Stimulus Check Missing Payment Issues Or Errors

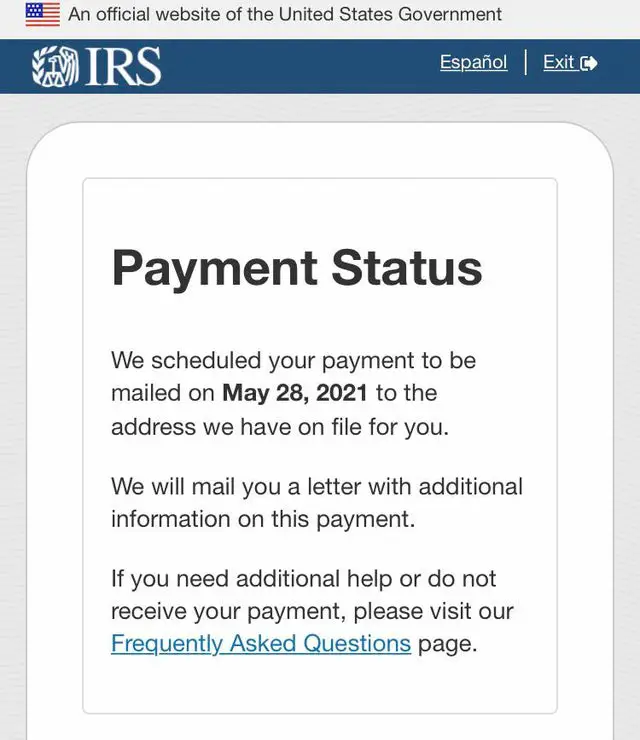

The IRS will also be mailing Stimulus Payment letters to each eligible recipients last known address 15 days after the payment is made. The letter will provide information on how the Payment was made and how to report any failure to receive the Payment. Note that the IRS or other government departments will not contact you about your stimulus check payment details either.

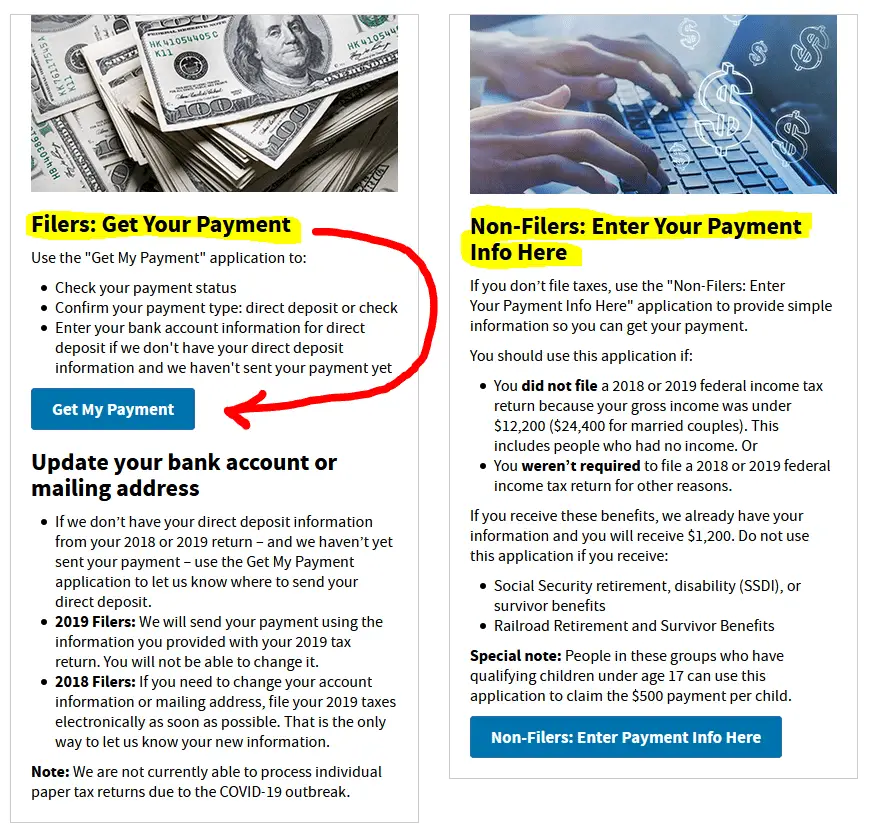

Why didnt I get a stimulus check? Remember that the IRS has to have your direct deposit details, which is normally only provided if you received a 2018 or 2019 refund. If you file a return and they cannot use their portal to add direct deposit details, then your payment will come via check which could take several weeks. At this checks will likely start arriving at your IRS registered address from the end of April.

