What Else Can You Do

Another action you can take is to call the IRS at 1-800-829-1040 to see whats going on if you feel its been way too long.

However, the IRS has warned that wait times to speak to a representative may be long.

And in most cases, no further action is needed beyond checking the status of your refund.

If the IRS needs more information, it will send you a letter.

Its tough to say how long it will take to receive your refund, but the IRS claims it can take up to four months which depends on a few factors.

The resolution of these issues could take 90 to 120 days depending on how quickly and accurately you respond, and the ability of IRS staff trained and working under social distancing requirements to complete the processing of your return, the IRS said.

To avoid these problems next year, Robert Farrington, founder of The College Investor, which has been tracking tax season and the IRS for almost a decade now, recommends waiting a little longer than usual to file for a return.

This is because of all major pieces of legislation that passed, which included stimulus checks and an enhancement to Child Tax Credit payments.

You might need to wait until late February depending on when you get your paperwork and forms to file your taxes, Mr Farrington said.

He also recommends contacting the IRS if youve been waiting on your refund more than six weeks.

What Happens When You Call The Irs About Stimulus Checks

In order “to protect the public and employees, and in compliance with orders of local health authorities around the country,” the IRS says it is offering very limited services right now and no live customer service assistance over the phone. The IRS still operates an automated phone service where you can get some information, but the agency says that this line does not offer any help regarding stimulus check payments:

“IRS phone lines supported by customer service representatives for both taxpayers and tax professionals are not staffed at this time. To check on regular tax refund status via automated phone, call 800-829-1954. “

When you call the IRS’s 800 number, a voice says, “At this time, we are unable to provide live assistance due to reduced staff levels.” The phone line offers warnings about scams and a directory with automated information regarding tax refunds, but nothing to address questions about stimulus payments. “We apologize for the inconvenience,” the voice says.

It certainly doesn’t help that, long before the coronavirus pandemic, the IRS’s budget has been cut severely and it sometimes struggled to answer even one-third of the phone calls placed by taxpayers. Even so, the IRS says that it had sent out 130 million stimulus payments through the first four weeks of the program, and it estimates a total of 150 million payments will be delivered in total.

Have All Of Your Personal Information Ready

Once you get through, you will need to verify your identity. Make sure you have all of your relevant documents and personal information at hand, including:

- Your Social Security Number , address and Date of Birth

- Individual Taxpayer Identification Number for taxpayers without a Social Security number

You may also be asked about your tax filing status: single, head of household, married and filing joint tax return, or married filing separate tax return.

Details of your tax return from last year may be required and possibly the one before that if you only filed for one of those years.

Don’t Miss: Get My Payment Stimulus Checks

A Number Of Factors Could Be Causing The Holdup

It anticipates bringing back additional workers as state and. Chime stimulus check update chime not depositing stimulus checks chime credit builder card work : Without a doubt, the internal revenue service provides us with a lot of tools and services to keep us open the irs page for checking the status of stimulus payments from here. The irs stimulus check timeline.

What If I Did Not Receive Notice 1444

If for some reason you didnt get a Notice 1444 informing you of the stimulus check and the number to call, our recommendation would be to try calling 800-919-9835. As far as we know, thats the number for everyone.

If you cant get through on the stimulus check number, you could also try phoning the general customer service hotline , but so far weve not heard that people are ending up on the dedicated stimulus check service through that and the service is extremely limited. .

Recommended Reading: 4th Stimulus Check For Single Person

You May Like: Didnt Get Any Stimulus Checks

Special Reminder For Those Who Dont Normally File A Tax Return

People who dont normally file a tax return and dont receive federal benefits may qualify for stimulus payments. This includes those without a permanent address, an income or bank account.

If youre eligible and didnt get a first, second or third Economic Impact Payment or got less than the full amounts, you may be eligible for a Recovery Rebate Credit, but youll need to file a tax return.

Dont Miss: File For Missing Stimulus Check

Amount And Status Of Your Third Payment

You can no longer use the Get My Payment application to check your payment status.

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending your payment. Were also sending Letter 6475 through March 2022 confirming the total amount of the third Economic Impact Payment and any plus-up payments you were issued for tax year 2021.

You can also securely access your individual tax information with an IRS online account to view your total Economic Impact Payment amounts under the 2021 tax year tab. You will need the total of the third payment and any plus-up payments you received to accurately calculate the 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022.

Recommended Reading: Irs.gov Refund Stimulus Check

Contacting The Irs In Person

Also Check: How Much Was All The Stimulus Checks

California Adjusted Gross Income

You must have $1 to $75,000 of California AGI to qualify for GSS II. Only certain income is included in your CA AGI . If you have income that’s on this list, you may meet the CA AGI qualification. To receive GSS II and calculate your CA AGI, you need to file a complete 2020 tax return by October 15, 2021. Visit Ways to file, including free options, for more information.

