Get Daily News Weather Breaking News And Alerts Straight To Your Inbox Sign Up For The Abc27 Newsletters Here

This is a program that has delivered more than $7.3 billion in property tax and rent relief since the programs inception in 1971, Revenue Secretary Dan Hassell said. We want Pennsylvanians to know that there is still time to apply for rebates on property taxes and rent paid in 2021. If you know of a friend or family member who may be eligible, encourage them to check their eligibility status and file an application with our agency prior to the deadline on Dec. 31, 2022.

The deadline to apply for rebates on rent and property taxes paid in 2021 was recently extended until Dec. 31, 2022, as Secretary Hassell noted. The Department of Revenue strongly encourages eligible applicants to file their rebate applications online by visiting mypath.pa.gov. The department launched myPATH to make it easier for the Pennsylvanians who benefit from the program to submit their applications.

Using myPATH to File Your Rebate Application

Submitting your application online through mypath.pa.gov is easy and does not require you to sign up for an account. Applicants will be asked to provide specific information on their income and rent/property taxes. Applicants should check the Property Tax/Rent Rebate Program instruction booklet to learn which information they will need to input/upload to complete the process.

Visit the Property/Tax Rent Rebate page on the Department of Revenues website for further information on the program and how to apply for a rebate.

How To Claim A Missing Payment

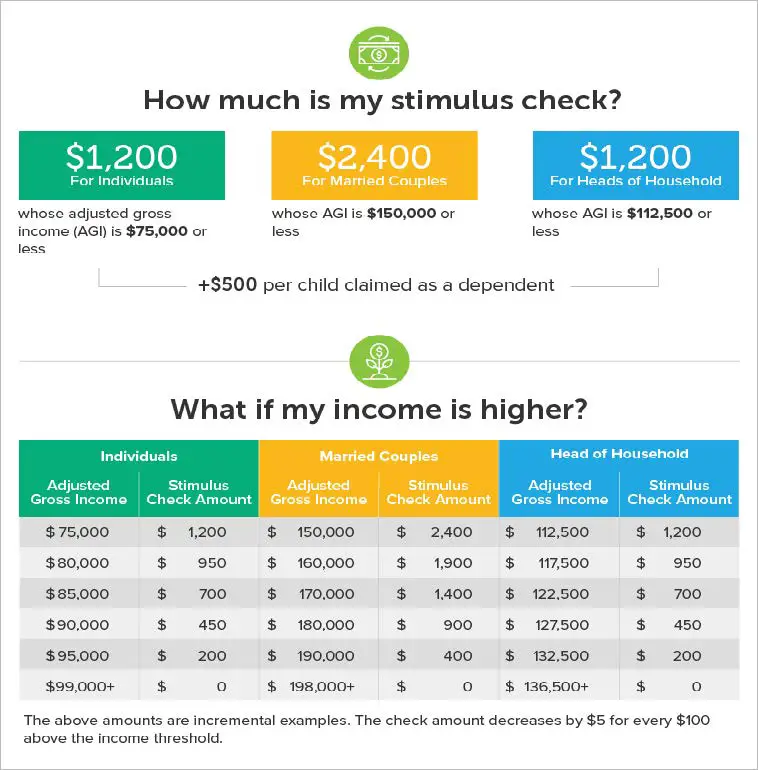

You may be eligible to claim a Recovery Rebate Credit on your 2020 or 2021 federal tax return if you didn’t get an Economic Impact Payment or got less than the full amount.

It is important to understand that the Economic Impact Payments applied to different tax years. Depending on whether you missed the first, second or third payment, you will need to file either a 2020 or 2021 tax return to claim a Recovery Rebate Credit.

