What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

I Received The Child Tax Credit For A Child On My 2020 Taxes But They No Longer Live With Me What Should I Do

If you will not be eligible to claim the Child Tax Credit on your 2021 return , then you should go to the IRS website to opt out of receiving monthly payments using the Child Tax Credit Update Portal. Receiving monthly payments now could mean that you have to return those payments when you file your tax return next year. If things change again and you are entitled to the Child Tax Credit for 2021, you can claim the full amount on your tax return when you file next year.

If you have any questions about your unique circumstances, you should visit irs.gov/childtaxcredit2021.

How To Claim Your Rebate Credit

To get your money, youll need to claim the 2021 Recovery Rebate Credit on your 2021 return. Filing electronically can guide you through the form. Dont claim any missing first or second stimulus payments on your 2021 return rather, youll need to file a 2020 return or an amended return to get these payments.

The rebate credit does not count toward your taxable income. And be aware that youll need to fill out your tax return accurately and include the precise amount of stimulus payments the IRS has actually paid you to avoid a delay in your returns processing. If you enter the incorrect amount, it can hold up the processing of your return, Greene-Lewis cautions. The agency will not automatically calculate your 2021 rebate. It is on you, the taxpayer, to claim the Recovery Rebate Credit, Steber says.

Adam Shell is a freelance journalist whose career spans work as a financial market reporter at USA Today and Investors Business Daily and an associate editor and writer at Kiplingers Personal Finance magazine.

Also of Interest

Recommended Reading: Is There Another Round Of Stimulus Checks Coming Out

What Is My Next Step For Stimulus Fund Receipt As I Only Received One Check For $600

If you should have received more for the third Economic Impact payments, file a 2021 tax year return and the additional amount will be added as a refund.

If using TurboTax, the question of how much you received will be asked.

For the first and second payments, you need to file a 2020 tax year return, or an amended return if you already filed.

Why Did We Get Only Half The Amount

Many couples are finding that they are getting direct deposits for only a portion of what they think their stimulus payment should be. Some have gotten half of their payment deposited one week and half the next, and other couples are finding that their dependents’ share of the stimulus money is split between the two parents.

The IRS has explained that the first payment made might be based on a taxpayer’s 2019 tax return, and the second payment is a “plus-up” payment that is based on the taxpayer’s 2020 tax return.

The IRS has also said that part of the problem may be with “injured spouse” claims on a tax return. of only one spouse, the “injured” spouse can request a refund.) The IRS says that these couples will get their payments as two separate payments.

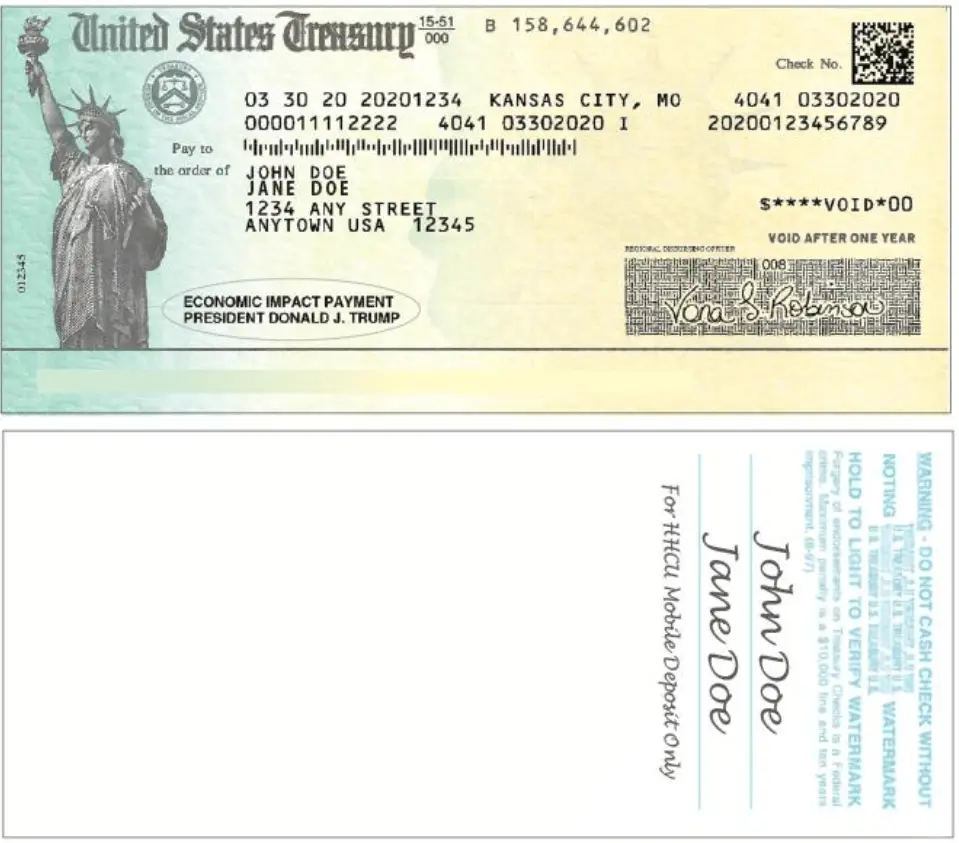

If you haven’t received the full amount, wait until you get your Notice 1444, Your Economic Impact Payment, from the IRS. That letter should have the correct amount of your stimulus payment. If you don’t receive deposits or checks in that amount, you may have to file a Recovery Rebate Credit . You can also read the IRS’s press release from April 1, which contains a lot of helpful details.

Also Check: Irs Gov Non Filers Form For Stimulus Check

How To Claim The Recovery Rebate Credit On A Tax Return

You will need to file your recovery rebate worksheet along with your 2020 or 2021 federal tax return, whichever is applicable. If you file your return using any of the best tax preparation software on the market, the program will guide you through the worksheet.

âWhen you file your 2020 or 2021 tax return, youâll have to report the stimulus checks you received with the recovery rebate credit you are entitled to claim,â says Samantha Hawkins, a certified public accountant and founder of Hawkins CPA Solutions in Upper Marlboro, Maryland.

You can find the amount of your first stimulus payment on your Notice 1444, which was mailed by the IRS. The tax agency followed up with a Notice 1444-B for the second stimulus round and Notice 1444-C for the third.

If you donât have the notices, you can create an online account with the IRS to verify the payments you received.

If you got less than the full stimulus payment for any of the rounds, the worksheet asks you questions about your income. In some cases, you may be entitled to claim an additional stimulus payment.

You can claim missing or partial first- and second-round stimulus payments only on your 2020 federal tax return. Any missing or partial third-round stimulus payments can be claimed on your 2021 federal tax return only.

If youâre behind on your returns, you have until Sept. 30 to file your 2020 taxes penalty-free. Taxpayers who got extensions to file their 2021 returns must submit those by Oct. 17.

Who Is Eligible For A Stimulus Check

The vast majority of Michigan residents are eligible to receive a stimulus check from the federal government this year. Even if you have no income, you are still eligible, but need to take action to receive your stimulus payment. This includes individuals with low or no earnings who normally don’t file taxes. Every American adult earning less than $75,000 is eligible for a stimulus check from the federal government this year. While this site is geared toward Michigan residents, the information is applicable nationwide.If you still have questions about your stimulus check after reviewing this website, call the IRS at or, United Way at .

After you sign up, make sure to add your account information on the IRS website. If you dont want to sign up for a bank account, you can also link to your prepaid debit card instead.You can also receive your funds through the Cash App, by providing the IRS with the routing and account numbers connected to your Cash App. You can download the Cash App or locate your Cash App account information here.

What if I havent filed taxes?

What if I dont qualify – where else can I get help?

If you dont qualify for the stimulus payment, we recommend reaching out to Michigan 2-1-1. They can connect you to resources in your community.

Will my payment be reduced or offset if I owe tax, have a payment agreement with the IRS, owe other Federal or State debt, or owe other debt collectors?

You May Like: When Was The 1200 Stimulus Check Sent Out

The 2021 Stimulus Payment

On March 11, 2021, the American Rescue Plan was signed into law. It called for sending a third round of stimulus checks to Americans. The American Rescue Plan authorized a $1,400 stimulus payment to eligible people. Learn more about it on the IRS website. Most people already received their payments, which were based on income reported on their 2019 or 2020 tax return.

If you believe you did not get all or part of the $1,400 stimulus from the American Rescue Plan of 2021, you should claim this as a recovery rebate credit on your 2021 tax returnLearn where to get help filing your taxes.

You Had A Lifestyle Change In 2020 That Wasnt Reflected In Your 2019 Taxes

A lot can change in a year, and its very possible the IRS didnt have enough up-to-date information accurately reflecting your financial situation.

A few circumstances that could qualify you for more money: You had a baby in 2020, or adopted or fostered a child. Less common, say you share joint custody with a child but only rotate that responsibility every other year. You might be eligible for extra money by filing for a credit, and there are instances when your former spouse might pocket extra money as well.

Say I filed with Susie Q. in 2019 and I got the stimulus checks for that child, and then my divorced spouse filed with Susie Q. for 2020. She would get the Recovery Rebate Credit as well, says Mark Jaeger, director of tax development at TaxAct. Its a little bit of double dipping, but it is something that is allowed.

Additionally, maybe you got married or divorced. Perhaps you graduated college and started working, meaning youre no longer considered a dependent. And, as is likely the case for millions of Americans, perhaps you had a higher-paying job in 2019 but lost that position in 2020. Even individuals who were working in 2019 but retired in 2020 could be eligible for the credit.

These are just a sampling of circumstances that might mean youre eligible for a stimulus check or a higher amount.

Theres a lot of reasons why you may be due more that are all legitimate, Steber says. Its real money, and its a lot of money.

You May Like: How Many Stimulus Checks Do We Get

Whether To File Another Irs Form

As was the case with the first and second check, if you filed a 2018, 2019 or 2020 tax return or receive government benefits, the IRS should automatically send your third check without you having to do anything.

If, however, you’re a nonfiler, a US citizen or permanent resident, had a gross income in 2019 under $12,200 — or $24,400 as a married couple — and didn’t file a return for 2018 or 2019, you may need to give the IRS a bit of information before it can process your payment. Since the IRS’ Non-Filers tool is now closed, you may need to file for that money on a 2021 tax return in the form of a recovery rebate credit, described above.

Here’s more information about who should file an amended tax form and who shouldn’t.

Receiving your stimulus check money isn’t always easy.

Who Is Eligible For The Third Stimulus Check

While eligibility is similar to the first and second stimulus checks, there are differences. There are four primary requirements:

1. Income: The income requirements to receive the full payment are the same as the first and second stimulus checks. There is no minimum income needed to qualify for the payment. Households with adjusted gross income up to $75,000 for individuals will receive the full payment. The third stimulus payment starts to phaseout for people with higher earnings. The third stimulus checks maximum income limit is lower than the first and second stimulus check. Single filers who earned more than $80,000 in 2020 are ineligible for the third stimulus check.

View the chart below to compare income requirements for the first, second, and third stimulus checks.

| Income to Receive Full Stimulus Payment | First Stimulus Check Maximum Income Limit | Second Stimulus Check Maximum Income Limit | Third Stimulus Check Maximum Income Limit |

| Single Filer | |||

| $120,000 |

2. Social Security Number: This requirement is different from the first and second stimulus check.

Any family member that has a Social Security number or dependent can qualify for the third stimulus check. For example, in a household where both parents have ITINs, and their children have SSNs, the children qualify for stimulus checks, even though the parents dont.

See the chart below for further explanation of how this works.

Don’t Miss: Create Irs Account For Stimulus Check

What Happens If You Dont Receive Your Payment Or Only Receive A Partial Amount

If you havent received your payment yet, dont panic, although its easier said than done. Compared with the first round of stimulus checks, the IRS and Treasury Department have significantly shrunk the delivery timeline by weeks, if not months. However, the text of the American Relief Plan still gives both agencies until Dec. 31, 2021, to distribute all funds, meaning the last round of checks might not hit consumers mailboxes until January 2022.

Consider signing up for the U.S. Postal Services informed delivery service, so you know in advance of any mail youll be receiving on a given day. If the IRS says it already mailed your check but you didnt receive one, down the road you might also decide to order a stimulus check payment trace. You can arrange one by calling a hotline at the IRS or submitting a completed Form 3911, Taxpayer Statement Regarding Refund by mail or fax. But be prepared: This process can take weeks. The IRS may also ask that you sit tight for the time being in some cases, for a period as long as nine weeks.

You May Like: Update On Ssdi Stimulus Check

When Are Stimulus Checks Being Sent Out

Heres the rough schedule so far, courtesy of a House Committee on Ways and Means memo:

- week of April 13: the IRS will send out 60 million payments to taxpayers for whom it has direct deposit information from their 2018 or 2019 tax returns

- late April: the IRS will do a second run of payments to Social Security beneficiaries who didnt file tax returns in 2018 or 2019 but do have direct deposit on file

- week of May 4: the IRS will start mailing paper checks at a rate of 5 million per week â a process that could last up to 20 weeks

Recommended Reading: Irs.gov Stimulus Check Sign Up

Will I Lose Out If I Didnt Sign Up In Time To Get A Payment On July 15

No. Everyone can receive the full Child Tax Credit benefits they are owed. If you signed up for monthly payments later in the year, your remaining monthly payments will be larger to reflect the payments you missed. If you do not sign-up in time for monthly payments in 2021, you will receive the full benefit when you file your tax return in 2022.

How Can You Correct Mistakes

The IRS sends out Notice 1444 by mail within 15 days of making a direct deposit or sending a paper check. That letter will tell you the amount of your stimulus payment and how it was made. The letter also provides instructions on fixing issues with your payment.

Donât Respond to Telephone Calls or Texts About Your Stimulus Check

The IRS will not call, text, or email you about your stimulus payment. The Federal Trade Commission is warning that thieves are posing as government employees to prey on stimulus payment recipients. These scammers may ask for your personal information or threaten you that if you donât send the money back in the form of money transfers or gift cards, youâll lose your driversâ license. Ignore these communications.

Copyright é2022 MH Sub I, LLC dba Nolo î Self-help services may not be permitted in all states. The information provided on this site is not legal advice, does not constitute a lawyer referral service, and no attorney-client or confidential relationship is or will be formed by use of the site. The attorney listings on this site are paid attorney advertising. In some states, the information on this website may be considered a lawyer referral service. Please reference the Terms of Use and the Supplemental Terms for specific information related to your state. Your use of this website constitutes acceptance of the Terms of Use, Supplemental Terms, Privacy Policy and Cookie Policy. Do Not Sell My Personal Information

Don’t Miss: How To Claim 2021 Stimulus Check

I Havent Filed Taxes In A While How Can I Receive This Benefit

You may be eligible for Child Tax Credit payments even if you have not filed taxes recently. Not everyone is required to file taxes. While the deadline to sign up for monthly Child Tax Credit payments this year was November 15, you can still claim the full credit of up to $3,600 per child by filing a tax return next year.

Who Isnt Eligible For The Recovery Rebate Credit

If you received full stimulus payments, you arenât eligible for any more cash. And you canât take the credit if someone else can claim you as a dependent.

Additionally, only U.S. citizens or âresident aliensâ qualify for the recovery rebate credit. If you are a ânonresident alienââ someone who has not passed the green card testâyou do not qualify for the credit.

You also are not eligible if you donât have a Social Security number. But if youâre married and your spouse has an SSN, there are certain instances where you might still qualify for the credit even if youâre not in the Social Security system.

Also Check: Stimulus Check Lost In Mail