I’m Eligible For A 2020 Recovery Rebate Credit But Did Not Claim It On My 2020 Tax Return Do I Need To Amend My 2020 Tax Return

Yes. Those who didn’t claim the credit on their 2020 tax return by entering an amount on line 30 of Form 1040 or Form 1040-SR, will need to file a Form 1040-X, Amended U.S. Individual Income Tax Return. The IRS will not calculate the 2020 Recovery Rebate Credit if the taxpayer did not enter any amount on their original 2020 tax return.

Those who need to file an amended return to claim the Recovery Rebate Credit should use the worksheet on page 59 of the 2020 instructions for Form 1040 and 1040-SR to determine the amount of the credit. Enter the amount on the Refundable Credits section of the 1040-X and include “Recovery Rebate Credit” in the Explanation of Changes section.

Those who filed their 2020 return electronically and need to file an amended return may be able to file Form 1040-X electronically.

Taxpayers who did not file their 2020 return electronically will need to submit a paper version of the Form 1040-X and should follow the instructions for preparing and mailing the paper form.

Those filing Form 1040-X electronically or on paper can use the Where’s My Amended Return? online tool to check the status of their amended return.

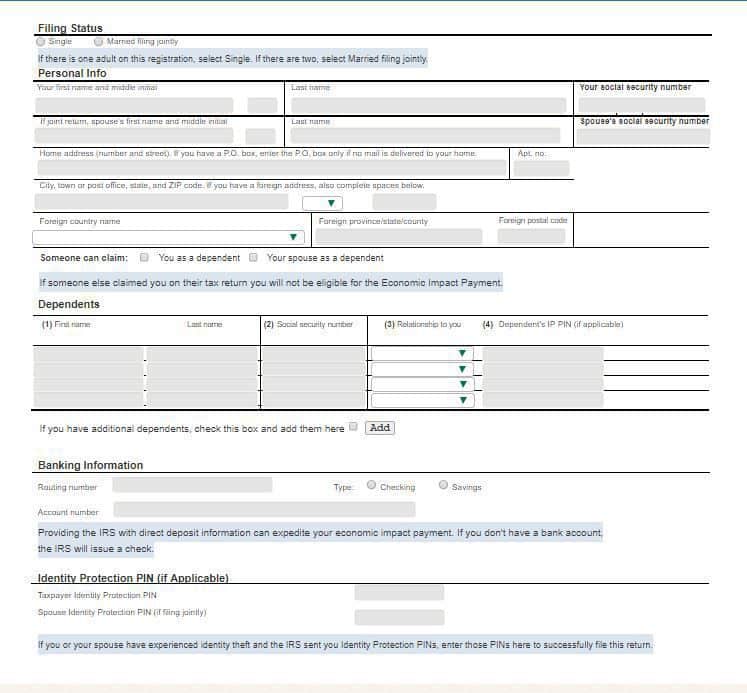

How To Use Online Form For Non

The simple steps for those who dont normally file a tax return are :

- Visit IRS.gov, and look for Non-Filers: Enter Payment Info Here.

The IRS will use the information submitted in the online form to confirm eligibility and calculate and send an Economic Impact Payment. Entering bank or financial account information will allow the IRS to deposit your payment directly in your account. Otherwise, your payment will be sent by postal mail to you.

IRS has clearly stated that the online information tool should not be used e if:

How Your Return Can Help With A $1400 Stimulus Check

Since March, the government has been deploying new batches of stimulus checks weekly.

Each of those rounds has included payments to people that were prompted by the IRS processing their 2020 tax returns.

That goes for people who do not typically file tax returns, but did so this year in order to get their $1,400 checks. Once those forms were processed, the IRS sent their payments.

In addition, people who already received their third stimulus check, and who are due more money after the IRS completed their latest return, received “plus-up” payments from the agency.

That could happen if their financial circumstances changed since their 2019 return, such as their income declining last year.

Not everyone needs to file a federal return in order to get their stimulus checks. If you receive federal benefits and do not typically file, you should get your payment automatically. However, you may want to file a return in order to submit information on eligible dependents.

In addition, if you used the IRS online non-filer tool last year, you should not have to resubmit your information.

The non-filer tool has not been reopened this year. Instead, the IRS has urged people who it does not already have on record to file tax returns, which can help the agency evaluate whether or not you may be eligible for other tax credits.