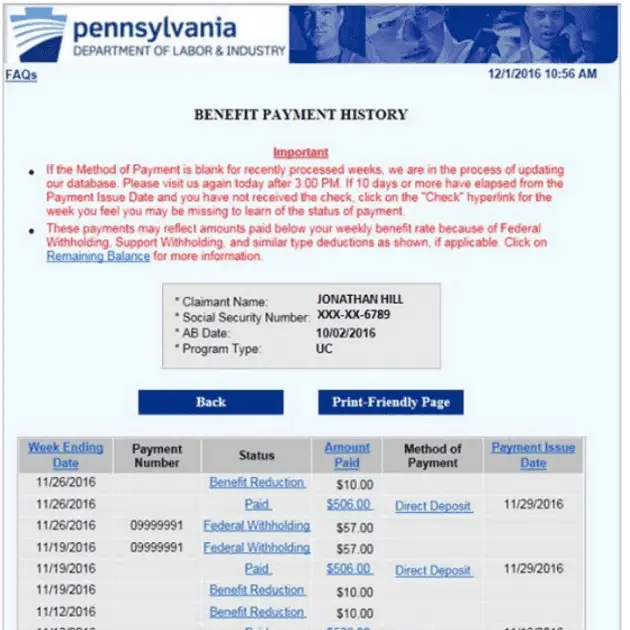

How Do I Check The Status Of My Property Tax/rent Rebate Claim To Find Out When I Can Expect My Rebate Check

When I can expect my rebate?

Rebate checks will begin being distributed each year on July 1. It takes an additional 4-6 weeks from the date your claim is approved for your rebate to be mailed or direct deposited. Approved rebates are not distributed prior to July 1. If you provided your phone number on your Property Tax/Rent Rebate Claim form you will receive an automated call from the department when you claim is received and when your claim is approved.

You may check on the status of your Property Tax/Rent Rebate Claim form online through myPATH or by calling the automated toll-free number, 1-888-PA TAXES . Please be prepared to provide your Social Security number, the claim year and your date of birth.

Here is the link where you can check on the status of your Property Tax/Rent Rebate: Property Tax/Rent Rebate Status

Please wait 8-10 weeks from the date you mailed your claim to check the status.

To speak to a customer service representative contact our Customer Experience Center at 1-888-222-9190 Monday through Friday between 8:00 am and 5:00 pm.

If you received your Property Tax Rent Rebate check and it was lost or stolen, please contact our Customer Experience Center at 1-888-222-9190 for a stop payment request. If your check was mailed out, but you did not receive it, you must allow 30 days from the mail date before requesting a stop payment. A stop payment request will take approximately 30 to 60 days before the results will be available.

Read Also: Will We Be Getting Another Stimulus

New Mexico: $500 Rebates

In early March, Gov. Michelle Lujan Grisham signed a law to send multiple rebates to state taxpayers.

Taxpayers earning under $75,000 annually received a rebate of $250 . The rebate was issued in July and sent automatically to taxpayers who filed a 2021 state return.

Another rebate was issued to all taxpayers. Single filers received $500, and joint filers received $1,000. This rebate was split into two equal payments, delivered in June and August 2022. The funds were sent automatically to taxpayers who filed a 2021 state return.

A taxpayer earning under $75,000 annually could potentially receive up to $750 with the combined rebates.

Residents who dont file income tax returns should have received a rebate in July. Single individuals without dependents received $500 households with married couples or single adults with dependents received $1,000.

If you file your 2021 state income tax return by May 31, 2023, youll receive your rebate by direct deposit or check. If you owe tax from your 2021 return, it will be deducted from your rebate amount.

Read more: New Mexico Residents To Receive Tax Rebate Of Up To $500

Gov Wolf Orders Commonwealth Flags To Half

Today, in honor of Pennsylvania State Representative Anthony M. Tony DeLuca, who died yesterday, Governor Tom Wolf ordered the commonwealth flag on all commonwealth facilities, public buildings and grounds fly at half-staff immediately. I am deeply saddened to hear of Rep DeLucas passing. He was a dedicated public servant and fierce advocate for his constituents

Also Check: How Much Were The 3 Stimulus Checks

Property Tax Relief For Older Pennsylvanians

The stimulus money will also fund a temporary 70% expansion of an existing state property tax relief program for people 65 or older and those with disabilities.

Typically funded by the Pennsylvania Lottery, the program will get a one-time $140 million infusion.

Last year, the program provided checks to 430,000 renters who make under $15,000 and homeowners who make under $35,000. Someone who received the maximum refund of $650 will receive an additional $455 under the one-year expansion.

Gov Wolf: $2000 Direct Payments To Pennsylvanians Will Make A Life

Governor Tom Wolf was joined by Representative Sara Innamorato and local officials at Roots of Faith ministries in Sharpsburg to continue calling on Pennsylvanias Republican-led General Assembly to finally take action and support Pennsylvanians by passing legislation for the $500 million PA Opportunity Program, which would send $2,000 checks directly to Pennsylvanians in need using money the commonwealth already has in the bank.

This money will make a life-changing difference for families in communities across the commonwealth, providing a much-needed buffer against prices that are artificially and temporarily higher due to inflation, said Gov. Wolf. Lets put this cash back in the pockets of Pennsylvanians, to help cover the higher costs of gas, groceries, and everything else.

Why on earth wouldnt we act to do all of that, when we have the funds necessary to make this investment in the people of Pennsylvania, right now? Gov. Wolf said. I am once again calling on Republican leaders in the General Assembly to send a bill to my desk to help the people of Pennsylvania.

Despite wide public support, the Republican-led General Assembly chose to not appropriate funding for the program during budget negotiations. Today, Rep. Innamorato echoed her colleagues support for the direct payment program.

In addition to Rep. Innamorato and Roots of Faith, the governor was joined by Allegheny County Executive Rich Fitzgerald and Pittsburgh Mayor Ed Gainey.

Also Check: Check On Status Of Stimulus Check

California: Up To $1050 Rebate

Californias new budget includes payments of $350 for individual taxpayers who make $75,000 or less. Couples filing jointly will receive $700 if they make no more than $150,000 annually. Eligible households will also receive an additional $350 if they have qualifying dependents.

Taxpayers with incomes between $75,000 and $250,000 will receive a phased benefit with a maximum payment of $250. Those households can get up to an additional $250 if they have eligible dependents.

Californians can expect to receive payments between October 2022 and January 2023 via direct deposit and debit cards.

Read more: California Families To Receive Stimulus Checks Up To $1,050

‘it’s Up To You To Spend It However You Want’

READING, Pa. Pennsylvania Gov. Tom Wolf stopped by the Salvation Army in Reading on Thursday to outline his initiative that would put $2,000 directly into people’s pockets.

“Gasoline prices are high, inflation’s up, food prices are up, rent,” Wolf said, “It’s $2,000, and it’s up to you to spend it however you want.”

The money would come from the American Rescue Plan, which is an economic stimulus bill passed by Congress and signed into law by President Joe Biden.

“This is an additional $2 billion we have sitting there that’s from the federal government,” Wolf said.

If passed, the $2,000 direct payments would be available for households with an income of $80,000 or less.

“You can see the pain in the faces of people all across Pennsylvania, right here in Reading, everywhere,” Wolf said.

While Wolf called the plan a no-brainer, some Republican lawmakers aren’t so sure.

“We believe it should be spent. We’re thankful to have it,” said state Sen. Dave Argall, a Republican who represents part of Berks County. “We want to spend it in such a way that is smart and doesn’t lead to a tax increase when the governor leaves.”

Argall did not discuss the other plans or proposals for the money, but he said there’s still time, as the budget doesn’t need to be finalized until the end of June.

Pennsylvania state Rep. Manny Guzman, a Reading Democrat, speaks during an event with Gov. Tom Wolf at the Salvation Army in Reading on April 28, 2022.

Scroll down for comments if available

You May Like: Who Qualified For Stimulus Checks In 2021

Gov Wolf Pushes For $2000 Direct Payments Without Plan To Bring Gop To The Table

- By

- Oliver Morrison, WESA

August 30, 2022

File photo: Pennsylvania Gov. Tom Wolf speaks at a Capitol news conference Monday, July 11, 2022, in Harrisburg, Pa.

This story originally appeared on WESA.

Barbara Williams daughter died 19 years ago, leaving a 2-year-old granddaughter to care for. She moved from Homewood to Sharpsburg soon after, and she had to learn to adjust. But then her husband passed away. And she became confined to her wheelchair and couldnt work.

She went into debt. I just felt like I couldnt get another job because we want to hire somebody in a wheelchair?

Then she got involved in a program called Roots of Faith in Sharpsburg, a Methodist organization that she said helped her get out of debt and get job training.

She lives off of Social Security and said even with a part-time job that she hopes will come through soon, she couldnt make ends meet.

Kathleen Stanley, the outreach director of Roots of Faith, said its anti-poverty campaign has boosted the income of its 14 graduates last year. Thats one part of a larger effort, she said, that has cut poverty from 30% to 23% in Sharpsburg. But now, she said, inflation has cut into those gains.

Georgia: $250 Rebate Payments

Thanks to a historic state budget surplus, Georgia residents who filed both their 2020 and 2021 tax returns were eligible to receive rebate payments based on their tax filing status:

- Single filers: Maximum $250

- Head of household: Maximum $375

If you owed income tax or other payments to the state such as delinquent child support payments, you may have received a smaller rebate. Partial-year residents may have also received a smaller rebate.

Residents who filed their taxes before Gov. Brian Kemp signed the legislation received their rebates via a separate payment. The state expected to send all rebates for returns filed by April 18 by early August.

Georgia taxpayers can learn more via the Georgia Department of Revenue.

Don’t Miss: How To Claim Stimulus Check 2021

Delaware: $300 Rebate Payments

Delaware sent relief rebate payments of $300 to taxpayers who filed their 2020 state tax returns. The one-time payment is possible due to a budget surplus. Couples filing jointly will receive $300 each.

Payments were distributed to most eligible Delaware residents in May 2022.

Instructions to claim the rebate havent yet been released for residents who havent filed a 2020 state tax return. Instructions are anticipated to be announced by Oct. 17.

Check your rebate status or get answers to frequently asked questions from the Delaware Department of Finance.

Gov Wolf Announces $17 Billion Plan To Secure A Brighter Pennsylvania For Generations

Governor Tom Wolf announced today his $1.7 billion plan to help Pennsylvania fully recover from the pandemic and pave the way for a successful future with support for families and workers, small businesses, the healthcare system, and statewide community revitalization through the American Rescue Plan Act .

As Pennsylvania endured the pandemic, we strategically invested to support small businesses, frontline workers, agriculture, healthcare, first responders, and more. This ensured that Pennsylvania survived, said Wolf. Now its time for Pennsylvanians to thrive and investing $1.7 billion in a bright future for this commonwealth will give Pennsylvanians a sense of security and a clear path forward.

My plan will not only help Pennsylvanians recover and rebuild financial security for themselves and their families, but it will improve the quality of life for Pennsylvanians for generations to come, said Wolf. I urge the legislature to act now. Pennsylvanians cant afford to wait.

While Pennsylvanians are still bruised and trying to recover from the pandemic, we cannot sit on billions of dollars in federal aid that could heal Pennsylvania, added Wolf. Its wrong to hold this money back from helping people. Its past time we take action.

The PA Opportunity Program, $500 million

Small Business Support, $225 million

Increased Property Relief for Low-Income Renters & Homeowners, $204 million

Read Also: What Is The Homeowners Relief Stimulus Program

Hawaii: $300 Rebate Payments

In June, Hawaiis legislature approved sending a tax rebate to every taxpayer Taxpayers earning less than $100,000 per year will receive $300, and those earning more than $100,000 per year will receive $100. Dependents are eligible for the rebate, too.

Taxpayers who filed their 2021 state income tax returns by July 31, 2022 can expect to receive their returns in September or October. For residents filing their 2021 return between Aug. 1 and Dec. 31, you can expect your payment up to 12 weeks after filing.

Gov Wolf Wants To Raise The Minimum Wage

The price increases were seeing right now are especially painful because wages havent kept up with the rising cost of living for many years, said Gov. Wolf. In addition to the $2,000 direct payments, he is proposing a minimum wage hike to $12 per hour by 1 July 2022. That would also come with a roadmap to $15 per hour by 2028.

This reality of unchanging wages and rising living costs has stretched the resources of working Pennsylvanians and their families to the limit, and with the recent dramatic price increases, beyond it, Gov. Wolf added. Pennsylvania is one of twenty states, and the only one among all of its neighbors, that has still not raised its minimum wage above the federal $7.25 an hour.

The federal rate has not changed since 2009 meaning families are losing purchasing power especially with the rampant post-pandemic inflation. The Keystone Research Center calculates that if it had kept in line with productivity growth since the late 1960s, the minimum wage would now be over $24 per hour today.

According to the MIT Living Wage calculator, in order to support themselves, a single adult in Pennsylvania needs to earn $16.93 per hour. Just to support their family, that amount jumps to $32.83 per hour for a single parent with one child.

Read Also: How Do I Apply For The 4th Stimulus Check

Minnesota: $750 Payments For Frontline Workers

Some frontline workers could receive a one-time payment of $750, thanks to a bill signed by Gov. Tim Walz in early May.

Eligible workers must have worked at least 120 hours in Minnesota between March 15, 2020 and June 30, 2021, and were not eligible for remote work. Workers with direct Covid-19 patient-care responsibilities must have had an annual income of less than $175,000 between Dec. 2019 and Jan. 2022 workers without direct patient-care responsibilities must have had an income of less than $85,000 annually for the same period. Applications for the payment are now closed.

Walz recently proposed using the states $7 billion budget surplus to fund a generous relief package, proposing that Minnesotans receive tax rebate checks of $1,000 per person. Doing so would require action from the state legislature.

Pennsylvanians Need Our Support Even More Today

Earlier this month Gov. Wolf was joined by Representative Patty Kim in Harrisburg to call on GOP state lawmakers to pass the PA Opportunity Program to help Pennsylvanians burdened by rising prices. A lot has changed since then, from inflation to price increases to a war in Ukraine. Pennsylvanians need our support even more today than they did in February, Gov. Wolf said.

The governor has touted his plan as a way to help workers and families still reeling from financial hardship caused by the pandemic. The direct payments would boost household income for many who are still covering pandemic-related costs, stabilizing their budgets, and rebuilding their savings.

The funds would give much-needed relief to cover expensive childcare and household expenses. Additionally, provide Pennsylvanians opportunities to complete educational and training courses to strengthen their skills and increase incomeall leading to a better quality of life.

Gov. Wolf has previously said that residents should not have to choose between paying for utilities or groceries, childcare or gas. We have the opportunity and the means to ensure theyre not struggling, to ensure their success.

Putting #PeopleFirst means getting federal COVID dollars out of the vault and into the hands of the people. @RepPattyKim joined @GovernorTomWolf to demand action!

PA House Democrats May 13, 2022

Also Check: How Much Was 3rd Stimulus Check 2021

Indiana: $325 Rebate Payments

Like Georgia, Indiana found itself with a healthy budget surplus at the end of 2021, and it has authorized two rebates to its residents.

In Dec. 2021, Gov. Eric Holcomb announced that Indiana taxpayers would get a $125 one-time tax refund after they filed their 2021 taxes.

Theres no income requirement. Residents must have filed a state tax return for the year 2020 by Jan. 3, 2022, as well as a 2021 Indiana tax return by April 18, 2022, to be eligible. Payments started in May, according to a state information page.

Taxpayers who filed jointly will receive a single deposit of $250.

A second rebate was approved in August 2022 to grant another $200 per taxpayer.

Most taxpayers will receive their refunds by direct deposit, and the second payments started rolling out in late August. If you changed banks or dont have direct deposit information on file, youll receive a paper check. A printing delay put mailing the first round on hold for several months, but mailing resumed in mid-August. Checks mailed after that point contain payments for both rebates, for a total of $325 per taxpayer.

Distribution of printed checks is expected to take place through early October. If you did not file your 2021 tax return by the April deadline, you can claim your $125 rebate on your 2022 taxes.

For more information, visit the state Department of Revenue website.