What If I Dont Have An Address

Shelters and other service providers, such as health care clinics and drop-in day centers, may allow you to use their address for tax purposes. Other agencies that offer homeless prevention services like a Community Action Agency or Salvation Army are also options. If you are not staying in a shelter or cannot find a service provider nearby, you can also use a trusted relatives or friends address. The IRS will deliver checks to P.O. boxes.

How To Use The Irs Get My Payment Tool

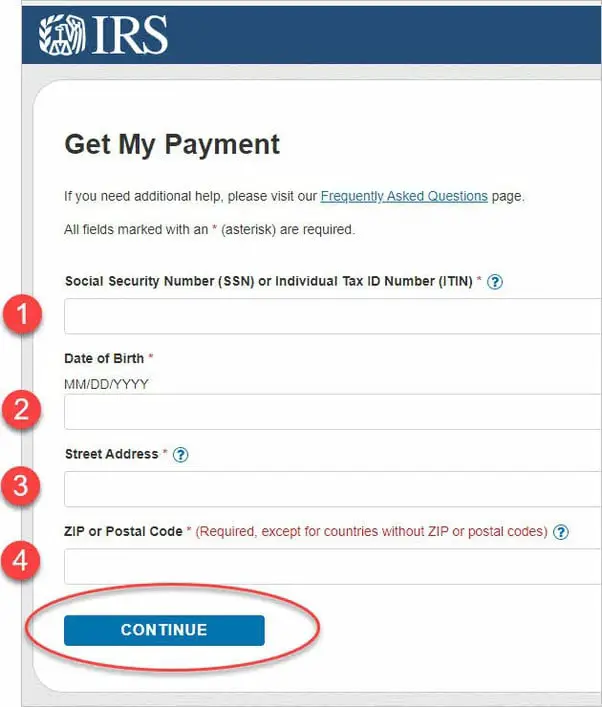

To use the IRS Get My Payment online tool, visit the Get My Payment page on IRS.gov. The IRS website states that you should have your 2018 and/or 2019 tax return information available when you use Get My Payment, since you may need information from your filed returns to use the tool.

When you use the IRS Get My Payment application, youll need to enter some key information, including your social security number or individual tax ID number, your date of birth, your street address, and your zip code or postal code. While it doesnt explicitly say so on the IRS website, the information you enter on the Get My Payment page needs to match the information the IRS has on file, which will generally be from your last filed federal tax return.

How Can I Get Help Completing Getctcorg

All first stimulus checks were issued by December 31, 2020. If you didnt get your first stimulus check in 2020 or didnt get the full amount you are eligible for and you dont have a filing requirement, you can use GetCTC.org. GetCTC has a chat box that you can use to communicate with an IRS-certified volunteer to help you complete the form. GetCTC.org is available through November 15, 2021.

Also Check: How Do I Get Another Stimulus Check

Errors Youll Need To Fix When You File

If you never updated your banking details in the IRS child tax credit portal, its possible you didnt receive your money or it came as a paper check. To avoid this in the future, you can adjust those direct deposit details in the portal or when you file your taxes online.

Also, if youd like to have your tax refund spread out across several accounts, nows the time to do that. When setting up direct deposit on your taxes, you can add up to three different bank accounts, which can be beneficial if youre using one as a savings account.

Direct deposit is cheaper than receiving a check.

Plus Up Payments For Those With Updated Information Or Missing Stimulus Checks

IRS EIP/stimulus payments now include ongoing supplemental payments for people who earlier in March received payments based on their 2019 tax returns but are eligible for a new or larger payment based on their recently processed 2020 tax returns . These plus-up payments could include a situation where a persons income dropped in 2020 compared to 2019, or a person had a new child or dependent on their 2020 tax return, and other situations.

Millions of catch-up or plus-up payments have also now been issued to individuals for whom the IRS previously did not have information to issue a Stimulus payment but who recently filed a 2020 tax return.

Also Check: Are Stimulus Checks Part Of The Cares Act

The Irs Tool Might Say Your Payment Was Sent To You

If the IRS online tool says the agency has issued your stimulus money, but you have no record of it in your bank account and it never arrived in your mailbox, you may need to take one of these steps, including possibly filing a stimulus check payment trace. Youll need to have the letter the IRS sent you.

Who Is Eligible For The Third Stimulus Check

If youre trying to track your stimulus check, youll first want to know if youre eligible to receive one information that the Get My Payment tool wont explicitly inform you when you go track your check.

One good rule of thumb for determining if you qualify: If you were eligible to receive the full amount before, youll be eligible again. Income requirements for receiving full stimulus checks are the same for both individual and married tax filers, while income information is based on your most recently processed tax return .

If you earned up to $75,000 youre slated to get the full relief check worth $1,400. Married couples will thus receive $2,800 as long as their combined AGI doesnt top $150,000.

But the point at which payments completely phase out for Americans happens sooner on the income scale, a move meant to appease more deficit-minded lawmakers and shrink the size of the overall relief package.

Individuals total payments decrease by $28 per every $100 over the income threshold. Single filers and married couples who make $80,000 and $160,000 or more a year, respectively, wont receive a check at all.

Eligible U.S. adults will see $1,400 per each individual in their household, including adult dependents, such as college students.

If youre ineligible for a stimulus payment but currently out of work, heres how to apply for unemployment benefits.

Read Also: How Much Was The Third Stimulus Check Per Person

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Social Security Informing Your Clients About Recent Scams

The most effective way to defeat scammers is to know how to identify scams. Let your clients know they should just hang up on any call theyre uncertain of and ignore suspicious emails. Scammers always find new ways to steal peoples money and personal information by exploiting their fears.

One common tactic scammers use is posing as federal agents and other law enforcement. They may claim your clients Social Security number is linked to a crime. They may even threaten to arrest your clients if they do not comply with their instructions. Tell your clients to just hang up.

Your clients should remain vigilant of phone calls when someone says theres a problem with their Social Security number or their benefits. If they owe money to Social Security, we will mail them a letter explaining their rights, payment options, and information about appealing.

If your clients do not have ongoing business with our agency, it is unlikely we will contact them. If they get a suspicious call claiming to be from Social Security, they should hang up and report it to our law enforcement office at oig.ssa.gov.

Read Also: When Did We Get Stimulus Checks In 2021

Also Check: When Will Nc Stimulus Checks Arrive 2021

New Payments Differ From Earlier Economic Impact Payments

The third round of stimulus payments, those authorized by the 2021 American Rescue Plan Act, differs from the earlier payments in several respects:

- The third stimulus payment will be larger for most people. Most families will get $1,400 per person, including all dependents claimed on their tax return. Typically, this means a single person with no dependents will get $1,400, while a family of four will get $5,600.

- Unlike the first two payments, the third stimulus payment is not restricted to children under 17. Eligible families will get a payment based on all of their qualifying dependents claimed on their return, including older relatives like college students, adults with disabilities, parents and grandparents.

You May Like: Do We Supposed To Get Another Stimulus Check

Amount And Status Of Your Payment

To find the amount of the third payment, create or view your online account or refer to IRS Notice 1444-C, which we mailed after sending the payment.

If you are sent a plus-up Economic Impact Payment after your 2020 tax return is processed:

- The amount of your initial third payment will no longer show in your online account. You will only see the amount of your plus-up payment.

- The status of your initial third payment will no longer show in Get My Payment. You will only see the status of your plus-up payment.

You May Like: How To Find Stimulus Check History

Key Stimulus Payment Dates As Deadline Set For Social Security Recipients

More stimulus payments are being sent out under the American Rescue Plan.

The federal government began processing a third round of economic impact payments in late March, the Internal Revenue Service said ahead of the Easter weekend.

Individuals earning less than $75,000 are eligible for the full $1,400 payments. Those earning between $75,000 and $80,000 get smaller payments, and they cut out completely for those earning upwards of $80,000.

This week, the agency said more than 130 million payments worth around $335 billion have been sent out so far.

However, there was a delay in payments for Social Security recipients and other federal beneficiaries who did not file a 2019 or 2020 tax return or did not use the tool made available on IRS website for non-filers.

- Stimulus bill passed Congress | March 10

- Stimulus bill signed into law | March 11

- First direct deposit sent | March 12 , March 17

- First paper checks sent | Week of March 15

- First EIP cards sent | Week of March 22 possible

- SSI and SSDI checks sent | Not yet announced

- IRS deadline to finish sending checks | Dec. 31, 2021

- Last date to receive a check | January 2022

Claims for missing stimulus money open 2021 tax season likely

Also Check: Stimulus For 65 And Older

Why Should I Double Check My Payment Total With The Stimulus Check Calculator

Delivering a third stimulus check in the middle of tax season has complicated matters. If you filed your taxes early and the IRS processed your 2020 return, it may use that information to calculate your stimulus total. If not, your third check will be based on 2019 totals, or other information the agency has .

If your estimated total from the stimulus calculator differs greatly from what you received through direct deposit, it may signal that the IRS owes you money for dependents that were unaccounted for, or a different life circumstance, like if your adjusted gross income from 2020 is lower than from 2019. Again, we recommend holding on to that IRS confirmation letter to file a future claim.

You may want to set up direct deposit with the IRS if you don’t have it already in place.

Don’t Miss: How To Know If You’re Eligible For Stimulus Check

Will My Stimulus Check Be Deposited On My Turbo Card

The IRS may deposit some stimulus payments on debit cards, including the Turbo® Visa® Debit Card, for taxpayers that chose to receive their refund through that method in tax year 2019. If the IRS deposits a stimulus payment onto your debit card, you will be able to immediately use the stimulus funds upon deposit.

Recommended Reading:

Recommended Reading: Do Stimulus Checks Get Taxed

Rhode Island: $250 Rebate Per Child

Rhode Island will send a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate checks will be issued automatically starting in October 2022. Taxpayers filing their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December.

Don’t Miss: How Much Were Stimulus Checks In 2021

Social Security 2017 Trustees Report

On July 13, 2017, the Social Security Board of Trustees released its annual report on the current and projected financial status of the Old-Age and Survivors Insurance and Disability Insurance trust funds.

The combined asset reserves of the OASDI trust funds are projected to become depleted in 2034, the same as projected last year, with 77 percent of benefits payable at that time.

In the 2017 Report to Congress, the trustees also announced:

- The combined trust fund reserves are still growing and will continue to do so through 2021. Beginning in 2022, the total annual cost of the program is projected to exceed income.

- The DI trust fund will become depleted in 2028, extended from last years estimate of 2023, with 93 percent of benefits still payable.

- The projected actuarial deficit over the 75-year long-range period is 2.83 percent of taxable payroll 0.17 percentage point larger than in last years report.

sThe longevity of our programs relies on the accurate, up-to-date data provided in these yearly reports. You can view the full 2017 Trustees Report at www.socialsecurity.gov/OACT/TR/2017/.

When Will A Second Stimulus Check Be Issued

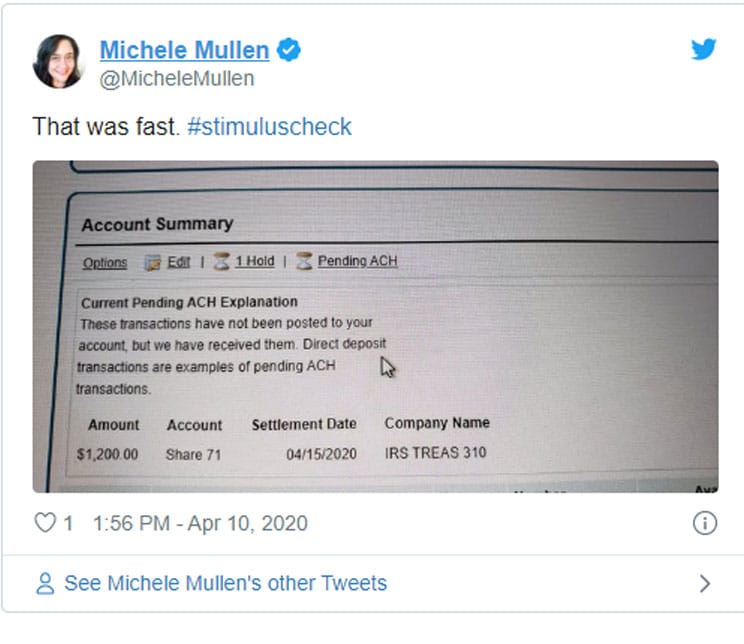

The government began sending direct deposit payments on December 28, 2020. Paper checks were sent out starting on December 30, 2020.

Payments are automatically sent to:

- Eligible individuals who filed a 2019 tax return.

- Social Security recipients, including Social Security Disability Insurance , railroad retirees, and Supplemental Security and Veteran Affairs beneficiaries.

- Individuals who successfully registered for the first stimulus check online using the IRS Non-Filers tool or who submitted a simplified tax return that has been processed by the IRS

There is no action that you have to take to get your second stimulus check. People who provided their banking information with the IRS shouldve received their stimulus checks by direct deposit. Social Security and Veterans Affairs beneficiaries who received the first payment via Direct Express shouldve received the second payment the same way.

The IRS sent paper checks or prepaid debit cards to people who did not provide their banking information. Mailed payments may be delivered in a different format than the first stimulus check.

All second stimulus checks were issued by January 15, 2021. If you didnt get a second stimulus check by then , you can claim your second stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

Read Also: Stimulus Check Who Gets It

Looking For Information About Your Tax Refund

E-file and sign up for Direct Deposit to receive your refund faster, safer, and easier! You can check the status of your refund using IRS Wheres My Refund?

Not using e-file? You can still get all the benefits of Direct Deposit by getting your tax refund deposited into your account. Simply provide your banking information to the IRS at the time you are submitting your taxes.

Convenience, reliability and security. No more special trips to your institution to deposit your check a nice feature if you are busy, ill, away from home, located far from a branch or in a place where parking is hard to find. You no longer need to wait for your check to arrive in the mail. Your money will always be in your account on time. If you move without changing financial institutions, you will not have to wait for your check to catch up with you. You do not have to worry about lost, stolen or misplaced checks.

We issue most refunds in less than 21 calendar days.

Use the IRS2Go mobile app or the Wheres My Refund? tool. You can start checking on the status of your tax return within 24 hours after we have received your e-filed return or 4 weeks after you mail a paper return.

The Treasury Bureau of the Fiscal Service’s Kansas City Regional Financial Center will be disbursing all tax refund direct deposits on behalf of the IRS. Information in the ACH Batch Header Record can be used to identify an IRS tax refund, as follows:

Direct Deposit

What You Should Do If Your Income Increased In 2020 Vs 2019

Undoubtedly, a whole separate camp of Americans saw their incomes rise in 2020 versus 2019, meaning they would no longer be considered eligible for a stimulus check if they were to submit their return today.

You could still wait to file your tax return and claim a stimulus check. The IRS wouldnt attempt to recoup that payment, and it also shouldnt open you up to any penalties or fines, according to the current text of the bill. Economic Impact Payments also arent considered taxable income.

But beware: You dont want to risk incurring late fees by waiting so long that you submit your tax return past the April 15 deadline .

Also Check: How Much Stimulus Check Are We Getting