How Quickly Will I Get My Refund

We issue most refunds in less than 21 calendar days. However, if you filed on paper and are expecting a refund, it could take six months or more to process your return. Wheres My Refund? has the most up to date information available about your refund.

It is also taking the IRS more than 21 days to issue refunds for some tax returns that require review including incorrect Recovery Rebate Credit amounts, or that used 2019 income to figure the Earned Income Tax Credit and Additional Child Tax Credit .

When Should You Call The Irs For Your Tax Refund

Internal Revenue Service, also known as IRS, has given an option to contact them under some circumstances. They have mentioned these reasons on its official website, and if you fall under any of these reasons, you should contact them.

If you have filed your income tax return and it has been more than 21 days, you should call the IRS for your tax refund. Apart from that, if you are trying to check your tax refund using the wheres my refund tool and the tool tells you to contact, you should contact the IRS for your tax refund.

Usually, the Internal Revenue Service contacts you by mail if they need any further information to process your income tax return.

You should expect a natural delay if you mailed a paper return or responded to an IRS inquiry about your return.

How Long It Will Take To Get A Stimulus Check After Filing Taxes

The IRS sends out most tax refunds within 21 days, or three weeks, of accepting your return. If your taxes are incomplete, impacted by fraud, require close review or contain errors, you may have to wait a while for your refund.

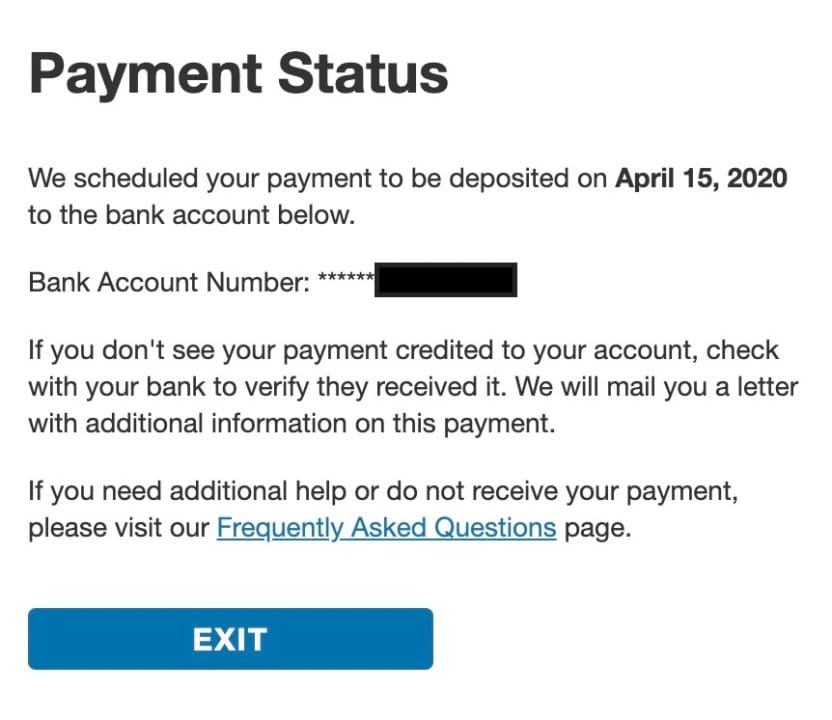

The fastest way to get your refund and any remaining EIP funds is to file digitally and select direct deposit as your refund method. You can check the Where’s My Refund? page, which refreshes daily, starting 24 hours after sending in an electronic return and four weeks after mailing your paper return.

You May Like: How Much Was 3rd Stimulus Check 2021

Irs Operations During Covid

We’re open and processing mail, tax returns, payments, refunds and correspondence. However, COVID-19 continues to cause delays in some of our services. Our service delays include:

- Live phone support

- Processing tax returns filed on paper

- Answering mail from taxpayers

- Reviewing tax returns, even for returns filed electronically

Information about IRS safety protocols can be found in the Treasury COVID-19 Workplace Safety PlanPDF.

Check this page periodically for updates.

What Is Happening When Wheres My Refund Shows My Refunds Status As Approved

Weve approved your refund. We are preparing to send your refund to your bank or directly to you in the mail. This status will tell you when we will send the refund to your bank . Please wait 5 days after weve sent the refund to check with your bank about your refund, since banks vary in how and when they credit funds.