Read Also: How To Check For Stimulus Checks

Do You Need To Do Anything To Get Your Coronavirus Stimulus Check

The IRS has created an Economic Impact Payment page where you can enter information if you need to. You will need to visit this page and complete a form to get your stimulus payment if any of the following are true:

- You did not file a 2018 or 2019 tax return and are not receiving any Social Security benefits, including SSI, SSDI, survivor benefits, or retirement benefits.

- You did not file a 2018 or 2019 return and you aren’t receiving railroad retirement benefits.

- You did not file a 2018 or 2019 return and you just started your Social Security or railroad retirement benefits in 2020.

- You did not file a 2018 or 2019 return, you are receiving Social Security or railroad retirement benefits, and you have a dependent.

In the first three situations, you need the form to provide the IRS with details on your income to show eligibility. In the last case, you may get a stimulus check if you don’t update the IRS, but you will not get the extra $500 available per dependent unless you fill out the form to tell them.

You can also visit the Economic Impact Page to enter your bank details if the IRS does not have them on file, or to update your mailing address or bank information so your check goes to the correct place.

Who Is Eligible For The Economic Impact Payment

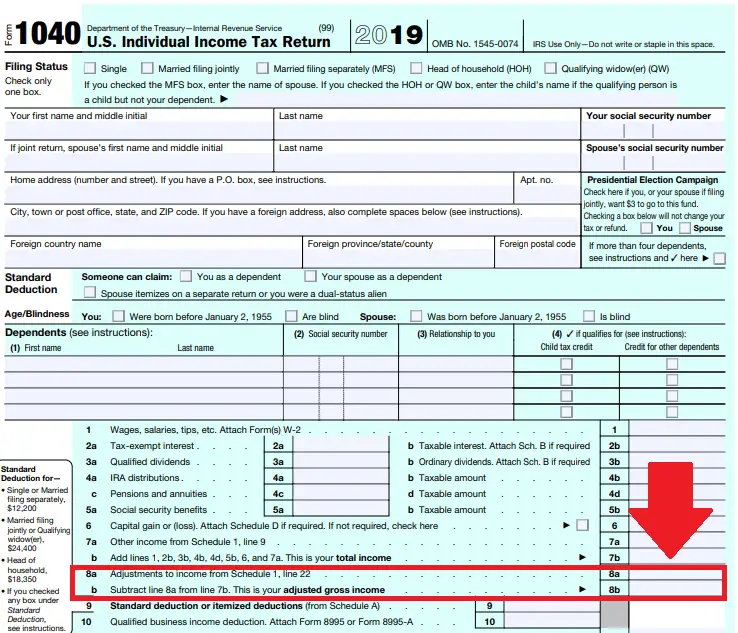

Tax filers with adjusted gross income up to $75,000 for individuals and up to $150,000 for married couples filing joint returns will receive the full payment. For filers with income above those amounts, the payment amount is reduced by $5 for each $100 above the $75,000/$150,000 thresholds. Single filers with income exceeding $99,000 and $198,000 for joint filers with no children are not eligible. Social Security recipients and railroad retirees who are otherwise not required to file a tax return are also eligible and will not be required to file a return.

Eligible taxpayers who filed tax returns for either 2019 or 2018 will automatically receive an economic impact payment of up to $1,200 for individuals or $2,400 for married couples and up to $500 for each qualifying child.

You May Like: How Much Was The Stimulus Payments In 2021

Penalty Relief For Certain 2019 And 2020 Returns

To help struggling taxpayers affected by the COVID-19 pandemic, the IRS issued Notice 2022-36PDF, which provides penalty relief to most people and businesses who file certain 2019 or 2020 returns late. The IRS is also taking an additional step to help those who paid these penalties already. To qualify for this relief, eligible tax returns must be filed on or before September 30, 2022. See this IRS news release for more information on this relief.

What Is The Recovery Rebate Credit

When the IRS started to send out stimulus checks, the preliminary amount of the stimulus check was based on your 2018 or 2019 Adjusted Gross Income . The final amount of your Economic Impact Payment will be based on your 2020 Adjusted Gross Income.

