Stimulus Registration For Non

If you still need to file your 2019 return, TaxAct can help. Choose the TaxAct product thats right for you and get your maximum refund, guaranteed.

Filing your return now gives the IRS the most up-to-date information to accurately calculate your stimulus payment and send it to you as soon as possible. Otherwise, the IRS will use your 2018 tax return to issue your payment.

New York City Property Tax Rebates

Finally, homeowners in New York City may get an additional $150 back this year on their property tax bill. To qualify, your New York City property can be a multi-family residence , a condominium, or a unit in a cooperative but it must be your primary residence. In addition, the 2020 combined federal adjusted income for all owners can’t be more than $250,000. Most who qualify for the STAR exemption or credit will automatically qualify. If you aren’t receiving STAR benefits but think you qualify for a rebate, you can submit an online application to receive a payment.

Rebate checks were mailed in August. However, if you’re behind on previous property tax payments, your rebate check will be applied towards the property taxes you owe. For that reason, your check could be less than $150 or wiped out altogether, which may explain why you didn’t receive a check in the mail. Otherwise, if you haven’t received a payment yet, you can contact the New York City Department of Finance at www.nyc.gov/dofcustomerservice .

How The Third Stimulus Check Works For Nonfilers

For the third round of payments, in many cases, you shouldn’t need to take an additional step to receive your money if you’re part of a federal program like SSDI or SSI, because these should have been issued automatically. However, if the IRS doesn’t know how many dependents you currently have, you may need to file a free, simple tax return for 2020 so it can pay you $1,400 for each.

If the IRS has your up-to-date 2019 records available, it’ll use those to account for payments, including anyone who used the IRS nonfiler tool to claim a first or second stimulus check. Nonfilers who received a previous stimulus check might also get a check through direct deposit , or in the mail as a paper check or EIP card. Some beneficiaries of federal programs, like SSDI and SSI recipients, may receive their stimulus money through their Direct Express card. Here’s how to track your payment schedule with the IRS.

Don’t Miss: Paying Back Stimulus Money 2021

How Do I File For The Recovery Rebate Credit On Freetaxusa’s Website

First, create or login to your FreeTaxUSA account. Then, when you get to the Deductions/Credits section of the federal tax return, we’ll ask some questions including if you received the Economic Impact Payment or stimulus checks, and how much you received. We’ll guide you through this section, help calculate the estimated credit, and help you file for the Recovery Rebate Credit as you file for your 2020 and 2021 tax returns.

If I Sign Up For The Child Tax Credit Will It Affect My Other Government Benefits

No. Receiving Child Tax Credit payments will not change the amount you receive in other Federal benefits like unemployment insurance, Medicaid, SNAP, SSI, TANF, WIC, Section 8, SSDI or Public Housing. The Child Tax Credit is not considered income for any family. So, these programs do not view tax credits as income.

Also Check: Where My Second Stimulus Check

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Do I Qualify And How Much Will I Receive

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, the IRS will use information from your 2019 or 2018 tax return or information that you provide to see if you qualify for an Economic Impact Payment.

To qualify for a payment, you must:

- Be a U.S. citizen or U.S. resident alien

- Not be claimed as a dependent on someone elses tax return

- Have a valid Social Security Number . Or if you or your spouse is a member of the military, only one of you needs a valid SSN

- Have an adjusted gross income below a certain amount that is based on your filing status and the number of qualifying children under the age of 17. If you are not required to file taxes because you have limited income, even if you have no income, you are still eligible for payment.

You may be eligible based on the criteria below, even if you arent required to file taxes. If you qualify, your Economic Impact Payment amount will be based on your adjusted gross income, filing status, and the number of qualifying children under age of 17. You will receive either the full payment or a reduced amount at higher incomes.

Don’t Miss: Where’s My 1st And 2nd Stimulus Check

New York State’s Homeowner Tax Rebate Credits

If you own a home in the Empire State, you may qualify for an advance payment of the state’s Homeowner Tax Rebate Credit for the 2022 tax year. New York started sending the advance credit checks in June, but not everyone has received their money yet. If you’re still waiting, the state says eligible residents should receive their payment before their local school tax bills are due. But note that the state won’t send payments for less than $100.

