Special Reminder For Those Who Dont Normally File A Tax Return

People who dont normally file a tax return and dont receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and others. For those eligible individuals who didnt get a first or second Economic Impact Payment or got less than the full amounts, they may be eligible for the 2020 Recovery Rebate Credit, but theyll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you arent required to file a tax return.

Nine Million Households Could Still Be Due Significant Stimulus Money And For Expanded Child Tax Credit And Earned

With rent, food prices and utility bills up, many families could use some extra cash. Inflation is stressing peoples budgets big time.

If youre struggling and didnt file a tax return this year, check your mail.

Last week, the IRS started sending letters to the 9 million households who may still be eligible for several lucrative tax benefits, including the third round of stimulus payments, worth as much as$1,400 for an individual and $2,800 for couples.

If you didnt get the full amount of the pandemic-related Economic Impact Payment under the $1.9 trillion American Rescue Plan, you may be able to claim the 2021 credit. But you must submit a 2021 tax return even if you dont usually file taxes.

The payments were the largest of those sent to Americans under federalcoronavirus relief packages starting in 2020.

You dont have to have income for 2021 to qualify for the stimulus money. But there are income caps.

The IRS faced a daunting task amid the pandemic to reach millions of people who dont typically file tax returns. Technically, the stimulus payments were an advance of a credit referred to on Forms 1040 and 1040-SR as the Recovery Rebate Credit.

For the third round of payments, eligible individuals with an adjusted gross income of $75,000 or less were entitled to the full $1,400. The ceiling was $112,500 for individuals filing as head of household and $150,000 for couples filing jointly. Your AGI is your gross income minus certain adjustments.

Typical Stimulus Check ‘math’ Errors

Recipients may have gotten a CP11, CP12, or CP13 notice, according to the IRS.

- CP11 means you owe more from your previous tax return.

- CP12 means you are owed more money.

- CP13 means you neither owe nor get more money.

The CTC payments can reach $300 per month for each child under age 6 and up to $250 per month for each child ages 6 through 17.

Most of the checks are distributed through direct deposit, but the IRS confirms many prefer to receive paper checks in the mail.

The majority of the checks are being issued by direct deposit. But the IRS confirmed some families will be mailed a “paper check” and some need to “allow extra time.”

To figure out if the payment is coming in paper or direct deposit – the IRS provides a tool Child Tax Credit Update Portal.

Also Check: Fourth Stimulus Check For Social Security

Can I Still Get My Stimulus Checks Good News Us Expats

01/16/2023

United States Expats: Did you receive your three COVID-19 stimulus payments from the IRS? If not, you could be eligible to claim up to $3,400, but you need to act soon.

Important context: The stimulus checks relate to the federal governments initiative to offer some financial relief to individuals and families in the wake of the COVID-19 pandemic.

Also known as the Stimulus Payments, Economic Impact Payments, or Recovery Rebate Credits, three legislative initiatives in 2020 and 2021 provided up to $3,400 per individual and up to $2,500 per eligible child. They were:

I Got A Stimulus Payment For Someone Who Has Died What Should I Do

Someone who has died after Jan. 1, 2021 may be issued a check. If you receive that payment by check and you are the spouse or guardian of the deceased person, you can keep it.

If you cant deposit or cash the check because it was made out to your deceased spouse, you can return it to the IRS. You should include a letter requesting the third payment be made in your name only as the surviving spouse. If you got an EIP card for your deceased spouse and cant access the funds, contact Money Network, the card issuer.

Stimulus payments wont be processed for anyone who died prior to Jan. 1, 2021.