Recommended Reading: Who Qualifies For Stimulus Check 2021

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

Reconcile Your Advance Payments Total On Your 2021 Tax Return

If you received advance payments of the Child Tax Credit, you need to reconcile the total you received with the amount youre eligible to claim.To reconcile advance payments on your 2021 return:

- Get your advance payments total and number of qualifying children in your online account.

- Enter your information on Schedule 8812 .

You can also refer to Letter 6419.

If Married Filing Jointly

If you received advance payments based on a joint return, each spouse is treated as having received half of the payments, unless one of you unenrolled.

To reconcile your advance payments on your 2021 tax return, add your advance payments total to your spouses advance payments total.

Each of you can find your advance payments total in your online account.

If Letter 6419 Has a Different Advance Payments Total

For the majority of taxpayers, the advance payments total in Letter 6419 will match the total in online account.

If the advance payments total differs between your Letter 6419 and your online account, rely on the total in your online account.

Your online account has the most current advance payment information. Do not rely on Tax Transcripts for the advance payments total.

Keep Letter 6419 for your tax records.

Frequently Asked Questions: Reconciling Your Advance Payments

Also Check: What’s Happening With The Stimulus Checks

What If Your 2020 Taxes Make It So The Stimulus Checks You Already Got Were Too Big

EIP 1 and EIP 2 were based on the adjusted gross income reported on your 2018 and 2019 tax returns. As mentioned above, they had income limits over which stimulus checks decreased and eventually phased out.

If your income from 2018/2019 changed in 2020 and based on that income level, you don’t qualify for the aid you already got don’t worry. The IRS has said it’s not clawing back excess funds from people whose stimulus checks were too big. It’s more concerned with taxpayers whose stimulus checks were too small.

“If you got paid too much money, you do not have to pay that back,” Pickering says. “That’s something that should make people feel really relieved.”

Im A Nonresident Alien I Dont Have To Pay Us Federal Income Tax How Do I Claim A Refund For Federal Taxes Withheld On Income From A Us Source When Can I Expect To Receive My Refund

To claim a refund of federal taxes withheld on income from a U.S. source, a nonresident alien must report the appropriate income and withholding amounts on Form 1040-NR, U.S. Nonresident Alien Income Tax ReturnPDF. You must include the documents substantiating any income and withholding amounts when you file your Form 1040NR. We need more than 21 days to process a 1040NR return. Please allow up to 6 months from the date you filed the 1040NR for your refund.

Read Also: I Still Haven’t Gotten My Stimulus

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

How To Check Your Tax Refunds

As you are already aware, the federal government of the United States, with the help of the Internal Revenue Service, initiates tax refunds to all eligible Americans who file income tax returns.

Apart from that, the federal government also announced some relief during the pandemic in the years 2020 and 2021. All of these reliefs are supposed to be processed by the Internal Revenue Service.

All Americans are well aware of its tax refunds and returns. That is why the Internal Revenue Service launched two portals for all Americans to check their tax refunds.

You May Like: Stimulus Checks Gas Prices 2022

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Im Told My Stimulus Check Was Sent But I Didnt Get It

To find the amounts of your economic impact payments , check your online account.

You can securely access your individual IRS account online to view the total of your first, second and third stimulus amounts under the economic impact payment information section on the tax records page.

The IRS mailed EIP notices to the address they have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

For married filing joint individuals, each spouse will need to log into their own online account or review their own letter to get their half of the payment.

Don’t Miss: Social Security Disability Stimulus Check 2022

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Tax Refund Frequently Asked Questions

Direct Deposit is a safe, reliable, and convenient way to receive Federal payments. The Department of the Treasury’s Bureau of the Fiscal Service and the Internal Revenue Service both encourage direct deposit of IRS tax refunds. Direct Deposit combined with IRS e-file provides taxpayers with the fastest and safest way to receive refunds.

This resource page of frequently asked questions about IRS tax refunds provides financial institutions with useful information for reference while assisting customers during the tax filing season.

For other FAQs about Direct Deposit, .

Read Also: When Are The Next Stimulus Checks Going Out

Beware Of Scams Involving Jobs Stimulus Checks And Tax Refunds Irs Warns

- The IRS warned of ongoing scams linked to tax refunds, fake job listings and pandemic-era benefits such as stimulus checks.