Income included in CA AGI

Generally, these are included in your CA AGI:

- Wages and self-employment income

- Gains on a sale of property

Visit Income types for a list of the common types of income.

Income excluded from CA AGI

Generally, these are not included in your CA AGI:

- Social Security

- Supplemental Security Income /State Supplementary Payment and Cash Assistance Program for Immigrants

- State Disability Insurance and VA disability benefits

- Unemployment income

You would generally not qualify for GSS II if these were your only sources of income. However, if you have income that is included in CA AGI in addition to this list, you may qualify for GSS II.

For information about specific situations, refer to federal Form 1040 and 1040-SR Instructions and California 2020 Instructions for Form 540. Go to Line 17 of Form 540 for CA AGI.

If you receive Social Security

You may be wondering whether or not you qualify for GSS II if you receive Social Security income. Social Security income is not included in CA AGI. However, if you have $1 or more of CA AGI , you may qualify for GSS II.

Recommended Reading: 4th Stimulus Checks For Social Security Recipients

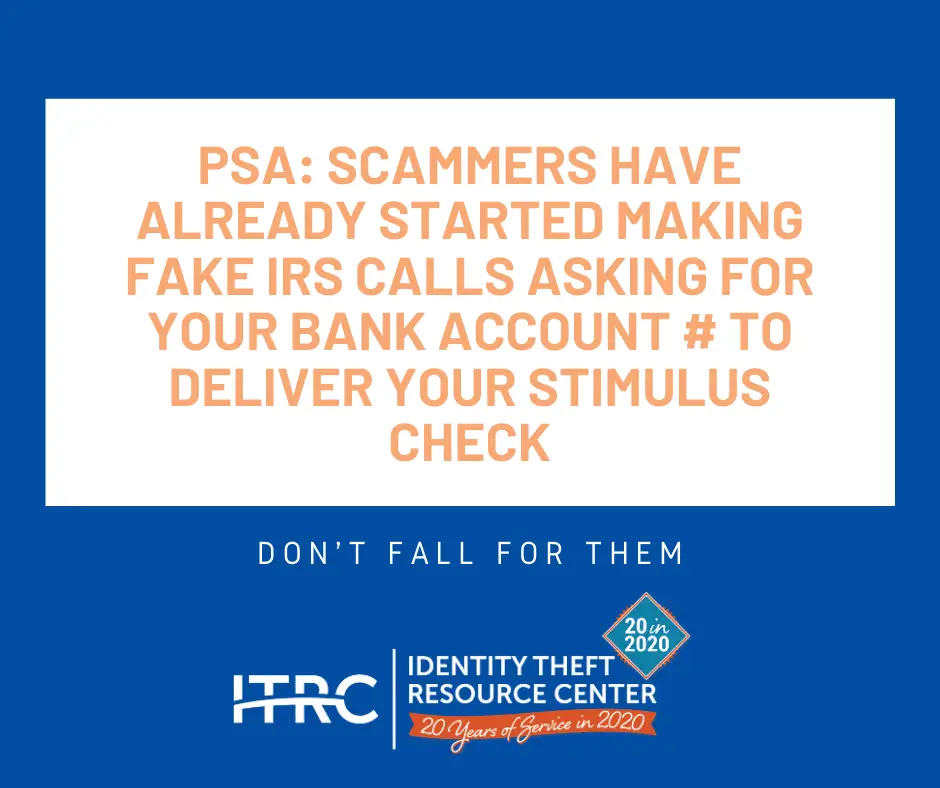

The Irs Wont Call About Your Stimulus Money

Most people have already gotten their economic stimulus payments, but the Internal Revenue Service is still sending them out. If you havent gotten yours yet or have questions about it, the IRS has a number you can call to get answers to common questions.

But the IRS wont be calling you.

Scammers pretending to be from the government can rig up caller ID to look like a call is coming from the government. But the truth is: Government agencies usually will not call or email you especially about something related to money. They almost always contact you by US mail.

If you have questions about Economic Impact Payments, the IRS urges people to visit their website, IRS.gov, to get answers to frequently asked questions. But you also can call the IRS at 800-919-9835.

Look, scammers like to pretend to be from the government to get your money or information. Theyll say theyre from Medicaid or Medicare, offering help getting medicine or equipment, or asking to verify your information. They pretend to be from the Social Security Administration, saying theres been fraud or another problem with your Social Security number and again needing to verify your number. And scammers love to say theyre from the IRS demanding payment or theyll arrest you.

But remember: if you get a call or email from the IRS or any government agency asking you for personal information or money, thats a scam. Hang up the phone or delete the email.

Irs Phone Numbers And Website

At www.irs.gov you can find:

- Forms, worksheets, and publications needed to complete your return

- Advice and FAQs

- Information on new and changing tax laws

- Links and information for your state taxes

- Online tools and calculators

To contact the IRS, call:

- Customer service 800-829-1040

- Questions about refunds and offsets to IRS liabilities 800-829-1954

- Taxpayer advocate service 877-777-4778

To pay tax by credit card Call any of these numbers:

To learn more, see these tax tips:

- Amended Return Form 1040X

The tax experts at H& R Block outline how students and parents can file Form 8863 and document qualified expenses. Read about Form 8863 here.

Recommended Reading: Is There More Stimulus Money Coming Out

How To Get Through To The Irs

Whatâs a taxpayer to do if you have questions and the information in your online account doesnât solve the mystery? What if the IRS sends you a billing notice for something you already paid?

Your first step should be to check your online account at IRS.gov. This free account is free to set up, and allows you to view information about your balances, prior tax records, payments and economic impact payments .

If your online account doesnât have the information you need, Bell offers a few tips for maintaining your cool as you navigate IRS systems during this incredibly trying time.

Economic Stimulus Check: Estragos

Early last year, the virus wreaked havoc in meatpacking plants, where workers work closely together on production lines, but also in other areas that have yet to be replenished.

The UFCW union, which represents approximately 80% of the workers in the beef and pork industry, and 33% of the workers in the poultry sector in the country, considers that at least 132 employees of packing plants in meat died of COVID-19 and at least 22,000 were infected.

Don’t Miss: I Didn’t Receive My Third Stimulus Check

Questions About Your Stimulus Check You Can Soon Call The Irs

May 21, 2020 / 12:15 PM / MoneyWatch

The federal stimulus payments now on their way to 150 million taxpayers have generated a flood of questions from consumers, many of whom have expressed frustration at their inability to get an answer or even someone on the phone from the IRS. But help is on the way, with the tax agency on Monday saying its adding 3,500 workers who will take questions about the checks.

However, its unclear whether taxpayers with complicated situations will be able to get answers about their stimulus checks, as the IRS says the workers will answer some of the most common questions about the payments. Based on emails and messages to CBS MoneyWatch, the most common query is when someone will receive their money.

To date, about 130 million of 150 million Americans have received their payments, according to the IRS. The stimulus payments are $1,200 for single people who earn less than $75,000, while married couples who earn less than $150,000 will receive $2,400. Children under 17 are eligible to get $500.

The goal of the payments, which were authorized by the Coronavirus Aid, Relief and Economic Security, or CARES, Act, is to help Americans weather the impact of the coronavirus pandemic.

The IRS didnt immediately return a request for comment. The IRS said in the statement that it is starting to add 3,500 telephone representatives, although its unclear if these are new hires or existing staff.

Also Check: When Is The Irs Mailing Stimulus Checks

No Matter How You File Block Has Your Back

You May Like: How To Claim Stimulus Check 2021

Havent Received Your Third Stimulus Check Call The Irs Phone Number And Tell Them

If you havent received your third government stimulus payment yet, theres a way to track it down without going to the IRS website and navigating the seemingly endless maze of menu links, FAQs and status messages.

Stimulus Update: States Give Out Thousands of Bonus $1,000 Checks Will You Get One?

Just pick up your phone and punch in these 10 numbers: 800-919-9835. Thats the IRS Economic Impact Payment phone number, which connects you with a live representative.

As noted on the Toms Guide website, the phone number is a good option if you have a hard time navigating the IRSs dedicated stimulus check website, or if you have a question that cant be answered on the site.

Just keep in mind that the IRS has been overwhelmed with inquiries during the pandemic, with millions of Americans clogging up the phone lines to ask about their tax refunds, stimulus payments and other benefits.

More: A Petition Nearing 3 Million Signatures Calls for $2,000 Monthly Stimulus Checks for Every American

When you call the number, youll likely be greeted by an automated recording that will attempt to help you before youre connected with a live representative. Be prepared to sit on hold for a while, and make sure you have your questions and basic personal information ready.

Meanwhile, something you should never do is accept phone calls from someone claiming to be with the IRS the IRS never calls. If someone calls you claiming to be with the IRS, they are almost certainly trying to scam you.

Lost Or Stolen Checks

Contact the paying agency and report the loss or theft. You will be sent information on the check claims process, including forms you must return for processing.

After you have completed all the required steps, you can call and request and update of the status of your claim:

1-855-868-0151, option 1

Read Also: Filing For Stimulus Check 2021

Received A Payment In Error

If you received the Golden State Stimulus payment and believe this is an error, please review the eligibility qualifications above to verify this is an erroneous payment. Once verified, follow the instructions that correspond to the payment received:

Direct deposits:

Paper checks that have not been cashed:

ATTN: Golden State Stimulus FundFranchise Tax Board