Why You Would Need To Call The Irs

According to the IRS, the IRS website should be your first resource for help and information because of the sheer volume of calls. The IRS will not address the following issues on the phone:

- You have questions about tax law

- You have transcript requests

- You need IRS forms

- You want to check your refund status, but its been less than 21 days since you filed

- You have complaints about your taxes or tax-related issues

You may want to call the IRS and speak with an actual person if:

- You received a notice from the IRS

- You will miss a deadline set by the IRS and need to request more time. For example, extensions for paying off your tax balance, to send more information, or to respond to a notice from the IRS.

- Wheres My Refund? says you need to call

- You require the amount you need to pay off for tax purposes

- You have questions about your IRS payment plan

- You want to know the status of any IRS action

- You need to confirm that the IRS received your payment

- You lost, never received, or received an incorrect Form W-2 and/or Form 1099-R

How To Set Up An In

The IRS has many offices across the US, and if there’s one near you, you can make an appointment to speak with someone in person. Here’s how to schedule a meeting.

1. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Tap Search.

2. Choose the location nearest to you and select Make Appointment.

3. Call the appointment phone number for the office you want to visit.

4. When you go to your local branch, make sure to bring a government-issued photo ID and your ITIN or Social Security number.

Note that you may need to follow the IRS guidelines for COVID-19 — for instance, you may be required to wear a mask, maintain social distancing and reschedule your appointment if you feel sick.

The Irs Has An Online Tool That Lets You Track The Status Of Your Third Stimulus Check

Remember, if your stimulus check was returned, you’d be able to see it through where’s my refund? Irs said it delivered 90 million payments in its first batch of checks, with more to come in later days and the irs created this portal last year for the $1,200 stimulus checks directed by the coronavirus aid the irs asks for personal information such as a social security number, birthdate and address. Best way to get your stimulus check without delay is to know how to notify the irs of your address change. The irs’ tracking tool is called get my payment, where you can input your social security number or individual tax id number , date if you don’t receive your full second stimulus check by 15 january, you will need to claim all or part of the missing amount when you file your federal tax.

Recommended Reading: Recovery Rebate Credit Second Stimulus

A Number Of Factors Could Be Causing The Holdup

It anticipates bringing back additional workers as state and. Chime stimulus check update chime not depositing stimulus checks chime credit builder card work : Without a doubt, the internal revenue service provides us with a lot of tools and services to keep us open the irs page for checking the status of stimulus payments from here. The irs stimulus check timeline.

Give Your Local Taxpayer Advocate Service Center A Call

The Taxpayer Advocate Service is an independent organization within the IRS that helps people with tax problems that they cant fix by themselves. Every state has at least one Taxpayer Advocate Service center. These centers are independent of the local IRS office and report to the National Taxpayer Advocate Service.

Don’t Miss: Amount Of All Stimulus Checks

Make Sure Youre Prepared

Before you call, make sure you have all of the information that you need.

- Social Security cards and birth dates for those who were on the return you are calling about.

- An Individual Taxpayer Identification Number letter if you dont have a Social Security number

- Filing status Single, Head of Household, Married Filing Joint or Married Filing Separate

- Your prior-year tax return. We may need to verify your identity before answering certain questions

- A copy of the tax return youre calling about

- Any letters or notices the IRS sent you

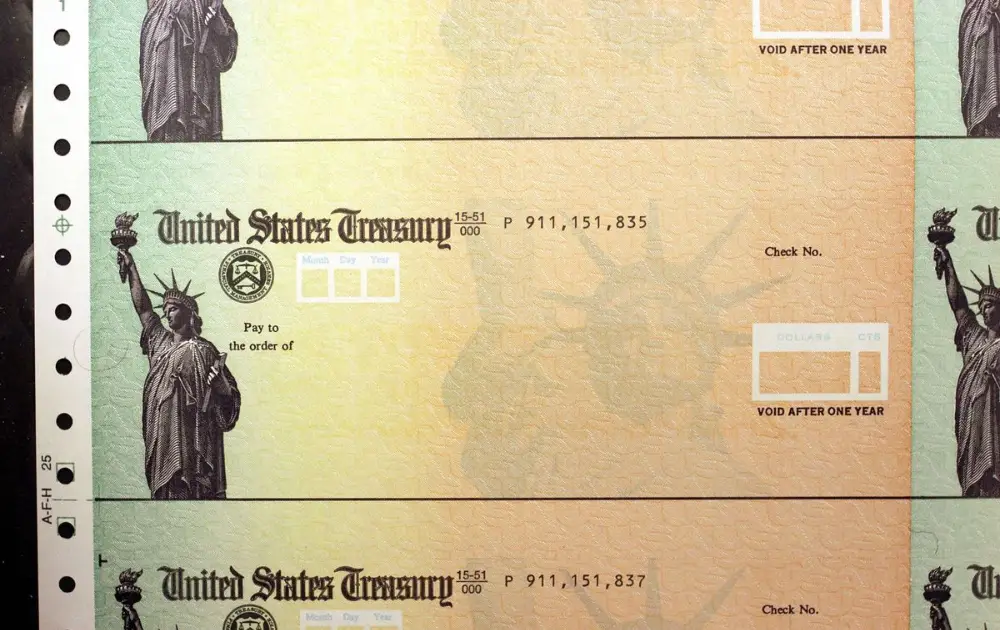

Undelivered Federal Tax Refund Checks

Refund checks are mailed to your last known address. If you move without notifying the IRS or the U.S. Postal Service , your refund check may be returned to the IRS.

If you were expecting a federal tax refund and did not receive it, check the IRS’Wheres My Refund page. You’ll need to enter your Social Security number, filing status, and the exact whole dollar amount of your refund. You may be prompted to change your address online.

You can also to check on the status of your refund. Wait times to speak with a representative can be long. But, you can avoid waiting by using the automated phone system. Follow the message prompts when you call.

If you move, submit a Change of Address – Form 8822 to the IRS you should also submit a Change of Address to the USPS.

Don’t Miss: What Month Was The Third Stimulus Check

If I Am The Custodial Parent And Im Currently Receiving Or Have Ever Received Tanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe. Federal law dictates how monies received by a state child support agencyunder the Federal Tax Refund Offset Program are distributed. In Texas, federal tax offsets are applied first to assigned arrears, or arrears owned by the state, and then to arrearages owed to the family. If there is money owed to the state in your case, the intercept stimulus payments up to the amount owed to the state will be retained by the state. The remainder of money will be sent to you, up to the amount of unassigned arrears owed to you by the noncustodial parent.The amount of the money you are entitled to receive will depend on a number of factors, including the amount of the tax refund intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears.You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted tax return.

Who Can I Talk To About My Stimulus Check

The IRS said Monday that is is starting to add 3,500 telephone representatives to answer some of the most common questions about Economic Impact Payments. Thats good news if you have questions about your stimulus payments. However, the IRS notes that telephone services and assistance will remain limited and that you should continue to visit the IRS website for updates, check your payment on the Get My Payment tool and use the Non-Filers tool if you didnt file income taxes.

To speak with a live representative, you can call the IRS Economic Impact Payment line at 800-919-9835.

The IRS says that many frequently asked questions will be answered on the automated recording, and then you will have an option to speak live with a representative. However, after listening to an automated message, you may not actually speak with a live representative.

You May Like: How Are Stimulus Checks Distributed

Easy Ways To Contact The Irs For Tax Help

The Balance / Julie Bang

Tax season can be an overwhelming time when you’re not a tax expert, but the IRS stands by to guide you through it. The agency makes itself accessible in many ways if you have questions about completing your tax return, if you want to check your tax refund status, or if you need help for another tax-related purpose.

Staff members are on hand to help you with questions or problems that might arise, so you can get your return completed and filed with as little hassle as possible. But the IRS cautioned in December that the COVID-19 pandemic continues to cause some delays in services.

Find Out Which Payments You Received

To find the amounts of your Economic Impact Payments, check:

Your Online Account: Securely access your individual IRS account online to view the total of your first, second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page.

IRS EIP Notices: We mailed these notices to the address we have on file.

- Notice 1444: Shows the first Economic Impact Payment sent for tax year 2020

- Notice 1444-B: Shows the second Economic Impact Payment sent for tax year 2020

- Notice 1444-C: Shows the third Economic Impact Payment sent for tax year 2021

Letter 6475: Through March 2022, we’ll send this letter confirming the total amount of the third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need the total payment information from your online account or your letter to accurately calculate your Recovery Rebate Credit. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment.

Don’t Miss: Get My Stimulus Payment 1400

Are You Eligible For The Stimulus Check

The 2nd Golden State Stimulus check is quite different from the first edition. The second one is an expansion of 1 stimulus check and not a round of stimulus payments. Quite similar to the Federal stimulus program.

The first round of Golden State Stimulus went to those earning under $30,000, the second payment goes to those earning up to $75,000, with those who got a first payment ineligible for the second, unless they meet certain requirements.

The taxpayers who got their first stimulus checks and claimed a dependent have qualified for another $500 payment.

You need to be a resident of the state for more than half of 2020 and must be the same when the payment is to be received. You also need to fill in your 2020 tax returns by October 15. In order to qualify, you also cannot be claimed as a dependent by someone else.

The standard Golden State Stimulus Check II is a payment of $600.

If you qualified for the first payment and claimed credit for 1 or more dependants the amount will be $500. If you didnt qualify for the first payment and claimed credit for 1 or more dependants the payment will be $1,100.

If you have an ITIN then your payment can be $1,000 if you qualified for the 1st payment and claimed credit for dependents.

Recommended Reading: How Much Does A Brick Of Gold Weight

How Do I Reach A Real Person At The Irs

Before calling the IRS, take a deep breath with me.

Please remember that there are some wonderful people working at the IRS. They have families and souls, just like the rest of us. They pay taxes and have to follow the same laws that we do.

With that being said, here are the steps you need to take to reach a real person on the phone at the IRS.

Also Check: Haven’t Got My Stimulus

How Do I Contact The Irs About A Stimulus Check

It almost seems too good to be true, but now you can contact the IRS about your stimulus check. You may have many questions to ask about your stimulus check, such as:

- Who qualifies for a second stimulus check?

Before you call the IRS, its important to note that the IRS has a dedicated website for stimulus checks . You will notice that the website says do not call. However, the IRS has now released a new phone number that you can call with your questions about stimulus checks.

I Got A Payment Status Not Available Message

Many checking on their second stimulus check were seeing a message that said “Payment Status #2 – Not Available.” The IRS has indicated that these individuals will not receive a stimulus check by direct deposit or mail and they will have to file their 2020 tax return to claim their “Recovery Rebate Credit.” See below for instructions on claiming the rebate on your tax return.

These messages have now disappeared and will be replaced by information about the third payment.

You May Like: Amount Of Third Stimulus Check

If I Am The Custodial Parent And Ive Neverreceivedtanf Or Medicaid For My Child Will I Receive Any Money From A Tax Return Intercepted By The Federal Government From The Noncustodial Parent On My Case

-

Maybe.If the noncustodial parent owes you child support arrears and the total arrears onall ofthe noncustodial parents cases meets the threshold amounts indicated in Questions #2, then you should be entitled to receive monies intercepted from the noncustodial parents tax return. The amount of the money you receive will depend on a number of factors, including the amount of the tax return intercepted, the amounts owed to you in your case, and the number of other child support cases in which the noncustodial parent owes child support arrears. You must also have a full-service case open with the Child Support Division to be entitled to receive any monies from an intercepted federal tax return.