- Criminals continue to leverage the Covid-19 pandemic as a way to steal money and data from unsuspecting victims, IRS Commissioner Chuck Rettig said Monday.

The IRS is warning taxpayers to look out for scams involving fake job offers, tax refunds and pandemic-era benefits such as stimulus checks, as criminals continue to use the ongoing health crisis to steal cash and data.

“Scammers continue using the pandemic as a device to scare or confuse potential victims into handing over their hard-earned money or personal information,” IRS Commissioner Chuck Rettig said in a bulletin issued Monday.

Rettig urged Americans to be skeptical of suspicious calls, texts and emails promising nonexistent benefits and suggested people should verify information on a trusted government website such as IRS.gov.

More from Personal Finance:How to convince your company to test a 4-day workweek

The federal government has issued all three authorized rounds of stimulus checks , and most eligible people already received their checks, according to the IRS.

But thieves are still using stimulus checks to lure victims and “pose a continuing threat,” the agency said.

The easiest way to check the status of a refund is through the “Where’s My Refund?” online tool or by using the IRS2Go app.

Job openings in April were near all-time highs amid historic demand for workers.

Theres Still Time To Get The Child Tax Credit

If you havent yet filed your tax return, you still have time to file to get your full Child Tax Credit.

Visit ChildTaxCredit.gov for details.

Under the American Rescue Plan of 2021, advance payments of up to half the 2021 Child Tax Credit were sent to eligible taxpayers.

The Child Tax Credit Update Portal is no longer available, but you can see your advance payments total in your online account.

Also Check: Can I Still Get Stimulus Check

I Have Not Received My Tax Refund Can I File A Second Tax Return

No, you should not file a second tax return if you still have not received your tax refund. Kindly take all the precautionary measures such as waiting for more than 21 days, checking the wheres my refund portal, etc. Before, you make any decisions such as filing form 1040-X to amend your original tax return. Any reaction decision might result in further delay. Kindly be patient, and IRS will return your tax.

Irs Free File Available Until October 17 Midnight Eastern Time

Welcome to IRS Free File, where you can electronically prepare and file your federal individual income tax return for free using tax preparation and filing software. Let IRS Free File do the hard work for you.

IRS Free File lets you prepare and file your federal income tax online using guided tax preparation, at an IRS partner site or Free File Fillable Forms. It’s safe, easy and no cost to you for a federal return.

To receive a free federal tax return, you must select an IRS Free File provider from the Browse All Offers page or from your Online Lookup Tool results. Once you click your desired IRS Free File provider, you will leave the IRS.gov website and land on the IRS Free File providers website. Then, you must create an account at the IRS Free File providers website accessed via IRS.gov to prepare and file your return. Please note that an account created at the same providers commercial tax preparation website does NOT work with IRS Free File: you MUST access the providers Free File site as instructed above.

Recommended Reading: Amending Taxes For Stimulus Check

Where Is My Refund

Where is my refund? It is the first portal to check your tax refunds. If you are a desktop user, then kindly click on the button given below, and it will take you to the official web page IRS, where you can easily check all of your tax refunds.

The refund webpage is not very hard to find the page on the official website of the Internal Revenue Service. You can simply visit the official website of IRS.Gov and click on the refund button at the header. It will directly take you to the refund page.

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Read Also: Who Is Getting The New Stimulus Checks

How You’ll Receive Your Payment

Californians will receive their MCTR payment by direct deposit or debit card.

Generally, direct deposit payments will be made to eligible taxpayers who e-filed their 2020 CA tax return and received their CA tax refund by direct deposit. MCTR debit card payments will be mailed to the remaining eligible taxpayers.

You will receive your payment by mail in the form of a debit card if you:

- Filed a paper return.

- Received your Golden State Stimulus payment by check.

- Received your tax refund by check regardless of filing method.

- Received your 2020 tax refund by direct deposit, but have since changed your banking institution or bank account number.

- Received an advance payment from your tax service provider, or paid your tax preparer fees using your tax refund.

What If My Refund Was Lost Stolen Or Destroyed

Generally, you can file an online claim for a replacement check if it’s been more than 28 days from the date we mailed your refund. Where’s My Refund? will give you detailed information about filing a claim if this situation applies to you.

For more information, check our Tax Season Refund Frequently Asked Questions.

You May Like: Update On Ssdi Stimulus Check

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit