Will My Third Stimulus Check Be Reduced

The number the IRS will look at is your adjusted gross income for 2020, which is your income without retirement contributions but before your standard or itemized deductions are taken out. You can find your adjusted gross income on line 11 of your Form 1040 of your 2020 tax return. If you haven’t yet filed your 2020 tax return, the IRS will use your AGI from your 2019 tax return.

Single people who make between $75,000 and $80,000 will have their checks reduced by 28% of the amount over $75,000, and married people who file joint returns and make between 150,000 and $160,000 will have their checks reduced by the same percentage of the amount over $150,000. Taxpayers who file as head of household and make between $112,500 and $120,000 will have their checks reduced by a similar percentage of the amount over $112,500. The $1,400 that parents receive for each dependent is subject to the same reduction.

This means that single people who earned $80,000 or more in 2020 don’t qualify at all for the third stimulus checkcompared with $87,000 for the second stimulus check. Couples who earned $160,000 or more won’t get a third stimulus check, down from $174,000 for the second stimulus check. And a family of four that earned $160,000 or more also won’t receive a third stimulus check.

When Is The Tax Filing Deadline This Year

The official deadline this year for most people is April 18, a few days later than normal because of a holiday in Washington, D.C., according to the I.R.S. But the agency has extended the filing deadline to May 16 for people in some states affected by recent natural disasters, including Kentucky and Colorado . Filers in Maine and Massachusetts get an extra day, until April 19, because of state holidays.

$1000 Monthly Checks In New York: Who Is Eligible And How To Claim

To be eligible for the $1,000 checks in New York you must be an artist over the age of 18, prove that you are a resident of the state, earn below the CRNY self-sufficiency standard and perform in one of the following areas:

- Interdisciplinary arts

Unfortunately, if you’ve not already applied, the deadline to register for the programme was 25 March, but on 15 April they will announce those who are eligible.

Los Angeles $1,000 monthly checks: Who is eligible and how to claim?

In the case of Los Angeles, the call for applications for the programme began on 31 March 2022. People over the age of 18 who have been financially hit by the pandemic, are residents of one of Los Angeles’ middle-class neighbourhoods and are not enrolled in other Universal Basic Income programmes can apply, as long as their income does not exceed the following limits:

- People living alone: $56,000 per year

- 2 residents in the same household: $76,800 per year

- 3 residents in the same household: $86,400 per year

- 4 residents in the same household: $96,000 per year

- 5 residents in the same household: $103,700 per year

- 6 residents in the same household: $111,350 per year

- 7 residents in the same household: $119,050 per year

- 8 residents in the same household: $126,700 per year

Registration must be done online through the program’s website. Only 1,000 people will be eligible.

We will continue to keep a close eye on new schemes being introduced around the country and share.

You May Like: Was There Any Stimulus Checks In 2021

What To Do With Your Stimulus Check

No matter how small or large your relief check is, the arrival of an unexpected sum of money can be a great incentive to move forward in your financial journey.

Whether you receive a stimulus check of $50 or $1,000, you should consider using it to pay down any high-interest debt such as or personal loans, investing it in a Roth IRA or traditional IRA or saving it for a future home purchase. Select ranked Charles Schwab and Fidelity as some of the best brokers who offer Roth IRAs.

If your emergency fund is low or you’re saving for a big purchase, put your new stimulus money into a savings account. And if you’re currently earning a low interest rate on these funds, think about opening a high-yield savings account which can pay you more on your money each month the American Express® High Yield Savings Account and the Sallie Mae High-Yield Savings Account are two good ones to consider.

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

You May Like: 4th Stimulus Check For Ssdi

New Debit Cards To Be Issued For Third Round Of Stimulus Checks

The new legislation includes provisions for those receiving payments by debit card. With this round of payments, new debit cards will be issued for the third/latest stimulus payments. The IRS cannot use the prior debit cards used for earlier stimulus payments.

Get the latest money, tax and stimulus news directly in your inbox

Covid19 Stimulus Checks Present People With Disabilities A Great Opportunity To Save For Their Future With Able Accounts

The government is giving people a stimulus payment of $1,200 and some will get $500 more if they have a child they support. The stimulus payment is meant to help our countrys struggling businesses and communities during the COVID-19 pandemic. If you are already getting monthly Social Security benefits you will get the stimulus payment the same way you receive your monthly benefits. The stimulus payment MUST be spent within 12 months. Otherwise, it will count as an asset and could reduce your benefits. Many people have already received their stimulus payments.

You can put all or part of your stimulus payment into an ABLE account. That way, you dont have to worry about spending the money right away if you dont need to. Putting the payment in an ABLE account can give you added flexibility. Plus, it will have the same benefits protection that the other money in your ABLE account has.

Also Check: When Is The 3rd Stimulus Check Coming

How Do I Get Help Filing A Tax Return To Claim My Eip

- The IRS recommends electronic filing, and we agree. It is a faster, more secure option. Paper forms will take much longer to be processed by IRS. You may qualify for free e-file software.

- You can also call the Vermont 2-1-1 hotline and follow the menu options for tax preparation. Through this service you may be able to schedule an appointment with a free Volunteer Income Tax Preparation Assistance site. These sites are staffed by trained volunteers. They provide free preparation services to taxpayers who meet eligibility requirements.

- Also, you can find Form 1040 and Form 1040 instructions on the IRS website.

Third Stimulus Check Calculator: How Much Will I Get

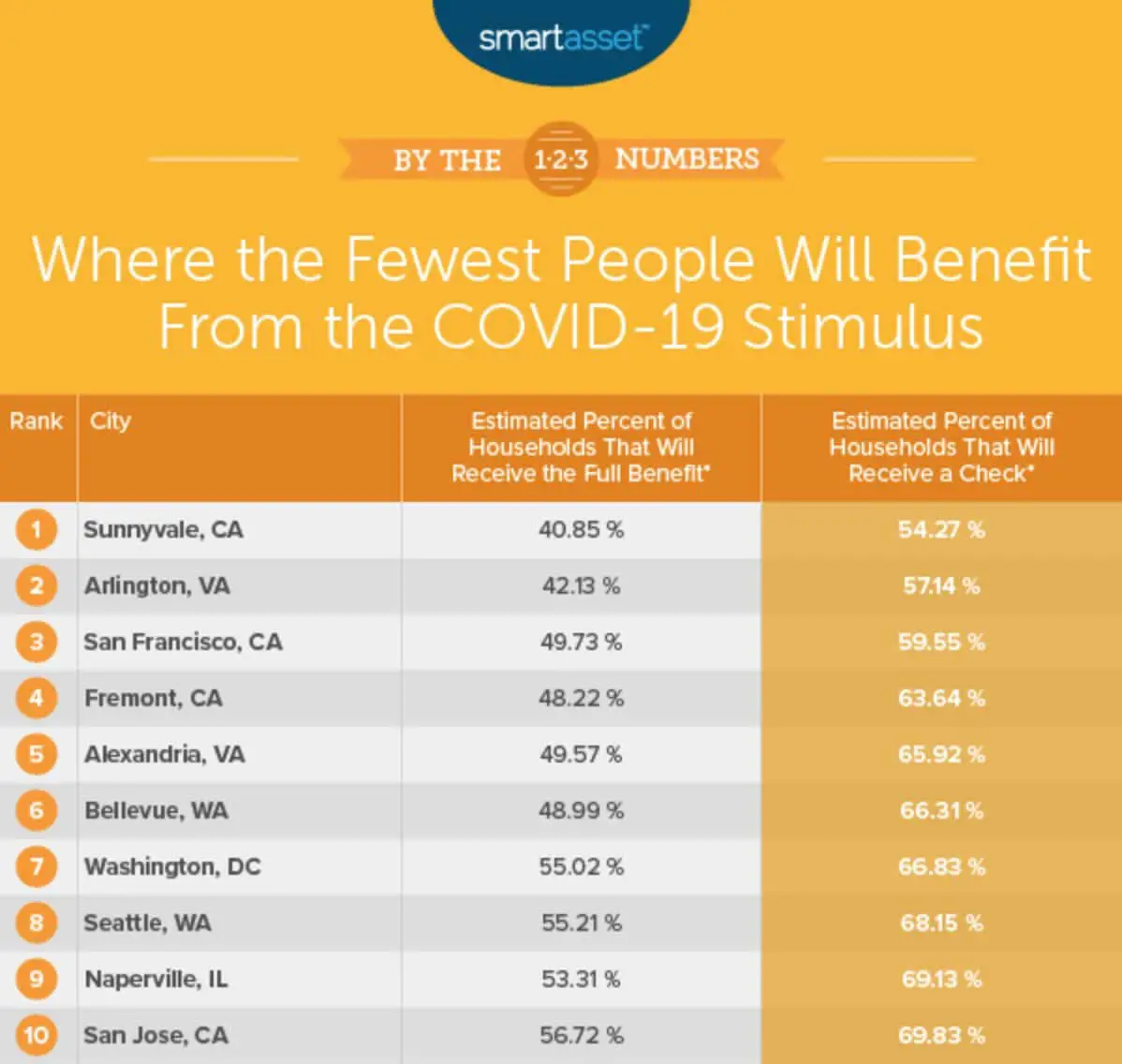

President Joe Biden signed the American Rescue Plan into law on March 11. The plan includes a third stimulus check that pays up to $1,400 for individuals and $2,800 for couples. Single taxpayers earning more than $80,000 and joint taxpayers making over $160,000 will not get a stimulus payment. Heads of household with an income above $120,000 will also be excluded. Use the third stimulus check calculator below to figure out how much you will get:

Read Also: When Are We Receiving Stimulus Checks

New Monthly Stimulus Checks For Families Will Start In July Irs Now Says

As part of President Joe Biden’s $1.9 trillion COVID relief package the new law that has been giving most Americans $1,400 stimulus checks working families can expect to receive up to $3,600 per child for 2021.

Half of that will come in the form of cash, as monthly payments due to start this summer. They’ll be another kind of stimulus check, to help millions of parents deal with basic bills or pay down debt.

The money is the result of a temporary expansion of the child tax credit. IRS Commissioner Charles Rettig had warned a few weeks ago that the new checks could be delayed, because the tax agency was overwhelmed. But this week, he offered Congress better news.

Indiana: $325 Rebate Payments

Like Georgia, Indiana found itself with a healthy budget surplus at the end of 2021, and it has authorized two rebates to its residents.

In Dec. 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by Jan. 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to a state information page.

Taxpayers who filed jointly will receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit, and the second payments started rolling out in late August. If you changed banks or dont have direct deposit information on file, youll receive a paper check. A printing delay put mailing the first round on hold for several months, but mailing resumed in mid-August. Checks mailed after that point contain payments for both rebates, for a total of $325 per taxpayer.

Distribution of printed checks is expected to take place through early October. If you did not file your 2021 tax return by the April deadline, you can claim your $125 rebate on your 2022 taxes.

For more information, visit the state Department of Revenue website.

Recommended Reading: Will There Be Another Stimulus Check In 2020 To

Still Living Paycheck To Paycheck

While the stimulus checks and now-expired Child Tax Credit provided direct aid to families, “most federal aid programs miss the mark, and only reach a fraction of the intended recipients,” noted Greg Nasif, political director of Humanity Forward.

He added, “They barely functioned even before the pandemic and they leave parents with a full-time job navigating bureaucratic hurdles.” In his view, providing “speedy, efficient, direct cash support” is the best option for helping struggling families.

Many people never applied for unemployment benefits because they didn’t think they were eligible, while others may have given up due to long waits and other issues.

Even those who qualified for aid didn’t always receive it. Only 4 in 10 jobless workers actually received unemployment aid, according to a from economist Eliza Forsythe.

I’m A Nonfiler Do I Have To File Taxes This Year To Receive My Stimulus Money

A nonfiler is a person who isn’t required to pay taxes to the IRS during tax season. The requirement to file a tax return depends on your gross income, which is all income you receive in the form of money, goods, property and services that aren’t tax-exempt .

People who are considered nonfilers don’t need to do anything to receive a third stimulus check, according to the IRS. However, if you’re claiming missing stimulus money in a Recovery Rebate Credit, even nonfilers will have to file a tax return this year. You may be able to use a special form and file for free. You will, however, need some specific information.

If you’re age 65 or older, you should file taxes under the following circumstances:

- Single filer with at least $13,850 in gross income.

- Head of household with at least $20,000 in gross income.

- Qualifying widow age 65 or older with at least $25,700 in gross income.

In the 2019 tax year, the IRS introduced Form 1040-SR, US Tax Return for Seniors. This form is basically the same as Form 1040, but has larger text and some helpful information for older taxpayers.

Don’t Miss: How Much Was The Stimulus Payments In 2021

Filed A Tax Return But Still Didn’t Receive Your Money Here’s What Else It Could Be

If you filed your taxes this year but still haven’t received your stimulus check or child tax credit money that you’re eligible for, there are some other things that could be holding it up.

- You don’t have a bank account set up.

- It was your first time filing.

- You have a mixed-status household.

- You haven’t updated your address with the IRS or USPS.

- You’re experiencing homelessness.

- You have limited or no internet access.

If none of these reasons apply to you, it may be time to file a payment trace with the IRS either by calling 800-919-9835 or mailing in Form 3911.

What Gaos Work Shows

1. IRS can use data to tailor outreach efforts.

It was challenging for IRS and Treasury to get payments to some peopleespecially nonfilers, or those who are not required to file tax returns. These people were eligible for the payments for a couple of reasons:

- first, there was no earned income requirement, so Americans with no or very little income could receive economic relief and

- second, the payments were refundable tax credits, so eligible individuals can claim the full amount even if it exceeds what they owe in taxes.

In 2020, Treasury and IRS used other data to identify and reach out to around 9 million potentially eligible nonfilers. In May 2021, TIGTA identified potentially 10 million individuals eligible for payments, but IRS has no further plans to reach out to these individuals.

We recommended that Treasury and IRS use available data to develop an updated estimate of total eligible individuals which they could use to better tailor and redirect their ongoing outreach and communications efforts for similar tax credits.

2. Improved collaboration will also help outreach to underserved communities.

We recommended that Treasury and IRS focus on improving interagency collaboration and use data to assess the effectiveness of their efforts to educate more people about refundable tax credits and eligibility requirements.

Recommended Reading: Sign Up For Stimulus Check 2022

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS. In this situation, Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Stimulus Payments Child Tax Credit Expansion Were Critical Parts Of Successful Covid

When COVID-19 began to spread rapidly across the United States in March 2020, the economy quickly shed more than 20 million jobs. Amid intense fear and hardship, federal policymakers responded, enacting five bills in 2020 that provided an estimated $3.3 trillion of relief and the American Rescue Plan in 2021, which added another $1.8 trillion. This robust response helped make the COVID-19 recession the shortest on record and helped fuel an economic recovery that brought the unemployment rate, which peaked at 14.8 percent in April 2020, down to below 4 percent. One measure of annual poverty declined by the most on record in 2020, in data back to 1967, and available data suggest that poverty levels in 2021 were similar to 2020. Two critical components of the fiscal response were Economic Impact Payments and the expanded Child Tax Credit, which quickly delivered much-needed income to families struggling to pay their bills.

With both the EIP and the Child Tax Credit, policymakers built on prior policies but with innovative design improvements to expand eligibility and make access easier:

You May Like: Who Qualified For Third Stimulus Check

Here Are Some Questions And Answers Around This New Stimulus Payment:

If I didnt file taxes in 2019/2020 will I receive the stimulus ? Unlike the first stimulus payment where those who didnt need to file a tax return could update the IRS non-filer tool, this time around due to the speed of roll-out of the second stimulus check and with tax season around the corner the IRS has said the non-filer tool is closed for updates. The IRS will be using information they have as of Nov 21, 2020 or from your first stimulus check payment . Otherwise they are encouraging you to the stimulus by filing a 2020 1040 or 1040-SR tax return. Free tax software programs can be used by people who are not normally required to file tax returns but are eligible to claim the credit.

How will I get paid? Like the first stimulus payment in 2020, the IRS will facilitate payment of these checks based on your 2019 tax information. You will also get the dependent stimulus payment for eligible dependents claimed on your tax return. For other groups who dont file taxes the IRS will work with other government departments or the Get My Payment tool. Direct deposit will still be the fastest way to get your payment.

Dependents in 2020? Households who added dependents in 2020 might not qualify for full payments immediately, since based on 2019 tax return information. But they can request additional money as part of the 2020 tax returns they will file in early 2021. See more in this articles for dependent qualification income thresholds.

Recommended Reading: