What If I Filed My Taxes Online

H& R Block and TurboTax have now resolved issues that were delaying direct-deposit payments for customers who opted to pay their 2019 tax prep fee using money from their refund. Read this column for more information.

Unfortunately, TaxAct and Jackson Hewitt were unable to get the IRS to respond as quickly to the same issue for their customers, so direct deposits will begin February 1, according to statements from the companies.

Will 2020 Tax Returns Affect How Much I Receive

In some cases, yes. If based on your 2020 tax returns you would be entitled to a larger payment than calculated based on your 2019 returns, you will be eligible to receive the difference as a tax credit. Of course, this additional payment wont be available until 2020 returns are filed this year.

But if the stimulus payment you are due is lower based on your 2020 income, you get to keep the higher payment that was sent to you based on your 2019 return.

Still No $1200 Stimulus Check

Keep in mind, there are still people waiting for all or part of their first Covid relief payment. Tax experts say it is not too late to request that cash.

“They can get the stimulus payment they are eligible for in the form of a Recovery Rebate Credit when they file their 2020 taxes,” said Lisa Greene-Lewis, certified public accountant and TurboTax expert.

The payments included up to $1,200 per individual or $2,400 per married couple, plus $500 per child under 17. The tax credit would either lower the amount of tax you need to pay, or increase the value of your tax refund.

The easiest way for a taxpayer to get a stimulus payment, or additional payment if they are, in fact, due more is to apply on their 2020 tax return, explained Mark Steber, chief tax officer for Jackson Hewitt Tax Services.

“There will be a schedule and line on the tax return to reconcile what they have received so far, and the amount actually due to them based on their 2020 tax return,” continued Steber.

The IRS says that eligible individuals can claim the Recovery Rebate Credit on their 2020 Form 1040 or 1040-SR. These forms can also be used by people who are not normally required to file tax returns but are eligible for the credit.

For those concerned about how this might complicate the filing process this year, Greene-Lewis tells filers not to worry because automated tax preparation software will factor this in for you.

Recommended Reading: Irs Fourth Stimulus Checks Update

I Got Divorced In 2020 How Will I Get My Money

Since this round of stimulus payments will be delivered the same way your CARES Act payment was delivered, you may need to communicate with your former spouse to ensure your payment was receivedâand you can divide the single payment between you.

Check the Get My Payment Portal for the status of the payment youâre expecting. If you canât communicate with your former spouse or they have moved away, you may need to claim your recovery rebate on your taxes in lieu of a stimulus payment now. Speak with a tax professional about your options.

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

Both the first and second stimulus check cannot be reduced to pay any federal or state debts. Unlike the first stimulus check, your second stimulus check cannot be reduced if you owe past-due child support payments and is protected from garnishment by creditors and debt collectors.

If you use direct deposit and owe your bank overdraft fees, the bank may deduct these from your payment.

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first and second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Recommended Reading: Can I Mobile Deposit Someone Else’s Stimulus Check

Can My Bank Take My Stimulus Check

It may. The New York Times reports that some people banking with credit unions are in danger of having their stimulus payments taken to offset overdraft fees and other liabilities.

But The Times also said the four biggest US banks JPMorgan Chase, Wells Fargo, Citi Bank, and Bank of America have agreed to credit customer’s accounts to bring negative balances to zero for about a month so that any stimulus money deposited won’t automatically be taken to pay outstanding fees. Other large regional banks, including Fifth Third Bancorp, Truist, PNC Financial Services, and US Bank are doing the same.

Here’s some advice on what to do if your bank takes your stimulus payment.

Payment Status Not Available

In short, the IRS says like the first time around this message indicates there was some kind of issue using or getting the data from your 2019 return, which is what stimulus payments are based on.

Heres the official Dec. 2020 statement from the IRS about this message:

The Get My Payment application will return Payment Status Not Available for several reasons, including:

- Youre required to file a tax return, but

- we havent finished processing your 2019 return

Recommended Reading: Are Stimulus Checks Still Going Out

Will You Get A Paper Check Or A Debit Card

If you are eligible for the second round of stimulus payments and you did not get a direct deposit by early January, chances are your payment was supposed to arrive by either a paper check or a debit card. If you got a paper check for your first stimulus payment last year, you might still get a debit card this time. And some people who got a debit card last time may receive a check now.

IRS and Treasury urge eligible people who dont receive a direct deposit to watch their mail carefully during this period for a check or an Economic Impact Payment card, which is sponsored by the Treasury Departments Bureau of the Fiscal Service and is issued by Treasurys financial agent, MetaBank®, N.A, the IRS explained. The Economic Impact Payment Card will be sent in a white envelope that prominently displays the U.S. Department of the Treasury seal. It has the Visa name on the front of the Card and the issuing bank, MetaBank®, N.A. on the back of the card. Information included with the card will explain that this is your Economic Impact Payment.

More information about the debit cards is available at EIPcard.com.

How The Stimulus Money Can Help

If you already have your basic needs covered, such as housing and food costs, it’s worth spending the stimulus check on paying off any outstanding credit card debt.

Sallie Krawcheck, co-founder and CEO of the digital investment platform Ellevest, says that if you feel stable about your job and income right now but have an outstanding credit card balance, put the money toward that debt.

Because credit cards come with notoriously high interest rates, it’s not worth carrying a balance if you can afford to chip away at it. And, as your decrease, your also lowers, which helps improve your .

Depending on your credit score, you might also consider looking into transferring your debt to a balance transfer credit card. These credit cards offer an introductory interest-free period ranging from six to 21 months. Many balance transfer cards, like the Citi® Double Cash Card and Citi Simplicity® Card, require good to excellent credit to qualify, but the Aspire Platinum Mastercard® allows applicants with fair credit to qualify.

Information about the Aspire Platinum Mastercard® has been collected independently by Select and has not been reviewed or provided by the issuer of the card prior to publication.

Editorial Note:

Don’t Miss: North Carolina Stimulus Check 2022

What If I Should Have Gotten The First Stimulus Check But Didnt

The IRS has established a page called Recovery Rebate Credit for taxpayers who qualified for the first stimulus check, but didnt receive it or only received part of what they should have.

If you believe you qualified, but didnt receive the stimulus check go to this page on the IRS website and find out information on how to get it.

What Information Will The Trace Provide Me

The IRS will process your claim for a missing payment in one of two ways:

- If the check was not cashed, they will reverse your payment and notify you. If you find the original check, you must return it as soon as possible. You will need to claim the 2020 Recovery Rebate Credit on your 2020 tax return to receive credit for EIP 1 and EIP 2, and then claim the 2021 Recovery Rebate Credit on your 2021 tax return for EIP 3, if eligible.

- If the check was cashed, the Treasury Departments Bureau of the Fiscal Service will send you a claim package that includes a copy of the cashed check. Follow the instructions. The Treasury Departments Bureau of the Fiscal Service will review your claim and the signature on the canceled check before determining whether the payment can be reversed. If reversed, you will need to claim the Recovery Rebate Credit on your 2020, or 2021 return depending on what EIP payment in reference, if eligible.

You May Like: Earned Income Tax Credit Stimulus

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

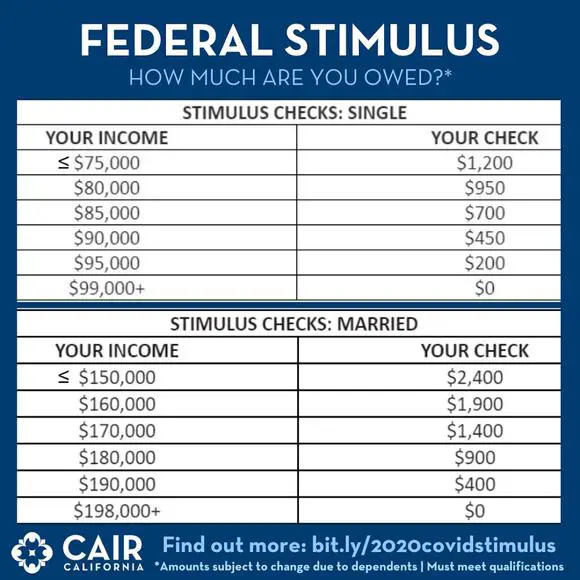

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

You May Like: What Does The Stimulus Debit Card Look Like

Is A $600 Stimulus Check Enough

While the $600 payments are half the amount Americans received in the first round of stimulus, the legislation also extends unemployment benefits for 11 weeks, and provides funds for the Supplemental Nutritional Assistance Program, emergency rental assistance, childcare providers, and small businesses.

Prominent economists have repeatedly urged Congress to authorize more stimulus checks. In an open letter signed by 125 economists in November, they called stimulus checks an “essential tool” for keeping millions of families out of poverty during the pandemic.

During negotiations, many top Democratic lawmakers said $600 direct cash payments were insufficient. Before a deal was reached, a group of 17 progressive Democrats signed a letter to congressional leadership urging $2,000 stimulus checks, Business Insider’s Joseph Zeballos-Roig reported. Twitter users mocked the smaller check.

“This is just the first step. This is an emergency,” Senate Minority Leader Chuck Schumer said during a press conference after the checks were approved. “We need a second bill to continue dealing with the emergency and to start stimulating our economy so we get back to where we were. That will be job No. 1 in the new Biden administration.”

Also Check: Where Do I Put Stimulus Money On Tax Return

Q: When Will I See My Money

The IRS and Treasury announced that stimulus payments started going out via direct deposit on Dec. 29. Paper checks were scheduled to begin being mailed on Dec. 30.

According to the IRS, checks will take three to four weeks to arrive. So if you log onto the IRS website and see your check was mailed on Jan. 6, you should receive them between Jan. 27 and Feb. 3.

If the IRS is unable to find direct deposit information, they will send the money by check.

You could be one of the 8 million people getting a stimulus debit card in the mail. Why are you getting a card when you didn’t get a card last time?

On the IRS.gov website it says:

The prepaid debit card, called the economic impact payment card, is sponsored by the Bureau of the Fiscal Service and is issued by Treasury’s financial agent, MetaBank. The IRS does not determine who receives a prepaid debit card.

More Videos

Most Americans, that are eligible for the payments, will receive them via direct deposit. So long as someone filed their taxes in past years, the IRS should have access to these accounts. Similarly, recipients of benefits like social security should have their direct deposit information on file.

RELATED: VERIFY: No, the stimulus checks won’t be going to undocumented immigrants

Second Round Of Direct Payments: December 2020

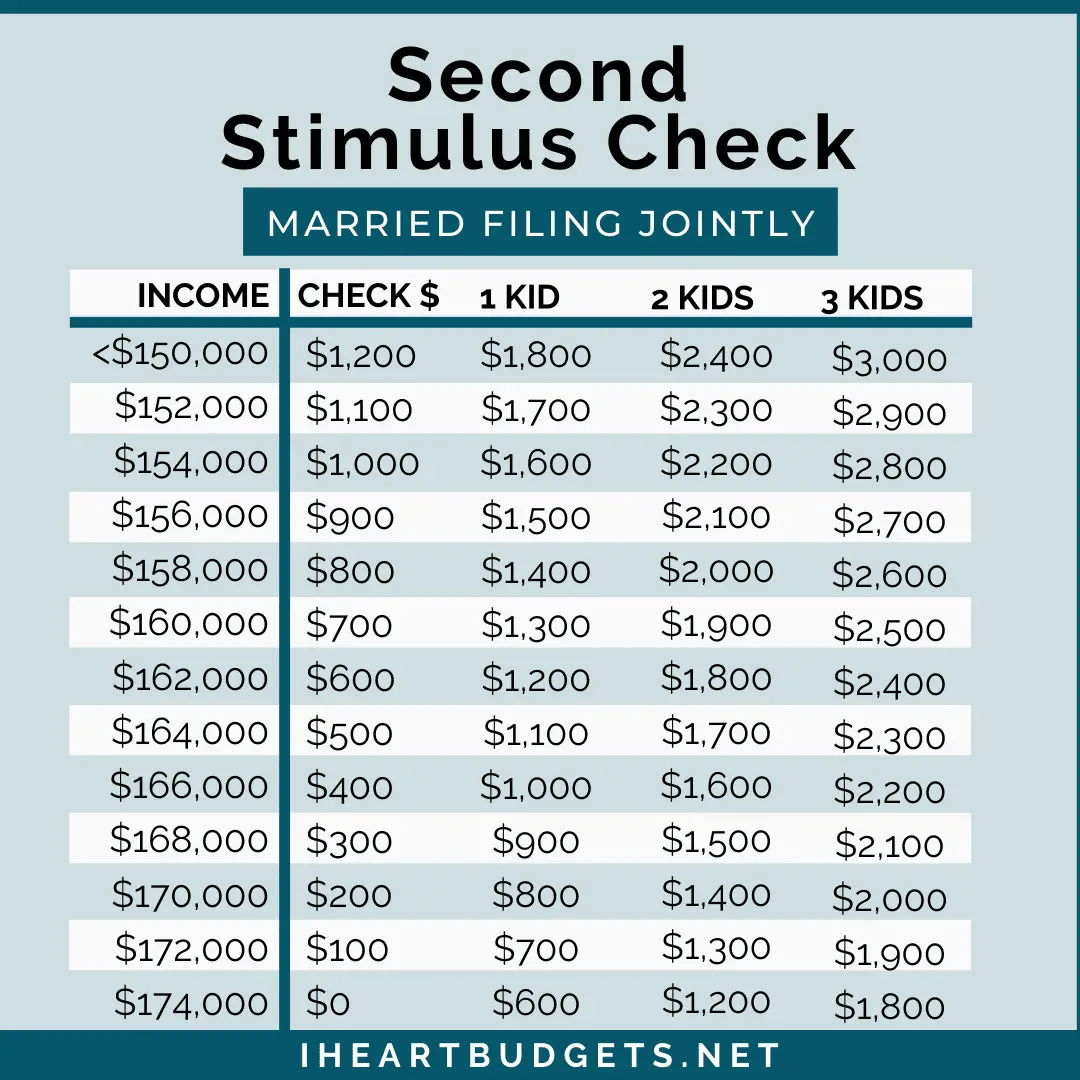

The second round of aid, a $900 billion package which was part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 was signed off by Trump on 27 December 2020. It provided a one-off check of up to $600, but this time, households were also able to claim an additional $600 for child dependents aged 16 or under. Those who earned under $75,000 in the 2019 tax year received the full stimulus check, while a steadily smaller figure was given to those on a higher annual income, up to a maximum phase-out limit of $87,000. The first payments, through direct deposit and paper checks with some later payments made by EIP 2 Cards, were issued between 29 December 2020 and 15 January 2021.

Those who didnt receive a stimulus payment either through the CARES Act or the December Covid-19 Relief bill were able to claim for it retroactively when they filed their federal tax returns for 2020 through the IRS Recovery Rebate Credit.

Read Also: Irs 3rd Stimulus Check 2021

According To The American Bankers Association The Economic Relief Package Includes :

- Second round of stimulus checks in the amount of $600 per adult and dependent children, subject to income limits

- $300 a week for enhanced unemployment insurance benefits

- Jobless workers would receive their regular state unemployment aid, plus $300 until March 14, 2021.

Treasury And Irs Begin Delivering Second Round Of Economic Impact Payments To Millions Of Americans

See IRS Statement Update on Economic Impact Payments for additional information.

IR-2020-280, December 29, 2020

WASHINGTON Today, the Internal Revenue Service and the Treasury Department will begin delivering a second round of Economic Impact Payments as part of the Coronavirus Response and Relief Supplemental Appropriations Act of 2021 to millions of Americans who received the first round of payments earlier this year.

The initial direct deposit payments may begin arriving as early as tonight for some and will continue into next week. Paper checks will begin to be mailed tomorrow, Wednesday, December 30.

The IRS emphasizes that there is no action required by eligible individuals to receive this second payment. Some Americans may see the direct deposit payments as pending or as provisional payments in their accounts before the official payment date of January 4, 2021. The IRS reminds taxpayers that the payments are automatic, and they should not contact their financial institutions or the IRS with payment timing questions.

As with the first round of payments under the CARES Act, most recipients will receive these payments by direct deposit. For Social Security and other beneficiaries who received the first round of payments via Direct Express, they will receive this second payment the same way.

Recommended Reading: What Stimulus Was Given In 2021

What If The Irs Sent The Check To A Closed Account

Because people can’t update their bank account information on the “Get My Payment” site, there’s concern that some checks might be sent to accounts that were recently closed. If that’s the case, the IRS says you’ll have to wait until you file your 2020 tax returns.

The stimulus checks are actually a tax rebate that can be applied to your annual tax returns but that means people may be waiting weeks or even months for their stimulus money to show up through their tax refund.

Third Round Of Stimulus Checks: March 2021

Barely a week after the second round of stimulus payments were completed, new president Joe Biden entered office and immediately unveiled his American Rescue Plan, which proposed a third of round of payments to Americans, including some of those who might have missed out on the first two rounds.

On Thursday 11 March, Biden signed his $1.9tn American Rescue Plan into law. The third payment provided eligible individual taxpayers for a check of up to $1,400, while couples filing jointly could receive a maximum of $2,800. In addition, families with dependents were eligible for an extra payment of $1,400 per dependent, regardless of the dependents age this time, there was no limit to the number of dependents that could be claimed for.

The first stimulus payments were issued swiftly just hours after Biden has signed the bill, the first batch of 164 million payments, with a total value of approximately $386 billion, arrived by direct deposit in individuals bank accounts. Some received their payments on the weekend of 13/14 March 2021. Since then, payments had been sent on a weekly basis including plus-up payments until the end of the year. Like before, those who didnt get all the EPI3 funds in 2021 due to them will be able to claim them when they file their tax returns in the spring of 2022.

Read Also: Nc $500 Stimulus Check Update