How To Claim The Recovery Rebate Credit

If you did not receive your first or second stimulus payment, or if it was for the wrong amount, you’ll need to file a tax return for the 2020 tax year . You’ll file Form 1040 or Form 1040-SR . You’ll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. You should have gotten your first Notice 1444 sometime last spring or summer, and you should have gotten your second one in February 2021. You’ll need the amount of the payment in the letter when you file your tax return in 2021.

If you don’t receive your third stimulus payment, or if it was for the wrong amount, you’ll need to file a tax return for the 2021 tax year . You’ll file Form 1040 or Form 1040-SR . You’ll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. You’ll need the amount of the payment in the letter when you file your tax return in 2021.

You can take the Recovery Rebate Credit for any rebate amount that is more than the economic impact payment that you received by completing line 30 of Form 1040 or Form 1040-SR. The instructions for Form 1040 and Form 1040-SR include a worksheet you can use to calculate the amount of the credit you are eligible for.

What Should I Do If I Havent Filed My Return Yet But Want To Claim The Waiver

The IRS issued instructions for those who havent filed a return yet, but want to claim the waiver of $10,200 on unemployment insurance.

For those who havent filed yet, the IRS will provide a worksheet for paper filers and work with software industry to update current tax software so that taxpayers can determine how to report their unemployment income on their 2020 tax return, the IRS said.

The IRS is currently accepting federal returns with the new waiver for those who haven’t filed yet. Depending on your tax company, that function may or may not be available due to software upgrades needed, according to Steber. Jackson Hewitt has made all the changes under the new rule, he added.

Phillips said H& R Block would be ready to implement the changes Friday.

What If I Already Filed My Return And My Refund Was Adjusted

If you are filed your 2020 or 2021 tax return before starting a trace and did not include the payment amount on line 16 or 19 of the Recovery Rebate Credit Worksheet, you may receive a notice saying your Recovery Rebate Credit was adjusted.

After the trace has been completed and it is determined your payment has not been cashed, an adjustment will be made and a check sent to the taxpayer. You will not need to take any additional action to receive the credit.

