Is Mortgage Stimulus A Real Thing

There is a lot of debate surrounding the idea of mortgage stimulus, with many people wondering if it is a real thing. While there is no definitive answer, it seems that mortgage stimulus could potentially help those who are struggling to make their mortgage payments. By providing additional financial assistance, mortgage stimulus could give people the breathing room they need to stay afloat. However, it is important to remember that mortgage stimulus is not a cure-all and should be used in conjunction with other financial planning.

There has never been a mortgage stimulus program called that. Some federal funds have, however, been made available to assist homeowners. A Homeowner Assistance Fund is a type of loan that is available to homeowners. As a result, the fund provides nearly $10 billion to states, the District of Columbia, and other US territories.

Emergency Rental Assistance Program

The Emergency Rental Assistance program provides funding to help renters who are unable to pay rent or utilities. The funds are provided directly to states, U.S. territories, local governments, American Indian tribes, Tribally Designated Housing Entities, and the Department of Hawaiian Home Lands. These entities may use ERA funds to provide assistance through existing or newly created rental assistance programs.

The Nearly Secret Stimulus Payment For Homeowners: Here Are The Details

The March 2021 package set aside $10 billion specifically for homeowners relief. This means that homeowners who are having trouble paying basic bills can request emergency funds from the government. These funds can be used towards any home-related expenses, including paying the mortgage, property taxes, homeowners insurance, utility bills, and other related fees.

Homeowners Assistance Fund: Another Stimulus Payment for Homeowners

Are you a homeowner struggling to pay your bills? If so, the Biden administration might have a lifeline for you.

The American Rescue Plan, President Bidens signature COVID-19 recovery bill, was passed in March. The bill, altogether nearly two hundred and fifty pages long, laid out funding requests for many different government COVID relief programs. One of those programs, the Homeowners Assistance Fund, was specifically targeted towards imperiled homeowners in need of temporary low-interest loans and other relief.

How It Works

The March 2021 package set aside $10 billion specifically for homeowners relief. This means that homeowners who are having trouble paying basic bills can request emergency funds from the government. These funds can be used towards any home-related expenses, including paying the mortgage, property taxes, homeowners insurance, utility bills, and other related fees.

To clarify the status of your states benefits, or for additional information, you can contact your states housing agency.

The Caveat

Recommended Reading: How Much In Total Were The Stimulus Checks

Who Qualifies For Fha Cash

An FHA cash-out loan allows homeowners with lower credit scores or a less than impressive debt-to-income ratio to access the equity of their home at a current low rate.

The basic requirements to qualify for an FHA cash-out refinance are:

- The home mustve been refinanced but be your primary residence, and you must have lived in the home for at least 12 months prior to applying for the loan

- You must have made on-time mortgage payments for the past 12 months prior to applying for the loan

These are the basic requirements, but there might be additional requirements depending on your circumstances, such as your credit score.

FHA loans usually require a debt-to-income ratio of 43% or less, but different factors may affect this, such as a high credit score or high home equity.

As mentioned, your current mortgage does not have to be an FHA loan to qualify for an FHA cash-out refinance.

Mortgage Refinance Relief Faq

Does Congress have a mortgage stimulus program?

Although theres no current mortgage stimulus from Congress, there is federal help available for homeowners. In March 2021, the American Rescue Plan designated $10 billion to help struggling homeowners. The funds are distributed by individual states and you can locate your states agency and contact information with this lookup tool.

What is the Congress mortgage stimulus program?

Although theres no current mortgage stimulus from Congress, there is federal help available for homeowners. Its called the Homeowner Assistance Fund. This money is intended to help with a variety of homeownership costs, in addition to monthly mortgage payments, including property taxes, homeowners insurance, utility bills and HOA dues.

Is HARP still available?

No. HARP was discontinued on the last day of 2018. HIRO and FMERR were launched in 2021 and serve a similar function.

Are mortgage relief programs real?

Yes, these mortgage relief programs are real and available to help homeowners experiencing financial hardship. Be sure to apply for mortgage assistance directly through your states housing finance agency.

Who is eligible for mortgage relief programs?

You may be eligible for one of several mortgage relief programs, depending on the type of mortgage you have, even if your home value is low compared to your mortgage balance.

Don’t Miss: How To Apply For Homeowner Stimulus Check

Relief Refinance Programs: Hiro And Fmerr

Former relief programs from Fannie Mae and Freddie Mac, including the Enhanced Relief Refinance and the HighLTV Refinance Option , have been paused due to a low number of applicants.

These programs were largely designed to offer mortgage relief to underwater borrowers those who owe more on their mortgage than their home is worth. Thanks to rising home values nationwide, the number of underwater borrowers has shrunk dramatically.

As a result, many homeowners are eligible to refinance but just dont know it yet.

So if youre looking for a mortgage relief refinance, its still worth talking to a lender. There are a wide variety of refinance options available today, and you may well qualify for one of them.

How To Find Out If Your Loan Is Federally Backed

To find out whether your loan is backed by the federal government, making you eligible for the help noted above, here are some actions that you can take:

- Check online. Use loan lookup tools provided by Fannie Mae or Freddie Mac to find out if either of those two government-backed providers owns your mortgage.

- Check the Mortgage Electronic Registration Systems website to find your servicer, if you dont know who it is.

Read Also: Irs Social Security Stimulus Checks Direct Deposit

Read Also: Is There Another Round Of Stimulus Checks Coming Out

What Can Americans Do To Help Pay Their Mortgages

There isnt a specific program created by Congress for mortgages and stimulus aid. There has been help made available to those that own their homes though.

This includes mortgage payments, utility bills, and homeowners insurance.

The cash is federal funding but its being given to the states to distribute it.

Applying For An Fha Loan

Even though the FHA loan is a stimulus package for homeowners, they dont lend money to people. FHAs main role in getting homeowners the mortgage refinancing that they are looking for is simply getting their mortgage loans insured against default.

To get the insurance on your loan, you will be required to apply for the loan from an FHA-approved lender. As such, it is recommended that you search around first before making the application since this will enable you to get the ideal lender completely insured for the loan.

If you default, the government will take care of the loan on your behalf. For initial homeowners buying a home for the first time, this is an important loan and the best form of financing when they are still unsure of the real estate landscape and what is involved in buying a new home for the first time.

Read Also: How To Find How Much Stimulus I Received

Senior Citizen Financial Planning

Social Security experts recommend living on 70% of your pre-retirement income. So, if you earned $50,000 a year when working, you should be comfortable living on $35,000 a year.

In reality, how much you should save for retirement depends on your lifestyle.

This is how much of your total income you should be spending on housing, transportation, food and healthcare, according to the Bureau of Labor Statistics Annual Expenditure Report.

- Healthcare 12.2%

These are the four greatest expenses for people over the age of 65. After the age of 75, healthcare costs eclipse transportation, taking up 15.6% of your income, while transportation drops to 13.9%.

To be clear, these are only averages. How much each person spends on each category will vary. You shouldnt set aside 17% of your budget for transportation if you live walking distance from your usual haunts. Nor should you throw budgeting to the wind for a European vacation just because you really want to see the Eiffel Tower.

If balancing your budget proves too daunting, consider working with a reputable financial advisor or nonprofit credit counseling organization. A credit counselor can review your debts and expenses to help you reach a level of financial stability.

Managing your debts is important no matter what stage of life youre in. The father of western wisdom, Socrates, said it best with his last words:

Crito, we owe a rooster to Asclepius. Please, dont forget to pay the debt.

Federal Stimulus For Homeowners

HIRO and FMERR are some of the special stimulus programs put in place by the government for homeowners looking to purchase a new home.

They are special programs that are ideally suited to the current state of the market and the fact that interest rates are at an all-time low. They come with reduced interest rates and minimal monthly payments, which are easier to manage, and more people can afford them.

People buying a home for the first time will find these programs especially useful and suited to their needs. Refinance relief programs can help you make use of the low-interest rates, and in the process, you will also be able to take advantage of low-interest rates.

Even when your mortgage is higher than the value of your home, there are programs in place that are designed to ensure that you can conveniently make payments without worrying about the terms.

Terms have been made easier for new home buyers, and the interest rates and monthly payments have also been reduced. This is the opportunity many people have been looking for, and to start making use of them, start checking your refinance eligibility and the program that suits you best.

Dont Miss: Free File Taxes For Stimulus

Recommended Reading: Apply For Fourth Stimulus Check

Mortgage Relief Options From Fannie Mae And Freddie Mac

Homeowners with conforming loans backed by Fannie Mae or Freddie Mac have options for mortgage relief.

If youre experiencing a temporary hardship, its not too late to ask about forbearance. Theres currently no deadline to make an initial forbearance request with your loan servicer.

If you have a conventional loan, theres currently no deadline to make an initial forbearance request with your loan servicer.

In addition, Fannie and Freddie recently came out with expanded refi programs that make it easier and cheaper to lower your interest rate and mortgage payment.

Fannie Maes RefiNow and Freddie Macs Refi Possible are designed for low- to moderate-income homeowners. You might qualify if you make average or below-average income for your area.

These refinance programs have unique benefits that can offer financial relief to homeowners, including:

- Lower mortgage rate and monthly payment

- Reduced closing costs with no appraisal fee

- Easier debt-to-income qualification

These new loan options can offer big savings for homeowners who might not otherwise qualify to refinance.

You can check your areas median income using Fannie Maes lookup tool and Freddie Macs lookup tool.

Stimulus Checks For Homeowners: Heres Whos Eligible For The Economic Benefit

WASHINGTON DC APRIL 2, 2020: United States Treasury check with US currency. Illustrates IRS tax refund or coronavirus economic impact stimulus payments to taxpayers affected by the pandemic. pieces for Biden asf ShutterstockShutterstock

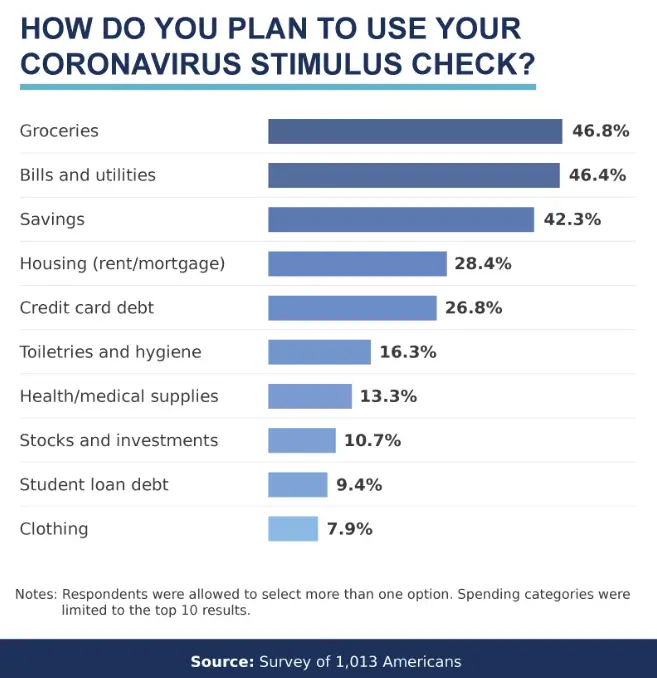

Millions are still receiving the third round of stimulus checks and plus-up payments, while parents with eligible co-dependents will start receiving the child tax credit in mid-July through mid-December. Theres another economic relief some Americans may be eligible for that they probably dont even know was a thing. Thats stimulus money given to some homeowners.

The American Rescue Plan, which included the third round of stimulus checks was signed into effect by President Joe Biden on Thursday, March 11. The following week millions of eligible Americans were deposited $1,400.

The Homeowners Assistance Fund is part of the bill, which will help homeowners struggling with their mortgages. The fund includes helping those who face delinquencies and foreclosures, due to the economic crisis caused by the coronavirus pandemic.

The IRS furthermore states the fund provides:

A minimum of $50 million for each state, the District of Columbia and Puerto Rico

$498 million for Tribes or Tribally designated housing entities and the Department of Hawaiian Home Lands

$30 million for the territories of Guam, American Samoa, the U.S. Virgin Islands, and the Commonwealth of the Northern Mariana Islands

READ MORE:

You May Like: I Never Got My California Stimulus Check

Dont Fall For Social Media Posts Promising Thousands In New Stimulus Money

If Your Time is short

- This isnt a real stimulus program.

A promotion dangling up to nearly $4,000 to American homeowners is spreading online, but its not real, so please dont get your hopes up.

“New GSE stimulus program is giving homeowners up to $3,708 every year,” says the headline of a blog post on the website ouramericanliving.com.

“Homeowners can start using this $3,708 however they want, thanks to a new stimulus package brought to us by the current administration,” the post goes on to say. “You can substantially reduce your home mortgage payments, improve your home, or use it for any other expense.”

To tap into this cash, the post tells people to complete a “mortgage stimulus survey.”

Featured Fact-check

This post was flagged as part of Facebooks efforts to combat false news and misinformation on its News Feed.

RELATED VIDEO

If you search for evidence to corroborate the stimulus claim online, youll find none. But there aresome fact-checks debunking it.

We rate this claim Pants on Fire.

Do You Qualify For A Lower Interest Rate

Refinancing can offer relief from high mortgage payments. By lowering your mortgage interest rate and/or extending your loan term, you can typically reduce your monthly payment and take some pressure off your budget.

To qualify for a refinance, youll need to meet some basic criteria. But these can be very flexible depending on the loan program.

Don’t Miss: What Was The 3 Stimulus Checks

Is There Any Mortgage Finantial Aid Available

Since many Americans receive multiple stimulus checks and funds during the pandemic, many are wondering if Congress will also help homeowners furthermore, but they have through President Biden’s American Rescue Act, which provided close to $10 billion dollars to the states and District of Columbia through the Homeowner Assistance Fund .

The states have implemented several systems and programs to distribute the funds, and generally an eligible recipient must make less than 100% of the median income for the entire United States.

The homeowner can have a $548,250 mortgage balance or less in order to qualify.

Some homeowners could be saving more than $300 dollars monthly if they refinanced their mortgage, with the National Council of State Housing Agencies saying the programs will start rolling out soon and they invite everyone to visit their website for updates.

How Much Can I Take Out With An Fha Loan

To figure out how much you can take out with an FHA cash-out refinance, you must be aware of your maximum loan-to-value ratio for an FHA cash-out loan, which is 80% for most homeowners.

This means that you can borrow as much as 80% of what your home is worth as long as you have at least 20% equity remaining.

Therefore, the amount of cash that you can take out depends on your equity. To get an estimate of how much you can take out, determine your equity, then subtract 20%. Factor in closing costs to get the best estimate.

Below is an example of an FHA cash-out refinance calculation:

Current Home Value: $400,000

Paying off Current Loan: -$250,000

Max FHA Cash Out: $70,000

In this example, the homeowners maximum FHA cash out is $70,000, minus closing costs.

This is the maximum in an ideal scenario, not factoring in credit scores or debt-to-income ratio, which could greatly affect the maximum amount you qualify to borrow.

Don’t Miss: How.many Stimulus Checks In 2021

Mortgage Rates Are Falling

According to Freddie Mac, the 30-year fixed-rate mortgage hit an average of 6.33% for the week ending on December 8. This rate is down from 6.49% a week ago since reports indicate that the stubborn inflation numbers may be coming down from their peak.

Sam Khater, a chief economist from Freddie Mac, noted that despite a significant decline in mortgage rates, the homebuyer sentiment has remained low, and there hasnt been a surge in purchase demand with the lower rates.

We also cant ignore the role of inflation on savings. As people are spending more money on everyday items, they may not be able to save up for a down payment as quickly as they could in the past.

Mortgage Advertising And Servicing

The FTC also works to protect consumers from illegal practices in the mortgage lending industry, with emphasis on the subprime market. Our cases have targeted deceptive and unfair practices by entities who work with consumers throughout the mortgage cycle including advertisers, lenders, and loan servicers. In 2011, the FTC also issued the Mortgage Acts and Practices Rule which bans advertisers from misrepresenting mortgage terms.

Cases

Read Also: Stimulus Checks For Social Security Disability

Don’t Miss: Information About The Second Stimulus Check