The Recovery Rebate Credit will act as a one-time refundable tax credit for those who have not received their Economic Impact Payment, or for those whose circumstances have changed and could be eligible to claim a higher amount now that the 2020 circumstances are known.

Also Check: When Was The Third Stimulus Check Sent Out In 2021

Stimulus Payment Guidance For Internationals

STIMULUS PAYMENT ELIGIBILITY To be eligible for a stimulus payment, you must be a “U.S. person” there are also other eligibility issues regarding level of income, etc. Nonresident aliens are not eligible for stimulus payments. For more information on Economic Impact Payment eligibility, please see .

HOW TO DETERMINE U.S. TAX RESIDENCY An individual who is not a U.S. Citizen or Lawful Permanent Resident, , must take the substantial presence test each year to determine whether he or she is a resident alien for tax purposes or a nonresident alien for tax purposes. If you “pass” the substantial presence test, you are a resident alien for tax purposes. If you “do not pass” the substantial presence test, you are a nonresident alien for tax purposes. There is more information about how to determine U.S. tax residency at this link: .

INCOME TAX FILING REQUIREMENTS The federal income tax return filed by a U.S. person is Form 1040 the federal income tax return filed by a nonresident alien is either Form 1040-NR or Form 1040-NR-EZ. If a nonresident alien incorrectly filed Form 1040, thus presenting himself or herself to the IRS as a U.S. person, the IRS may send the nonresident alien an economic stimulus payment in error.

My Stimulus Payment Was Too High

Some individuals whose income increased too much in 2019 were not eligible for a full stimulus payment, but they got one anyway since the IRS based the payment on their 2018 taxes. Those individuals will not have to pay back the payment.

In other cases, families were paid an extra $500 or $600 for children who were 17 or older . This could happen if the IRS took the number of children who qualified for the child tax credit in 2018 without updating children’s ages for 2019. But in other cases, it looks like the IRS took the number of dependents from a family’s 2018 tax return, without regard to their age. The IRS has said that those who received such overpayments will not have to pay them back.

You May Like: Never Received 3rd Stimulus Check

Need Funds To Help Manage During The Covid

To help people cope with the impact of the coronavirus pandemic, the federal government is providing stimulus checks. These are worth up to $1,200 for individuals and $2,400 for couples. And if you have eligible dependent children, you’ll get an additional $500 per qualifying child.

The amounts described above are the maximum you’ll receive, and you need to make under $75,000 as a single person or $150,000 as a married joint filer to get that amount. If your income exceeds these limits, the amount of your payment drops by $5 for each $100 in additional earned income.

The IRS needs to know your income information and how many dependents you have in order to get your money to you. Most people don’t have to do anything to provide these details because the IRS can get them from 2018 or 2019 tax returns.

But for some people, more information is needed. If you’re one of them, you can fill out a simple form on the IRS website. You can find out below if you need to complete that form.

Image source: Getty Images.

State Stimulus Payments 202: Is Your State Mailing Out A Check This Week

Numerous states are issuing tax rebates and stimulus payments in September.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Hawaiians should start seeing direct deposits of a one-time tax refund on Friday, according to Gov. David Ige. Close to $300 million is being returned to taxpayers, Ige told KHON. Those who earned less than $100,000 will get $300, while residents making more than $100,000 will receive $100.A qualifying family of four could receive $1,200.

The Aloha State isn’t the only one giving money back to taxpayers this month: In Illinois, residents will start receiving tax rebate checks worth up to $400 next week. And in Colorado, refund checks for $750 — or $1,500 for joint filers — have been trickling into mailboxes since August, thanks to the Taxpayer’s Bill of Rights Amendment, and should be done by the end of this month.

Which other states are issuing payments? How much can eligible taxpayers get? When will the money arrive? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

Recommended Reading: When Will South Carolina Receive Stimulus Checks

Should I Keep Letter 6475 After I File My Taxes

You should always save tax return-related documents, says , chief tax information officer at Jackson Hewitt: W-2s, interest statements and IRS letters are a good record of your account “in case anything comes along in the next two or three years,” he says.

The IRS also advises keeping all documents related to income, deductions, credits and other tax items for at least three years.

Where To Mail Form 3911

Once you complete the IRS Form 3911, you need to mail it to the right place.

