Here’s What Else You Should Know

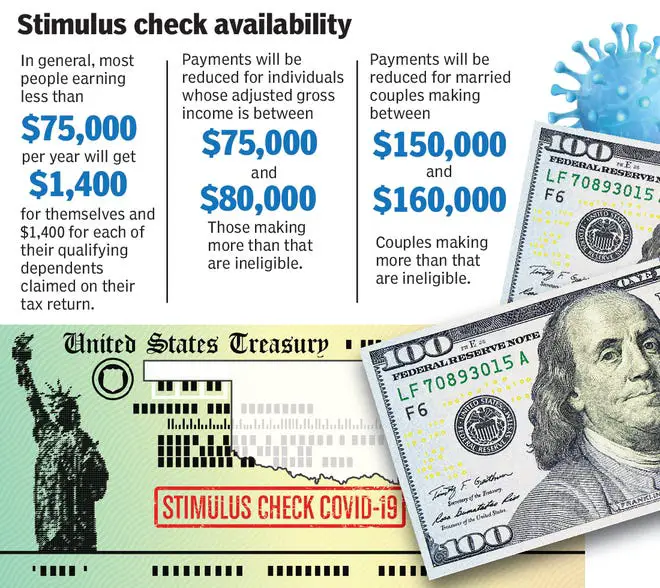

Stimulus payments can total up to $1,400 per person for those with adjusted gross incomes of $75,000 or less as single filers, or $160,000 or less for joint filers.

Families can also receive $1,400 per dependent, regardless of the dependent’s age.

The Child Tax Credit was also temporarilyextended by Congress to consider more families and increase how much they can receive.

Most families are eligible for $3,000 per child between the ages of six and 17 and $3,600 for each child under six. You can check the IRS’s site to determine if you qualify.

Tax returns can also be completed and submitted through CTC’s site, including the simplified filing tool which was updated on Wednesday.

GAO discovered that people within certain groups may have faced difficulty receiving their payments.

This includes those who:

Th Stimulus Checks Given Out To Targeted Groups

Some states are digging into that wad of cash the government gave them and giving out the fourth stimulus checks to specific groups of people. The requirements look different for each state, but all seem to have a few things in commonlike falling into certain income levels or going through some kind of hardship.

The Grand Canyon State has a different take when it comes to stimulus checkstheyre giving them out to people who are going back to work. Arizonas Back to Work Program is offering $2,000 to those who got a job after being on unemployment.3 But you have to hold down your new job for at least eight weeks before getting the benefit.

The Golden State is the only one on the list to give out big ol broad-sweeping stimulus checks that look like the ones the federal government gave out. Heres how their numbers break down: Californians making $75,000 or less were sent a one-time check of $600 or $1,200 as part of the Golden State Stimulus I.4 And with the Golden State Stimulus II, they could be eligible for a second stimulus payment anywhere from $500 to $1,100.5 Thats on top of extra money the state paid out through the Young Child Tax Credit to those who have children age 6 or younger.6

These guys decided to shift their focus to giving their stimulus checks to the unemployed. They sent $375 to folks who had gotten at least one unemployment check payment between March 15, 2020, and October 24, 2020.7

What If Both My Spouse And I Have Itins And Our Children Have Ssns Can Our Family Get The Third Stimulus Check For Our Children

Yes. For the third stimulus check, any household member that has an SSN qualifies for a payment.

This is different than the first and second stimulus check, where at least one tax filer must have an SSN for the household to claim the stimulus checks. That adult with the SSN and any qualifying children with SSNs will get the stimulus checks.

You May Like: Veterans 4th Stimulus Check 2021

Theres Still Time To Get Payments

If you havent yet filed your tax return, you still have time to file to get your missed 2021 stimulus payments.

Visit ChildTaxCredit.gov for details.

The IRS has issued all first, second and third Economic Impact Payments. You can no longer use the Get My Payment application to check your payment status.

Most eligible people already received their Economic Impact Payments. However, people who are missing stimulus payments should review the information below to determine their eligibility to claim a Recovery Rebate Credit for tax year 2020 or 2021.

Securely access your IRS online account to view the total of your first, second and third Economic Impact Payment amounts under the Tax Records page.

Donât Miss: How.much Was.first Stimulus Check

State Stimulus Checks 202: See If Payments Are Coming Your Way Before The Year Ends

Nearly 20 states approved stimulus payments in one form or another in 2022, and residents in a dozen of them are still waiting for their money. If you live in one of the following 12 states and you havent yet received a payment you qualified for, dont panic the check might be in the mail.

Take a look below for more payment information from these state governments.

Recommended Reading: Can Unemployed Get Stimulus Check

Your Stimulus Check Is Coming Soon Heres How To Prepare

Trending

Congress passed the Coronavirus Aid, Relief, and Economic Security Act, which includes providing stimulus checks to stimulate the economy, and provide financial relief. The Treasury Department and the Internal Revenue Service will distribute these checks in the next three weeks. Heres what you need to know to ensure you receive your check, and how to make the most of your money.

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer. Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022, should have received their returns in September, and those who requested paper checks should have received them by October 31. Taxpayers who filed their returns after July 31 should receive their check up to 10 weeks after their return is accepted by the tax department.

Also Check: When Will We Get Our Stimulus Checks

What If I Was Underpaid Or Overpaid

First, double-check how much money you should be getting and make sure the amount you think youre supposed to get is right. You can do this on the IRSs Child Tax Credit Eligibility Tool or by checking to see what amount is on the letter that the IRS sent to you at the beginning of July .

If it still looks a little weird to you guys, then head over to the IRS Portal and make sure they have your latest information.

Stimulus Checks Could Be Coming To These 4 States Soon

The last federal stimulus check went out in 2021, but individual states are starting to come through with financial help for residents as record inflation continues to affect many Americans bottom lines and budgets.

Important: 5 Things You Must Do When Your Savings Reach $50,000

As GOBankingRates reported earlier this week, 13 states are currently offering stimulus money to constituents. Among them are California, where a Middle-Class Tax Refund provides up to $1,050 per single tax filer, and Massachusetts, where a new law called Chapter 62F declares the state has to refund budget surpluses back to residents. Residents will get back around 14% of the state income taxes they paid in 2021.

Other states currently offering stimulus payments include Colorado, Delaware, Hawaii, Illinois, Indiana, Minnesota, New Jersey, Pennsylvania, Rhode Island, South Carolina and Virginia. Many others provided financial support earlier this year.

A few more states may soon announce stimulus packages, income tax rebates and gas rebates, reported Forbes, noting that lawmakers are still debating proposed legislation. Heres where the next round of payments may be happening.

Read Also: How To Check On Stimulus Payment For Non Filers

More Third Stimulus Payment Money For Some In 2022

Parents who added a child in 2021 could be getting up to $1,400 after they file their 2021 taxes this coming spring thanks to the American Rescue Plan. The money won’t come as a direct check but will be part of the overall tax return.

The 2021 Economic Impact Payment — colloquially known as the third stimulus check — was actually an advance on what is called the 2021 Recovery Rebate Credit. What that means is that the $1,400 stimulus check most individual Americans received in 2021 is, in fact, money they would have gotten after filing their taxes in the spring of 2022 as a Recovery Rebate Credit.

In other words, millions of Americans already got part of their tax refund 12 months early.

“The bottom line is that’s money that’s going out almost immediately to millions of people as a tax credit in advance of putting it on a tax return in the next year,” said Raphael Tulino, IRS spokesman.

However, the IRS was going off of 2019 or 2020 tax returns for its information on the third EIP. It was using that information to determine if taxpayers would get stimulus money for their dependents. If eligible parents had a child born into their family in 2021, they can request the Recovery Rebate Credit on their taxes to get the payment for that child.

It gets more complicated with adoption because all the paperwork and processes to finalize the adoption must be completed first.

This does not pertain to the first or second stimulus payments that were paid in 2020.

How Can I File My Taxes

If you know you need to file a 2020 tax return, you should do so as soon as possible to get your Economic Impact Payment and any tax refund that you are eligible for.

Online: If youre comfortable using computers and confident preparing your own taxes, consider using a free online tax software. MyFreeTaxes is an online tool that helps you file your taxes for free. You can use these online programs until November 20, 2021.

You May Like: How To Apply For Stimulus Check Online

Stimulus Update: Will There Be A Stimulus Check For Inflation

Hey, weve all felt the pain of high prices on gas, groceries and just about everything else. To combat inflation, nearly 20 states have decided to give out inflation stimulus checks.

Each state has different guidelines for its inflation stimulus plans. Some states are offering tax rebates while others are sending direct payments that range from $50 up to more than $1,000.

Congress is also considering sending out a $100 gas rebate check to everyone in every month the national average gas price is $4 or more. But so far, the Gas Rebate Act of 2022 hasnt picked up much speedand neither has the idea for a federal gas tax holiday.

Will I Get An Economic Impact Payment

If you meet the following four requirements, you likely qualify for the stimulus.

1. Income Limits: If you are filing as single with an adjusted gross income up to $75,000, married filing jointly with an AGI up to $150,000, or head of household with an AGI up to $112,500, you will receive the full payment. Above these income limits, the payment amount decreases 5 percent for every additional $100 of income up to $99,000 for a single adult, $136,500 for head of household, and $198,000 for a married couple.

If you have zero income you can still get the payment.

2. Age requirements: There is no age requirement for the stimulus check, however you cannot be someone elses dependent. Children must be under 17 to get the additional payment for them.

3. Taxpayer Identification Number :At least one tax filer must have a valid Social Security number . If you are married filing jointly, and one spouse has an SSN and one has an Individual Taxpayer Identification Number , the spouse with an SSN and any children with SSNs or an Adoption Taxpayer Identification Number can get the payment. If one spouse is an active member of the military, then both spouses are eligible for a stimulus check even if only one spouse has an SSN and the other spouse has an ITIN.

4. Citizenship or Residency: You must be a U.S. citizen, permanent resident, or qualifying resident alien.

Read Also: Are We Going To For Stimulus Check

What Was The Timeline For The Third Stimulus Check

Once the bill moved through all the hoops, eligible people started seeing their stimulus payments before March 2021 was over.7 The IRS and U.S. Treasury have been quick with delivering past stimulus checksDecember 2020s payments reached most folks by direct deposit within a week of then President Donald Trump signing the legislation.8

South Carolina: Rebate Checks Of Up To $800

A budget plan approved in June earmarked $1 billion for a tax rebate that will provide a one-time payment to South Carolina residents.

The maximum rebate is $800 ,and the South Carolina Department of Revenue offers instructions for calculating your rebate amount. Rebates will be distributed prior to December 31.

South Carolina residents who choose to file their tax returns on or before the February 15 disaster relief extension will have their rebates issued in March 2023.

If you received your 2021 refund by direct deposit, youll also receive your rebate to that account.

You can estimate your rebate by following the instructions on the state Department of Revenue rebate news website.

Recommended Reading: When Did I Receive My Stimulus Check

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Fourth Stimulus Check Amount

The fourth stimulus check amount depends on several factors. If passed, it would probably look similar to the previous checks, although that’s not guaranteed.

For reference, the first stimulus check amounted to as much as $1,200, while the second stimulus check brought $600 to eligible Americans. The third stimulus check, which the IRS is still in the process of distributing, is worth up to $1,400 per person, although the eligibility requirements are narrower.

All three checks gave the full amounts to taxpayers who made up to $75,000 a year, according to their most recent tax returns. Couples filing jointly got the full payment if they had a joint total income of $150,000 or less.

With the first two checks, those making up to $99,000 alone or $198,000 as a couple received prorated payments. With the third check, individuals who earned more than $80,000 per year or $160,000 per year as joint filers got nothing. Our guide to the stimulus check calculator can show you what your own eligibility looks like.

Also Check: Only Received One Stimulus Check

Will There Be A New Stimulus Check For Summer 2022 Three Scenarios When You May Get It

- 9:32 ET, Jul 18 2022

AS the Covid-19 pandemic continues into 2022, many Americans are hoping there will be another federal stimulus payment.

Stimulus checks serve the purpose of helping those in need stimulate the economy during a financial downturn.

As a result of the coronavirus pandemic, we have seen three stimulus check packages passed on the federal level.

The first stimulus package included $1,200 in direct payments, and the next one sent $600 to Americans.

The latest stimulus payments, as part of President Joe BidensAmerican Rescue Act, sent $1,400 checks to Americans.

While another stimulus incentive seems unlikely given the rapid rebound in the economy and inflation, we list three reasons why another could happen.

Inflation Stimulus Checks Are Coming To These States

11 Min Read | Dec 5, 2022

Wait a minuteare people really talking about stimulus money again? Thats right, just when you thought they were all a long lost thing of the past, here come inflation stimulus checks. The whole point of these is to, you guessed it, help combat inflationnot to stimulate the economy like those other checks did. After all, that might have a little something to do with why we have this killer inflation in the first place. But thats a topic for another day . . .

So, whats the deal with inflation stimulus checks, and is your state on the list for dishing one out? Lets see what all the fuss is about.

You May Like: How To Find Out If You Get Stimulus Check

I Already Filed My Tax Return And Still Havent Gotten My Payment What Can I Do

If you filed a 2019 tax return and it wasnt processed in time to issue your first stimulus check by December 31, 2020, you can claim your first stimulus check as the Recovery Rebate Tax Credit on your 2020 tax return or use GetCTC.org if you dont have a filing requirement.

If you filed your 2020 tax return, the IRS may still be processing your return. The fastest way to receive the payment is through direct deposit. Your first stimulus check, which you claim as the Recovery Rebate Credit, will be sent as part of your tax refund. You can check the status of your tax refund using the IRS tool Wheres My Refund.

Because of COVID-19, it is taking more than 21 days for the IRS to issue refunds for certain mailed and e-filed 2020 tax returns that require review.