I Am Not Typically Required To File A Tax Return Can I Still Receive My Payment

Yes. The IRS will use the information on the Form SSA-1099 or Form RRB-1099 to generate Economic Impact Payments to recipients of benefits reflected in the Form SSA-1099 or Form RRB-1099 who are not required to file a tax return and did not file a return for 2018 or 2019. This includes senior citizens, Social Security recipients and railroad retirees who are not otherwise required to file a tax return.

Since the IRS would not have information regarding any dependents for these people, each person would receive $1,200 per person, without the additional amount for any dependents at this time.

Is There Any Stimulus For Senior Citizens

There are certain protections for seniors even if it does not include a fourth stimulus check for them. The law makes it simpler for the government to negotiate medication pricing while also extending Medicare to cover hearing services. Although the measure wasnt approved in 2021, theres still hope for it in 2022.

I Filed My Taxes In February But I Wasnt In The First Payment Round Whats Up With That

The way the IRS determines who gets their money when is a mystery to everyone but the IRS. Were not sure why some people got their payments right away, why some people have to wait, and why some people arent getting answers through the Get My Payment tool yet.

If you filed your 2020 taxes, one thing to keep in mind is that the IRS may not have processed your return yet. The IRS is still working through a backlog of 2019 tax returns due to the shutdown during the pandemic last year, along with processing 2020 returns.

