Other Benefits For California Residents

The budget contains a handful of additional measures to try to relieve inflations impact on residents:

- $1.95 billion for emergency rental assistance for qualified low-income tenants who requested assistance before March 31

- $1.4 billion in funds to help residents cover past-due utility bills

The budget also includes a $14.8 billion, infrastructure and transportation package, as well as more than $200 million in additional funding that will go toward reproductive health care services.

Californias new budget also provides universal access to health coverage for low-income residents aged 26 to 49, regardless of immigration status, becoming the first state to do so.

Who Is Eligible For Golden State Stimulus Check 2

To be eligible for the Golden State Stimulus I , you must meet the following criteria:

- Have filed your 2020 taxes

- Be either: A California Earned Income Tax Credit recipient An ITIN filer who made $75,000 or less

- Be a California resident on the date payment is issued

- Be 18 years or older as of the last date of the tax year

- Not be eligible to be claimed as a dependent

Here are the qualifications for the California Earned Income Tax Credit

To qualify for CalEITC, you must:

- Have taxable earned income up to $30,000

- Not use married/RDP filing separately if married or RDP

- Live in California for more than half the year

- Meet all other qualifications

If you dont qualify for GSS I, you may qualify for GSS II

Overpaid Tax Or Tax Due

To avoid delay in processing of your tax return, enter the correct amounts on line 97 through line 100.

If you received a refund for 2019, you may receive a federal Form 1099-G. The refund amount reported on your federal Form 1099-G will be different from the amount shown on your tax return if you claimed the refundable California Earned Income Tax Credit and/or the Young Child Tax Credit. This is because the credit is not part of the refund from withholding or estimated tax payments.

Line 97 â Overpaid Tax

If the amount on line 95 is more than the amount on line 65, your payments and credits are more than your tax. Subtract the amount on line 65 from the amount on line 95. Enter the result on line 97.

Refund Intercept â FTB administers the Interagency Intercept Collection program on behalf of the State Controllerâs Office. The IIC program intercepts refunds when individuals and business entities owe delinquent debts to government agencies including the IRS and California colleges. All refunds are subject to interception. FTB only intercepts the amount owed.

Refunds from joint tax returns may be applied to the debts of the taxpayer or spouse/RDP. After all tax liabilities are paid, any remaining credit will be applied to requested voluntary contributions, if any, and the remainder will be refunded.

If the debt was previously paid to the requestor and FTB also intercepted the refund, any overpayment will be refunded by the agency that received the funds.

Don’t Miss: Are We Receiving Another Stimulus Check

How To Track Your $600 California ‘golden State’ Stimulus Check

In February, Governor Gavin Newsom announced that qualifying Californian’s will receive a $600 Golden State stimulus check. The stimulus package was signed by Newsom on February 23, and a total of 5.7 million Californian’s will be eligible according to the governor’s office. $600 payments have started to go out to Californians on April 15th from The California Franchise Tax Board and will be received in the same way you received your tax return. For eligibility on the Golden State Stimulus click here! If eligible, the speed at which you will receive your payment depends on when you filed your taxes. The state must receive your 2020 taxes before the payment is sent and the deadline to send your taxes for the one-time payment is October 15, 2021. If your taxes were filed between January 1st and March 1st you can expect the Golden State Stimulus after April 15th. If you filed after March 2nd it can take up to 45 days to receive payment depending on the method of delivery.

The California Franchise Tax Board has a wait-time availability on their website for the Golden State Stimulus. Eligible residents can contact The California Franchise Tax Board by talking with a representative on their website or by calling 800-852-5711.

Who Does The Irs Consider An Adult Or A Dependent For Stimulus Payments

Under the tax law especially in terms of stimulus check, it is important to define adult or dependent clearly. There are rules from the tax law defining dependents. To be dependent, you must depend on your parents income. Then your parent should explain you as a dependent to get stimulus payment in the year 2019 or 2020.

Also Check: How Many Stimulus Checks Did I Get In 2021

Don’t Miss: Irs Forms For Stimulus Checks

Other Situations When You Must File

If you have a tax liability for 2020 or owe any of the following taxes for 2020, you must file Form 540.

- Tax on a lump-sum distribution.

- Tax on a qualified retirement plan including an Individual Retirement Arrangement or an Archer Medical Savings Account .

- Tax for children under age 19 or student under age 24 who have investment income greater than $2,200 .

- Alternative minimum tax.

- Deferred tax on certain installment obligations.

- Tax on an accumulation distribution from a trust.

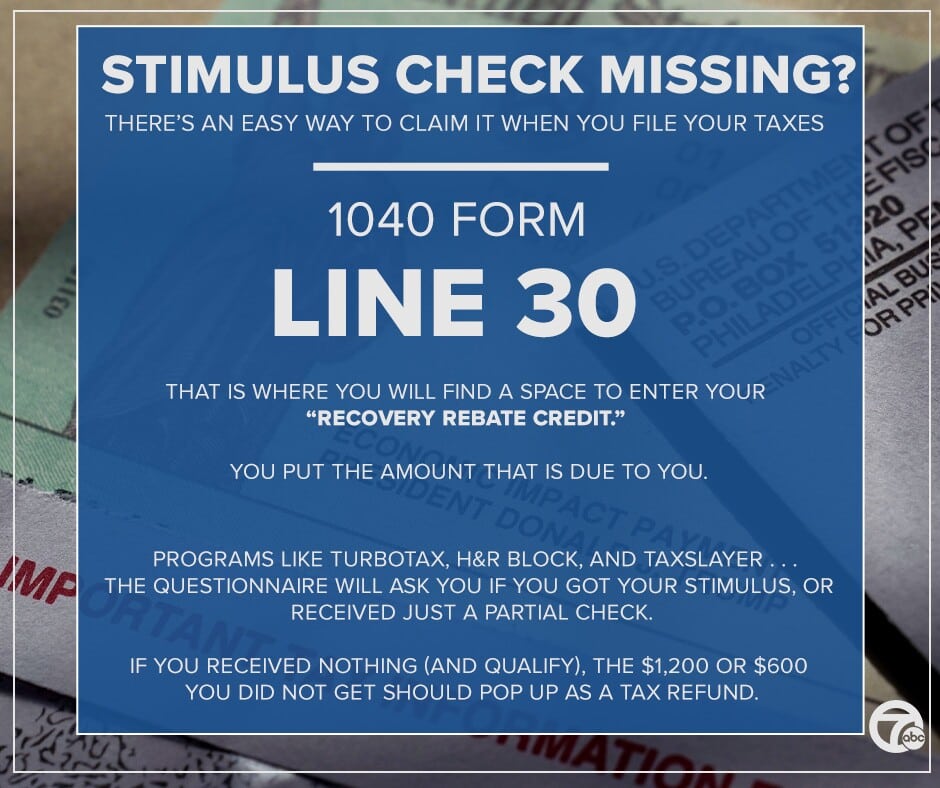

First And Second Stimulus Check

You will need to file a tax return for Tax Year 2020 . The deadline to file your taxes this year was May 17, 2021. The tax filing extension deadline is October 15, 2021.

If you missed the filing deadline, you can still file your tax return to get your first and second stimulus checks. If you dont owe taxes, there is no penalty for filing late. If you owe taxes, you may be subject to penalties and fines for not filing or not paying taxes. The government may reduce your tax refund to pay for any taxes you owe and other federal and state debts.

Also Check: When Did The Stimulus Checks Go Out In 2021

Also Check: When Will South Carolina Receive Stimulus Checks

Wheres My 3rd Stimulus Check

The IRS is sending stimulus funds throughout 2021. If you havent received your payment yet, dont assume you wont ever get it.

You can check the status of your stimulus check using the IRSs Get My Payment tool, which updates once a day. It will show you when and how your money is being sent, either direct deposit or through the mail .

If you get a not available status message, the IRS says youre either not eligible for a third stimulus check or your payment hasnt been processed yet. If you get a need more information message, you can enter your direct-deposit details to speed up your payment.

If you didnt qualify for the third check based on 2019 income but thats the most recent return the IRS has for you, file your 2020 return as soon as you can. Your payment will be sent once the IRS has processed your return.

If you arent required to file a tax return because your income is too low and you didnt register using the IRS nonfilers tool last year, you will need to file a 2020 tax return to get any of the stimulus checks.

Also Check: N.c. $500 Stimulus Check

Will I Still Receive A Direct Deposit If I Haven’t Gotten It Already

The short answer yes. But it depends on a few factors.

Californians who received a Golden State Stimulus check should receive a direct deposit by Tuesday, Oct. 25.

If you did not receive the Golden State Stimulus, but are still eligible for the inflation relief payment, you should see the direct deposit between Oct. 28 and Nov. 14, according to the state,

Don’t Miss: I Still Haven’t Gotten My Stimulus

I Filed My Taxes Months Ago And I Still Havent Received My Stimulus Paymentswhat Should I Do

If you filed your tax returnand are waiting for your refund, do NOT send the IRS another tax return for the same year. Filing again before the IRS processes your original return will putyour return at the back of the line, causing you to have to wait longer.

If the IRS states that they have issued your stimulus payments and you havent received them, you can request a payment trace to track your payment. The IRS can track your payment after you wait:

- 5 days, if the payment was sent by direct deposit

- 4 weeks, if the payment was mailed by check to a standard address

- 6 weeks, if the payment was mailed to a forwarded address on file with the local post office

- 9 weeks after the payment was mailedto a foreign address

To start a payment trace mail or fax a completed IRSForm 3911, Taxpayer Statement Regarding Refund to the IRSor call 800-829-1954.

California Stimulus Check Summary

Heres the bottom line:

The state of California will provide the Golden Status Stimulus payment to families and people who qualify.

There is Golden State Stimulus I and Golden State Stimulus II.

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

To receive your payment, file your 2020 tax returns by October 15, 2021.

You May Like: Income Limit For 3rd Stimulus Check

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Requesting A Copy Of Your Tax Return

The FTB keeps personal income tax returns for three and one-half years from the original due date. To get a copy of your tax return, write a letter or complete form FTB 3516, Request for Copy of Personal Income or Fiduciary Tax Return. In most cases, a $20 fee is charged for each taxable year you request. However, no charge applies for victims of a designated California or federal disaster or you request copies from a field office that assisted you in completing your tax return. See âWhere To Get Tax Forms and Publicationsâ to download or order form FTB 3516.

Read Also: How Much Were The 3 Stimulus Checks

California Stimulus Checks: What To Do If You Didn’t Receive Your $600

California is sending out $600 stimulus payments to certain people, and for those who haven’t received their payment, the first thing to do is make sure their 2020 tax return was filed.

The Golden State Stimulus plan allocates $600 or $1,200 to eligible residents in the state, but to receive the money, a person must have filed 2020 tax return. Payments are sent out bimonthly, and those who haven’t filed their return will have to wait up to 60 days after they file to receive a payment.

If you think your payment was stolen, the California’s Franchise Tax Board advises reporting it by using the online Fraud Referral Report. Those who still have questions about their lack of a payment are encouraged to contact the Franchise Tax Board. Along with mail and phone options, the website has a chat feature where people can communicate with a representative from the website between 8 a.m. and 5 p.m., Monday through Friday.

However, the Franchise Tax Board noted that people should give the agency 45 days beyond mailing time frames after they file for a refund, to allow for the payment to process.

If you filed a tax return before April 23 and haven’t received a payment, it may still be processing. The Franchise Tax Board says people who filed between March 2 and April 23 may have to wait up to two weeks for a direct deposit, or up to six weeks if they’re set to receive a paper check.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally dont file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

Don’t Miss: Telephone Number For Stimulus Check

When Will The Checks Go Out

Payments will be issued between this month and January.

Direct deposits will be sent to residents who e-filed their 2020 state returns and received a refund from the state by direct deposit. About 90% of the direct deposits are expected to be issued in October, starting on Friday.

Other payments will be issued on debit cards sent in the mail starting later this month.

A total of 18 million payments will be sent. The checks are expected to benefit up to 23 million Californians.

To find out when you may receive your money, check the online payment schedule.

Will The Payments Cause Inflation

California is not the only state to deploy one-time rebates amid budget surpluses. Florida, for example, is sending $450 to certain families with kids.

A big question prompted by the checks sent by California and other states is whether they will exacerbate inflation.

While California “on net will come out ahead,” it may be impacted as other states export inflation with their refunds, Harvard University economics professor Jason Furman recently tweeted.

“Californians are going to come out behind from any ‘inflation relief payments’ made by Florida and other states,” he wrote.

States are sitting on record surpluses and many individuals are struggling under the weight of extremely high inflation.Jared Walczakvice president of state projects at the Tax Foundation

While states have been deploying one-time payments all year, there has been an uptick as Election Day approaches, noted Jared Walczak, vice president of state projects at the Tax Foundation.

“States are sitting on record surpluses and many individuals are struggling under the weight of extremely high inflation,” Walczak said.

That’s prompting policy makers to put the two together and want to write checks.

“Unfortunately, that’s only fueling further inflation by injecting more money in an overheated economy,” Walczak said.

You May Like: News About The Stimulus Check

Golden State Stimulus Check #1

California Gov. Gavin Newsom and the California state legislature announced a $9.6 billion spending deal in February 2021 to help those hit hardest by the COVID-19 pandemic.

This bill is also called the Golden Status Stimulus package.

California will provide the Golden Status Stimulus payment to families and people who qualify. This is a one-time $600 or $1,200 payment.

The Golden State Stimulus aims to:

- Support low-income Californians

- Help those facing hardship due to COVID-19

When And How Will I Receive My Payment

Heres the timeline for when you can expect to receive the $600 Stimulus Check for Californians:

Once your 2020 tax returns are processed and it is determined that you are eligible for the Golden State Stimulus payment, then heres what will happen:

If you filed your tax return between January 1, 2021, and March 1, 2021:

You will receive your stimulus payment beginning after April 15, 2021.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you filed your tax return between March 2, 2021, and April 23, 2021:

You will receive your stimulus payment beginning after May 1.

- Direct deposits: Allow up to 2 weeks

- Paper checks: Allow up to 4 to 6 weeks for mailing

If you file your tax return after April 23, 2021:

- Direct deposits: Allow up to 45 days after your return has been processed

- Paper checks: Allow up to 60 days after your return has been processed

Some payments may need extra time to process for accuracy and completeness.

You May Like: Are Stimulus Checks Part Of The Cares Act

Golden State Stimulus Check #2

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

GSS I payments were a one-time check of either $600 or $1,200.

As mentioned above, it went out to those who typically earned less than $30,000 and received the California Earned Income Tax Credit, or CalEITC, or those who filed their taxes with an Individual Tax Identification Number, or ITIN.

However, GSS II has been expanded so that more Californians qualify.

Here are the eligibility requirements for GSS II: