Get Your Stimulus Check: File With The Irs

As part of the Coronavirus Aid, Relief and Economic Security Act Americans will be receiving economic impact payments to provide some financial relief during the COVID-19 pandemic.

The IRS has begun to distribute these payments. However, in order to receive these payments individuals and couples must have filed with theInternal Revenue Service .

Also Check: Payable Doordash 1099

Who Qualifies For The Third Stimulus Payments

Generally, if youâre a U.S. citizen and not a dependent of another taxpayer, you qualify for the full third stimulus payment. In addition, your adjusted gross income canât exceed:

- $150,000 for married filing jointly

- $112,500 for heads of household

- $75,000 for single filers

A partial payment may be available if your income exceeds the thresholds. However, you will not receive any payment if your AGI is at least:

- $160,000 for married filing jointly

- $120,000 for heads of household

- $80,000 for single filers

The full amount of the third stimulus payment is $1,400 per person and an additional $1,400 for each qualifying dependent.

Appendix Ii: Estimating The Outreach Population For Economic Impact Payments

Table 1 in this paper and Appendix Table 1 both rely on nationally representative survey data to estimate the number of individuals eligible for Economic Impact Payments while excluding those likely to receive those payments automatically because they filed federal income taxes or participate in federal benefit programs . The estimates are approximate and are affected by underreporting of income and benefits, recent changes in program participation, and other data limitations.

Data reflect the population, economy, and program participation patterns of 2015 through 2017 and are from CBPPs analysis of the Census Bureaus Current Population Survey Annual Social and Economic Supplement, adjusted to correct for underreporting of SNAP and SSI participation in the CPS using baseline data from the Transfer Income Model Version 3 . TRIM 3 is developed and maintained by the Urban Institute with primary funding from the Department of Health and Human Services Office of the Assistant Secretary for Planning and Evaluation . To improve the reliability of the state estimates, we average together three years of data , the most recent available from TRIM. We exclude immigrant families likely to be ineligible due to lacking a Social Security number.

Read Also: 2021 Homeowner Relief Stimulus Program

Stimulus Checks And Direct Deposit

While Get My Payment allows you to give bank direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file. Why? As the IRS explains, To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS. You also cant change your form of payment if the IRS has already scheduled it for delivery.

If you havent filed your 2019 taxes , you might want to do that now. Many people can file federal tax returns for free, and tax-prep services like TurboTax and H& R Block are easy to use. The deadline for filing taxes in 2020 was moved from April 15 to July 15.

The Get My Payment app was designed for people who file federal taxes. The IRS has a separate spot online where non-tax filers, including many low-income earners, can enter their information to get stimulus checks for themselves and qualifying dependents.

Who gets stimulus checks first? The Treasury Department says that the first recipients of stimulus checks officially called economic impact payments, part of the $2 trillion CARES Act to provide economic relief amid the coronavirus pandemic were taxpayers who have already filed their 2019 tax returns and have provided direct deposit information to the IRS. Many of these payments began showing up in taxpayers bank accounts on Wednesday, April 15, or even earlier.

Promoted:

I Get Ssi Should I Spend The Stimulus Money Within A Year What Can I Spend It On

Spend down your CARES Act EIP money before 12 months have passed since receiving the payment. You are not limited in what you can spend the money on. You can spend down on whatever you wish, including on gifts and charitable contributions. If you donât spend it within 12 months, the Social Security Administration will count the money as a resource.

You May Like: Fourth Stimulus Check Irs.gov

Eligible Parents Of Children Born In 2021 And Families That Added Qualifying Dependents In 2021 Should Claim The 2021 Recovery Rebate Credit Most Other Eligible People Already Received The Full Amount And Wont Need To Claim A Credit On Their Tax Return

The third-round Economic Impact Payment was an advance payment of the tax year 2021 Recovery Rebate Credit. The amount of the third-round Economic Impact Payment was based on the income and number of dependents listed on an individual’s 2019 or 2020 income tax return. The amount of the 2021 Recovery Rebate Credit is based on the income and number of dependents listed on an individual’s 2021 income tax return.

Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020. These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return:

- Parents of a child born in 2021 who claim the child as a dependent on their 2021 income tax return may be eligible to receive a 2021 Recovery Rebate Credit of up to $1,400 for this child.

- All eligible parents of qualifying children born or welcomed through adoption or foster care in 2021 are also encouraged to claim the child tax credit worth up to $3,600 per child born in 2021 on their 2021 income tax return.

