus check payments, there is still time to claim the money due from the government.

Be aware, though, that the deadline is fast approachingand will close on the extended Tax Day of May 17.

For weeks, the government has been urging Americans who do not receive federal benefits or typically file tax returns to submit one this year in order to provide their necessary payment information to receive the cash.

If you didnt get any payments or got less than the full amounts, you may qualify for the Recovery Rebate Credit and must file a 2020 tax return to claim the credit even if you dont normally file, states the IRS website.

Also Check: When Can Social Security Recipients Expect The Stimulus Check

A Fourth Stimulus Check In 2022 To Deal With Inflation Pressures

There has plenty of talk of a fourth stimulus check in 2022, originally as a relief payment in Bidens build Back Better Bill and now as a way to offset higher costs many consumers are seeing due to record inflation.

However progress on a 4th stimulus check has stalled in Congress due to lack of agreement among Democrats and Republicans and what they can sell to their constituents ahead of the upcoming mid-term elections.

A 2022 Gas Stimulus?

With rising gas prices, many states are providing gas tax holidays which save drivers a few cents at the pump. Some states and even Congress are also considering a 2022 gas relief stimulus check which will pay families up to $400 p/month through 2022.

With the economy rebounding strongly, higher inflation and unemployment claims falling, it was hard for most Democrats in Congress to justify spending billions of dollars on even more stimulus payments.

Some states like California however, are making state specific stimulus payments to provide inflation relief for lower income workers which may be replicated in other states.

There is also the expanded monthly Child Tax Credit stimulus payment for families who have qualifying dependents. While this is not technically a fourth dependent stimulus and rather more of an advanced tax credit it will act like a stimulus payment because it is being paid directly by the IRS to nearly 70 million dependents and their families. This has provisions for another 12 month extension under the BBB.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

You May Like: When Should I Get My Stimulus Check

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

What To Do If There’s A Direct Deposit Issue

The IRS tracking tool for the third stimulus check doesn’t allow you to add direct deposit information this time unless the IRS can’t deliver your payment. So if you have a problem, what do you do? Your check may have bounced back to the IRS if the agency tried to send your payment to a now-closed bank account or to a temporary prepaid debit card a tax preparer set up for you. If your payment was returned to the IRS, the agency will mail your check to the current address it has on file for you. If that check is returned, then the IRS will let you enter your banking information in the Get My Payment tool, the IRS said.

First, we suggest you call your bank or tax preparer — it never hurts to cover all your bases to confirm that an attempt was made to deposit money into a closed account or debit card.

Unfortunately, you’ll need to wait and monitor the Get My Payment tracker to keep tabs on your check delivery. We also recommend signing up for a free service to track your check to your mailbox.

Read Also: Track My Golden State Stimulus 2

How The Third Stimulus Check Became Law

The American Rescue Plan was signed into law on March 11, authorizing a third round of stimulus checks that pay a maximum of $1,400 for millions of Americans. Targeted income limits, however, exclude individuals earning over $80,000 and joint tax filers making more than $160,000.

Biden said at the signing of the bill: this historic legislation is about rebuilding the backbone of this country and giving people in this nation working people and middle-class folks, the people who built the country a fighting chance. Thats what the essence of it is.

House Democrats had moved the $1.9 trillion COVID-19 relief bill to Bidens desk with a 220-211 vote just one day earlier. But progressives in the party expressed concern over Senate amendments that excluded higher-earning taxpayers from getting a stimulus payment.

Biden agreed to narrow income level requirements as a concession to moderate Senate Democrats who wanted to cap payments for individual taxpayers at $80,000 and joint tax filers at $160,000.

The Senate bill narrowly passed with a 50-49 vote on March 6 after an overnight marathon of disputed amendments and negotiations. A 50-50 tie between both parties was avoided because Senator Dan Sullivan could not vote after returning to Alaska for a family funeral.

Read Also: H& r Block Stimulus Check

Will The Irs Tax My Third Stimulus Check

The IRS does not consider stimulus checks to be taxable income. This means that you do not have to report the money on your federal income tax return, or pay income taxes on your stimulus check.

You should also note, that if you owe taxes, you could still qualify to get a stimulus payment because the IRS does not use it to offset federal or state tax debts like it normally does with tax refunds.

For private debts, however, the American Bankers Association has pointed out a loophole in the new stimulus plan where banks and other financial services providers will be legally required to comply with court ordered garnishments. The association says that without legislation to shield your third stimulus payment, creditors or collectors can take it to pay off existing debt.

As a reference, the 2020 COVID-Related Tax Relief Act did shield stimulus payments from private debt collection: The Advance payments are generally not subject to administrative offset for past due federal or state debts. In addition, the payments are protected from bank garnishment or levy by private creditors or debt collectors.

But while your stimulus money could be taken to pay for private debt, the new offsetting rules prevent the IRS from deducting overdue child support from eligible recipients. You should keep in mind, however, that the IRS intercepted or reduced payment from the first round of stimulus checks for past-due child support.

Also Check: Nc $500 Stimulus Check Update

Read Also: Irs Get My Payment 3rd Stimulus Check