Biden Says People Are Still Hurting Over Inflation

Despite the somewhat good news that inflation has gone slightly down, Joe Biden believes we are seeing the first positive signs.

“We’re seeing some signs that inflation may be beginning to moderate,” Biden said. “People were still hurting, but zero inflation last month.

“Now I want to be clear, with the global challenges we face, from the war in Europe to disruption of supply chains and pandemic shutdowns in Asia, we could face additional headwinds in the months ahead. Our work is far from over.”

Maine: $850 Direct Relief Payments

Gov. Janet Mills signed a supplemental budget on April 20 to authorize direct relief payments of $850 for Maine taxpayers.

Full-time residents with a federal adjusted gross income of less than $100,000 are eligible. Couples filing jointly will receive one relief check per taxpayer for a total of $1,700.

Taxpayers are eligible for the payment regardless of whether they owe income tax to the state.

Residents who did not file a state tax return for 2021 can file through Oct. 31 to claim their payment.

The one-time payments, which are being funded by the states surplus, started rolling out via mail in June to the address on your 2021 Maine tax return.

The supplemental budget also includes an increased benefit for Maines earned income tax credit recipients.

Read more: Everything You Need To Know About Maine Stimulus Checks

Is Congress Talking About A Fourth Stimulus Check

There are no signs that lawmakers in Washington, D.C. are in serious discussions about a fourth direct payment stimulus check. While there have been calls by the public and from some lawmakers for recurring payments, there has been practically nothing in terms of action.

Emails and phone calls to the White House, Sen. Bernie Sanders, I-Vt., who is chair of the Senate Budget Committee, and Rep. John Yarmuth, D-Ky., chair of the House Budget Committee, asking if such payments are under discussion were not returned.

One pandemic-related stimulus that is being considered for an extension is the monthly advance child tax credit. It raised the previous tax credit from $2,000 at tax time to $3,000-$3,600 with the option of monthly payments. A one-year extension is part of the Build Back Better bill that passed the House. But Sen. Joe Manchin, D-W.V., announced Sunday he would not vote for it. With no Republicans on board, passage of the bill is doomed unless an alternative is found.

A group of Democrats sent a letter to Biden in back in May , but the letter did not get into specifics and nothing else came of it.

A change.org petition started by Denver restaurant owner Stephanie Bonin in 2020 called on Congress to pass regular checks of $2,000 for adults and $1,000 for kids for the duration of the pandemic crisis.

As of late December, the petition has reached nearly 3 million signatures.

You May Like: Telephone Number For Stimulus Check

Fourth Stimulus Check Update

Biden’s American Rescue Plan Act, which created the third stimulus checks, did boost tax credits for most parents with children under 18, but only for the year 2021. Most parents and legal guardians will receive a tax credit of $3,600 for children under six, and $3,000 per child aged six through 17.

Half of that credit is coming in the form of monthly advance payments to parents beginning July 15 $300 per month for younger kids, and $250 for older ones. That’s similar to the monthly recurring checks that some legislators have called for.

The same law also retroactively exempted a large chunk of unemployment benefits paid out in 2020 from federal income tax. People who collected unemployment in 2020 and paid tax on it are getting thousands of dollars in tax-refund checks.

The American Rescue Plan Act also offers tax credits that cover all or most of the cost of a “Silver” health-insurance plan for six months under the Affordable Care Act, aka Obamacare. You’re eligible for this if you filed for unemployment benefits at any time in 2021, and if you don’t currently get health insurance through Medicare, Medicaid or someone else’s health plan.

Biden’s American Families Plan, which is separate from the American Jobs Plan, will seek to extend those tax credits, including the advance payments, through the end of 2025.

The American Families Plan would also mandate up to 12 weeks of paid parental leave and subsidies for childcare.

Massachusetts: Up To 7% Of Income May Be Returned

Massachusetts taxpayers will receive rebate checksbut how much theyll receive wont be officially announced until September 20. Massachusetts Governor Charlie Baker will use a 1986 law to return $3 billion to state taxpayers.

The state auditors office declared the state surplus to be some $2.3 billion. And under Chapter 62Fthe 1986-era law, tax rebates are allowed when theres a revenue surplus.

Residents are expected to receive about 7% of the amount of income tax they paid to Massachusetts in 2021. For someone with a $75,000 income, that would mean a rebate of about $250, state officials told WBUR.

You May Like: How Can I Apply For Stimulus Check

How Have Americans Spent Their Stimulus Checks

There have been threecount themthree wide-reaching stimulus checks from the government since the pandemic hit. And now that a good chunk of time has gone by since they dished out the first one, were starting to see how people spent that money. Our State of Personal Finance study found that of those who got a stimulus check:

- 41% used it to pay for necessities like food and bills

- 38% saved the money

- 11% spent it on things not considered necessities

- 5% invested the money

And on top of that, heres some good news: Data from the Census Bureau shows that food shortages went down by 40% and financial instability shrank by 45% after the last two stimulus checks.25 Thats a big deal. But the question here isif people are in a better spot now, will they be more likely to manage their money to make sure things stay that way?

Second $600 Stimulus Check Details

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

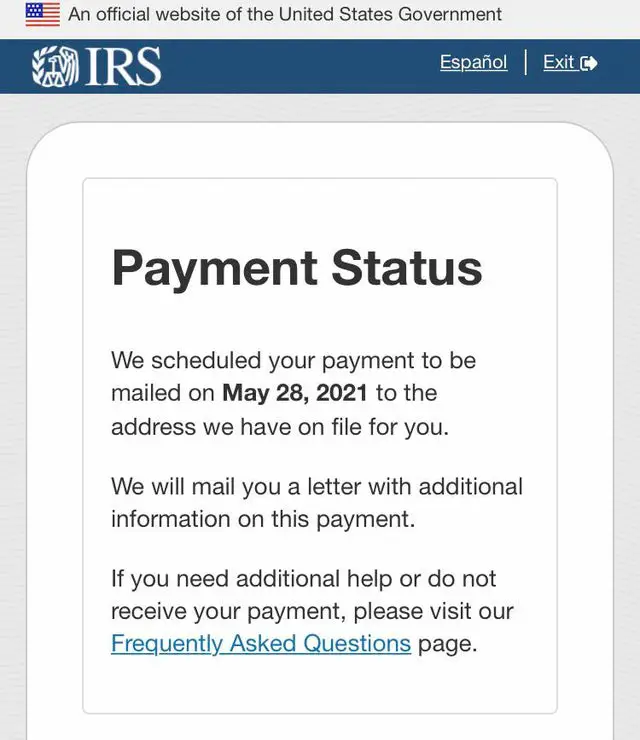

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers like Turbo Tax and Tax Act have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

Read Also: When Was The Third Stimulus Check Sent Out In 2021

State Stimulus Payments 202: Is Your State Mailing Out A Check This Week

Numerous states are issuing tax rebates and stimulus payments in September.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

Hawaiians should start seeing direct deposits of a one-time tax refund on Friday, according to Gov. David Ige. Close to $300 million is being returned to taxpayers, Ige told KHON. Those who earned less than $100,000 will get $300, while residents making more than $100,000 will receive $100.A qualifying family of four could receive $1,200.

The Aloha State isn’t the only one giving money back to taxpayers this month: In Illinois, residents will start receiving tax rebate checks worth up to $400 next week. And in Colorado, refund checks for $750 — or $1,500 for joint filers — have been trickling into mailboxes since August, thanks to the Taxpayer’s Bill of Rights Amendment, and should be done by the end of this month.

Which other states are issuing payments? How much can eligible taxpayers get? When will the money arrive? Read on to find out.

For more on economic relief, check out plans for statewide child tax credits, as well as gas rebate checks and gas tax holidays across the US.

How Likely Is A Fourth Stimulus Check

Don’t hold your breath, according to Wall Street analysts.

For one, the Biden administration has focused on infrastructure spending to spark economic growth, betting that an investment in roads, trains and other direct investments will help get people back to work and spur the ongoing recovery.

Secondly, economists have pointed fingers at relief efforts such as the three rounds of stimulus checks for contributing to inflation. Because Americans had cash in their pockets, they boosted spending on goods such as furniture, cars and electronics. Combine that with the supply-chain crunch, and the result was sharply higher inflation, according to economists.

Without new stimulus efforts on the horizon, it’s likely that inflation could moderate in 2022, according to Brad McMillan, the chief investment officer at Commonwealth Financial Network. “One cause of inflation has been an explosion of demand driven by federal stimulus,” he noted in a December report. “But that stimulus has now ended.”

He added, “Yes, we will continue to face inflation and supply problems, but they are moderating and will keep doing so.”

Don’t Miss: Irs Sign Up For Stimulus

When Should I Get My Payment

The IRS was given hard and fast deadlines to send the two rounds of Economic Impact Payments out to American families. The first round of payments had to be sent out by December 31, 2020. The second round had to be sent out by January 15, 2021.

What this means: If you have not received the first or second round of payments yet, then you will not be getting them in advance. The good news is that you can still do something to get these payments. Read below.

Fourth Stimulus Check Update: Millions Of Americans Could Receive Payment

A trio of Democratic lawmakers proposed a bill last week that would introduce a new national stimulus payment aimed at offsetting the escalated price of gasoline. Should the bill pass, millions of Americans would be eligible for stimulus checks in any month where the national average gas prices exceed $4 per gallon.

Representatives Mike Thompson of California, John Larson of Connecticut and Lauren Underwood of Illinois introduced the bill on March 17. The Gas Rebate Act of 2022 would send eligible Americans an energy rebate of $100, as well as another $100 for each dependent.

The new stimulus measure is designed to ease the impact on American families, who have already been hit by the steepest rise in inflation in decades. Gas prices have also been escalating rapidly, and Russia’s invasion of Ukraine contributed to prices hitting record highs earlier this month.

According to AAA, the current national gas average as of Thursday is $4.236. The national gas average topped $4 on March 6 for the first time in a decade. The company also said that the previous record high was $4.11, which was set in July 2008.

“Americans are feeling the impact at the pump of Vladimir Putin‘s illegal invasion of Ukraine, and right now we must work together on commonsense policy solutions to ease the financial burden that my constituents are feeling,” Thompson said in a statement.

Recommended Reading: Irs Stimulus Check Tax Return

Here’s Where We’re At

Congress has not addressed the issue of another payment to Social Security recipients. Regardless of rumors to the contrary, the IRS has not been ordered to issue a fourth payment to any American.

Congress has not outright rejected the proposal, so the issue is not quite dead and buried. However, no one should count on another round of stimulus payments from the federal government.

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full. The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Don’t Miss: Who’s Eligible For 3rd Stimulus Check

Will There Be A 4th Stimulus Check Heres What The Jobs Data Suggests About Another Payment

Last week’s unemployment numbers in the U.S. are good news for the economy, but bad news for those looking for a fourth stimulus check. AP

Last weeks unemployment numbers in the U.S. are good news for the economy, but bad news for those hoping for a fourth stimulus check as the Biden administration is looking to other ways to juice the economy.

As of July, the unemployment rate has reached its lowest since the beginning of the pandemic at 5.4%, according to the Bureau of Labor Statistics.

While the unemployment rate has not yet reached pre-pandemic levels, the news is encouraging as more Americans are joining the workforce.

However, the pandemic itself is far from over, and many Americans could be headed for financial trouble in the winter season.

South Carolina: Rebate Checks Of Up To $800

A budget plan approved in June earmarked $1 billion for a tax rebate that will provide a one-time payment of up to $700 for some taxpayers.

Rebate amounts will be determined after Oct. 17 . Then rebates will be distributed prior to Dec. 31. If you received your 2021 refund by direct deposit, youll also receive your rebate to that account. You can estimate your rebate by following the instructions on the state Department of Revenue rebate news website.

You May Like: Stimulus Checks Status Phone Number

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Is There Another Round Of Stimulus Payments Coming

On June 9, the federal government announced that the Internal Revenue Service, the U.S. Department of the Treasury, and the Bureau of the Fiscal Service had distributed over 2.3 million additional Economic Impact Payments under the American Rescue Plan. This brings the total to more than 169 million stimulus payments that have been sent to people so far, representing a total value of approximately $395 billion since these payments began rolling out to Americans in batches on March 12, 2021.

You May Like: When Will South Carolina Receive Stimulus Checks

More Third Stimulus Payment Money For Some In 2022

Parents who added a child in 2021 could be getting up to $1,400 after they file their 2021 taxes this coming spring thanks to the American Rescue Plan. The money won’t come as a direct check but will be part of the overall tax return.

The 2021 Economic Impact Payment — colloquially known as the third stimulus check — was actually an advance on what is called the 2021 Recovery Rebate Credit. What that means is that the $1,400 stimulus check most individual Americans received in 2021 is, in fact, money they would have gotten after filing their taxes in the spring of 2022 as a Recovery Rebate Credit.

In other words, millions of Americans already got part of their tax refund 12 months early.

“The bottom line is that’s money that’s going out almost immediately to millions of people as a tax credit in advance of putting it on a tax return in the next year,” said Raphael Tulino, IRS spokesman.

However, the IRS was going off of 2019 or 2020 tax returns for its information on the third EIP. It was using that information to determine if taxpayers would get stimulus money for their dependents. If eligible parents had a child born into their family in 2021, they can request the Recovery Rebate Credit on their taxes to get the payment for that child.

It gets more complicated with adoption because all the paperwork and processes to finalize the adoption must be completed first.

This does not pertain to the first or second stimulus payments that were paid in 2020.