What Is The Fastest Way To Get Stimulus Payment And Tax Refund

File electronically, instead of a paper return, to avoid delays. Make sure the return is accurate, reflecting complete information regarding the advance payments for the child tax credit and the third stimulus payment. Have your tax refund directly deposited into a bank account to avoid mail delays.

Recommended Reading: How Much 2021 Stimulus Check

How Do I Know If I’m Eligible For More Stimulus Money

All stimulus check payments ended on December 31, 2021. Most Americans received their full payments, but there are a few reasons why you may not have received as much as you are eligible for: If you had a baby or added qualifying children to your family in 2021, you’re due another $1,400 for each additional kid.

Likewise, if your income dropped considerably last year, you could also be owed more money.

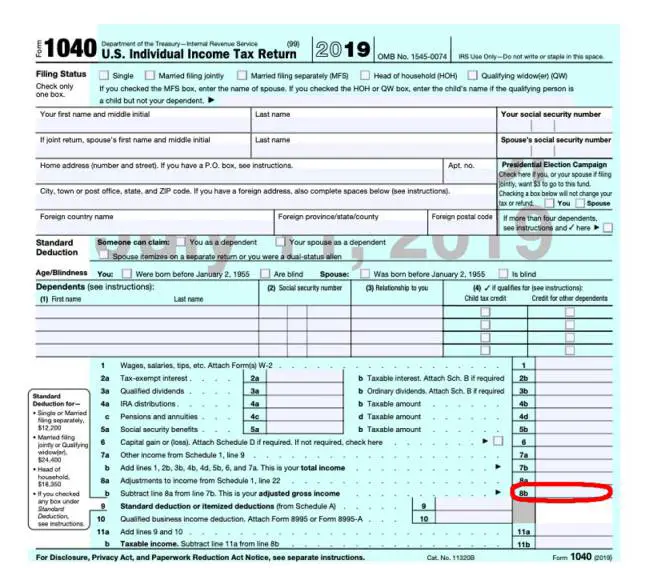

If you believe that you are eligible for more stimulus money than you received in 2021, the best tax software will calculate your recovery rebate credit automatically and include the amount of additional money on line 30 of your IRS Form 1040.

If you want to calculate your potential recovery rebate credit yourself, use the Recovery Rebate Credit Worksheet as directed in the IRS instructions for Form 1040.

What If Letter 6475 Says That I Received Money But I Didn’t

First, the IRS recommends that you check your bank account records for 2021 to make sure. They particularly advise looking for deposits from the IRS in spring or early summer.

Next, check your online IRS account. The info on the IRS website will be more up to date than Letter 6475, particularly if a payment was returned. If your online account says that you received stimulus payments, but you didn’t see the money, you should contact the IRS immediately to see if a payment trace is required.

You May Like: How To Get My Second Stimulus Check

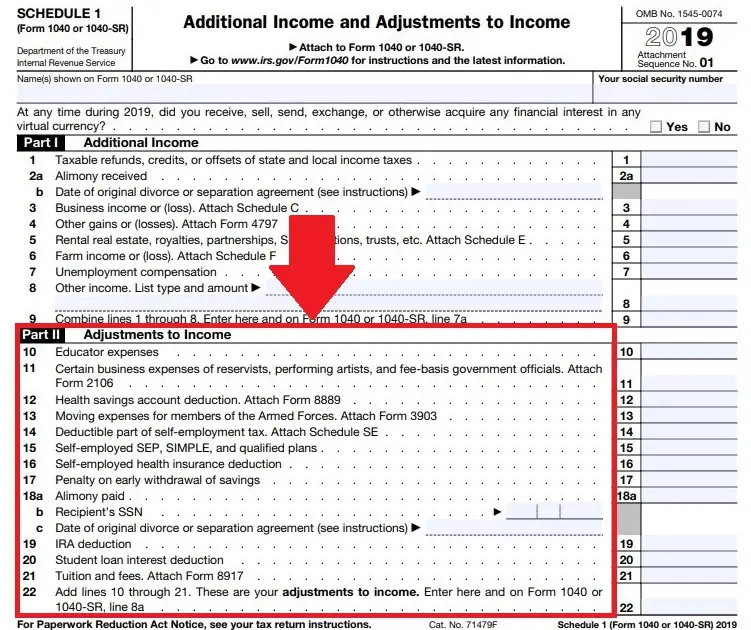

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Who Is Eligible For The Economic Impact Payment

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Social Security recipients and railroad retirees who are otherwise not required to file a tax return are also eligible and will not be required to file a return.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

You May Like: How Much Was The Stimulus Payments In 2021

Don’t Miss: Earned Income Tax Credit Stimulus

Should I Keep Letter 6475 After I File My Taxes

You should always save tax return-related documents, says , chief tax information officer at Jackson Hewitt: W-2s, interest statements and IRS letters are a good record of your account in case anything comes along in the next two or three years, he says.

The IRS also advises keeping all documents related to income, deductions, credits and other tax items for at least three years.

How To Claim Your Missing Third Stimulus Payment On Your 2021 Tax Return

Youâll need to request any missing third stimulus payments on your 2021 tax return by claiming the Recovery Rebate Tax Credit.

This is the case if you received a partial amount or didnât previously qualify for the third stimulus payment.

Letâs say youâre single and your income for the 2020 and 2019 tax years exceeds the threshold . However, you lost your job in 2021, so your income drastically decreased. You can now claim the Recovery Rebate Tax Credit since your earnings fell below the threshold.

Families that added dependents may also be able to claim the credit.

In addition, a few lingering taxpayers who file taxes using ITINs may not have received payments for their eligible dependents who have Social Security numbers.

You need to complete the Recovery Rebate Tax Credit worksheet and submit it along with your 2021 tax return. If you use a tax software program, it should guide you through the process. Keep in mind, the IRS predicted a frustrating and slow tax season this year, so file your return as soon as possible.

Before completing the worksheet, you must know the amount of any third stimulus payments received for you, your spouse, and any dependents. The worksheet will also request your adjusted gross income for the year to determine your eligibility.

The IRS started mailing Letter 6475 to taxpayers in Januaryâthe letter confirms the total amount of the third stimulus payments received for the 2021 tax year.

Recommended Reading: When Did Americans Receive Stimulus Checks

More 1040 Tax Form Help

Want more 1040 tax form guidance? View H& R Blocks tax filing options to fit with your unique tax situation.

Whether you make an appointment with one of our knowledgeable tax pros or choose one of our online tax filing products, you can count on H& R Block to help you complete your Form 1040.

Related Topics

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Read Also: When Was The 3rd Stimulus Payment Issued

How To Fill Out Stimulus Rebate Form

How To Fill Out Stimulus Rebate Form Youve come to the right site if youre unsure how to complete a stimulus rebate form. You will learn more about this forms requirements in this post, along with instructions on how to determine your recovery rebate credit. Samantha Hawkins, a certified public accountant and the owner of Hawkins CPA Solutions in Upper Marlboro, Maryland, is the author of this article.

Stimulus Payments: Find Tax Info You Need To See If You Get More

Use Letter 6475 or the IRS website to report your 2021 stimulus payments in order to qualify for more.

Peter Butler

How To writer and editor

Peter is a writer and editor for the CNET How-To team. He has been covering technology, software, finance, sports and video games since working for @Home Network and Excite in the 1990s. Peter managed reviews and listings for Download.com during the 2000s, and is passionate about software and no-nonsense advice for creators, consumers and investors.

Dan Avery

Writer

Dan is a writer on CNETs How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Your chance to file a 2021 tax return on time is running out tax deadline day is Monday, April 18. Its also your final chance to claim any additional stimulus payments you might be eligible for.

The American Rescue Plan provided third stimulus check payments last year of up to $1,400 for each adult and child. If you didnt receive the full amount of your eligible money youll need to claim the recovery rebate credit on your 2021 federal tax return.

You May Like: Stimulus Check For Expecting Mothers 2022

Also Check: Irs Find My Stimulus Check

Will I Lose Out If I Cant Sign Up In Time To Get A Payment On July 15

No. Everyone who signs up and is eligible will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive the full benefit when you file your taxes in 2022.

What To Do If You Missed The Deadline To Claim Your Money

If you missed any of the deadlines above to claim your missing child tax credit payments or stimulus money, don’t worry. You can still claim that money when you file your taxes in 2023 — you just won’t receive it this year.

The final cutoff day for claiming the money will be on Tax Day in 2025, but we recommend filing as soon as possible.

Don’t Miss: How To Sign Up For The Stimulus Check

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Why Did I Receive Irs Letter 6475

According to the IRS, Economic Impact Payment letters include important information that can help you quickly and accurately file your tax return, including the total amount sent in your third stimulus payment.

This could include plus-up payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

Even though it is not taxable income, you still need to report any stimulus money on your IRS return. In 2020, the IRS received over 10 million returns that incorrectly reported stimulus money, according to IRS Commissioner Charles P. Retting, resulting in manual reviews and significant refund delays.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but thats not what you want to use to prepare your 2021 return.

You May Like: Who Is Eligible For 4th Stimulus Check