My Payment Tool Is Not Available What Should I Do

If you did not receive any stimulus payment or you were missing one installment, then you should use my payment tool on the official website of the Internal Revenue Service. But, recently, the government announced that they are going to disconnect the tool. So, if you have any issue related to your stimulus payment, you can use an online IRS account, or you can use Recovery rebate credit.

Why Should I Double Check My Payment Total With The Stimulus Check Calculator

Delivering a third stimulus check in the middle of tax season has complicated matters. If you filed your taxes early and the IRS processed your 2020 return, it may use that information to calculate your stimulus total. If not, your third check will be based on 2019 totals, or other information the agency has .

If your estimated total from the stimulus calculator differs greatly from what you received through direct deposit, it may signal that the IRS owes you money for dependents that were unaccounted for, or a different life circumstance, like if your adjusted gross income from 2020 is lower than from 2019. Again, we recommend holding on to that IRS confirmation letter to file a future claim.

You may want to set up direct deposit with the IRS if you donât have it already in place.

Donât Miss: How To Know If Youâre Eligible For Stimulus Check

File For A Recovery Rebate Credit

Should you be unable to get a status update on the stimulus checks, there still are other options, like filing for a Recovery Rebate Credit.

If you didnt get the first or second payment or you received less than the full amount that youre eligible for you can claim the credit on your 2020 tax returns, even if you dont normally file.

This means you need to add up the amount of payments you did receive in order to determine the credit you would have otherwise been eligible for on your returns.

You May Like: When Will We Get The $1400 Stimulus Check

Also Check: When Was Stimulus Check 3

Don’t Lose The Irs Letter That Confirms Your Stimulus Payment

If the IRS issues you a stimulus check, it sends a notice by mail to your last known address within 15 days after making the payment to confirm delivery. The letter contains information on when and how the payment was made and how to report it to the IRS if you didn’t receive all the money you’re entitled to. You’ll need to reference this information if you don’t receive your full payment and need to claim your money later. Here’s how to recover the information if you lost or tossed the letter.

How Do I Find My Stimulus Money What To Do About A Missing $1400 Check

Your third stimulus payment could be delayed for a variety of reasons. Well help you track down your IRS payment.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Clifford Colby

Managing Editor

Clifford is a managing editor at CNET. He spent a handful of years at Peachpit Press, editing books on everything from the first iPhone to Python. He also worked at a handful of now-dead computer magazines, including MacWEEK and MacUser. Unrelated, he roots for the Oakland As.

To date, the IRS has made 169 million payments for the third round of stimulus checks for $1,400. The agency continues to send weekly batches of payments, so there is still time if you are waiting for your money. However, there could actually be an issue with your payment and the IRS doesnt want you to call them with problems related to a missing check.

Reasons for a delay could include a lag in mail delivery , if the IRS has incorrect direct deposit information for you or if the agency suspects identity theft. There might be other problems if youre a recipient of SSI, SSDI or veterans benefits. Or maybe you received a letter from the IRS saying that your $1,400 payment was sent, but the check never arrived. Then what?

Don’t Miss: Why Have I Not Received My 3rd Stimulus Check

I Got A Letter Saying My Stimulus Payment Would Be Offset Was It A Mistake

If you received an IRS Notice CP21C saying your stimulus payment would be held back to pay an old tax bill, you can disregard it. More than 100,000 taxpayers got this letter from the IRS in error, according to the agency. Instead, they should have received letters stating that their first Economic Income Payment couldnt be distributed, and they should use the Recovery Rebate Credit worksheet to claim their payment on their taxes.

