Irs Get My Payment Tool

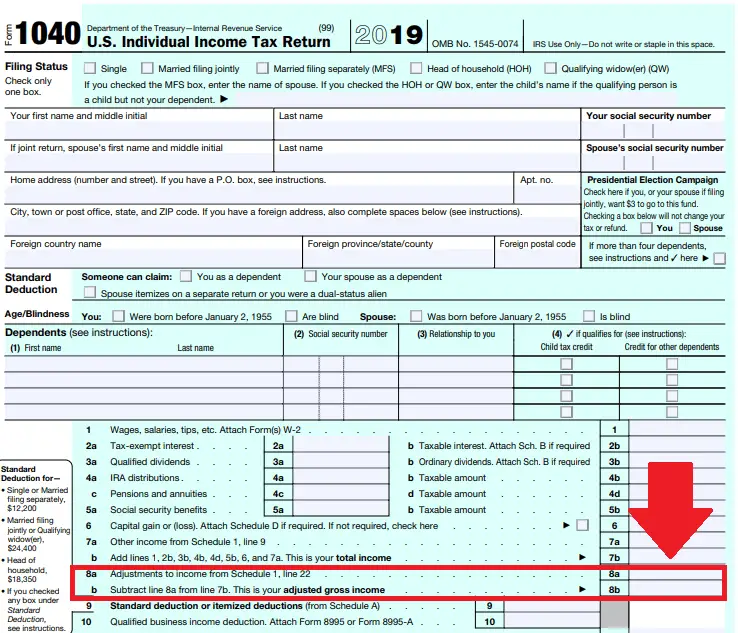

Most people don’t need to do anything to receive their stimulus checks, which pay out up to $1,200 per adult, and $500 per child under age 17. According to the IRS, 130 million stimulus payments were sent out through the program’s first four weeks, and somewhere between 150 million to 170 million payments will be distributed overall. The payment amounts are based on your adjusted gross income, as calculated in your most recent tax return, and the IRS is paying most checks via direct deposit provided that information is already on file.

Yet in this particularly trying economic climate, where millions have lost their jobs, many people were waiting for the IRS to offer a service letting them track their stimulus checks, similar to the tool allowing you to track your tax refund. Some taxpayers are also unsure how or when they will receive their $1,200 checks, or they seek to provide the IRS with updated direct deposit information so that they can get their checks as soon as possible. The Get My Payment application is supposed to address all of these needs.

Avoid Scams Related To Economic Payments Covid

The IRS urges taxpayers to be on the lookout for scam artists trying to use the economic impact payments as cover for schemes to steal personal information and money. Remember, the IRS will not call , text you, email you or contact you on social media asking for personal or bank account information even related to the economic impact payments. Also, watch out for emails with attachments or links claiming to have special information about economic impact payments or refunds.

Stimulus Checks Headed To Millions Of Americans Today

Stimulus checks headed to millions of Americans today | How to check your status

Check your bank account! Stimulus checks have been arriving for some Americans over the last couple of days, but Wednesday is when the government says most people will get their direct deposit.

The Internal Revenue Service launched a website Wednesday morning where you can check the status of your payment.

to check your stimulus payment status.

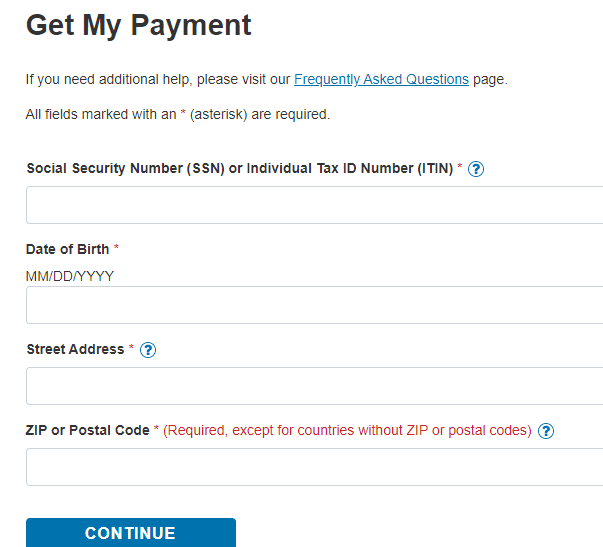

You will need your social security number, your date of birth and your street address. You may also need information from your 2018 and/or 2019 tax return.

The Coronavirus Aid, Relief, and Economic Security Act is paying out as much as $1,200 per person and $500 per child. However, not every single American is eligible for the payments .

Stimulus calculator: How much money should you expect from coronavirus relief bill

The IRS said this first wave of payments is going to Americans who filed their 2018 or 2019 tax returns and authorized the federal government to deposit their tax return checks directly into their bank accounts.

If the federal government does not have your bank account on file, you will either have to submit that information or wait for a physical check to be mailed.

The IRS is working on its Get My Payment application that will allow people to submit their bank account information, but that application is not complete at this time. The IRS’s website said it should be completed “mid-April.”

Recommended Reading: When Do We Get The Next Stimulus Checks

Who Qualifies For A Stimulus Payment

If youre not sure whether or not you qualify for the coronavirus stimulus check, you can use the Get My Payment tool to check your eligibility. Alternatively, you can review the IRS guidelines for eligibility, which are as follows:

- U.S. citizens and U.S. resident aliens are eligible to receive the full $1,200 stimulus payment if they have a work eligible Social Security number, if they are not a dependent of another taxpayer, and if their adjusted gross income is up to:$75,000 for individuals with the filing status single or married filing separately$112,500 for head of household filers$150,000 for married couples filing joint returns

- Otherwise qualifying taxpayers can receive a reduced payment if their adjusted gross income was between:$75,000 and $99,000 for individuals with the filing status single or married filing separately$112,500 and $136,500 for head of household filers$150,000 and $198,000 for married couples filing joint returns

Can I Still Get A Stimulus Check

If you still haven’t received your payment, or got less than you were eligible for, you can claim the money on your 2021 tax return by using the Recovery Rebate Credit. If you’re eligible, you’ll need to file a 2021 tax return, even if you don’t usually file a tax return, the IRS said in a statement.

Don’t Miss: Irs Sign Up For Stimulus

When Did Eip2 From The Consolidated Appropriations Act Arrive

The Consolidated Appropriations Act EIPs were sent in January, 2021. Direct deposits generally occurred within the first two weeks of January. Mailed payments generally arrived before February 24, 2021.

Get My Payment no longer has information for EIP2, but you can access your EIP2 info via an Online Account at IRS.gov.

Note: To access an Online Account, you will need an ID.me account to verify your identity. .

Why You Get A ‘payment Status Not Available’ Message

You can use the Get My Payment app to find out the projected date when your deposit is scheduled to arrive in your bank account. The Get My Payment tool will also tell you if you’re set to receive payment by paper check, along with a scheduled arrival date in the mail. However, there could be several reasons why you can’t get a status update on your stimulus payment right now.

The IRS says that through midday on Wednesday, April 15, that over 6 million taxpayers had successfully found out their payment status through the new Get My Payment app. If instead, your inquiry resulted in a “Payment Status Not Available” message, the IRS says that this could be because:

- You are not eligible for a payment.

- You have not filed a tax return in tax year 2018 or 2019.