Read Also: Update On 4th Stimulus Check For Ssi

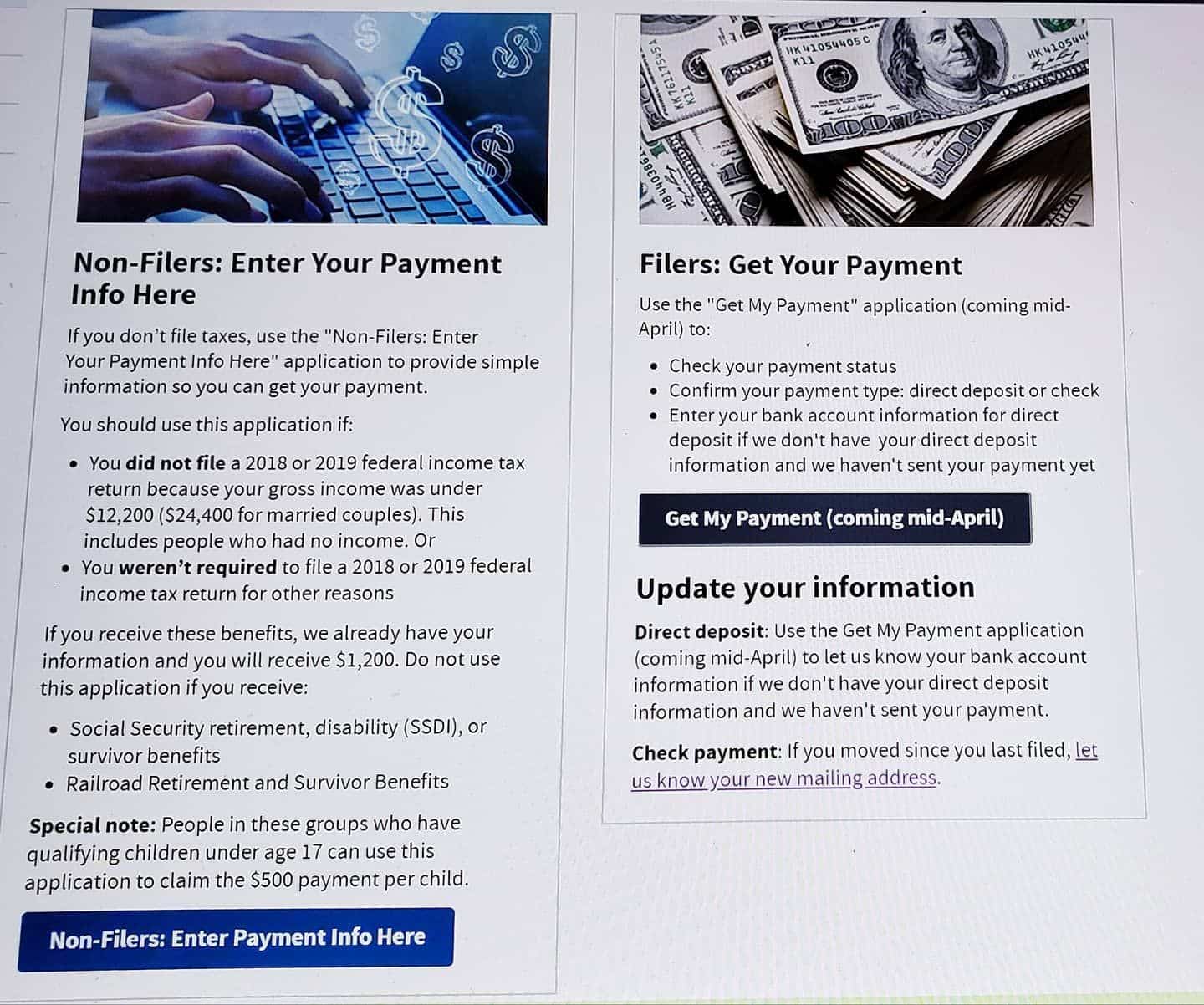

You Can Still Claim $1400 Stimulus Checks And Child Tax Credits For Free

You can still claim $1,400 stimulus checks and child tax credits for free. This is to all United States residents, that means you North Carolina. So, keep reading if you want to find out how you can score this deal before its too late.

How To Get Your Claim

The stimulus payments we received were much needed and appreciated. I know for me, it helped a lot with bills that were piling up. But many people are unaware that money is still out there for them to claim. Nearly 10 million eligible individuals havent yet received Stimulus payments or 2021 child tax credits. This funds are still available and just waiting to be claimed. To determine if you qualify for stimulus payments, child tax credits, or earned income tax credits, you can still file a 2021 tax return.

So how do you know if you can still get a stimulus check?

At ChildTaxCredit.gov, you can file a simple tax return if you think youre eligible for a COVID stimulus payment or the 2021 child tax credit. Time is of the essence if you think this applies to you. The simplified return deadline for this year is November 15. In the event you missed the April 18 filing deadline, youll need to file a tax return on ChildTaxCredit.gov by October 17, in order to find out if you qualify for a stimulus payment or child tax credit. However, according to the IRS you can still file your 2021 tax return, and claim the Child Tax Credit for the 2021 tax year, at any point until April 15, 2025. So there is a bit of time there.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Recommended Reading: Free File Taxes For Stimulus

Irs: If You Didnt Get The Third Stimulus Check Heres What You Should Do

If you didnt get the third stimulus check, heres what you should do

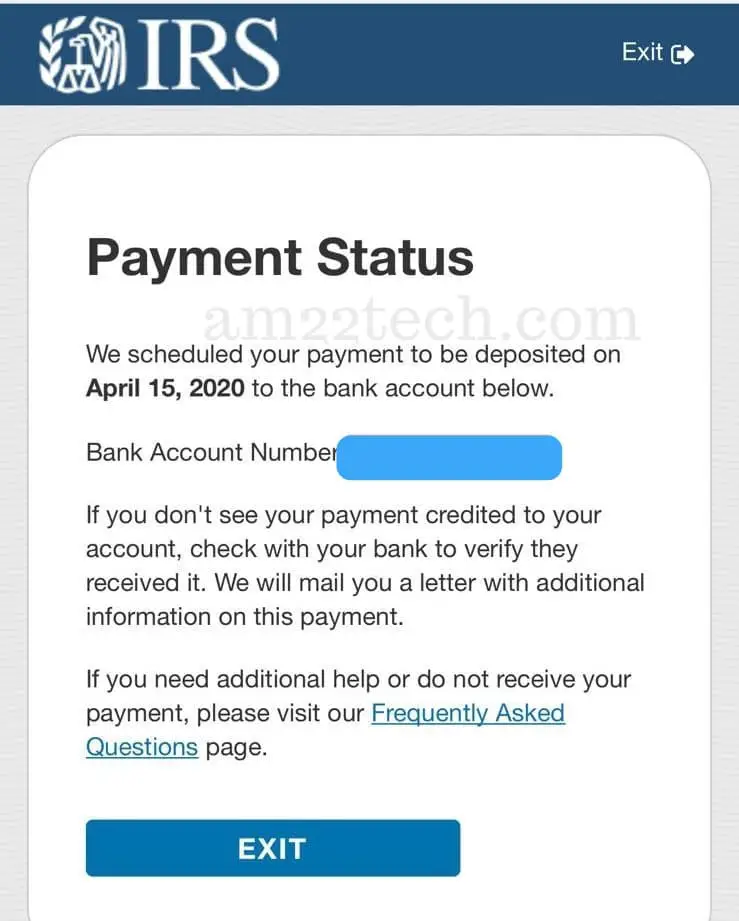

The last 2021 stimulus payment has been issued, the Internal Revenue Service said Wednesday, but if you did not get yours, you are not out of luck yet.

According to the IRS, if you did not get a stimulus check but are eligible for one, you must use the recovery rebate credit on your 2021 income tax return to claim the $1,400-per-person economic impact payment.

The agency also reminds parents that if you had a child born in 2021 and that child did not receive a payment, you can also claim the payment via the recovery rebate.

If you are unsure about your payments, look for a Letter 6475 from the IRS that shows that you either had a payment sent to you, or that you are entitled to and can claim the recovery rebate credit on your 2021 tax return.

According to the agency, Families and individuals in the following circumstances, among others, may not have received the full amount of their third-round Economic Impact Payment because their circumstances in 2021 were different than they were in 2020.

These families and individuals may be eligible to receive more money by claiming the 2021 Recovery Rebate Credit on their 2021 income tax return.

Individuals must claim the 2021 recovery rebate credit on their 2021 income tax return to get this payment, the IRS pointed out, because the agency will not automatically calculate the 2021 recovery rebate credit.

©2022 Cox Media Group

Do I Still Have A Shot At Qualifying For A Check If I File Now

The situation is still very fluid.

If you didnt qualify for the third round of stimulus checks based on 2019, but you do qualify based on 2020, the next best step is to file your 2020 taxes as soon as possible, tax experts say.

If the IRS processes it in time, theyll use the most recent year to qualify taxpayers for the third round of economic stimulus payments, says Meredith Tucker, tax principal at Kaufman Rossin, one of the largest CPA and advisory firms in the U.S. But, if you are passed over for round three because your 2020 tax return hasnt been submitted or processed in time, then you should be able to claim a credit on your 2021 taxes.

Filing a tax return early is always a best practice and proven this year with the stimulus checks to those who have already filed, says Steber. As to filing now and still getting a check, the IRS has not detailed timing and impact, but it is certainly possible, especially if your tax situation changed from 2019 to 2020.

You May Like: Is 2021 Stimulus Check Taxable

What Is A Recovery Rebate Credit

The IRS has lots of different rules, regulations and terms that make things confusing for filers, but pay no attention to the man behind the curtain: The Recovery Rebate Credit is simply just another name for your stimulus check. And if you were one of the lucky Americans who received two EIPs with no problems, you technically just received an advance of that Recovery Rebate Credit.

Americans can claim that credit by filling out a new, special section on their 2020 Form 1040 or 1040-SR if theyre a senior. That also goes for taxpayers who normally dont have to file a tax return, according to the IRS.

But rest assured: Receiving a stimulus check wont come back to bite you. The IRS says that the credit will only increase the amount you receive as a tax refund or decrease the amount you owe, rather than subtract from the refund youre entitled to. Your stimulus check also isnt considered taxable income.

Recommended Reading: How Do I Get The Second Stimulus Check

What If I Donated To A Food Bank Or Another Charity During The Pandemic

Food banks and others found themselves in need of contributions as the country dealt with skyrocketing unemployment. Many of us heard the call and wrote out checks that can now be used as a tax deduction.

See Line 10-b on the 1040 return for 2020 to take an above-the-line deduction for charitable contributions. Cash donations of up to $300 made to qualifying organizations before Dec. 31, 2020, are now deductible when you file your tax return, thanks to a special provision enacted earlier last year.

Susan Tompor

Follow Susan on Twitter @tompor.

You May Like: Recovery Rebate Credit Second Stimulus

If You Are A Head Of Household And Not Married How Does Your Stimulus Payment Change

Single taxpayers with adjusted gross income of $75,000 or below will qualify for a full $1,400 economic impact payment. From here, it begins to phase out for those making above $80,000. It would be $2,800 for a married couple filing jointly, plus an additional $1,400 for each dependent child. Married couples with incomes up to $150,000 will get the full payment and will phase out for those earning above $160,000.

A Head of Household taxpayer isnt eligible if their income is $120,000 or greater, although there is a phase-out between $112,500 and $120,000. Otherwise, a Head of Household will receive a $1,400 stimulus payment for themselves and each qualifying dependent with a Social Security Number, regardless of age, according to Steber.

When Will Those $1400 Stimulus Checks Go Out

Lets not get ahead of ourselves right now, Bidens proposal is merely that. For those $1,400 payments to get the green light, lawmakers will have to approve Bidens bill. However, now that Democrats have a majority in the Senate, thats more likely to happen, and once it does, Americans could see their additional stimulus cash within weeks.

As was the case with the last round of $600 checks, those with direct deposit details on file with the IRS will get their money the soonest. Those who didnt register bank account details will have to wait for either a paper check or debit card to arrive in the mail with their stimulus funds.

Biden has made a point of stating that he wants to send out additional aid to the public within his first 100 days of office. As such, theres reason to believe hell be pushing for an early vote on his proposal to get that stimulus round out as quickly as possible.

Also Check: Do I Have To Claim Stimulus Check On 2021 Taxes

Read Also: When Did The First Stimulus Check Come Out

What People Should Do If Their Third

COVID Tax Tip 2022-55, April 11, 2022

In 2021, the IRS issued more than 175 million third-round Economic Impact Payments, totaling over $400 billion. Most eligible people already received the full amount of their credit in advance and don’t need to include any information about this payment when they file their 2021 tax return.

As required by law, the IRS is no longer issuing third-round Economic Impact Payments. People who are missing a stimulus payment or received less than the full amount may be eligible to claim a recovery rebate credit on their 2021 federal tax return.

To claim a recovery rebate credit, individuals need the amount of their third-round Economic Impact Payment.

I Received A Second Payment But My Spouse Didn’t

There have been cases where a couple submit their tax returns as “married filing jointly,” and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRS’s part. Unfortunately, the spouse who didn’t receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Read Also: Social Security Disability Stimulus Check 2022

How Do I File My Taxes If I Didn’t Receive A Notice 1444

… I received one of the stimulus checks in 2020 and one in 2021, do I report both in 2020 taxes or on the years received?

Brittany Benson, senior tax research analyst, The Tax Institute at H& R Block, said even if you dont receive, or didn’t keep a Notice 1444 for a stimulus payment, you should still enter the amount you received in advance payments to accurately calculate your recovery rebate credit. You can use an IRS online account and go to the “tax records” tab to see the amount of EIPs received.