Recommended Reading: Do I Get A Stimulus Check 2021

Read Also: How Much Did The Stimulus Checks Cost

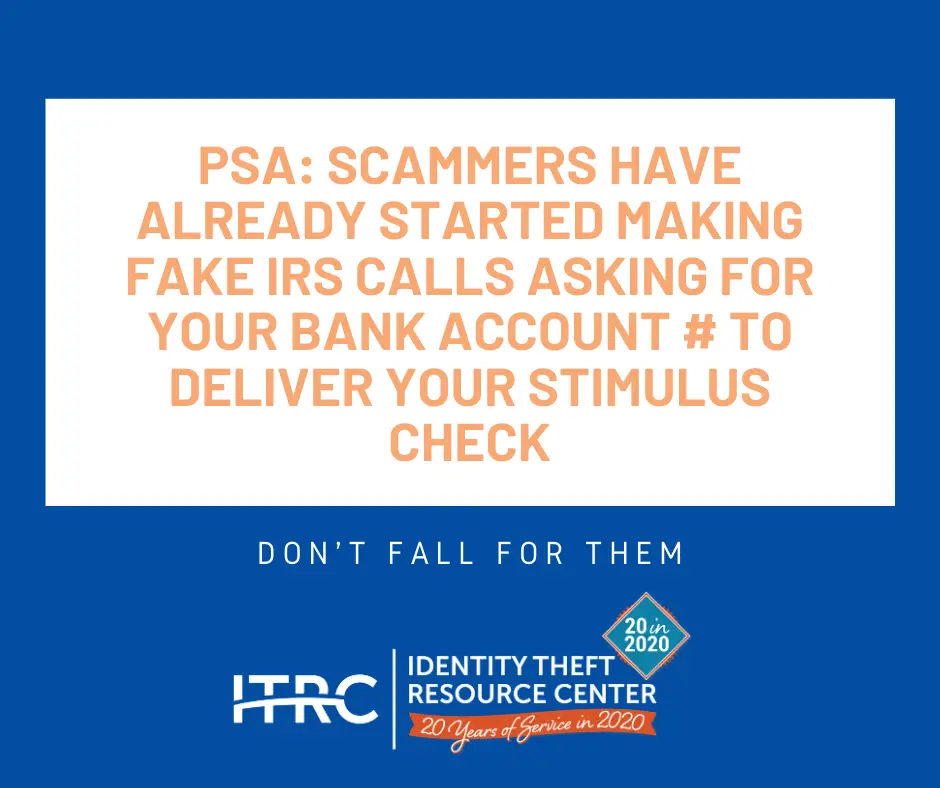

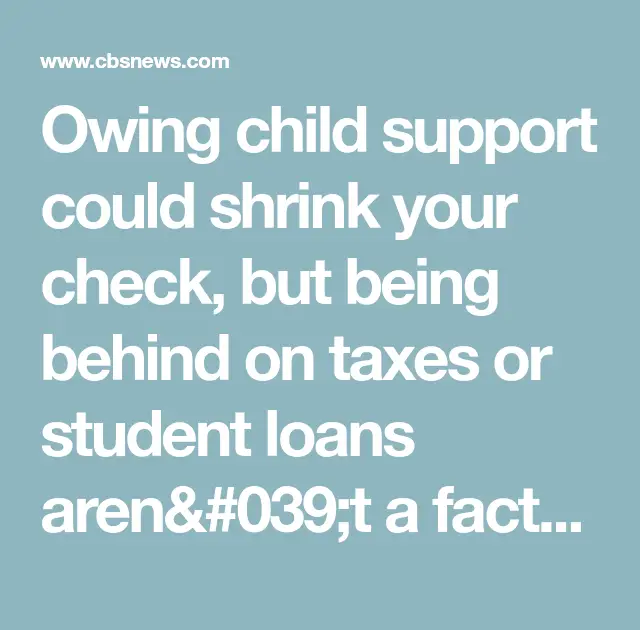

Do I Get A Irs Stimulus Check If I Owe Taxes

The answer is yes. You will still get a stimulus check if you owe taxes. The IRS will not offset any unpaid taxes against the stimulus provided by the government.

The IRS states there is just one reason why an eligible taxpayer may not receive their stimulus check: owed child support.

If you need to pay child support and the deadline has elapsed, the Bureau of Fiscal Service will let you know. The amount of past-due child support will be taken off the stimulus check.

The IRS will determine whether you are eligible to receive a stimulus payment when you file your 2019 or 2020 taxes.

Finally, if you receive a stimulus payment based on the income stated on your 2019 tax return, but your 2020 income is higher, which would ordinarily impact your eligibility, you will not be required to give it back in 2021.

Stimulus Check Second Round

The second round of stimulus checks resulted from another economic relief bill that was passed at the end of last year.