To get a payment, you must qualify for a 2022 School Tax Relief credit or exemption and have a school tax liability that’s more than your 2022 STAR benefit. Your 2020 income also can’t exceed $250,000.

How much will you get? It depends on your income, where you live, and whether you receive Enhanced STAR or Basic STAR benefits. Generally, though, your payment will be between 18% and 163% of your STAR benefit. The state has an online tool that will help you estimate the amount of your payment, the average payment for people living outside of New York City is expected to be about $970 and around $425 for New York City residents.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Don’t Miss: When Will Nc Stimulus Checks Arrive 2021

How To Find Unclaimed Retirement Benefits

If you changed jobs several times before retiring, you could have unclaimed retirement benefits that need to be tracked down. Heres how to do just that.

If you need help right away, this relief program will direct deposit a short term loan into your bank account. Review the terms of this funding closely before accepting these funds.

Believe it or not, its common for retirement accounts to get lost in the shuffle. When you move, change jobs, or life simply gets in the way, its easy to forget you have those benefits that you earned during your working years. To see if you have any retirement benefits waiting to be claimed, follow these tips:

1. Get in touch with past employers.

Changing a job could have caused you to leave a 401 , pension, or another retirement account in a former employers hands. If you think this is the case, look for the companys human resources department and give them a call. Tell them youd like to speak with the plan administrator or whoever is in charge of benefits. As a former employee, you have every right to ask for this service, so be persistent until they give you the answer youre looking for.

You may have a harder time completing this goal if the company merged, was bought out, or went out of business. Dont let this stand in your way, though, as there are other methods to find unclaimed retirement benefits besides directly contacting a company.

2. Use the Internet to find unclaimed retirement benefits.

Unclaimed.org

STOP!

Can I Provide The Irs With My Account Information

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, your payment will be distributed in the same method as your benefits. Learn more to see if this applies to you.

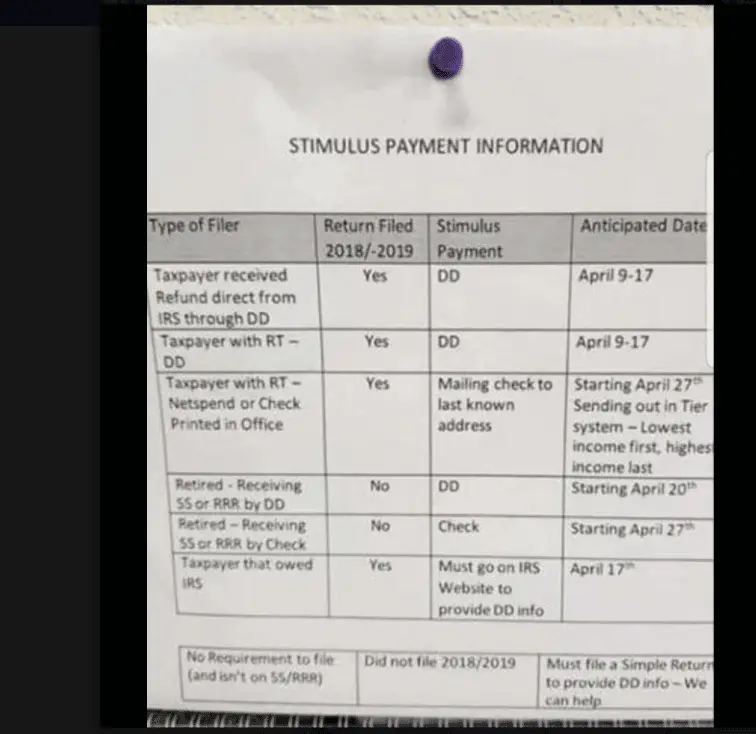

If you filed your taxes in 2018 or 2019 and owed taxes when you filed, you will receive a check or prepaid debit card in the mail. If you filed your taxes but received a refund that was directly deposited, you will receive the refund in the same account and will not be able to update this information at this time.