The IRS suggests that you can check your IRS account online for the stimulus amount received, if you misplaced Form 1444 or Form 1444-B.

The IRS only began mailing out Form 1444-B for the second stimulus payments the first week of February. So there’s a shot that form will show up in the mail soon. Don’t throw it out.

Susan Tompor

Follow Susan on Twitter @tompor.

Is The Child Tax Credit Expanded

Yes, the American Rescue Plan includes a temporary increase for the child tax credit for 2021.

The credit is worth $2,000 per child under 17 that can be claimed as a dependent.

It temporarily boosts the credit to $3,000 per child, or $3,600 per child under 6. It allows 17-year-old children to qualify for the first time.

The credit will begin to phase out for those earning more than $75,000 a year, or $150,000 for those married filing jointly. The IRS will look to prior-year tax returns to determine who qualifies for the higher credit. If a return for 2020 hasnt been filed yet, the agency will look to 2019 returns.

Families who aren’t eligible for the higher child credit may still be able to claim $2,000 credit per child.

If you have more tax questions you can submit them here and read earlier answers below.

Don’t Miss: What Does The Stimulus Debit Card Look Like

Your Payment Hasnt Been Sent Out Yet

The third round of stimulus checks is being sent out in batches, and as with other rounds of stimulus payments, payments made via direct deposit to bank accounts on file with the IRS are prioritized. That said, the IRS has also been mailing out paper checks and debit cards with each batch of direct deposit payments, and it will continue to mail them out in the coming weeks.

If your bank account information was not on file with the IRS, chances are good that youre going to have to wait slightly longer to receive a paper check or prepaid debit card, which will have to be processed through USPS before it hits your mailbox. This can add significant delays to the time it takes to receive your payment.

You May Like: Is There A Second Stimulus Check

My Stimulus Payment Was Too High

Some individuals whose income increased too much in 2019 were not eligible for a full stimulus payment, but they got one anyway since the IRS based the payment on their 2018 taxes. Those individuals will not have to pay back the payment.

In other cases, families were paid an extra $500 or $600 for children who were 17 or older . This could happen if the IRS took the number of children who qualified for the child tax credit in 2018 without updating children’s ages for 2019. But in other cases, it looks like the IRS took the number of dependents from a family’s 2018 tax return, without regard to their age. The IRS has said that those who received such overpayments will not have to pay them back.

Also Check: When Was The Second Stimulus Check Sent Out

Will I Owe Taxes On Stimulus Checks

No, stimulus checks aren’t considered income by the IRS. They are prepaid tax credits for your 2020 tax return, authorized by two relief bills passed last year that aimed at stabilizing the struggling U.S. economy in the wake of the pandemic. Because the stimulus payments arent considered income by the tax agency, it wont impact your refund by increasing your adjusted gross income or putting you in a higher tax bracket, for instance.

When it comes to getting paperwork ready, you’ll want to dig up the IRS Notice 1444 for the stimulus payment amount you were issued in 2020. And the second round of payments would be outlined in Notice 1444-B.

Jessica Menton and Aimee Picchi

Follow Jessica on Twitter @JessicaMenton and Aimee @aimeepicchi

Stimulus Checks 202: Your State Could Still Owe You Hundreds Of Dollars

Numerous states are issuing special one-time tax rebates.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Millions of South Carolinians are expected to receive a one-time income tax rebate of up to $700. Payments started going out via at the start of November and will continue through the end of the year, according to the state Department of Revenue.But South Carolina is hardly the only state giving taxpayers a reason to rush to the mailbox: Massachusetts began refunding $3 billion in surplus tax revenue to residents this month and Illinois is still issuing $50 and $100 income tax rebates.

Is your state sending out tax refund checks this month? See if you qualify below, and find out how much money you could be getting. For more on taxes, see if you qualify for additional stimulus or child tax credit money.

Recommended Reading: How.many Stimulus Checks In 2021