Recommended Reading: 2nd Stimulus Check Release Date

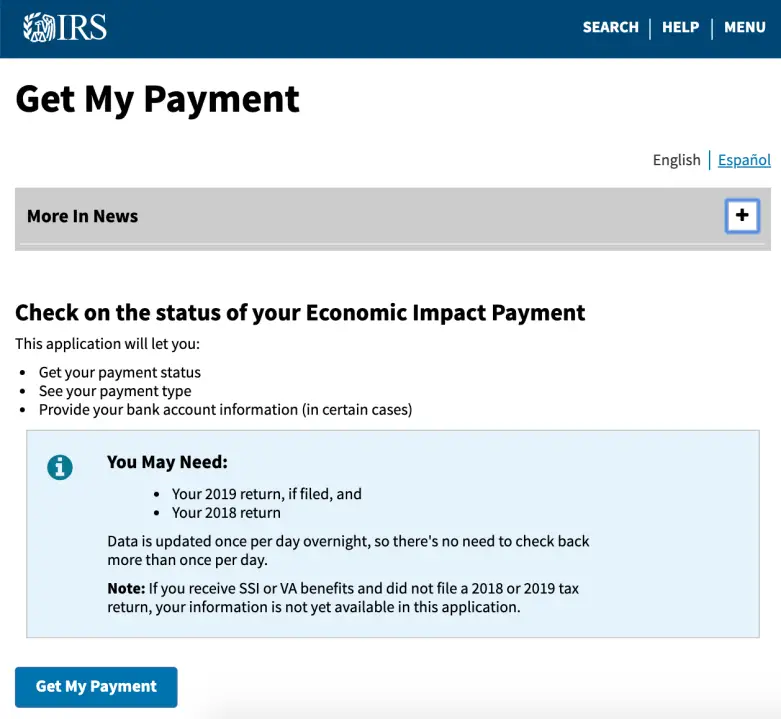

Irs Get My Payment: How To Use The Online Tracker Tool

To get an update on your third stimulus check using Get My Payment, enter your Social Security number, date of birth, street address and ZIP or postal code. The tool will display a message with information about your payment. You can see things like whether your money was sent or is scheduled to be sent, the payment method and the date your stimulus money was issued. The tool may also say it can’t yet determine your status — see more below about error messages.

You May Like: When Did We Receive Stimulus Checks

Why You Get A ‘payment Status Not Available’ Message

You can use the Get My Payment app to find out the projected date when your deposit is scheduled to arrive in your bank account. The Get My Payment tool will also tell you if you’re set to receive payment by paper check, along with a scheduled arrival date in the mail. However, there could be several reasons why you can’t get a status update on your stimulus payment right now.

The IRS says that through midday on Wednesday, April 15, that over 6 million taxpayers had successfully found out their payment status through the new Get My Payment app. If instead, your inquiry resulted in a “Payment Status Not Available” message, the IRS says that this could be because:

- You are not eligible for a payment.

- You have not filed a tax return in tax year 2018 or 2019.

- You filed your tax return recently and it’s still being processed, or you provided information through Non-Filers: Enter Your Payment Info on IRS.gov.

- You receive Social Security, or are a RRB Form 1099 recipient, SSI or VA benefit recipient. Status updates for these recipients is not yet available through the Get My Payment app.

Here are more explanations for why you can’t get a payment status update, or why your check simply hasn’t come yet. If you cannot get a status update on your payment, the IRS says that you should check back 24 hours later and try again then.

What If My Mailing Address Changed Since I Received My Previous Stimulus Checks How Will I Get My Third Stimulus Check

If you are expecting to receive your third stimulus check by mail, it will be mailed to the last address you filed with the IRS. If your address has changed since then, there are different options you can take to make sure your stimulus check gets to you:

Option 1: File your 2020 federal tax return to update your address. If you havent filed your 2020 tax return yet, this is an easy way to update your address. File a tax return with your current address and your payment will be sent through the mail once the IRS receives your updated address.

Option 2: Provide your banking information in the IRS Get My Payment tool. If the post office was unable to deliver your stimulus check, it will be returned to the IRS. Two to three weeks after the payment has been issued, Get My Payment will display the message Need More Information. You will have the option to have your payment reissued as a direct deposit by providing your banking information.

If you dont provide your banking information, the IRS will mail your payment once your address is updated.

Option 3: Notify the IRS that your address has changed by telephone, an IRS form, or a written statement. It can take 4-6 weeks for the IRS to process your request.

You May Like: Ssi Get Stimulus Check 2022

How To Use Irs Get My Payment

The IRS also updated frequently asked questions Saturday on how to use the Get My Payment tool, which requires users to enter their full Social Security number or tax ID number, date of birth, street address and ZIP code.

But before you start entering your information hourly, the IRS says the tool updates once per day, usually overnight and that people should not call the IRS. Our phone assistors dont have information beyond whats available on IRS.gov.

The tool will show the status of when a payment has been issued and the payment date for direct deposit or mail, according to the frequently asked questions. Some will get a message that says Payment Status Not Available.

If you get this message, either we have not yet processed your payment, or you are not eligible for a payment, the IRS said. We will continue to send the 2021 Economic Impact Payment to eligible individuals throughout 2021.

And others will get a Need More Information message when using the tool if the payment was returned to the IRS because the post office was unable to deliver it for another reason.

If your address has changed the IRS says the easiest way to update is to file your 2020 tax return with your current address, if you havent already done so. Once we receive your current address, we will reissue your payment.

Contributing: Jessica Menton, USA TODAY

Follow USA TODAY reporter Kelly Tyko on Twitter:

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

You May Like: Irs.gov 2nd Stimulus Check

What Does Irs Letter 6475 Look Like

These letters started going out in late January and say, Your Third Economic Impact Payment in bold lettering at the top. You can also find the terms Letter 6475 on the bottom at the very righthand corner.

Earlier in the program, the IRS sent out a Notice 1444-C that shows the third Economic Impact Payment advanced for tax year 2021. If you saved that letter last year, you can refer to it, as well.

If you received stimulus money at various points during the year, you might have more than one notice. Letter 6475 gives you a total dollar amount.

Unsure If Youre Owed Stimulus Payments How To Find Out

AMERICANS have just days left to see if they are owed up to $1,400 in stimulus payments from last year.

While the extended deadline to file your taxes for 2021 was on October 17, the IRSs Free File program will stay open until

Qualifying Americans can grab the maximum payment as long as their income is $75,000 and below, or $150,000 for couples.

Past those thresholds, the $1,400 check starts to phase out and then capped at $80,000 and $160,000 respectively.

An estimated 165million Americans have received a cumulative $931billion worth of payments under three stimulus rounds from April 2020 through 2021, according to a report from the Government Accountability Office .

While most Americans have received their third stimulus payments, there are millions that may still be owed money.

Don’t Miss: How To Track Third Stimulus Check

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

The Irs Doesnt Have Your Direct Deposit Info

The fastest way to get your stimulus check is via bank direct deposit from the IRS. If the IRS doesnt have your direct deposit info on file, you can still get paid, but itll come via paper check â and getting a check in the mail could delay your payment by weeks or even months. Treasury Secretary Steve Mnuchin told CNN that it was his idea that paper check stimulus payments have President Donald Trumps signature on them, and that reports saying that the signature would add further delay to the arrival of paper checks is incorrect.

The checks have not gone out yet, Mnuchin said to CNNs Jake Tapper on Sunday, April 19, and the reason they have not gone out yet is that were hoping that more people, as I said, will go to IRS.gov. Its much safer to send out direct deposits.

Most taxpayers provide the IRS with their bank account details, for the purposes of making a payment or receiving a tax refund. If the agency does not have your direct deposit details, you can provide the IRS with that information at the Get My Payment appâ which also lets you track the status of your check. However, the last day to give your direct deposit info to the IRS was May 13 if you missed the deadline, are eligible, and havent received your payment already, it will come as a paper check. You can still use the Get My Payment app to reveal how you will receive your payment , and give a scheduled arrival date, if the payment has been processed.

Don’t Miss: Update On The Stimulus Package

How Will I Know When My Stimulus Payment Has Been Deposited

As always, you can use online banking or the U.S. Bank Mobile App to monitor your account balance and transactions as often as you wish.

To be notified in real time, we recommend setting up a transaction alert . You can choose to be notified by text1 or email whenever a deposit or withdrawal is made on your account.

Visit the Get My Payment site at IRS.gov to monitor the status of your payment.

Are Stimulus Checks Taxable

- 8:35 ET, Aug 8 2022

TAX season is in the rearview mirror, but many Americans took an extension that will allow them to file a 2021 tax return by October 17.

And many are wondering if stimulus checks received last year are subject to being taxed.

In 2021, millions of Americans received a stimulus check worth up to $1,400.

That was the third round of stimulus issued amidst the ongoing Covid pandemic.

The payment was in addition to the child tax credit payments that began in July 2021, offering up to $300 per month per child to qualified parents.

Some individual states also issued aid to residents and more states rolled out relief refund programs this year to help compensate for surging inflation.

Dont Miss: How Much Is Sales Tax In Florida

Also Check: How Can I Get My Second Stimulus Check

How Do I Check On The Status Of My Payment

The IRS created an online tool, called Get My Payment, that can be used to check on the status of your money. It launched Wednesday and is available on the IRS website.

Youll need to enter your Social Security number, date of birth and mailing address in order to track your payment, the Treasury Department said.

Some people who used the tool on Wednesday received a message that their payment status was not available. The Treasury Department suggested checking again because it only updates the tool once daily, usually overnight.

How Will I Receive My Stimulus Payment

The Internal Revenue Service Uses three different modes to send out stimulus payments to each eligible person in the whole United States of America. Either you will receive a bank check via mail, or you will receive a visa debit card. Somehow if you are not able to receive any of these things, then the IRS will try to send you a stimulus payment via Internet banking.

Also Check: Stimulus Check For Grocery Workers

Q How Much Was The Second Stimulus Check For

A. Your second stimulus check depended on your 2019 income. The full amount was $600 per individual, $1,200 per couple, and $600 per qualifying child under the age of 17. For expats to qualify for the full second stimulus check, you must have had $75,000 or less in income if you filed as single, $112,500 or less if you filed as head of household, or $150,000 or less if you filed jointly with your spouse or as a qualifying widow. Youd also then qualify for a $600 payment per qualifying child.

For those above this income level, your stimulus check amount would lower $5 for each $100 your AGI exceeded the above thresholds.

Q. Did I have to pay back the amount I get?

A. No.

Q. Will this affect my 2020 tax return?

A. It could only help your 2020 return. If you are eligible for more stimulus than you were awarded, you may be able to claim it as a credit on your return that either decreases your tax liability or increases your refund. If youre eligible for less or received the full amount, you dont have to pay it back and it wont affect your return.

Q. Will I owe tax on this second stimulus check in 2021 or have to pay it back?

A. No, this is considered a tax credit, not income, so you will not need to pay taxes on it in 2021 or pay it back.

Q. Im retired overseas and dont file a tax return did I qualify for the second stimulus check?

Q. What if I didnt have an SSN but filed a U.S. return. Did I get to take advantage of the second stimulus check?