Finally you will also likely be able to claim any missing payments in your 2020 tax return as a tax credit. All this unfortunately will mean delays in getting your stimulus payment until issues are worked through.

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and others. For those eligible individuals who didn’t get a first or second Economic Impact Payment or got less than the full amounts, they may be eligible for the 2020 Recovery Rebate Credit, but they’ll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren’t required to file a tax return.

Do You Have To Pay Back The Stimulus Check

No, you dont have to pay it back. It also doesnt reduce any refund you would otherwise receive.

No, there is no provision in the law requiring repayment of an Economic Impact Payment, the IRS website said about the first round of checks.

If your income dropped in 2020 compared with 2019, you may now be eligible for the payment or a bigger payment if you have already filed your taxes and they have been processed by the IRS.

If your payment is too high based on your 2020 income and you still haven’t filed your 2020 taxes, youre not responsible for paying back the difference.

Denitsa is a writer for Yahoo Finance and Cashay, a new personal finance website. Follow her on Twitter @denitsa_tsekova

Read more:

Recommended Reading: Stimulus Checks Direct Deposit Date

Rhode Island: $250 Rebate Per Child

Rhode Island will send a one-time payment of $250 per child, thanks to a state budget surplus.

Households can receive a payment for up to three dependent children. Those children must have been listed as your dependents on your 2021 federal and state income tax returns.

Taxpayers must earn $100,000 or less to be eligible for the payment.

Child Tax Rebate checks will be issued automatically starting in October 2022. Taxpayers filing their 2021 state tax returns on extension by October 2022 will receive their rebates starting in December.

Stimulus Checks: Round 3

The third round of stimulus checks was created and authorized by the American Rescue Plan, which was signed into law by President Biden on March 11, 2021. This was the third major piece of federal legislation focused on COVID-related relief for struggling Americans.

The American Rescue Plan covers a variety of programs including the third round of stimulus checks, extended weekly unemployment benefits, expanded tax credits, and more. While promoting this bill, President Biden declared that it would send stimulus checks to 85% of American households.

The third stimulus check is worth up to $1,400 for each eligible person. For a single filer, the maximum amount they can get is $1,400. For a married couple that files jointly, the maximum amount they can get is $2,800. Additionally, if you have a qualified dependent, you can qualify for an extra $1,400 for each eligible dependent.

RELATED: $1400 Stimulus Checks 3rd Round of Direct Payments Are on the Way

Also Check: When Did The First Stimulus Check Come Out

Didn’t Get The Full Third Payment Claim The 2021 Recovery Rebate Credit

You may be eligible to claim a 2021 Recovery Rebate Credit on your 2021 federal tax return.

Individuals can view the total amount of their third Economic Impact Payments through their individual Online Account. Through March 2022, we’ll also send Letter 6475 to the address we have on file for you confirming the total amount of your third Economic Impact Payment and any plus-up payments you received for tax year 2021.

You will need this information from your online account or your letter to accurately calculate your 2021 Recovery Rebate Credit when you file your 2021 federal tax return in 2022. For married filing joint individuals, each spouse will need to log into their own online account or review their own letter for their half of the total payment. All amounts must be considered if filing jointly.

Using the total amount of the third payment from your online account or Letter 6475 when preparing a tax return can reduce errors and avoid delays in processing while the IRS corrects the tax return.

Increase The Child Tax Credit Earned

- For those without children, the American Rescue Plan increased the Earned-Income Tax Credit from $543 to $1,502.

- For those with children, the American Rescue Plan increased the Child Tax Credit from $2,000 per child to $3,000 per child for children over the age of six and $3,600 for children under the age of six and raised the age limit from 16 to 17.

- The American Rescue Plan also increased and expanded the Child and Dependent Care Tax Credit, making more people eligible and increasing the total credit to $4,000 for one qualifying individual and $8,000 for two or more.

You May Like: Can Stimulus Check Be Taken For Back Taxes

Which Of My Dependents Qualify For The Third Stimulus Check

For the third stimulus check, all your dependents qualify, regardless of age. This means that for each child or adult dependent you have, you can claim an additional $1,400.

This is different from the first and second stimulus checks, which only allowed child dependents to get the additional payment.

If You Did File Taxes But Are Still Missing Payments

If you filed taxes in 2021, you shouldve already received the money from the first two rounds of stimulus checks. If you filed your taxes and still never received your stimulus or child tax credit money, here are some potential reasons those payments never arrived:

-

You dont have a bank account set up.

-

It was your first time filing.

-

You have a mixed-status household.

-

You havent updated your address with the IRS or USPS.

-

Youre experiencing homelessness.

-

You have limited or no internet access.

What you can do now is file a payment trace with the IRS, either by calling 800-919-9835 or mailing in Form 3911. Heres our guide to actually getting through to a real human at the IRS so that you can get the money youre owed.

More from Lifehacker

Also Check: Do We Supposed To Get Another Stimulus Check

How Do I Get My 4th Stimulus Check

If you have been paying your taxes by direct withdrawal from your bank account, your stimulus checks should have been deposited directly into the bank account the IRS has on file. That means you should see a deposit in your bank account directly from the IRS.

The stimulus payments should show up as IRS TREAS 310. It should have a code of TAXEIP1 for the 1st stimulus check, TAXEIP2 for the 2nd stimulus check, and TAXEIP3 for the 3rd stimulus check.

If the IRS did not have a bank account on file, you should have received a paper check in the mail. In some cases, the stimulus payments were sent out as prepaid debit cards.

Focus On What Goes On At Your Housenot The White House

Its hard not to worry as you watch billions and trillions of dollars fly out the window in Washington, D.C. And while those things matter, the truth is, you have ultimate control over your money and what choices are made in your house. You have the power to improve your money situation right nowtodaywithout having to rely on the government.

And it all starts with a budget. Because when you make a plan for your money, you’re more likely to make progress and hit your financial goalsstimulus check or not. So, go ahead and create your budget with EveryDollar today! Take control of your future and get the hope you need.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

You May Like: The First Stimulus Check Amount

There’s Still Time To Claim

There is some good news: There’s still time for people who missed out on their stimulus checks to claim them, the report noted.

“Individuals with little or no income, and therefore not required to pay taxes, have until November 15 to complete a simplified tax return to get their payments,” the GAO said.

There’s also still time for people to claim the expanded Child Tax Credit, which was provided last year to eligible families. That credit provided as much as $3,600 to families with children under 17, but parents who didn’t receive the payments last year have only until November 15 to claim them.

To claim a missing stimulus payment, people should go to the IRS website for “Economic Impact Payments,” the official name for the program, and follow the instructions there. You’ll have to file a simplified tax return to receive the money.

Parents who still have missing Child Tax Credits from 2021 can go to the GetCTC.org website to claim them.

However, people who are required to file taxes due to their income and who missed the April 15 tax filing deadline have until October 17 to claim the payments, the GAO said. October 17 is the deadline for filing 2021 tax returns if you requested an extension from the IRS.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Recommended Reading: Stimulus Check For Grocery Workers

How Have Americans Spent Their Stimulus Checks

There have been threecount themthree wide-reaching stimulus checks from the government since the pandemic hit. And now that a good chunk of time has gone by since they dished out the first one, were starting to see how people spent that money. Our State of Personal Finance study found that of those who got a stimulus check:

- 41% used it to pay for necessities like food and bills

- 38% saved the money

- 11% spent it on things not considered necessities

- 5% invested the money

And on top of that, heres some good news: Data from the Census Bureau shows that food shortages went down by 40% and financial instability shrank by 45% after the last two stimulus checks.25 Thats a big deal. But the question here isif people are in a better spot now, will they be more likely to manage their money to make sure things stay that way?

Will There Be A Fourth Stimulus Check From The Government

Some lawmakers pushed for a fourth stimulus check to help Americans who were struggling to rebuild after COVID-19 and its economic impact. But that stimulus never happened.

With the economy and jobs both on the upswing after the country started to reopen, another federal stimulus check didnt seem necessary. But some states took matters into their own hands and sent out a fourth stimulus check to their residents.

Read Also: Did Not Receive 3rd Stimulus Check

How Can I Get My Stimulus Payment Faster

The quickest way to get your payment is through direct deposit. Beware of scams! The IRS will not contact you by phone, email, text message, or social media to request personal information especially banking details or ask you to provide a processing fee. They will send written correspondence with instructions on steps to take and the timeframe for action. Remember, you do not need to pay to get this money.

Additionally, the IRS refers to this money as an Economic Impact Payment. Communications that use stimulus check or recovery rebate are unlikely to be from the IRS. Hang up on phone calls you receive and delete email or text messages that seem too good to be true. You can report scams to the Better Business Bureau to helps protect others.

What Is The New Child Tax Credit Amount

Heres how the numbers break down: The American Rescue Plan bumps the Child Tax Credit up to $3,000 for children ages 617 and $3,600 for children under age 6.3 Expecting a baby in 2021? First of all, congrats! And heres some more good news for youbabies born in 2021 will qualify for the full $3,600. Have a college student? Parents can receive a one-time payment of $500 for each full-time college kid ages 1824.4

So, for a family that has three children , heres how it all breaks down:

Lets say they have three kids that are ages 12, 7 and 4 and a household income of $72,000 a year. Their new Child Tax Credit would be $9,600.

But remember, instead of applying the full amount of the credit to income taxes they might owe or getting a refund after they file their taxes, parents can get the credit up front in monthly payments of $250 for each qualifying child .5 So that family of three in our example would get $800 a month from July through December. Wow!

Right now, this change would be only for 2021but theres talk in Congress and the White House to make it a permanent thing for the next five years under Bidens American Families Plan. Yep, there are a lot of plans and acts to keep straight these days.

Recommended Reading: News About The Stimulus Check

What Can I Do If The Amount Of My Stimulus Payment Is Wrong

If you didnt get the additional $500 for your children or didnt get the full payment amount that you expected based on your eligibility, you can get the additional amount by filing a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you receive Social Security, Social Security Disability Insurance , or Supplemental Security Insurance OR are a railroad retiree or Veterans Affairs beneficiary, and didnt get the first stimulus check or the full amount you are eligible for, you will also have to file a 2020 tax return or use GetCTC.org if you dont have a filing requirement.

What Information Will You Need

To access the tool, youll be asked to provide a:

- Street address and

- Five-digit ZIP or postal code.

If you file a joint tax return, either spouse can typically access the portal by providing their own information for the security questions used to verify a taxpayers identity. Once verified, the same payment status is shown for both spouses. In some cases, however, married couples who file a joint tax return may get their third stimulus payment as two separate payments half may come as a direct deposit and the other half will be mailed to the address the IRS has on file. If that case, each spouse should check the Get My Payment tool separately using their own Social Security number to see the status of their payments.

If you submit information that doesnt match the IRSs records three times within a 24-hour period, youll be locked out of the portal for 24 hours . Youll also be locked out if youve already accessed the system five times within a 24-hour period. Dont contact the IRS if youre shut out. Instead, just wait 24 hours and try again.

Also Check: Is There Another Stimulus Check On Its Way

What Is The Earned Income Tax Credit

The American Rescue Plan of 2021 also boosted the Earned Income Tax Credit, which has been available for decades and is aimed at helping low-income workers. Prior to the legislation, childless workers between 25 to 64 could only get up to $538, but the pandemic law boosted that to $1,502.

The law also increased the amount that can be claimed by working families with children, increasing it to as high as $6,728 for parents with three children.

Most people can claim the EITC if they earn under $21,430 for single taxpayers or $27,380 for married people filing jointly.

Why Didnt So Many People Initially Get The Irs Payments

Many of those people didnt initially get their payments because the IRS didnt have their information on file from a recent tax return. People with very little or no income, for instance, arent required to pay taxes.

Throughout the pandemic, IRS and Treasury struggled to get COVID-relief payments into the hands of some people especially those with lower incomes, limited internet access, or experiencing homelessness, the Government Accountability Office, an internal government watchdog, said.

You May Like: Social Security Recipients Stimulus Checks