If you dont typically file taxes and you are providing your information to the IRS through their non-filers portal, you can provide your account information directly in the portal for direct deposit.

If you are being asked to provide banking account information and would like to receive payment on your own prepaid card, enter your cards direct deposit routing and account number directly in the portal. Check your account online or call the card provider to find out if your prepaid account is eligible to receive direct deposit, which is the fastest way to receive the payment.

You May Like: Who Qualifies For Stimulus Check 2021

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Also Check: When Was 3rd Stimulus Check Mailed

I Received A Message From The Irs Asking For My Personal Information Is This A Scam

Yes, this is a scam. With the rollout of Economic Impact Payments, theres an increased risk of scams. Its important to stay vigilant and aware of unsolicited communications asking for your personal or private information through mail, email, phone call, text, social media or websites that:

- Ask you to verify your SSN, bank account, or credit card information

- Suggest that you can get a faster payment if they fill out information on your behalf or if you sign over your check to them

- Send you a bogus check, perhaps in an odd amount, and then ask you to call a number or verify information online in order to cash that check

Be aware that scammers are also able to replicate a government agencys name and phone number on caller ID. Its important to remember that the Internal Revenue Service will never ask you for your personal information or threaten your benefits by phone call, email, text or social media.

If you receive an unsolicited email, text or social media attempt that appears to be from the IRS or an organization associated with the IRS, like the Department of the Treasury Electronic Federal Tax Payment System, notify the IRS at . You can also learn more about coronavirus-related scams.

Recommended Reading: How Many Stimulus Checks Were There In 2020

How To Determine If You Have Money Coming To You

Starting in late January, the IRS began sending out information via what it dubs Letter 6475. Its something for taxpayers to watch out for, Steber says. At the top of the letter, which the IRS says it will send through March, youll see the words Your Third Economic Impact Payment. The letter, which the agency did not send out last year, provides details about the total amount you received in third-round stimulus payments in 2021 and includes all payments, even if they were issued at separate times.

Keep in mind that the third-round EIPs were advance payments of the 2021 Recovery Rebate Credit. This letter will help Economic Impact Payment recipients determine if they are entitled to and should claim the Recovery Rebate Credit on their 2021 tax returns when they file in 2022, the IRS announced in a.

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

Read Also: How Do I Know If I Got My Stimulus Check

What Steps Do I Need To Take To Receive An Economic Impact Payment

If you receive certain social security, retirement, disability, survivors, railroad retirement, or veterans benefits, you may automatically qualify to receive a payment. Learn more to see if this applies to you.

For most people, you will not need to take any action and the IRS will automatically send you your payment. For some people who are eligible for a payment, the IRS will need more information from you first before they can send you money. You will do this using one of two different IRS portals. It is important that you provide this information using the right IRS portal so that the IRS can process your information quickly.

- If you already filed your 2018 or 2019 taxes, go to the IRS Get My Payment portal to check the status of your payment. This portal will let you know if your payment has been processed and let you know if the IRS needs more information before sending you your payment.

- If your payment has already been processed, the IRS does not need any more information from you at this time.

- If you paid additional taxes when you filed your tax return, it is possible that the IRS does not have your payment account information to direct deposit your payment. You can provide that directly in the portal so that they can process this information quickly and send you your payment. If the IRS does not have your direct deposit information and you dont provide it to them, your payment will be sent to you by check to the address they have on file.

When Will You Receive Your Stimulus Payment After You File For A Recovery Rebate Credit

The IRS started processing 2020 tax returns on Feb. 12 but extended the tax deadline to May 17 and focused on sending stimulus checks instead. If you filed for a Recovery Rebate Credit as part of a 2020 tax form and submitted it in February or early March, you can check the status of your tax return and refund to see if it’s been processed. It isn’t certain what the IRS’ revised timeline is for processing tax returns submitted in mid-March and beyond.

You May Like: Who Will Get Stimulus Checks