This payment ended up being $600 per person plus $600 per dependent. This payment was issued late December 2020 and January 2021 and was recorded on IRS Notice 1444-B.

To be eligible for the second round check, or portion there-of based on phase-out limitations, the maximum income limit is as follows:

- Single â adjusted gross income up to $87,000 with a phase-out above $75,000

- Head of Household â adjusted gross income up to $124,500 with a phase-out above $112,500

- â adjusted gross income up to $174,000 with a phase-out above $150,000

Recommended Reading: What To Do If You Didn’t Receive Your Stimulus Check

Stimulus Checks Are Tax

Stimulus checks are a tax-free boost from the government. This means you will not have to pay any tax on a stimulus check if you receive one. You dont even have to report it on your tax return as income!

Your stimulus check is not considered taxable income. This payment wont reduce your refund or increase the amount that you owe when you file your 2020 tax return. The stimulus payment is actually a refundable tax credit. This means the government gives you money, even if you didnt pay anything in taxes.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Read Also: If You Didn’t Receive Stimulus Check

Here’s Why Your Tax Refund Or Missing Stimulus Money Could Have Been Seized

Stimulus checks are technically considered a tax credit, no matter how you get them. Typically, the IRS can reduce a taxpayer’s refund to repay outstanding debts like past-due child support, unpaid student loans and certain other federal and state liabilities. The CARES Act stated that the first stimulus check could not be garnished for these purposes, except for overdue child support.

The went a step further and protected the second round of stimulus checks from all garnishment, including child support. However, it also limited that exception only to advance payments, and retroactively revised the CARES Act’s rules as well — meaning that your Recovery Rebate Credit that arrives on your tax refund for missing stimulus money is treated differently from the stimulus money that arrived for others in the mail, , an independent organization within the IRS.

For the third check, because of the way it was passed, it’s open to garnishment from private debt collectors, but not child support payments.

Bottom line: If you’re eligible for a stimulus payment through a Recovery Rebate Credit, but you have certain outstanding debts, some or all of your credit could be withheld to pay those debts, the Taxpayer Advocate Service wrote in a .

Heres What To Know About The Cares Act

The CARES Act refers to the Coronavirus Aid, Relief, and Economic Security Act. Congress passed this legislation on March 25, 2020. It was signed into law on March 27, 2020.

It provides up to $1,200 per adult from the federal government. This doubles to $2,400 if youre married and filing a joint return.

This amount is entirely free and non-taxable.

Additionally, Americans are entitled to an additional $500 for each dependent child if you have eligible dependents. Qualifying children were defined as those below 17 expats should also be aware that these children also qualify for a Child Tax Credit. This means that in addition to the sums discussed within this article, American parents living abroad with children could be entitled to even more.

If youre married and have two children, you could be eligible for up to $3,400. Put another way, thats nearly 1.5x the average monthly rent in the Greater London area, which is one of the most expensive places to live in Europe.

Recommended Reading: Amount Of The 3rd Stimulus Check

What If The Irs Still Hasn’t Processed Your 2019 Taxes

Due to pandemic-related delays, the IRS is still working its way through a backlog of paper tax returns from 2019. As of the end of January 2021, there were for 2019 that had yet to be processed, according to the agency. These processing delays could be due to a number of things, including a mistake, missing information, or suspected identity theft or fraud. If the IRS contacts you for more information, you should get a letter. Resolving the problem then depends on how quickly and accurately you get back to the agency.

However, the new bill specifies that a third stimulus check will be based on your 2019 or 2020 tax return — not your 2018 one. The : “On the basis of information available to the Secretary shall, on the basis of such information, determine the advance refund amount with respect to such individual.”

If your 2019 tax return is still being processed, the best thing to do right now is to file your 2020 return electronically as soon as you can, according to , a senior fellow at the Urban-Brookings Tax Policy Center. But if the holdup in processing your 2019 return is due to a problem that also occurs on your 2020 return, your return may get slowed down — which could delay your payment, Holtzblatt said.

A Challenging Year For The Irs

It will be a challenging year for the IRS, an agency whose budget has been cut about 20% over the past decade, leaving it with antiquated technology and a smaller staff.