Usually, the IRS includes an envelope with the correct return address for the taxpayer to use for sending the completed Form 3911. So if you have a self-addressed envelope, you can send Form 3911 in this envelope to the specified contact address. Or, you can send it to the same place you send your tax return.

You May Like: Irs Stimulus Check Sign Up

Finding The Amounts Of Your First Second And Third Stimulus Checks

To find the amount of stimulus payment youve received, you can:

- Refer to the IRS notices that were mailed to you. IRS Notice 1444shows how much you received from the first stimulus check. IRS Notice 1444-B shows how much you received from the second stimulus check. IRS Notice 1444-C shows how much you received from the third stimulus check.

- Check your bank statements. If you had your payments direct deposited, you can find the amount of your first, second, and third stimulus check using your bank statements. They should be labeled as IRS TREAS 310 and have a code of either TAXEIP1 , TAXEIP2 , or TAXEIP3 .

- Request an account transcript. You can request an account transcript sent electronically or by mail using Get Transcript. You can also call the IRS automated phone transcript service at 800-908-9946 or mail in Form 4506-T to have your transcript be sent by mail.

- Create an account on IRS.gov/account. You can view your stimulus check amounts under the Tax Records tab. If you filed jointly with your spouse, you will only see your half of the stimulus check amounts. Your spouse will need to sign into their own account to see the other half of the stimulus check amounts.

To create an account, you will need:

What Is The Foreign Tax Credit

The foreign tax credit is a non-refundable credit that will reduce your US tax liability dollar-for-dollar for taxes you paid to a foreign country. Simply put, if you paid taxes to a foreign country, you can claim these foreign taxes as a credit against your US taxes. If you paid more taxes to a foreign country, than usually you will owe no US tax on that income.

Read Also: What’s Happening With The Stimulus Checks

I Received An Irs Letter Saying There Was An Issue With My Recovery Rebate Credit What Do I Need To Do

The notice saying the IRS changed the amount of a 2020 Recovery Rebate Credit will also explain the reason for the change. Review the 2020 tax return, the 2020 Recovery Rebate Credit requirements and the worksheet in the Form 1040 and Form 1040-SR instructions. The 2020 Recovery Rebate Credit questions and answers provide additional guidance for specific situations addressed in related IRS notices.

What If I Reported My Stimulus Money Incorrectly

If you’ve already filed your 2021 tax return and realized that you reported the wrong information for your stimulus check payments, do not file an amended return. The IRS says that it will correct any mistakes and send you a notification indicating the changes it has made to your return.

Even though you won’t need to file an amended return, making a mistake when reporting stimulus money will definitely delay the processing of your return and any potential tax refund. As mentioned above, stimulus payment errors were one of the biggest reasons for IRS delays last year.

If, however, you filed your 2021 tax return and reported $0 for your recovery rebate credit and you do want to claim more stimulus money, you will need to file an amended return, using IRS Form 1040 X

Also Check: Stimulus Check 2022 Who Qualifies

Why Did I Receive Irs Letter 6475

According to the IRS, Economic Impact Payment letters include important information that can help you quickly and accurately file your tax return, including the total amount sent in your third stimulus payment.

This could include “plus-up” payments, the additional funds the IRS sent to people who were eligible for a larger amount based on their 2019 or 2020 tax returns, or information received from the Social Security Administration, Department of Veterans Affairs or the Railroad Retirement Board.

Even though it is not taxable income, you still need to report any stimulus money on your IRS return. In 2020, the IRS received over 10 million returns that incorrectly reported stimulus money, according to IRS Commissioner Charles P. Retting, resulting in manual reviews and significant refund delays.

You may have already received a Letter 1444-C, which showed the amount you were paid and how it was delivered, but that’s not what you want to use to prepare your 2021 return.

When Will I Get The Recovery Rebate Credit

You will most likely get the Recovery Rebate Credit as part of your tax refunds. If you electronically file your tax return, you will likely receive your refund within 3 weeks. If you mail your return, it can take at least 8 weeks to receive your refund.

Claiming the Recovery Rebate Credit will not delay your tax refund. However, if you dont claim the correct amount of the Recovery Rebate Credit, your refund may be delayed while the IRS corrects the error on your return. The IRS will send you a notice of any changes made to your return.

You can check on the status of your refund using the IRS Check My Refund Status tool.

Don’t Miss: How Can I Apply For Stimulus Check