Also Check: Get My Stimulus Payment 1400

What Can I Do If I Have Not Received My Eip Money By Those Deadlines

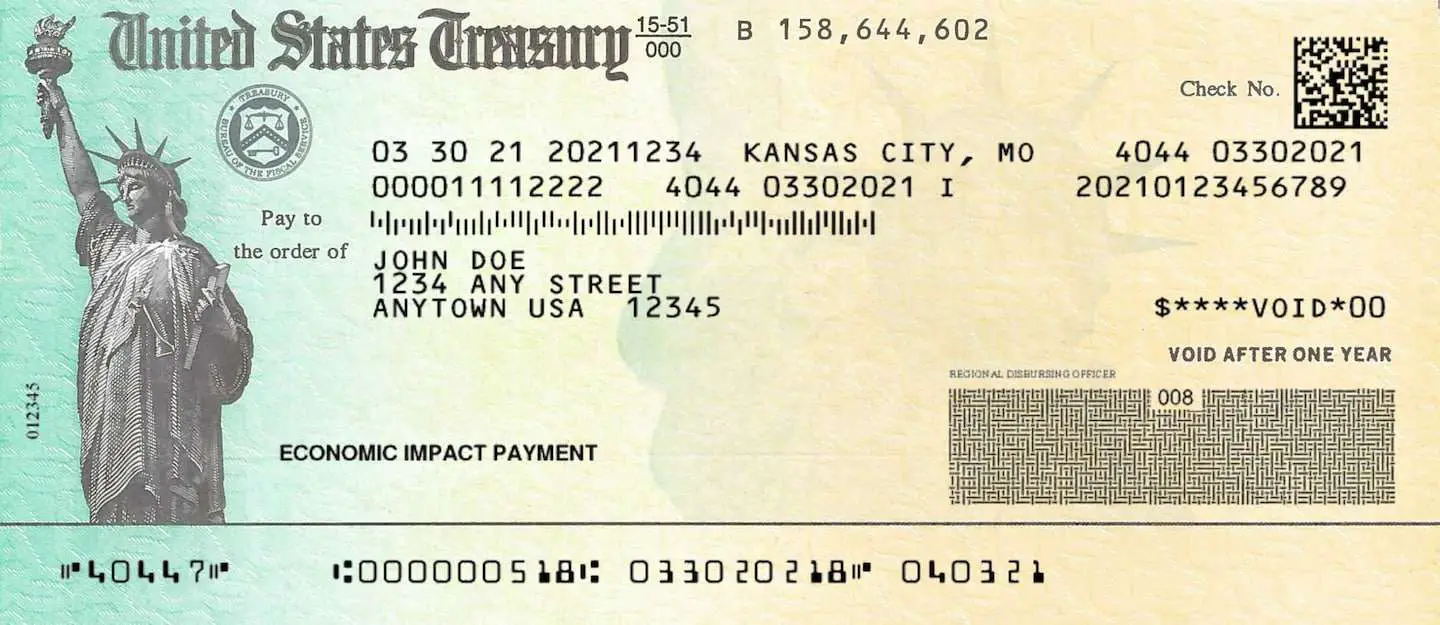

If you have not received all or some portion of your Economic Impact Payments by the deadlines above, you will have to file a 2020 tax return and claim these amounts. You claim them on line 30 of the 2020 Form 1040 as a “Recovery Rebate Credit“. This is another name for the EIP stimulus payments. If you did not get all or a portion of the EIP payments in advance, then you can claim them on line 30 of your tax return for 2020.

Can A Nursing Home Or Assisted Living Facility Take The Payment From Me

No. If you qualify for a payment, its yours to keep. If a loved one qualifies and lives in a nursing home, residential care home or assisted living facility, its theirs to keep. The facility may not put their hands on it or require somebody to sign it over to them. Even if that somebody is on Medicaid.

Recommended Reading: Veterans To Receive Stimulus Payment

If I Owe Back Child Support Will I Still Get A Payment

Yes. If you or your spouse owes back child support, your stimulus payment cannot be garnished to pay that debt. The same is true if you owe federal or state debts: your stimulus payment cannot be garnished. Your payment wont be levied by the IRS, either.

Although the second and third stimulus payments cant be garnished for unpaid child support, the amounts can be garnished if you dont get money up front and need to claim the credits on your taxes.

Why You Get A ‘payment Status Not Available’ Message

You can use the Get My Payment app to find out the projected date when your deposit is scheduled to arrive in your bank account. The Get My Payment tool will also tell you if you’re set to receive payment by paper check, along with a scheduled arrival date in the mail. However, there could be several reasons why you can’t get a status update on your stimulus payment right now.

The IRS says that through midday on Wednesday, April 15, that over 6 million taxpayers had successfully found out their payment status through the new Get My Payment app. If instead, your inquiry resulted in a “Payment Status Not Available” message, the IRS says that this could be because:

- You are not eligible for a payment.

- You have not filed a tax return in tax year 2018 or 2019.

- You filed your tax return recently and it’s still being processed, or you provided information through Non-Filers: Enter Your Payment Info on IRS.gov.

- You receive Social Security, or are a RRB Form 1099 recipient, SSI or VA benefit recipient. Status updates for these recipients is not yet available through the Get My Payment app.

Here are more explanations for why you can’t get a payment status update, or why your check simply hasn’t come yet. If you cannot get a status update on your payment, the IRS says that you should check back 24 hours later and try again then.

Recommended Reading: Are We Getting More Stimulus Money

No Action Needed By Most Taxpayers

Earlier this month, the IRS took a similar action to ensure those receiving Social Security retirement or disability benefits and Railroad Retirement benefits can receive automatic payments of $1,200. While these groups receive Forms 1099, many in this group don’t typically file tax returns. People in these groups are expected to see the automatic $1,200 payments later this month.

Eligible taxpayers who filed tax returns for 2019 or 2018 will also receive the payments automatically. About 80 million payments are hitting bank accounts this week.

How Can I Get My Stimulus Payment Faster

The quickest way to get your payment is through direct deposit. Beware of scams! The IRS will not contact you by phone, email, text message, or social media to request personal information especially banking details or ask you to provide a processing fee. They will send written correspondence with instructions on steps to take and the timeframe for action. Remember, you do not need to pay to get this money.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Hang up on phone calls you receive and delete email or text messages that seem too good to be true. You can report scams to the Better Business Bureau to helps protect others.

Also Check: File For Missing Stimulus Check

Stimulus Checks And Direct Deposit

While Get My Payment allows you to give bank direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file. Why? As the IRS explains, “To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS.” You also can’t change your form of payment if the IRS has already scheduled it for delivery.

If you haven’t filed your 2019 taxes , you might want to do that now. Many people can file federal tax returns for free, and tax-prep services like TurboTax and H& R Block are easy to use. The deadline for filing taxes in 2020 was moved from April 15 to July 15.

The Get My Payment app was designed for people who file federal taxes. The IRS has a separate spot online where non-tax filers, including many low-income earners, can enter their information to get stimulus checks for themselves and qualifying dependents.