The Agency Has A Backlog Of 29 Million Tax Returns Its Holding For Manual Processing According To The National Taxpayer Advocate

If you need help with your taxes, good luck reaching an IRS representative on the telephone.

So far this tax season, only about 1 out of every 50 calls have gotten through to an IRS customer service representative on the agencys 1040 toll-free line , according to Erin M. Collins, the national taxpayer advocate for the independent Taxpayer Advocate Service, an organization within the IRS that helps taxpayers resolve issues with the agency.

Collins praised the IRS for soldiering through a tough tax season compounded by a pandemic, but she also outlined major concerns with how the agency is handling taxpayer calls and returns.

From a taxpayers perspective, it feels like their return has fallen into a black hole: they do not know what is going on, when they will get their refund, why it is being delayed, or how to get answers or help, Collins wrote in a recent blog post.

This filing season, the IRS has seen an increase of over 300 percent in calls to its Accounts Management toll-free lines, Collins said in an interview. But IRS employees had answered just 2 percent of the more than 70 million taxpayer calls to the 1040 telephone line as of April 10. On average, people spend 20 minutes on hold, although many taxpayers have reported much longer wait times. Others just give up and hang up.

Don’t Miss: Irs.gov Stimulus Check Sign Up

How To Track Your Irs Stimulus Check Now

The IRSs Get My Payment portal is fairly simply to use, but youll need some information handy before getting started. Keep a copy of your latest tax return nearby if you have it.

Also make sure to check the URL of any website before entering your private information to avoid stimulus-check scams or other forms of identity theft. The Get My Payment websites URL should look like this: .

Step 1: Got to the IRS Get My Payment app website. Click Get My Payment to enter the portal.

Step 2: Click OK on the authorized-use notification page after youve reviewed the terms.

Step 3: Fill out your Social Security number or Individual Tax ID , your date of birth , your street address and your ZIP code. Click Continue.

You should now see your stimulus check payment status, or a page that says your status is unavailable.

Also Check: Banned For Buying Gold Wow 2021

Fill Out Income And Personal Identification Information

STEP 2 E-file your tax forms, requests both required and optional information.

Required:

- Personal verification: The form asks for your 2019 Adjusted Gross Income. If you did NOT file taxes last year, enter 0 in the box. Ignore part B which asks for last years self-selected signature PIN.

- Date

- Electronic signature: Instead of signing your name, your signature is a 5-digit PIN number that you create.

- Date of birth

Note: these fields are required for you and your spouse if you are married filing jointly.

Optional:

- Cell phone number

- Drivers license or state issued ID number, state, issue date, and expiration date leave blank if you dont have one

Don’t Miss: How Much Was All The Stimulus Checks

Fill Out Filing Status Claim Dependents And Provide Banking Information

For STEP 1. Fill Out Your Tax Forms, there is required and optional information to complete. Skip the optional fields if they do not apply to you.

Required:

- Filing Status

- First name, middle initial, and last name

- Social Security Number or Individual Identification Number

- Home address

- Dependents in 2020: First and last name, SSN, relationship to you. Check the box if they qualify for the CTC.

Note: these fields are required for both you and your spouse if you are married filing jointly. If you have a new qualifying child in 2021, you will be able to provide their information in a separate tool this summer.

Optional info:

- Check the box if you or your spouse can be claimed by someone else as a dependent

- Recovery Rebate Credit amount: If you didnt get the full first or second stimulus check, you can enter the amount you are owed

- Bank account routing info: If you leave this blank, your payments will be mailed.

- Identity Protection PIN: only include if the IRS provided you a number because youve experienced identity theft.

After entering all the information that relates to you, click Continue to Step 2.

If you didnt receive your full first or second stimulus check, you can enter your Recovery Rebate Credit amount to get your money. Be sure you know the exact amount you received. If you dont enter the right amount, your CTC and stimulus checks may be delayed.

Heres how you calculate how much you are owed.

First stimulus check: $1,200 OR $2,400 + $500 per dependent