Will The Irs Reload A Prior Pre

Some people who received one or both of their first two stimulus payments on a pre-paid debit card may wonder if the IRS will reload that card with the $1,400 for the latest round of payments. The answer is no, the IRS says.

If the IRS now has bank account information for you, it will send the money via direct deposit. If not, it will either issue a check or a pre-paid debit card, but the latter will come in the form of a new card, the tax agency said.

People should look for a white envelope with the return address Economic Impact Payment Card accompanied by a U.S. Treasury Department seal. The card says Visa on the front, and the issuing bank, MetaBank, on the back.

Im Counting On My Refund For Something Important Can I Expect To Receive It In 21 Days

Many different factors can affect the timing of your refund after we receive your return. Even though we issue most refunds in less than 21 days, its possible your refund may take longer. Also, remember to take into consideration the time it takes for your financial institution to post the refund to your account or for you to receive it by mail.

Why Is My Refund Different Than The Amount On The Tax Return I Filed

All or part of your refund may have been used to pay off past-due federal tax, state income tax, state unemployment compensation debts, child support, spousal support, or other federal nontax debts, such as student loans. To find out if you may have an offset or if you have questions about an offset, contact the agency to which you owe the debt.

We also may have changed your refund amount because we made changes to your tax return. This may include corrections to any incorrect Recovery Rebate Credit or Child Tax Credit amounts. Youll get a notice explaining the changes. Wheres My Refund? will reflect the reasons for the refund offset or different refund amount when it relates to a change in your tax return.

Tax Topic 203, Refund Offsets for Unpaid Child Support, Certain Federal and State Debts, and Unemployment Compensation Debts has more information about refund offsets.

Read Also: 4th Stimulus Check For Single Person

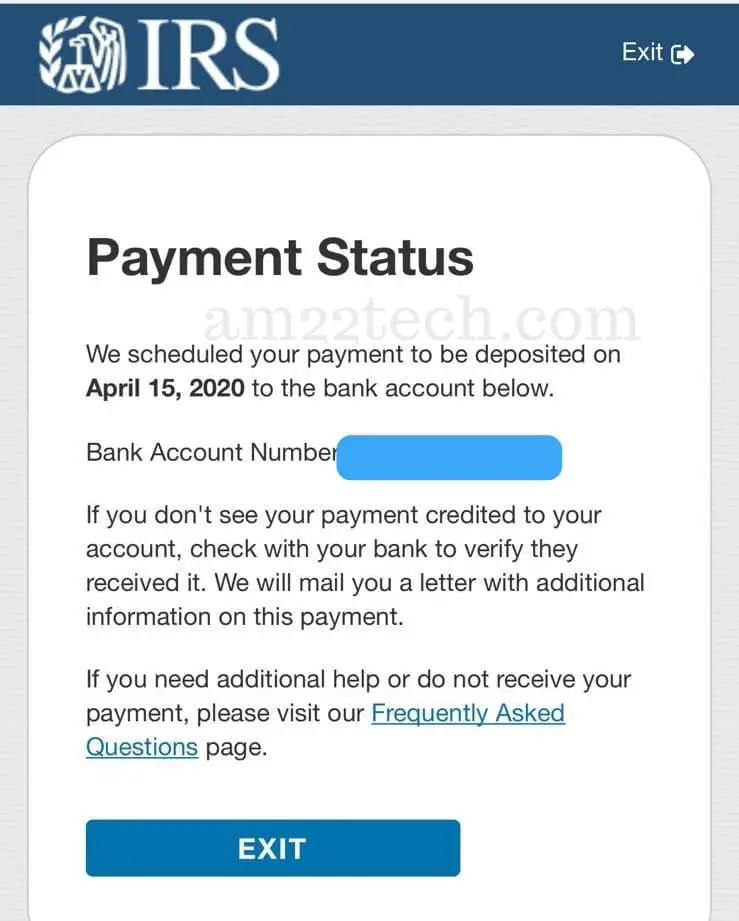

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

How Much Will I Get

Payments can be as small as $200 or as large as $1,050. How much you receive depends on three factors: your income, your tax filing status, and whether or not you have dependents.

We break down each scenario in the chart below. First, find your tax filing status , then determine the appropriate row for your income and the appropriate column for your dependent status.

| $400 |

Recommended Reading: Is North Carolina Getting Another Stimulus Check

Also Check: Who Qualified For Stimulus Checks In 2021

I Received A Validation Key Letter Will That Delay My Refund

In the best interest of all our taxpayers, the Colorado Department of Revenue implements measures to detect and prevent identity theft-related refund fraud. The Department has a “Validation Key” process where information will be requested to be entered on Revenue Online to validate their Colorado refund. Please be aware that if you do not respond to the validation key letter in a timely manner your refund will be delayed. Visit the Identity Verification web page for more information.

We Received Your Return And May Require Further Review This May Result In Your New York State Return Taking Longer To Process Than Your Federal Return No Further Information Is Available At This Time

Once we receive your return and begin to process it, our automated processing system scans it for any errors or signs of fraud. Depending on the result of that scan, we may need to manually review it. This status may update to processing again, or you may receive a request for additional information. Your return may remain in this stage for an extended period of time to allow us to review. Once your return goes back to the processing stage, we may select it for additional review before completing processing.

Don’t Miss: When Were The Three Stimulus Checks Sent Out

Will Calling You Help Me Get My Refund Any Faster Or Give Me More Information

IRS representatives can research the status of your return only if:

- It’s been more than 21 days since you received your e-file acceptance notification,

- It’s been more than 6 months since you mailed your paper return, or

- The Where’s My Refund? tool says we can provide more information to you over the phone.

Millions In State Tax Refunds Heading To Unclaimed Property If Taxpayers Dont Claim Themcontinue Reading

BATON ROUGE Louisiana taxpayers have until Oct. 6, 2022, to claim millions of dollars in state income tax refunds before they become unclaimed property.

The Louisiana Department of Revenue sent letters to 20,400 individual and business taxpayers advising them to claim their refunds before they are transferred by law to the Unclaimed Property Division of the state treasurers office. More than $36 million in unclaimed refunds is due for transfer if not claimed from LDR.

To claim a refund, complete and return to LDR the voucher in the Notice of Unclaimed Property letter dated Aug. 18, 2022. The department will issue paper checks to all taxpayers submitting completed vouchers by the Oct. 6 deadline.

Any refund not claimed by the deadline remains the property of the taxpayer, and can be retrieved from the Unclaimed Property Division.

You May Like: When Did We Receive Stimulus Checks

What Is The 2021 Recovery Rebate Credit

That’s the official name of the third round of stimulus checks authorized by lawmakers during the pandemic, providing up to $1,400 per eligible person, including qualifying children claimed on a tax return.

That means a family of four could qualify up to $5,600 in stimulus money, assuming they earn under the income limit for the program. Under the law, the full amount is available to single taxpayers who earn less than $75,000 and married couples who earn less than $150,000.

Payments are gradually phased out for people who earn above those thresholds.

Find Out If Your Tax Return Was Submitted

You can file your tax return by mail, through an e-filing website or software, or by using the services of a tax preparer. Whether you owe taxes or youre expecting a refund, you can find out your tax returns status by:

-

at 1-800-829-1040

-

Looking for emails or status updates from your e-filing website or software

If you file your taxes by mail, you can track your tax return and get a confirmation when the IRS has received it. To do so, use USPS Certified Mail or another mail service that has tracking or delivery confirmation services.

You May Like: New Round Of Stimulus Check

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

I Claimed The Earned Income Tax Credit Or The Additional Child Tax Credit On My Tax Return When Can I Expect My Refund

According to the Protecting Americans from Tax Hikes Act, the IRS cannot issue EITC and ACTC refunds before mid-February. The IRS expects most EITC/Additional CTC related refunds to be available in taxpayer bank accounts or on debit cards by March 1, if they chose direct deposit and there are no other issues with their tax return. However, some taxpayers may see their refunds a few days earlier. Check Wheres My Refund for your personalized refund date.

Wheres My Refund? on IRS.gov and the IRS2Go mobile app remains the best way to check the status of a refund. WMR on IRS.gov and the IRS2Go app will be updated with projected deposit dates for most early EITC/ACTC refund filers by February 19.

Don’t Miss: How To See Stimulus Check History

Irs Operations During Covid

We’re open and processing mail, tax returns, payments, refunds and correspondence. However, COVID-19 continues to cause delays in some of our services. Our service delays include:

- Live phone support

- Processing tax returns filed on paper

- Answering mail from taxpayers

- Reviewing tax returns, even for returns filed electronically

Information about IRS safety protocols can be found in the Treasury COVID-19 Workplace Safety PlanPDF.

Check this page periodically for updates.

I Have Not Received My Tax Refund Can I File A Second Tax Return

No, you should not file a second tax return if you still have not received your tax refund. Kindly take all the precautionary measures such as waiting for more than 21 days, checking the wheres my refund portal, etc. Before, you make any decisions such as filing form 1040-X to amend your original tax return. Any reaction decision might result in further delay. Kindly be patient, and IRS will return your tax.

Also Check: State Of Maine Stimulus Check

Stimulus Check Irs Phone Number: Where To Call

The IRS Economic Impact Payment phone number is 800-919-9835. You can call to speak with a live representative about your stimulus check.

Be prepared to sit on hold, though. If the automated responses cant answer your questions and youd like to talk to a live operator, you may join a long waiting list. Some people say they havent even been able to get through.

Thats why the IRS recommends using its dedicated stimulus check portal for fast assistance. It also reminds those who are eligible for a stimulus check but arent required to file a tax return to use the Non-Filers tool to register for their payment.

Looking for more information about stimulus checks? Check out our stimulus check FAQ page for answers to common payment questions.

Read Also: How To Change Your Bank Account For Stimulus Check

Check The Status Of Your Refund

The best way to check the status your refund is through Where’s My Refund? on IRS.gov. All you need is internet access and this information:

- Your Social Security numbers

- Your filing status

- Your exact whole dollar refund amount

You can start checking on the status of you return within 24 hours after the IRS received your e-filed return, or four weeks after mailing a paper return.

Generally, the IRS issues most refunds in less than 21 days, but some may take longer.

On the go? Track your refund status using the free IRS2Go app. Those who file an amended return should check Wheres My Amended Return?

You May Like: How Much Stimulus Check 2021

What Can Slow Down Your Refund

- Your return was selected for additional review. As refund fraud resulting from identify theft has become more widespread, were taking extra steps to review all individual income tax returns we receive to be sure refunds go to the rightful owners. Additional safeguards can mean that it takes us longer to process your refund. However, our goal is to stop fraudulent refunds before theyre issued, not to slow down your refund. Learn more about our refund review process and what we’re doing to protect taxpayers.

- Missing information or documents. If we send you a letter requesting more information, please respond quickly so we can continue processing your return.

- Errors on your return. We found a math error in your return or have to make another adjustment. If the adjustment causes a different refund amount than you were expecting, we will send you a letter to explain the adjustment.

- Problems with direct deposit. If you requested direct deposit, but the account number was entered incorrectly, your bank won’t be able to process the deposit. When this happens, your bank notifies us, and we will manually re-issue your refund as a check. This process could take up to 2 weeks between the time we receive notification from the bank and when you receive the check.

Three Arrested On Charges Of Defrauding State Disaster Relief Programcontinue Reading

BATON ROUGE Three Louisiana residents face felony charges after allegedly defrauding a state program that offers sales tax refunds on personal property destroyed in a natural disaster.

Based on a Presidential declaration, citizens can apply for a refund of sales tax they paid on items lost during a declared disaster.

Starr Carbo, Johnnie Mae Ricard and Erica Williams, all of Westwego, are charged in connection with fraudulently preparing and submitting Natural Disaster Claim for Refund of State Sales Taxes Paid forms following Hurricane Ida in 2021.

Investigators with the Louisiana Department of Revenue say the three women, working for Global Tax Service, charged clients as much as $110 to prepare and submit the sales tax refund form using false information and inflating the value of the losses. The companys clients told investigators they had not provided the information that was submitted on their behalf.

Carbo, Ricard and Williams were booked into the East Baton Rouge Parish Prison on charges of Injuring Public Records, which can result in a sentence of up to five years and fines of up to $5,000.

LDR wants the citizens of Louisiana to know that the Natural Disaster Claim form is available for free on its website, revenue.louisiana.gov.

LDR is committed to preserving the funds available to those who qualify for this program and continues its investigation into disaster related fraud, said Secretary of Revenue Kevin Richard.

Recommended Reading: When Were The Stimulus Checks Issued

I Need Help With Rent

I need help with rent.

If you are behind on your rent and at risk of losing your home, apply at a state or local level for emergency rental assistance:

I lost my job.

Get an extra $300 per week andunemployment benefits extended until 9/6/21.

Find your states Unemployment Benefits and sign up:

Where Is My Refund

Where is my refund? It is the first portal to check your tax refunds. If you are a desktop user, then kindly click on the button given below, and it will take you to the official web page IRS, where you can easily check all of your tax refunds.

The refund webpage is not very hard to find the page on the official website of the Internal Revenue Service. You can simply visit the official website of IRS.Gov and click on the refund button at the header. It will directly take you to the refund page.

You May Like: Sign Up For Fourth Stimulus Check

If You Didnt Get The Full Economic Impact Payment You May Be Eligible To Claim The Recovery Rebate Credit

If you didnt get any payments or got less than the full amounts, you may qualify for the credit, even if you dont normally file taxes. See Recovery Rebate Credit for more information.

The tool is closed and it will not be available for other payments including the second Economic Impact Payment or the Recovery Rebate Credit. Economic Impact Payments were an advance payment of the Recovery Rebate Credit. You may be eligible to claim the credit by filing a 2020 1040 or 1040-SR for free using the IRS Free File program. These free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

If you submitted your information using this tool by November 21, 2020 or by mail for the first Economic Impact Payment, IRS will use that information to send you the second Economic Impact Payment, if youre eligible.

You can check your payment status with Get My Payment. Go to IRS.gov Coronavirus Tax Relief and Economic Impact Payments for more information.

Advance Child Tax Credit

Even if you dont pay any taxes, you may qualify for a refund of the CTC.

The CTC was expanded under the American Rescue Plan Act of 2021 for tax year 2021 only. If you are eligible, you should have begun receiving advance Child Tax Credit payments on July 15. The payments will continue monthly through December 2021. Under ARPA, families are eligible to receive:

- Up to $3,000 per qualifying child between ages 6 and 17

- Up to $3,600 per qualifying child under age 6

The Internal Revenue Service began sending out letters in early June to more than 36 million families who may be eligible for the monthly payments. Most families do not need to do anything to get their payments, as long as theyve filed their 2020 or 2019 tax return. Learn more about the letter and how it can help you determine your eligibility.

Dont Miss: When Did The Third Stimulus Check Go Out

Read Also: Will There Be Another Stimulus Check In California