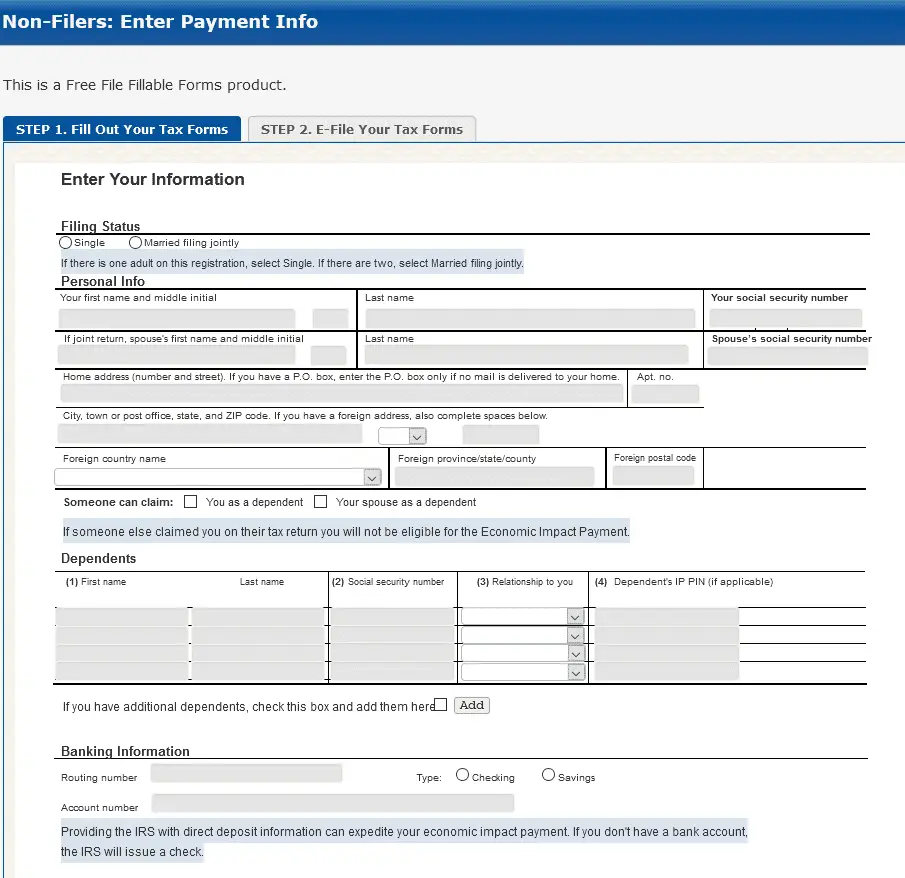

- You filed your tax return recently and it’s still being processed, or you provided information through Non-Filers: Enter Your Payment Info on IRS.gov.

- You receive Social Security, or are a RRB Form 1099 recipient, SSI or VA benefit recipient. Status updates for these recipients is not yet available through the Get My Payment app.

Here are more explanations for why you can’t get a payment status update, or why your check simply hasn’t come yet. If you cannot get a status update on your payment, the IRS says that you should check back 24 hours later and try again then.

Recommended Reading: Why Have I Not Received My 3rd Stimulus Check

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return.

- Received your Golden State Stimulus payment by check.

- Received your tax refund by check regardless of filing method.

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number.

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

Purchasing Us Savings Bonds

You can purchase up to $5,000 of series I U.S. savings bonds as an additional option to receiving all or part of your refund in the form of an electronic deposit or paper check.

- The benefit of purchasing this type of savings bond is that the interest you earn is exempt from state income taxes.

- You may be able to receive the interest free of federal income tax if you pay higher education expenses for yourself, your spouse, or your dependents and satisfy other eligibility requirements.

You May Like: Irs 1044 Form For Stimulus Check

What Do I Need To Do To Get My Stimulus Check

You will need to file a 2020 tax return to get the first and second stimulus checks and a 2021 tax return to get the third stimulus check. If you didn’t get your first, second, or third stimulus check, don’t worry you can still claim the payments as a tax credit and get the money as part of your tax refund.

Real Tax Experts On Demand With Turbotax Live Basic

Get unlimited advice and an expert final review. Done right, guaranteed.

-

Estimate your tax refund andwhere you stand

-

Know how much to withhold from your paycheck to get

-

Estimate your self-employment tax and eliminate

-

Estimate capital gains, losses, and taxes for cryptocurrency sales

The above article is intended to provide generalized financial information designed to educate a broad segment of the public it does not give personalized tax, investment, legal, or other business and professional advice. Before taking any action, you should always seek the assistance of a professional who knows your particular situation for advice on taxes, your investments, the law, or any other business and professional matters that affect you and/or your business.

Recommended Reading: Where My Second Stimulus Check

How Can I Get My Stimulus Check Direct Deposit

Please check with each bank directly for more details. Once you have signed up for a bank account, you can use it to get your payment faster when you file taxes. Have your new account number and routing number before you start the process. This will allow you to receive your stimulus check as a direct deposit.

Feel Good About Getting Your Full Stimulus Payments

When you file your taxes with 1040.com, we’ll calculate your Recovery Rebate Credit in the backgroundall you have to do is answer some simple questions. The pandemic makes life hard, but we can make sure taxes don’t add to the noise.

Ready to feel good about taxes? Just or log in, and we’ll be with you every step of the way.

Recommended Reading: Where’s My Second And Third Stimulus Check

What Do I Do If I Havent Gotten My Stimulus Payments Yet

EIP1 and EIP2 could be claimed with the RRC on your 2020 tax return. If you didn’t receive a payment but the IRS says you were sent one, you should request a payment trace. See the IRS’s FAQ page on claiming the 2020 RRC for more information.

For EIP3, you can claim any additional amount you qualify for with the RRC on your 2021 tax return. If the IRS has sent payment but you haven’t received it yet, you can request a payment trace. You should only request a payment trace if it has been:

- 5 days since the deposit date and the bank says it hasn’t received the payment

- 4 weeks since the payment was mailed by check to a standard address

- 6 weeks since the payment was mailed, and you have a forwarding address on file with the local post office

- 9 weeks since the payment was mailed, and you have a foreign address

To request a payment trace, mail or fax a completed Form 3911 to the address listed for your location here.

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: Amending Taxes For Stimulus Check

Combining Electronic Filing Plus Direct Deposit Yields Fastest Refunds

The safest and most accurate way to file a tax return is to file electronically. Many people may be eligible to file electronically for free. Most refunds are issued in less than 21 days, but some returns may take longer. Taxpayers can track their refund using Where’s My Refund? on IRS.gov or by downloading the IRS2Go mobile app.

Where’s My Refund? is updated once daily, usually overnight, so there’s no reason to check more than once per day or call the IRS to get information about a refund. Taxpayers can check Where’s My Refund? within 24 hours after the IRS has received their e-filed return or four weeks after mailing a paper return. Where’s My Refund? has a tracker that displays progress through three stages:

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

You May Like: Essential Worker Stimulus Check 2021

Some Taxpayers Reported A Pending

Now that President Biden has signed the $1.9 trillion pandemic relief bill into law, millions of desperate Americans are wondering the same thing: When will I get my money?

Some people got their answer Friday. Just one day after Biden signed the legislation into law, a reader in Alexandria, Va., found a pending post in his bank account labeled IRS TREAS 310 – TAXEIP3 for $6,892.90 for his family of five.

The IRS refers to the stimulus money as an economic impact payment, or EIP.

I was wondering if Biden was overpromising, the reader said in an interview. But I looked. And, wow, its actually there.

The notation on his pending post says the stimulus funds will be available to him on March 17.

The fast turnaround is laudable considering the IRS is in the middle of the 2021 tax season and is also still processing millions of 2019 returns.

But the devil is in the details, and not all people will get their money that quickly.

As in previous rounds, the IRS will eventually post answers to many of your questions at irs.gov. But Ive put together some information on when you can expect a payment, including what might delay your stimulus funds.

The first wave of electronic payments went out to those who had received a refund and this was key had their refund direct-deposited into a bank account.

Some Taxpayers Will Receive The Rebate By Direct Deposit And Some Will Receive A Paper Check

If you received a refund by direct deposit this year, youll likely receive your rebate by direct deposit in the same bank account, with the description VA DEPT TAXATION VATXREBATE. All other eligible taxpayers will receive their rebate by paper check in the mail.

- If you’ve moved in the last year and have a current forwarding order with the USPS, then your check will be forwarded to your new address.

- Were not able to update your bank account information. If the bank account where you received your Virginia refund by direct deposit is closed, call us at , and we can mark it as an invalid account. Youll receive your rebate by paper check in the mail.

Recommended Reading: Get My Stimulus Payment 1400

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

You May Like: What Was The First Stimulus Check Amount