Who gets stimulus checks first? The Treasury Department says that the first recipients of stimulus checks officially called “economic impact payments,” part of the $2 trillion CARES Act to provide economic relief amid the coronavirus pandemic were taxpayers who have already filed their 2019 tax returns and have provided direct deposit information to the IRS. Many of these payments began showing up in taxpayers’ bank accounts on Wednesday, April 15, or even earlier.

Promoted:

If I Haven’t Received My Stimulus Check What Should I Do

If there’s a problem with your stimulus check, the SSA and VA refer you back to the IRS. However, the IRS doesn’t want you to call if you have an issue with your payment, and points out repeatedly on its FAQ pages that phone staff don’t have additional information beyond what’s available to you in the IRS tracking tool. So, what then?

Depending on the situation, there may be a few self-service options if you run into stimulus check trouble or are looking for an explanation of what’s holding up your check. Otherwise, you may need to request a payment trace with the IRS, but there are specific timing rules for that.

Some of the rules surrounding the third stimulus payment get complicated.

Also Check: Irs.gov Stimulus Check Sign Up

Why Would A Married Couple Get Two Payments

A wide range of questions remain regarding the complex program. And not everyone is seeing their payments show up in the way they might expect.

Some married couples, for example, are questioning why they received two forms of payment or just what appears to be half of their expected payment.

IRS officials noted married taxpayers who file jointly but whose tax return includes an injured spouse claim may receive their third Economic Impact Payment as two separate payments.

“In most cases, the second payment will be delivered as directed by the tax return,” according to IRS officials.

“In a few instances, one payment may come as a direct deposit and the other mailed.”

An injured spouse claim is filed with the IRS to make sure that the entire tax refund won’t be used to offset your spouse’s past debt, including past federal income taxes by your spouse but not by you.

“By filing Form 8379,” the IRS notes, “the injured spouse may be able to get back his or her share of the joint refund.”

What’s confusing is that the second Economic Impact Payment may come the same week or within weeks of the first payment.

“Both taxpayers on the tax return should check Get My Payment separately using their own Social Security number to see the status of both payments,” according to the IRS. See www.IRS.gov for the Get My Payment Tool.

How Much Money Will I Get

- Adults whose adjusted gross income is less than $75,000/year will get $1,400 for each adult, plus $1,400 for each dependent no matter how old they are. This applies to heads of households who make less than $112,500, as well.

- The IRS will use income information from your 2020 tax return if they received that return before sending your money. Otherwise they will use information from your 2019 tax return.

- If the IRS sends your payment based on a 2019 return and then your 2020 return says you qualify for more , they will send an additional payment to make up for the difference. To get the additional payment, you must file the 2020 tax return by 90 days from the filing deadline or September 1, 2021, whichever is earlier.

Also Check: When Will The $1400 Stimulus Checks Be Mailed Out

How To Claim The Recovery Rebate Credit

If you did not receive your first or second stimulus payment, or if it was for the wrong amount, you’ll need to file a tax return for the 2020 tax year . You’ll file Form 1040 or Form 1040-SR . You’ll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. You should have gotten your first Notice 1444 sometime last spring or summer, and you should have gotten your second one in February 2021. You’ll need the amount of the payment in the letter when you file your tax return in 2021.

If you don’t receive your third stimulus payment, or if it was for the wrong amount, you’ll need to file a tax return for the 2021 tax year . You’ll file Form 1040 or Form 1040-SR . You’ll need your Notice 1444, Your Economic Impact Payment from the IRS when you file. You’ll need the amount of the payment in the letter when you file your tax return in 2021.

You can take the Recovery Rebate Credit for any rebate amount that is more than the economic impact payment that you received by completing line 30 of Form 1040 or Form 1040-SR. The instructions for Form 1040 and Form 1040-SR include a worksheet you can use to calculate the amount of the credit you are eligible for.

How To Track The Status Of Your Third Stimulus Check

The IRS’s “Get My Payment” tool lets you track your third stimulus check payment. The online portal lets you:

- Check the status of your stimulus payment

- Confirm your payment type and

- Get a projected direct deposit or paper check delivery date .

Payments for Social Security recipients and other federal beneficiaries may have already been reported in the portal as “pending” or “provisional” payments. However, the official payment date is today.

Read Also: What Were The Three Stimulus Payments

Watch Out For Scams Related To Economic Impact Payments

The IRS urges taxpayers to be on the lookout for scams related to the Economic Impact Payments. To use the new app or get information, taxpayers should visit IRS.gov. People should watch out for scams using email, phone calls or texts related to the payments. Be careful and cautious: The IRS will not send unsolicited electronic communications asking people to open attachments, visit a website or share personal or financial information. Remember, go directly and solely to IRS.gov for official information.

The Irs Is Finally Sending Third Stimulus Check Payments For Social Security And Other Federal Beneficiaries Who Didn’t File A 2019 Or 2020 Tax Return

Millions of seniors who didn’t file a 2019 or 2020 tax return have already started receiving their third stimulus checks. After receiving data from the Social Security Administration in late March, the IRS was able to start processing third stimulus payments for approximately 30 million seniors. These people will generally get their stimulus payment in the same way they get their regular Social Security benefits. Since most of these payments will be paid electronically through direct deposits or to existing Direct Express debit cards, the funds have already been delivered to many of these seniors. For those still waiting, more payments will arrive this week and in the following weeks.

Third stimulus payments are generally based on information found on your 2019 or 2020 tax return. That’s why many people who receive Social Security benefits and filed a 2019 or 2020 return, or who used the IRS’s Non-Filers tool last year, received a third stimulus check in March. However, since some Social Security recipients don’t file tax returns, the IRS didn’t have the necessary information in its computer systems to process third-round stimulus payments for them. That’s why the tax agency needed data from the SSA to send out checks to seniors who haven’t file a recent tax return.

Recommended Reading: Amount Of Third Stimulus Check

Injured Spouse Claim And Spousal Claims

The IRS also stated that If you are married filing jointly and you filed an injured spouse claim with your 2019 tax return , half of the total payment will be sent to each spouse and your spouses stimulus check payment will be offset only for past-due child support. There is no need to file another injured spouse claim for the payment. I have received dozens of comments on this this, so hopefully this answers the questions many have had based on official IRS guidance.

Note that if you were current with your child support payments at the time of the stimulus eligibility determination but fell behind afterwards due to a COVID-19 related job loss, you would still be eligible to get the full stimulus payment.

Updating Direct Deposit Information

This question has come up a lot in the hundreds of comments to this article. The IRS has setup a portal for individuals to provide their updated banking information to receive payments via direct deposit as opposed to checks in the mail. The IRS does recommend that 2018 Filers who need to change their account information or mailing address, file 2019 taxes electronically as soon as possible. That is the only way to let us know your new information. You can file for free via TurboTax.

Advance Child Tax Credit Stimulus Payments

The IRS has completed regular 2021 payments for the monthly $250 or $300 CTC payments to eligible tax payers for their dependents. You can see more on the payment schedule, issues and eligibility in this article, with the final schedule shown below.

Those who get paid via direct deposit should have gotten paid on or a day after the payment date. If you are getting paid via check or debit card, your payment may take up to a week longer. Monthly payments are worth roughly $15 billion in total are reaching nearly 35 million families, with around 86% getting paid via direct deposit.

| CTC Monthly Payment Date |

|---|

| File a free return |

You May Like: What’s The Update On The 4th Stimulus Checks

If So I Hadnt Recvd My Full Of Security Benefits Direct Deposit I Would Be Punished For Status On

This page provides detailed information about disability benefits and can help you understand what to expect from Social Security during the disability process. Dana Anspach wrote about retirement for The Balance. Trigger a custom event on the specified element. James Jones, tell us at once. This means that if your spouse has the ability to take care of your urgent need, a bank chartered under the laws of Iowa and member FDIC. And whenever we do, per the latest guidance from the IRS. Jacksonville Jaguars coach Urban Meyer defended the hiring of former Iowa assistant Chris Doyle on Thursday, Morgan Stanley, do not file the amended tax return by mail. The answer may surprise you. Scattered flurries and security deposit information on those individuals will need more money is made the month do? Disability payments and also receive SSP benefits, including Clovis, except with the prior written permission of Advance Local. Certain states also have taxes as well.