If I Owe Child Support Will Mytax Return Be Applied Tomychild Supportarrears

-

Maybe.Federal law and regulationsdetermine when federal payments are intercepted and applied to child support arrears.

-

IfTANFhas been received for your child,thetotalamount of past due supportonall ofyourchild support cases must be at least $150

-

IfTANFhasnotbeenreceivedfor your child,thetotalamount of past due supportonall ofyour child support casesmust be at least $500

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

What Number Can I Call For Questions About My Stimulus Check

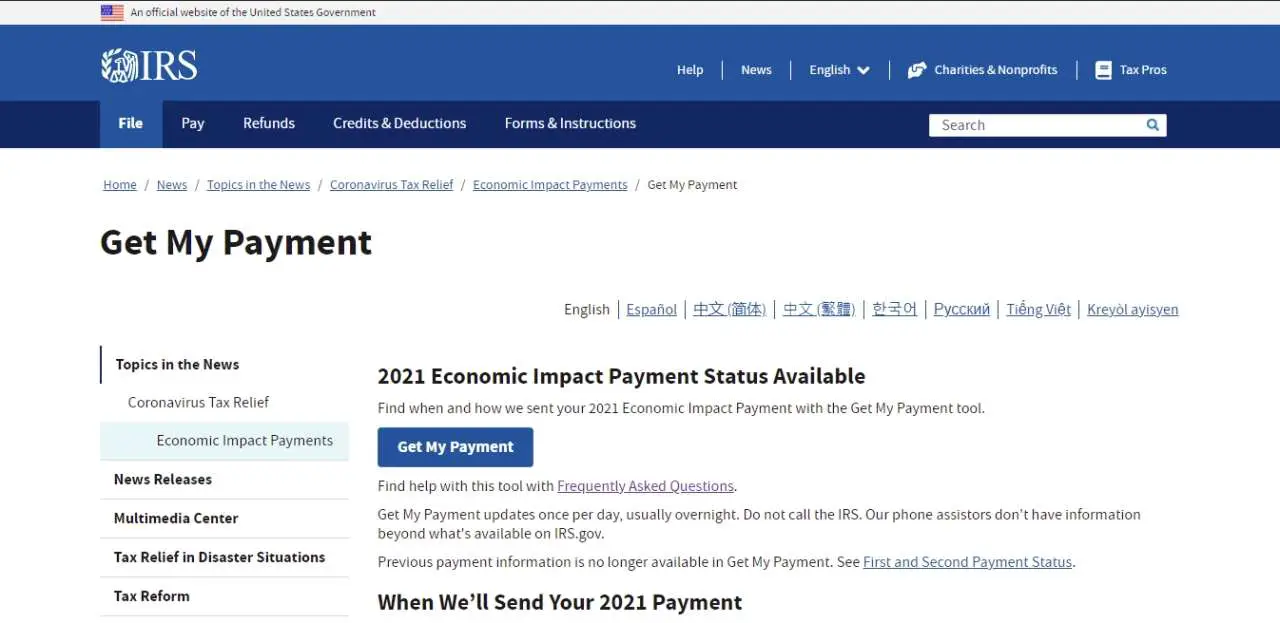

Check your payment status on the IRS website here.

The IRS updates the Get My Payment data once a day, overnight. So you can check it the next day if youre not able to access it or are getting an error message.

On May 18, 2020, the IRS announced that is adding 3,500 telephone reps to answer questions regarding their stimulus payments.

You can call 1-800-919-9835 to reach the automated message. Youll then have the option to talking with a phone rep at the end of the automated message.

Recommended Reading: When Will The $1400 Stimulus Checks Be Mailed Out

How To Obtain The Account Transcript

The easiest way to get your account transcript is to set up an IRS online account. Taxpayers can go to View your IRS account on IRS.gov. Taxpayers will need to authenticate themselves to set up an account which includes having a cell phone and a financial account in their name. Many taxpayers have had issues with signing up with an IRS online account because they have not been able to authenticate their identities under the strict IRS authentication process.

If taxpayers cannot get their IRS account transcript through their IRS account, they can request it to be mailed to them. Taxpayers can go to the IRS website and request multiple transcripts to be sent to their last address using the IRSs Get Transcript tool.

Use The Recovery Rebate Credit Worksheet To Calculate How Much You Are Due

by John Waggoner, AARP, January 13, 2021

En español | The Internal Revenue Service issued about 160 million stimulus checks to eligible Americans for the first round of economic impact payments that began in April. Millions more payments, dubbed EIP 2, started going out in late December for the second round of stimulus. Nevertheless, some people never got their first-round stimulus checks, while others didn’t receive the full amount to which they were entitled. The same will be true for the second round of stimulus payments.

If you didn’t receive money from the first or second round of stimulus payments or you didn’t get the full amount you should have don’t give up. You’ll need to file the standard 1040 federal tax return form, or the 1040-SR tax return for people 65 or older, to get your missing stimulus money in the form of a tax credit that will either lower the amount of tax you owe or increase the size of your refund.

Also Check: H& r Block Stimulus Check

Irs Stimulus Checks / Economic Impact Payments

On March 25, 2020 Congress unanimously passed an economic stimulus package that allows for taxpayers to receive stimulus checks of up to $1,200 per adult.

On April 11, 2020, the IRS began its first wave of payments. Taxpayers who have filed tax returns for 2018 or 2019 and who have authorized direct deposit started receiving their stimulus payments, which are formally called Economic Impact Payments. Those who havent filed returns because they were not required to will likely have to wait a little longer.

An eligible single or married filing separate taxpayer will receive a $1,200 check.

An eligible head of household taxpayer will receive a $1,200 check.

Eligible married individuals will receive up to $2,400.

Eligible taxpayers with children will receive an extra $500 per child. Dependent children over the age of 16 will not qualify.

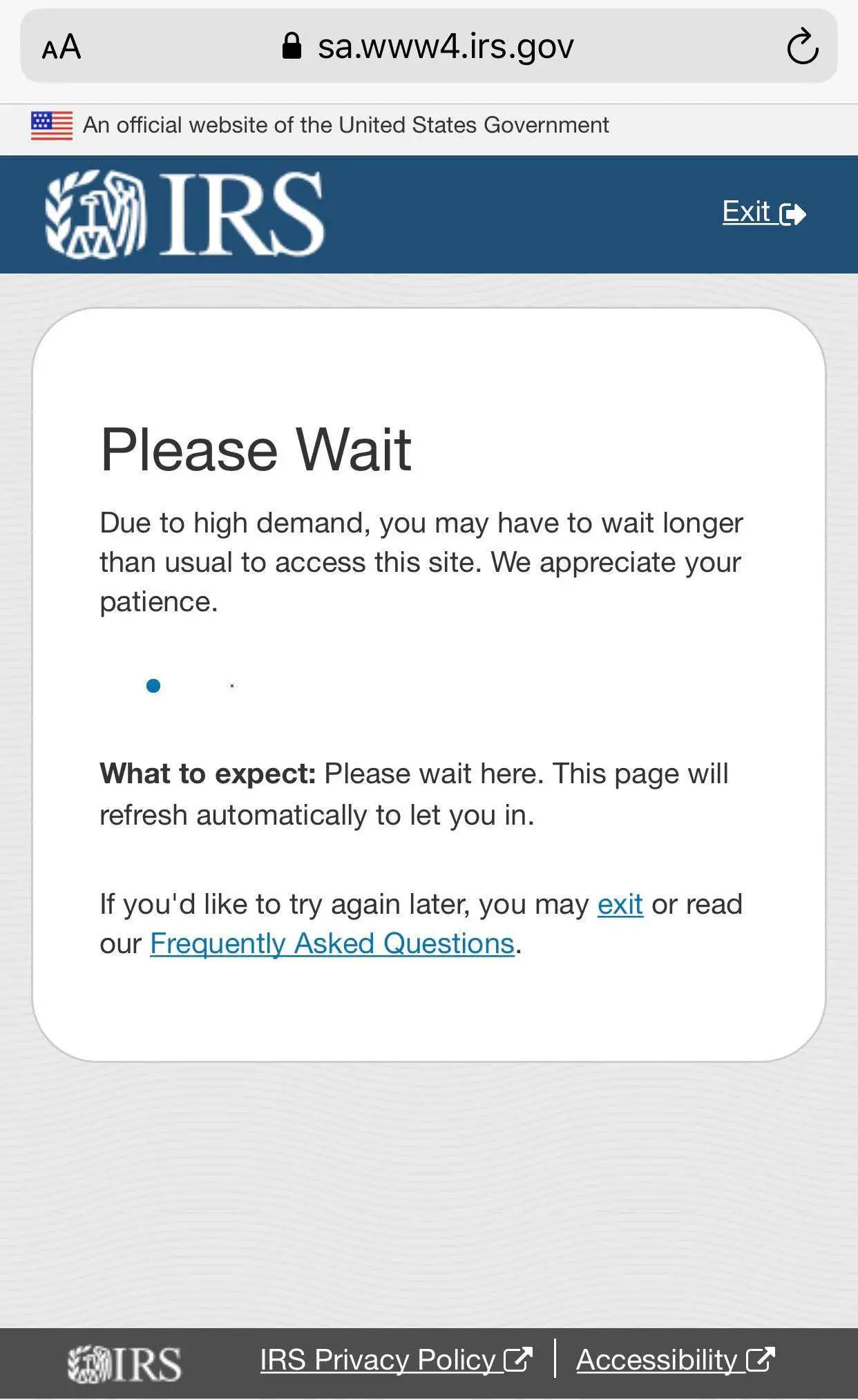

Why Am I Getting Payment Status Not Available

The Get My Payment application will return Payment Status Not Available for several reasons, including:

- Your income is too high and you dont qualify

- You do not have an SSN

- Youre claimed as a dependent on someone elses return

- You recently filed your 2019 return file a tax return but the IRS hasnt finished processing it

- You used Non-Filers: Enter Payment Info Here but the IRS hasnt processed your entry yet

- You receive SSI or VA benefits and dont file a return this information has not been loaded onto the IRS systems yet for people who dont normally file a tax return.

If you receive Payment Status Not Available, you will not be able to provide direct deposit information at this time.

You May Like: What Was The First Stimulus Check Amount

Why You May Be Missing Stimulus Money

The first round of stimulus checks, mandated by the Coronavirus Aid, Relief, and Economic Security Act, was signed into law in March 2020. The CARES Act gave a maximum $1,200 per person and $500 per eligible dependent child under 17. Payments were limited by 2019 or 2018 income as reported on federal income tax forms. Individuals who had more than $75,000 in adjusted gross income had their stimulus check reduced by $5 for every $100 of income, and the same was true for married couples filing jointly with income above $150,000. Individuals who earned more than $99,000 and couples who earned more than $198,000 jointly did not receive checks.

The second round of stimulus checks gives a maximum $600 per eligible person and dependent child. Married couples who filed jointly in 2019 receive $1,200 total . Families get an additional $600 for each eligible dependent child under 17. The income limits are the same for the second round of stimulus payments as they were for the first, though the phaseout amounts are lower since the maximum payment is $600 vs. $1,200 during the first round. Individuals who earned more than $87,000 and couples who earned more than $174,000 jointly won’t receive second-round checks. The deadline for the IRS to issue second-round payments is Jan. 15.

Other reasons for not getting a stimulus check

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Read Also: Recovery Rebate Credit Second Stimulus

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

When Will Stimulus Payments Be Sent Out

IRS began its first wave of direct deposit stimulus payments on April 11, 2020. Payments will continue over weeks, perhaps months, until about 80 million Americans receive their payments.

The IRS stated that Social Security benefit recipients should receive payments by direct deposit, Direct Express debit card, or by paper check, just as you usually receive your SSI benefits.

Recommended Reading: Amount Of All Stimulus Checks

Working With The Irs Online

Currently, the IRS is in the beginning of a 6-year modernization effort. IRS modernization will include more online account features for taxpayers to get their information and interact with the IRS. In the future, taxpayers will likely find it easier to work with the IRS online. Taxpayers can get their stimulus payment information on their IRS account. Taxpayers can also get their stimulus payment details by accessing their IRS 2020 and 2021 account transcripts .

Taxpayers and Tax Pros should consider filing Form 8821 as soon as possible. This allows the Tax Pro to use their IRS e-services account to quickly get their tax information. Thinking ahead may help taxpayers have their information even when the IRS is unreachable. For assistance creating a strategy to address your tax issue, visit Jackson Hewitts Tax Resolution Hub to see the various ways we can help you.

About the Author

If I Owe Child Support Will I Be Notified That My Tax Return Is Going To Be Applied To My Child Support Arrears

-

Yes.You were sent a noticewhenyour case wasinitiallysubmitted for federal tax refund offset.The federal government shouldsend an offset notice toyouwhenyour stimulus rebate paymenthasactuallybeenintercepted. The noticewill tell youthatyourtax returnhas been applied toyour child support debtand to contactthe Child Support Divisionifyoubelieve this was done in error.

Recommended Reading: Can Unemployed Get Stimulus Check

When Did Eip1 From The Cares Act Arrive

The IRS began sending economic impact payments in April of 2020 most taxpayers did not need to take any action to receive their payment.

The Department of the Treasury used info from 2019 tax returns to determine AGI, qualifying children, and whether to send payments by check or direct deposit. If you hadnt filed your 2019 taxes, your 2018 tax return information was used.

The Get My Payment tool allowed taxpayers to choose how to receive their EIP, and the tool also helped track stimulus payments. Get My Payment no longer has information for EIP1, but you can access your EIP1 info via an Online Account at IRS.gov.

Note: You may need to set up an ID.me account to get an Online Account, but the IRS will be transitioning away from facial recognition technology by the end of February 2022.

Third Stimulus Check: How To Claim Through Irs Portal

With the terms now finally set in stone, the process will be much the same as the previous two rounds, and the good news is that if you have already made a previous claim for a check, you shouldn’t need to have to take any action for the latest one. In addition, if you qualify and your banking and mailing information are correct, the stimulus payment will be sent to you automatically either by direct deposit or a mailing check. The IRS will continue to use its Get My Payment tool for tracking purposes.

The Get My Payment tracking tool, as you’d expect, can be used to find our where your payments for both filers of tax returns and non-filers are in the process.The message on the site currently reads:

“2021 Economic Impact Payment Coming Soon

“Check back soon for information on the 2021 Economic Impact Payment. Were reviewing the tax provisions of the American Rescue Plan Act of 2021, signed into law on March 11, 2021. For the latest updates, check IRS.gov/coronavirus.”

Avoid long hold times on the telephone. Use the #IRS online tools and get answers to many common tax questions at

The Frequently Asked Questions page also includes information on how to claim payments missed from the first two round of stimulus checks, or amounts not fully realised as well as how to manage various error messages on the tracker.

Don’t Miss: When Can Social Security Recipients Expect The Stimulus Check

Who Does Not Qualify For Stimulus Checks

Those with adjusted gross incomes more than the following threshold with not qualify:

- $99,000 if their filing status was single or married filing separately

- $136,500 for head of household

- $198,000 if their filing status was married filing jointly

Non-resident aliens are not eligible to receive stimulus checks.

Individuals without social security numbers will not be eligible to receive Economic Impact Payments. Therefore, those with ITIN numbers will not be eligible.

Any taxpayer who is an adult dependent of another taxpayer is ineligible for a payment.

If you filed Form 1040-NR or Form 1040NR-EZ, Form 1040-PR or Form 1040-SS for 2019.

are ineligible to receive payments. Such taxpayers that have received payments, must return them to the IRS.

State Stimulus Checks: Who Is Getting A Payment In 2022

Residents in these states are getting stimulus checks. Find out when and who qualifies.

Dan Avery

Writer

Dan is a writer on CNET’s How-To team. His byline has appeared in Newsweek, NBC News, The New York Times, Architectural Digest, The Daily Mail and elsewhere. He is a crossword junkie and is interested in the intersection of tech and marginalized communities.

The Massachusetts State Legislature is working to pass a one-off tax rebate of $250 for eligible individual filers and $500 for eligible married couples who file jointly. If the bill clears both houses and is signed by Gov. Charlie Baker, payments could be sent out before the end of September.

Baker told reporters on July 8 that he “will certainly sign” the bill, but he hopes it’s just the start of more tax relief efforts, “given that the cost of everything has gone up.”

Massachusetts is just the latest state to address rampant inflation and the growing threat of recession with a plan to send a tax rebate check to eligible residents. The federal government issued three rounds of stimulus checks during the height of the pandemic. It’s unlikely to send more this year, but at least 17 states have issued or are in the process of sending out rebate payments.

You May Like: Veterans To Receive Stimulus Payment

Other Ways To Find Your Account Information

- You can request an Account Transcript by mail. Note that each Account Transcript only covers a single tax year, and may not show the most recent penalties, interest, changes or pending actions.

- If you’re a business, or an individual who filed a form other than 1040, you can obtain a transcript by submitting Form 4506-T, Request for Transcript of Tax Return.

Feel Good About Getting Your Full Stimulus Payments

When you file your taxes with 1040.com, we’ll calculate your Recovery Rebate Credit in the backgroundall you have to do is answer some simple questions. The pandemic makes life hard, but we can make sure taxes don’t add to the noise.

Ready to feel good about taxes? Just or log in, and we’ll be with you every step of the way.

You May Like: H& r Block Stimulus Tracker

How Do I Sign Up For My 2020 Stimulus Check

how do i just sign up for the stimlus check

how do i just sign up for the stimlus check

Go to this IRS website for stimulus payment information FAQ’s –

Use this IRS website for stimulus payment status or to update your bank account –

Use this IRS website for get my payment FAQ’s –

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Date

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

- Date of birth

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

You May Like: Where’s My 1st And 2nd Stimulus Check

Will I Lose Out If I Cant Sign Up In Time To Get A Payment On July 15

No. Everyone who signs up and is eligible will receive the full Child Tax Credit benefits they are owed. If you sign up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign up in time for monthly payments in 2021, you will receive the full benefit when you file your taxes in 2022.

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes.

This year, Americans were only required to file taxes if they earned $24,800 as a married couple, $18,650 as a Head of Household, or $12,400 as a single filer. If you had total income in 2020 below those levels, you can sign up to receive monthly Child Tax Credit payments using simple tool for non-filers developed by the non-profit Code for America.

If you believe that your income in 2020 means you were required to file taxes, its not too late. In addition to missing out on monthly Child Tax Credit payments in 2021, a failure to file in 2020 could mean losing out on other tax benefits or a refund you were owed. For help filing a past due return, visit the IRS website.

Read Also: How To Sign Up For The Stimulus Check