Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Prepare For Your Appointment

- Schedule your appointment ahead of time.

- Bring the following items with you:

- A current government-issued photo ID.

- A taxpayer identification number, such as a Social Security number.

- Any other documentation you need for your appointment.

How To Check Your Refund Status

Use the Where’s My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours.

You can to check on the status of your refund. However, IRS live phone assistance is extremely limited at this time. Wait times to speak with a representative can be long. But you can avoid the wait by using the automated phone system. Follow the message prompts when you call.

Also Check: How To Check My Stimulus Payment

I Am Not Familiar With Prepaid Debit Cards What Is Important To Know About Using This Card

The Economic Impact Payment Card is a VISA prepaid debit card. The government has loaded your Economic Impact Payment onto the card for you. You do not need to pay this money back and you will not be taxed on this money. Once activated, your money is safe on this card and is eligible for FDIC insurance. Be sure to immediately report if your card is lost or stolen.

If you have had a checking account debit card or credit card before, this card may be a little different. First, this card is not linked to any bank or credit union account and will not have any impact on your credit score or help you build your credit. You cannot overdraft or spend more than what has been loaded on the card. If you dont have enough money to cover a purchase, the transaction may be declined or partially authorized. If this happens, you may be asked to use another form of payment to pay the full or remaining amount if you want to complete the transaction.

You can get cash, request a check, or make a purchase anywhere VISA debit cards are accepted. Each time you use your card, the amount will be deducted from your balance until you use all your funds. You will not be able to load your own money on this card and your money will not expire. If you do not use all your money before the expiration date printed on the card, you can call customer service to request a refund check for the remaining balance.

I Would Like To Pay A Bill That Doesnt Allow Payment With Debit Cards How Can I Do This Without Paying A Fee

You can pay rent, bills, or other payments from your account using a Money Network Check without paying a fee.

To do this, you need to:

- Request a Money Network Check by calling customer service at 1-800-240-8100

- Check your balance to make sure you have enough funds to cover your payment

- When you receive the check, fill out the date, dollar amount, and name of who you are paying

- Activate your check by calling customer service at 1-800-240-8100 and following the instructions to enter the check number, digit, and amount, and record the issuer number and transaction number provided by the automated phone system

- Once you have successfully activated your check, the payment will be immediately deducted from your account balance and you can send your payment for your rent or other bill

Tip: If you occasionally pay a bill with a money order, consider using a Money Network Check to pay your bill instead to avoid paying a money order fee.

Read Also: How To File For The Third Stimulus Check

Lost Or Stolen Refund

You can always check the status of your refund using Wheres My Refund? at IRS.gov or the IRS2Go mobile app. Wheres My Refund? is updated no more than once every 24 hours, usually overnight.

If one of these apps indicates the IRS issued your refund, but you havent received it, your refund may have been lost, stolen, or misplaced.

If this is the case, you can ask the IRS to do a refund trace. This is the process the IRS uses to track a lost, stolen, or misplaced refund check or to verify a financial institution received a direct deposit.

How To Prepare For The Phone Call With Irs Customer Service

Before you call IRS customer service, be sure you know or have the following information handy:

- Social Security numbers and birth dates for those who were on the return you are calling about

- An Individual Taxpayer Identification Number letter if you dont have a Social Security number

- Your filing status single, head of household, married filing, joint, or married filing separate

- Your prior-year tax return, in case the IRS needs to verify your identity before answering certain questions

- A copy of the tax return youre calling about

- Any letters or notices the IRS has sent you

Note that the IRS will only speak with the taxpayer or their legally designated representative. You cannot call about someone elses account without a valid Form 2848 or Form 8821.

Also Check: Is There Going To Be Another Stimulus Check In 2022

How Do I Transfer Money From My Card To A Personal Account Without Paying A Fee

To transfer your money to a personal account without a fee, you will need to log into your account at EIPCard.com to initiate a transfer.

- To transfer to a personal bank or credit union account, you will need to provide your routing and account number for your personal account at EIPcard.com.

- To transfer to an existing personal prepaid card, first check if your personal prepaid card accepts transfers by logging into your account or calling your card provider. If it does, provide the routing and account number for your personal prepaid card at EIPCard.com.

Tip: In many cases, peer-to-peer appslike Venmo or Paypalwill accept your Economic Impact Payment Card as a source of funding. Check with the P2P provider for specific instructions on if you can do this for free.

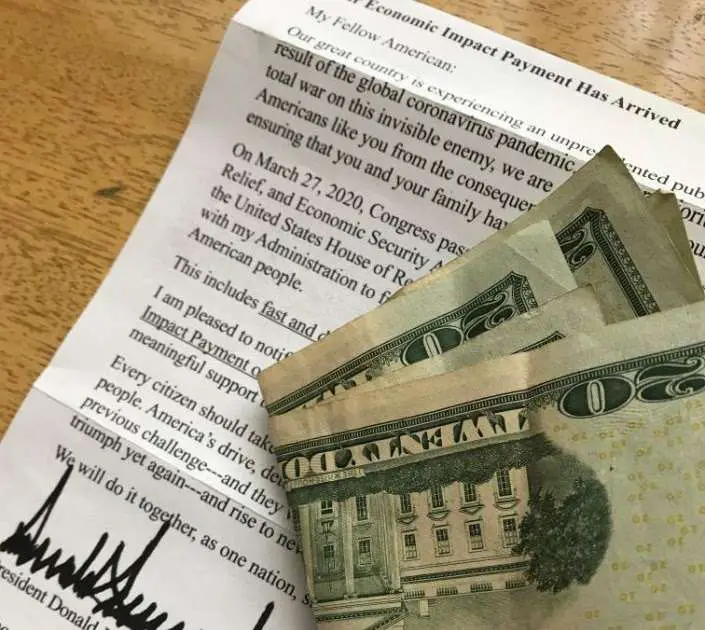

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Recommended Reading: Where’s My Second And Third Stimulus Check

Free File To Stay Open Until November 17

To help people claim these benefits, without charge, Free File will remain open for an extra month this year, until November 17, 2022. Available only at IRS.gov/freefile, Free File enables people whose incomes are $73,000 or less to file a return online for free using brand-name software. Free File is sponsored by the Free File Alliance, a partnership between the IRS and the tax-software industry.

People can also visit ChildTaxCredit.gov to file a 2021 income tax return. Individuals whose incomes are below $12,500 and couples whose incomes are below $25,000 may be able to file a simple tax return to claim the 2021 Recovery Rebate Creditwhich covers any stimulus payment amounts from 2021 they may have missedand the Child Tax Credit. Individuals do not need to have children in order to use Get Your Child Tax Credit to find the right filing solution for them.

I Received An Economic Impact Payment Visa Prepaid Debit Card From The Government In The Mail Is This A Scam

This is not a scam. The government is sending some people Economic Impact Payment Cards if they qualified for a stimulus payment and the IRS couldnt direct deposit the payment.

Your Economic Impact Card will come in a plain envelope from Money Network Cardholder Services along with important information about the card, instructions for activation, fees, and a note from the U.S. Treasury. The card itself will have the words VISA and DEBIT on the front and the issuing bank, MetaBank, N.A., on the back and should look like this:

Read Also: Stimulus Check I Didn’t Get It

What Are The Benefits Of Paying My Taxes On Time

By law, the IRS may assess penalties to taxpayers for both failing to file a tax return and for failing to pay taxes they owe by the deadline.

If you’re not able to pay the tax you owe by your original filing due date, the balance is subject to interest and a monthly late payment penalty. There’s also a penalty for failure to file a tax return, so you should file timely even if you can’t pay your balance in full. It’s always in your best interest to pay in full as soon as you can to minimize the additional charges.

Returning An Economic Impact Payment

COVID Tax Tip 2020-73, June 18, 2020

Millions of eligible individuals have already received their Economic Impact Payment. Some people, including those who received a payment for a deceased individual, may be unsure whether they should return a payment.

Here is additional information about returning an Economic Impact Payment.

Read Also: Will Social Security Get The Fourth Stimulus Check

Also Check: Is There Another Stimulus Check Coming Out Soon

Have All Of Your Personal Information Ready

Once you get through, you will need to verify your identity. Make sure you have all of your relevant documents and personal information at hand, including:

- Your Social Security Number , address and Date of Birth

- Individual Taxpayer Identification Number for taxpayers without a Social Security number

You may also be asked about your tax filing status: single, head of household, married and filing joint tax return, or married filing separate tax return.

Details of your tax return from last year may be required and possibly the one before that if you only filed for one of those years.

Levy Prohibited And The Irss Time To Collect Is Suspended

With certain exceptions, the IRS is generally prohibited from levying and the IRSâs time to collect is suspended or prolonged while an installment agreement is pending. An installment agreement request is often pending until it can be reviewed, and an installment agreement is established, or the request is withdrawn or rejected. If the requested installment agreement is rejected, the running of the collection period is suspended for 30 days. Similarly, if you default on your installment agreement payments and the IRS proposes to terminate the installment agreement, the running of the collection period is suspended for 30 days. Last, if you exercise your right to appeal either an installment agreement rejection or termination, the running of collection period is suspended by the time the appeal is pending to the date the appealed decision becomes final. Refer to Topic No. 160.

With certain exceptions, the IRS is generally prohibited from levying and the IRSâs time to collect is suspended or prolonged while an OIC is pending, for 30 days immediately following rejection of an OIC for the taxpayer to appeal the rejection, and if an appeal is requested within the 30 days, during the period while the rejection is being considered in Appeals. Refer to Topic No. 160 and Topic No. 204.

Recommended Reading: Who Is Eligible For Stimulus Checks 2021

Recovery Rebate Credit: What It Is & How To Claim It In 2022

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The IRS sent out the third round of stimulus payments to eligible taxpayers from March through December of 2021.

If you believe you qualified for the third payment but didn’t receive it, or if you think you received less than you were eligible for, there’s some good news. You might be able to claim the funds via the recovery rebate credit when you file your 2021 tax return.

Irs Phone Number: Customer Service And Human Help Options

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The main IRS phone number is 800-829-1040, but thats not the only IRS number you can call for help or to speak to a live person. Here’s a list of other IRS phone numbers to try so you can reach the people you need.

We’ve also included links to our articles on a number of topics, which might save you a call.

Recommended Reading: When Will We Get 4th Stimulus Check

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

They Have A Lot Of Influence: Ex

The IRS has started sending letters to around nine million households nationwide reminding Americans who have not yet filed their tax returns this year that they could be eligible for $1,400 stimulus checks or even $2,800 checks for married couples.

Americans who havent yet claimed the third installment of stimulus payments that were sent out by virtue of the $1.9 trillion American Rescue Plan can still do so if they file a 2021 tax return.

The benefit would be applied to those who have yet to file their returns that were due this past April.

The plan, one of the first major pieces of legislation passed by the Democrat-controlled Congress and signed into law by President Joe Biden, included rental assistance, tax rebates, vaccine distribution funds, and direct payments to Americans who were struggling due to the coronavirus pandemic.

The federal government under the Trump administration began sending direct checks to Americans in the early days of the coronavirus pandemic, when state governors began mandating lockdowns and business closures to mitigate the spread of the virus.

Households should check their mailboxes for letters from the IRS, according to The Washington Post.

Americans can claim the third stimulus check even if they didnt have an income last year though there are income caps.

Those with an adjusted gross income which is gross income minus certain adjustments of $75,000 or less are eligible to get the full $1,400.

Read Also: Amount Of Third Stimulus Check

How The Treasury Offset Program Works

Here’s how the Treasury Offset Program works:

If you owe more money than the payment you were going to receive, then TOP will send the entire amount to the other government agency. If you owe less, TOP will send the agency the amount you owed, and then send you the remaining balance.

Here’s an example: you were going to receive a $1,500 federal tax refund. But you are delinquent on a student loan and have $1,000 outstanding. TOP will deduct $1,000 from your tax refund and send it to the correct government agency. It will also send you a notice of its action, along with the remaining $500 that was due to you as a tax refund.

The Internal Revenue Service can help you understand more about tax refund offsets.