The agency is also grappling with several changes to the tax law made by the Covid relief bills. The one passed in March also directs the IRS to send out periodic payments for an expanded child tax credit, as well as waive income taxes on up to $10,200 in unemployment benefits received in 2020, helping some laid-off workers who faced surprise tax bills on their jobless benefits.

Also Check: Where Do I Apply For Stimulus Check

Can I Get A Stimulus Check If I Owe Taxes

For many Americans, stimulus checks have been a saving grace.

In times of trouble and financial hardship, these payments have helped keep millions of Americans afloat, and theyve also helped boost economic activity and growth to keep the country ticking over.

Unfortunately, not everyone is eligible for a stimulus check. If youve got outstanding taxes that need to be paid, you may be wondering whether or not the IRS considers you eligible for payment.

In this article, well discuss stimulus check eligibility and restrictions and clear up any confusion for people with overdue taxes. So, stick with us to find out whether or not your outstanding debts impact your eligibility.

Contents

Where To Enter Information

Non-taxpayers will need to visit the IRS dedicated webpage for COVID-19 stimulus checks, click on the blue button that says Non-Filers: Enter Payment Info Here, and the same button on the succeeding page.

The link will access the Free File Fillable Forms website, which is a partner of the IRS, and where people will need to create an account before they can fill out a form.

The form will require several pieces of information, including the persons full name, current mailing address, email address, birthday, Social Security number, bank account, details of qualifying children, and if available, the Identity Protection Personal Identification Number issued by the IRS and a state-issued ID such as a drivers license.

An email will be sent to acknowledge the submission of the form, or to flag a problem with the information and how to fix it.

Recommended Reading: Stimulus Check For Ssi Recipients 2022

State Stimulus Payments In 202: These States Are Still Sending Out Checks

Dozens of states announced tax rebates in 2022. Find out which are still sending payments in the new year.

It’s a new year, but numerous states are still issuing tax refunds and stimulus checks announced in 2022. Massachusetts only began returning $3 billion in surplus tax revenue to residents in November, and California officials don’t expect to finish issuing the state’s “middle-class tax refunds” until mid-January. New Jersey homeowners haven’t even started getting payments from the state’s $2 billion property tax relief program, which was signed into law by Gov. Phil Murphy last summer. Those likely won’t go out until the spring.

Your state could still be sending out checks, too. See if you qualify and how much you could be owed.

How Much Money Could You Expect

It depends on the differences between your 2019 and 2020 taxes and which one the IRS used to calculate your third payment. For each new dependent you claimed for the first time in 2020, they could count toward more money. And dependents of any age count, including 17-year-olds and adult dependents. And if you earned less in 2020 than you did in 2019, you might also qualify for a plus-up payment, again, depending on which tax year the IRS had on hand when it figured your amount.

Read Also: How Do I Get The 3rd Stimulus Check

Irs Free File Open Until November 17

To help get the word out about these tax benefits, the IRS announced on October 13, that it is sending letters to more than nine million individuals and families who appear to qualify for these stimulus benefits but did not claim them by filing a 2021 federal income tax return.

This includes people eligible not only for the 2021 recovery rebate credit and the child tax credit but also the earned income tax credit. The letters should arrive in the coming weeks.

Also, in addition to filing a 2021 tax return at ChildTaxCredit.gov, the IRS says that Free File will remain open for an until November 17, 2022. Thats one month later than the tool is normally available. If your income is $73,000 or less, Free File allows you to file your tax return online at no cost to you.

A Smaller Child Tax Credit

The Child Tax Credit got supercharged in 2021, with parents of children under 6 receiving $3,600 and parents of children ages 6 to 17 getting $3,000.

But in 2022, that tax credit reverted to its pre-pandemic level of $2,000 per child, regardless of age. While that’s certainly a help, that slimmer tax break could make an impact on parents’ refunds.

Some lawmakers and child advocates are pushing to reinstate the higher CTC amounts, with Representative Adam Schiff, a Democrat from California, in December urging congressional leaders to extend the expanded CTC. But with Congress now divided, with Republicans controlling the House, it’s unlikely that the benefit would be returned to its expanded form.

Don’t Miss: What Is Congress Mortgage Stimulus Program For The Middle Class

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.