How To Set Up An In

The IRS has many offices across the US, and if theres one near you, you can make an appointment to speak with someone in person. Heres how to schedule a meeting.

1. Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code. Tap Search.

2. Choose the location nearest to you and select Make Appointment.

3. Call the appointment phone number for the office you want to visit.

4. When you go to your local branch, make sure to bring a government-issued photo ID and your ITIN or Social Security number.

Note that you may need to follow the IRS guidelines for COVID-19 for instance, you may be required to wear a mask, maintain social distancing and reschedule your appointment if you feel sick.

Estimate Your Check Amount

To estimate the amount youll receive, youll need information from your 2021 New York State income tax return . If you dont have a copy of your return, log in to the software you used to file to view a copy, or request the information from your tax preparer .

Note: To protect your information, our Contact Center representatives cannot provide amounts from a return you filed.

Empire State child credit additional payment computation table

| If your line 19a amount is | your payment based on your 2021 Empire State child credit is | |

|---|---|---|

| equal to or greater than | but less than | |

| 100% of the credit amount you received. | ||

| $10,000 | 75% of the credit amount you received. | |

| $25,000 | 50% of the credit amount you received. | |

| $50,000 | N/A | 25% of the credit amount you received. |

Example: On Taxpayer Bs return, the line 19a amount is $18,000 and the line 63 amount is $333:

Try Calling The Taxpayer Advocate Service

The Taxpayer Advocate Service is an independent organization within the IRS that can help people with tax problems they can’t resolve on their own. Every state has at least one local Taxpayer Advocate Service center that is independent of the local IRS office, and it reports to the national Taxpayer Advocate Service. You can see the local addresses and phone numbers for every local Taxpayer Advocate Service office here.

You May Like: When Did I Get My Stimulus Check

Get My Payment Says Payment Issued But I Havent Received It

The IRS says that it may take three to four weeks to receive a check after its mailed. If it has been weeks since the Get My Payment tool says the payment was mailed, and you havent received it, you can request a payment trace. The IRS will research what happened to your check if the check wasnt cashed, you will need to claim the Recovery Rebate Credit on your next tax return. If the IRS finds that the check was cashed, youll receive a claim package from the Treasury Department with a copy of the cashed check and instructions on filing a claim.

Similarly, if the Get My Payment tool says your payment was direct-deposited, but the money doesnt show in your bank account after five days, first check with your bank. If the bank says it hasnt received a payment, you can request a payment trace.

To request a payment trace, call 800-919-9835 or fill out IRS Form 3911, Taxpayer Statement Regarding Refund.

California Stimulus Check Summary

Heres the bottom line:

The state of California will provide the Golden Status Stimulus payment to families and people who qualify.

There is Golden State Stimulus I and Golden State Stimulus II.

The Golden State Stimulus II payments are different from the Golden State Stimulus I payments.

Also Check: What Were The Three Stimulus Payments

Also Check: Where Do I Cash My Stimulus Check

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

What Is The Meaning Of Irs Tax Return Status

The IRS has three different messages which can explain your tax return status. If you have received a status, that means the IRS has a tax return, and they are working on it. The second status is approved, which means that your return has been confirmed. And the last one is sand which means your refund is on its way.

Recommended Reading: How Can I Cash My Stimulus Check Without An Id

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Speak To A Live Person At The Irs

IRS customer support may be difficult to reach, but they are available to speak with you about your tax return. They are available from 7:00 AM to 7:00 PM five days a week Monday through Friday. According to the official website, www.irs.gov, average wait times can range from fifteen minutes to almost thirty minutes after filing deadlines have passed .

The primary IRS phone number is 829-1040. This serves as a catchall and will send you to a menu. However, there are also alternative numbers you can dial to reach a live person in a specific department. This may help you to connect directly with someone who deals with the issue you are facing.

NerdWallet has compiled a full list of all extant phone numbers to speak to a live person at the IRS. Here is the contact information for the most-used departments:

- Issues with stimulus checks 919-9835

- Self-employed tax payers 829-4933

- Estate and gift tax questions 699-4083

- Check the status of your refund 829-1954

- Make a payment 555-4477

- The Office of the Taxpayer Advocate 777-4778

- Schedule an appointment with your local office 545-5640

- Request paper tax forms 829-3676

- Tax filing questions for non-profits 829-5500

- Corporate taxpayers, nonprofits, and partnerships 255-0654

Recommended Reading: When Will The Unemployment Stimulus Start

Read Also: Did Not Receive 3rd Stimulus Check

Log In To Ui Onlinesm

Once you are logged in, select Payment Activity to see all payments made on your claim.

Your last payment issued and claim balance appear at the bottom of the homepage in the Claim Summary section. To view other payments made, select View Payment Activity to see:

To view how your payment was calculated, select Details for the week you want to view.

You can select Claim History to review your certifications by week. You can also view details on certifications that were submitted, but not paid because of excessive earnings, a disqualification, or another eligibility issue.

You Owe The Irs Money

If you owe back taxes to the IRS, the agency may take some or all of your tax refund to pay off that debt. If your refund contains more money than you owe, youll receive the remaining balance via direct deposit or check in the mail, but it could be delayed. Taxpayers whose refunds are used by the IRS to cover existing payment obligations should receive a CP49 notice in the mail.

Even if you dont owe the IRS money, the agency can keep your tax refund money if you have other debts to state or federal agencies. The Treasury Offset Program enables the IRS to take all or part of your tax refund to pay obligations such as child support, state taxes or unemployment compensation repayments. Such debts could delay the arrival of your remaining tax refund or eliminate it completely.

You May Like: What Stimulus Was Given In 2021

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Unclaimed Federal Tax Refunds

If you are eligible for a federal tax refund and dont file a return, then your refund will go unclaimed. Even if you aren’t required to file a return, it might benefit you to file if:

- Federal taxes were withheld from your pay

and/or

- You qualify for the Earned Income Tax Credit

You may not have filed a tax return because your wages were below the filing requirement. But you can still file a return within three years of the filing deadline to get your refund.

Don’t Miss: Are The Stimulus Checks For 2021 Taxable

How Do I Get My Third Stimulus Check

You dont need to do anything if:

- You have filed a tax return for tax year 2019 or 2020.

- You are a Social Security recipient, including Social Security Disability Insurance , railroad retiree. Or you are a Supplemental Security Insurance and Veterans Affairs beneficiary.

- You successfully signed up for the first stimulus check online using the IRS Non-Filers tool or submitted a simplified tax return that has been processed by the IRS.

The IRS will automatically send your payment. You can check on the status of your third stimulus check by visiting the IRS Get My Payment tool, available in English and Spanish.

If you are missing your third stimulus check, file your 2020 tax return or use GetCTC.org if you dont have a filing requirement. By submitting your information to the IRS, you will be signed up and automatically sent the third stimulus check.

Economic Stimulus Check: Estragos

Early last year, the virus wreaked havoc in meatpacking plants, where workers work closely together on production lines, but also in other areas that have yet to be replenished.

The UFCW union, which represents approximately 80% of the workers in the beef and pork industry, and 33% of the workers in the poultry sector in the country, considers that at least 132 employees of packing plants in meat died of COVID-19 and at least 22,000 were infected.

Recommended Reading: Are We Getting More Stimulus Money

Lean On Your Tax Professional

If you worked with an enrolled agent or accountant to file your taxes, contact them to get further insight into your issue with the IRS. They may not be able to speed up delays in the IRS system, but they can help you decipher notices from the agency and call on your behalf if further information is needed.

If you havenât worked with a tax professional before and want extra help figuring out your situation, you might consider contacting one in your area. Expect to pay a fee for their services if youâre a new client, as the accountant or tax preparer will need time to get familiar with your situation before calling on your behalf.

Irs Adds Phone Operators To Answer Economic Impact Payment Questions

IR-2020-97, May 18, 2020

WASHINGTON Today, the Internal Revenue Service is starting to add 3,500 telephone representatives to answer some of the most common questions about Economic Impact Payments.

IRS telephone assistance and other services will remain limited, and answers for most of the common questions related to Economic Impact Payments are available on IRS.gov. The IRS anticipates bringing back additional assistors as state and local advisories permit.

Answers for most Economic Impact Payment questions are available on the automated message for people who call the phone number provided in the letter . Those who need additional assistance at the conclusion of the message will have the option of talking to a telephone representative.

You May Like: Who Qualified For Third Stimulus Check

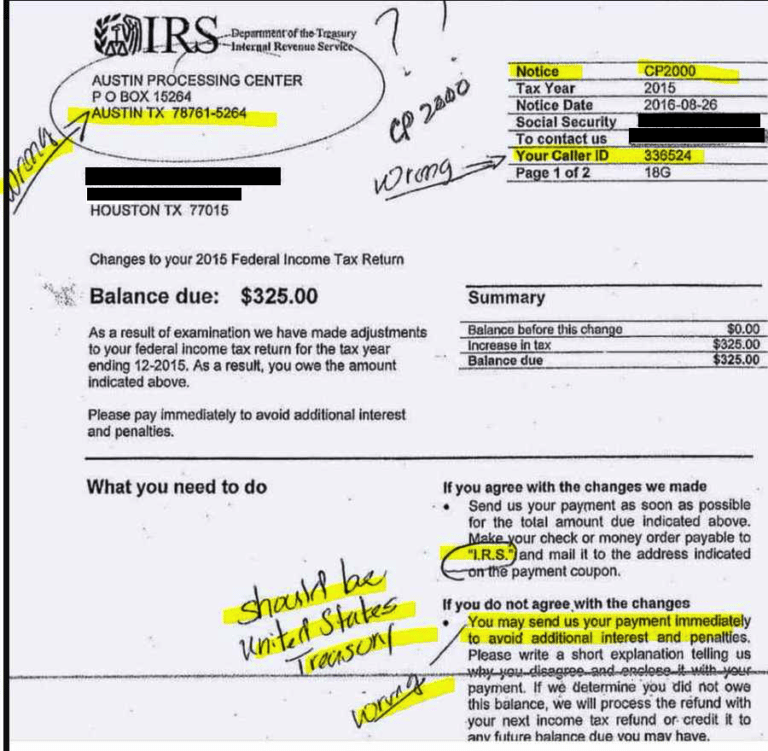

Watch Out For Irs Phone Scams

You can call every IRS phone number you want, but the IRS will rarely call you. It initiates most contacts, including demands for payment, through regular mail from the U.S. Postal Service. In special circumstances, the agency will call or come to a home or business when:

-

A taxpayer has an overdue tax bill.

-

To secure a delinquent tax return.

-

To secure a delinquent employment tax payment.

-

To tour a business as part of an IRS audit or during criminal investigations.

Avoid tax scams. The IRS does not:

-

Initiate contact with you via email, text or social media.

-

Ask you to pay your tax bill with prepaid cards, gift cards or wire transfers.

-

Threaten to call the police, immigration officers or other people to arrest you.

-

Revoke your drivers license, business license or immigration status.

I Got A Payment Status Not Available Message

Many checking on their second stimulus check were seeing a message that said Payment Status #2 Not Available. The IRS has indicated that these individuals will not receive a stimulus check by direct deposit or mail and they will have to file their 2020 tax return to claim their Recovery Rebate Credit. See below for instructions on claiming the rebate on your tax return.

These messages have now disappeared and will be replaced by information about the third payment.

Don’t Miss: How Many Irs Stimulus Payments In 2021

What If I Owe Child Support Payments Back Taxes Money To Creditors Or Debt Collectors Or Federal Or State Debt

None of the three stimulus checks can be reduced to pay any federal or state debts and back taxes. Unlike the first stimulus check, your second and third stimulus check cannot be reduced if you owe past-due child support payments.

| Federal or State Debt | |

| Protected | Not protected |

If you are claiming the payments as part of your 2020 tax refund , the payments are no longer protected from past-due child support payments, creditor and debt collectors, and other federal or state debt that you owe . In other words, if you receive your first or second stimulus checks as part of your tax refund instead of direct checks, it may be reduced.

Theres Still Time To Claim

There is some good news: Theres still time for people who missed out on their stimulus checks to claim them, the report noted.

Individuals with little or no income, and therefore not required to pay taxes, have until November 15 to complete a simplified tax return to get their payments, the GAO said.

Theres also still time for people to claim the expanded Child Tax Credit, which was provided last year to eligible families. That credit provided as much as $3,600 to families with children under 17, but parents who didnt receive the payments last year have only until November 15 to claim them.

To claim a missing stimulus payment, people should go to the IRS website for Economic Impact Payments, the official name for the program, and follow the instructions there. Youll have to file a simplified tax return to receive the money.

Parents who still have missing Child Tax Credits from 2021 can go to the GetCTC.org website to claim them.

However, people who are required to file taxes due to their income and who missed the April 15 tax filing deadline have until October 17 to claim the payments, the GAO said. October 17 is the deadline for filing 2021 tax returns if you requested an extension from the IRS.

Recommended Reading: How Can I Get My Stimulus Checks I Never Received

What To Do If The Irs Needs More Information

If the Get My Payment tool gave you a payment date but you still havent received your money, the IRS may need more information. Check the Get My Payment tool again and if it reports Need More Information, this could indicate that your check has been returned because the post office was unable to deliver it, an IRS representative told CNET. Here are more details on how the tracker tool works and what the messages mean.