Who May Be Eligible To Receive More Stimulus Money

- Parents of a baby born in 2021 who claim the child as a dependent on their 2021 tax return

- Families who added a dependent, such as a parent, grandchild or foster child, on their 2021 tax return who was not listed as a dependent on their 2020 return

- Single filers who had incomes above $80,000 in 2020 but less than that in 2021 married couples who filed a joint return who earned more than $160,000 in 2020 but made less money in 2021 and head-of-household filers with incomes above $120,000 in 2020 but less than that in 2021

- Single filers who had incomes of between $75,000 and $80,000 in 2020 but earned less in 2021 married couples who file jointly who had incomes of between $150,000 and $160,000 in 2020 but less than that in 2021 and heads of household who had incomes of between $112,500 and $120,000 in 2020 but made less money in 2021

Even if you didnt qualify for the first and second round of stimulus payments in 2020, if you had a tough time financially in 2021 and your income is lower , you will get the credit on your 2021 return, Steber says.

Join today and save 43% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

A New Addition To The Family

You will also be able to claim Recovery Rebate Credit if you have had or adopted a child in 2020, or just have not got around to registering a child. Claim this child as a dependent on your 2020 US tax return and the Recovery Rebate Credit will be available for them. Ensure you have registered the birth abroad and gained US citizenship and a Social Security Number for the child.

It Is Not Open To People Who Passed Away In 2021 Or 2022

If a person died in the first two years of his or her life and made less than $75,000 a year, the IRS has published some helpful information for people who are still alive. However, its important to remember that the credits arent available to those who died after January 1, 2021 or 2022. These details can assist you compute the credit rating youre expected.

To determine the credit you need to subtract the third stimulus payment from the sum you professed. The recovery rebate income tax credit history is the same as eighty-5 $ $ $ $ annually. Right after subtracting the third stimulus repayment, the credit history is equivalent to about $4200. Additionally, you need to have a real Social security number released before the expected particular date of your respective 2021 tax return. The credit is available to you if your spouse passed away in 2021 or before.

Read Also: When Will The $1400 Stimulus Checks Be Mailed Out

Tax Return Recovery Rebate Credit

2022 Tax Return Recovery Rebate CreditIf you have filed your tax returns and received a Recovery Rebate Credit, you can use this to your advantage. Your tax refund will likely be larger and you will definitely are obligated to pay a lot less tax. Your reimbursement will be delivered through immediate put in or by sign in the mail. Healing Refund Tax Credits are refundable and can considerably reduce the taxation you owe on your own reimburse. This can result in an excess refund for you if you have paid too little tax in the first place. 2022 Tax Return Recovery Rebate Credit.

How Will I Receive The Recovery Rebate Credit

The IRS will only send the Rebate Recovery Credit to a US bank account. If you dont have one, its possible to open one directly with a US bank, virtually from abroad.

However, there are also other absent payment mechanisms. To open a US currency account, you dont necessarily have to be in the US. A lot of International banks, such as HSBC in the UK, can open US dollar account for you.

Also Check: H& r Block Stimulus Check

How Is My Second Stimulus Check Calculated

The IRS relies on your tax return to calculate whether you qualify for the second stimulus check. So your eligibility was based on your 2019 tax returns, which you filed by July 15, 2020.

According to the text released by Congressional leaders, the COVID-19 relief bill notes those with an adjusted gross income over certain limits receive a reduced amount of money, with the checks phasing out entirely at higher incomes.

Your AGI is calculated by subtracting the deductions that you made during the tax year from your gross income .

Heres a quick breakdown of the AGI limits for the $600 stimulus checks:

- Single filer checks begin to phase out at AGIs above $75,000.

- Head of household checks start getting phased out at incomes over $112,500.

The IRS reduces stimulus payments by 5% for the total amount that you made over the AGI limit. This means that for every $100 that you make over the limit, your check goes down by $5. At high enough incomes, the checks phase out entirely. So if you earned over $87,000 as an individual taxpayer, $174,000 as a joint filer, or $124,500 as a head of household, you do not get a stimulus payment. The following calculator allows you to calculate your benefit amount:

This second round of stimulus checks is currently half the maximum amount of the first stimulus checks that were included in the CARES Act in March.

Recuperation Rebate Taxation Credit History Is A Refundable Federal Government Taxes Credit Score

If you are a U.S. citizen or a permanent resident alien, you may qualify to claim the Recovery Rebate Tax Credit on your 2020 federal tax return. Nonresident aliens need to complete an eco friendly cards examination and are unable to state the credit rating except when there is a Societal Security number. If you are married but have not obtained a Social Security number, you may also be eligible. You need to submit a kind called the Healing Refund Worksheet and can include it along with your profit. Taxes preparation software can help you complete the Worksheet and claim your credit rating.

The Recovery Rebate Tax Credit may be refundable for some taxpayers, but not for all. Income thresholds might minimize this credit rating. In 2021, those with an altered gross cash flow over $75k may need to data file amended profits for their tax statements. Within the identical season, these filing collectively because of their partner can have a credit reduction starting at $150,000. The credit history lessening will begin at $112,500 for brain of family filers.

Read Also: Get My Stimulus Payment 1400

How Do I Claim The Credit

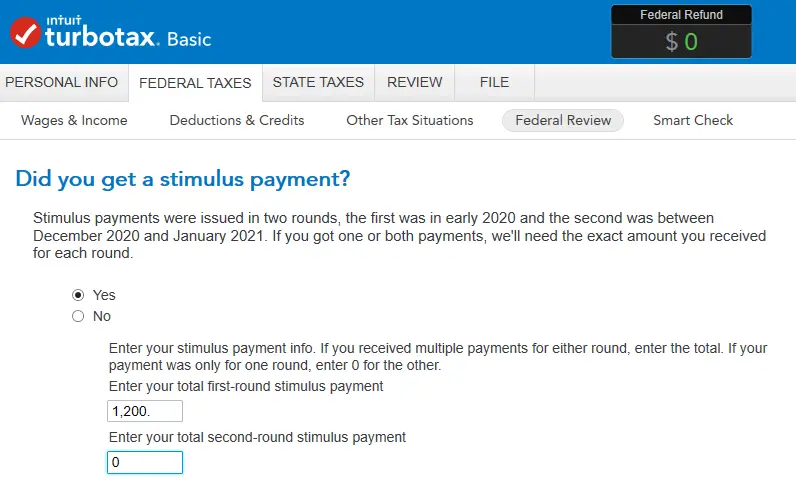

If you didn’t receive the full credit amount as an economic impact payment, claiming the tax credit is relatively easy. TurboTax can help you claim the credit by asking you questions about your tax situation and the economic impact payments you may have received. That information is used to fill out the correct tax forms and claim any credit that you are eligible for on your tax return.

If you’re completing your tax return on your own, the credit can be claimed on line 30 of Form 1040 or Form 1040-SR. Instructions for completing this line are included in Form 1040’s instructions. In particular, look for the Recovery Rebate Credit Worksheet – Line 30 to calculate your potential credit amount.

Didnt Receive The Stimulus Payment Because Your Spouse Was A Non

If you claimed for the first stimulus payment as married filing jointly, you may not have received the payment because your spouse was a non-US citizen with an ITIN. As a result, you and your children may have been left out.

The rules have now changed with the second stimulus payment, and only one spouse is required to have a US Social Security Number. You will now be able to receive the Recovery Rebate Credit through your 2020 US tax return.

Read Also: When Can Social Security Recipients Expect The Stimulus Check

What To Do If You’re Still Waiting For A Stimulus Check

The IRS has created a specific tax credit for eligible taxpayers who didn’t get the stimulus money that was owed to them according to legislation that passed in 2020 . It’s called the Recovery Rebate Credit. You’ll find it on line 30 of your 2020 tax return.

For the fastest processing, the IRS encourages citizens to file 2020 tax returns electronically. The agency has not yet announced when you can start filing 2020 tax returns. As the situation unfolds, more information may become available.

Is My Second Stimulus Check Taxable

The IRS does not consider stimulus checks taxable income. This means that you do not have to report them on your tax return or pay income taxes on either check.

Eligible recipients who did not get the first or second stimulus checks can claim a recovery rebate credit to increase their tax refund or lower their tax liability. So if you are expecting to get money back on your 2020 tax return, your refund could get a big boost depending on how much stimulus money the government owes you.

And comparatively, if you expect to owe taxes on your 2020 return, then you can use your recovery rebate credit to offset your tax bill and get a refund for the remaining amount.

Many taxpayers this year are looking to their tax refunds to get extra money for their finances. For reference, the average tax refund in 2020 was more than $2,500. The IRS expects over 150 million tax returns to be filed this year.

The 2021 tax season will begin on February 12. And taxpayers will need to file their 2020 returns by April 15.

Read Also: Third Stimulus Check File Taxes

I Missed The Deadline For Getting A Cares Act Stimulus Payment Can I Still Get This Payment

Yes. Some people who typically donât file a tax return were required to register for a stimulus payment. If you didnât register and didnât receive a maximum $1,200 payment from the first stimulus package, you may be eligible to receive those funds through a tax credit by filing a 2020 tax return when the IRS system opens Feb. 12, 2021.

If youâre a non-filer who didnât register for the CARES Act stimulus payment, you cannot do so for the second round of payments. Youâll have to wait to file a 2020 tax return to claim the Recovery Rebate Credit.

Recovery Rebate Credit 2022 Tax Form

Recovery Rebate Credit 2022 Tax FormYou can use this to your advantage if you have filed your tax returns and received a Recovery Rebate Credit. Your taxes refund will probably be bigger and you will probably owe much less taxes. Your return will probably be mailed either through immediate put in or by check in the mail. Healing Refund Taxation Credits are refundable and might considerably decrease the income tax you are obligated to pay on your reimbursement. If you have paid too little tax in the first place, this can result in an excess refund for you. Recovery Rebate Credit 2022 Tax Form.

You May Like: H& r Block Stimulus Tracker

I Got A Notice 1444 In The Mail Should I Keep It

Yes. Notice 1444 specifies the payment amount you received for the first Economic Impact Payment in 2020, while Notice 1444-B will note the amount of your second stimulus payment. If you need to complete the Economic Recovery Rebate Credit worksheet on your 2020 tax return, youâll need to refer to Notice 1444 and Notice 1444-B for the amount you received. Even if you received the full stimulus payment amount, retain this notice with your 2020 tax records.

How Do I Calculate The Amount Of My Credit

The amount of the credit is based on your:

- Filing status

- Amounts of your economic impact payments previously received

- Adjusted gross income

If you’re eligible for the full credit, you may receive up to the following amounts.

The first economic impact payment, or up to:

- $2,400 if youre married, filing jointly, or

- $1,200 for any other filing status, and

- $500 for each qualifying child under age 17 at the end of 2020

The second economic impact payment, or up to:

- $1,200 if youre married, filing jointly, or

- $600 for any other filing status, and

- $600 per eligible qualifying child under age 17 at the end of 2020

If you have already received Economic Impact Payments for the full amounts that you’re eligible for based on your 2020 tax return, you don’t qualify for any additional credit. However, if you received more than you are qualified to receive based on your 2020 tax returns, you do not have to pay back the excess amount.

If you received less than you are eligible for based on your 2020 situation, you can calculate the additional amount of credit to be included on your 2020 tax return.

The credit amount on your tax return begins with the maximum that you are eligible for in 2020. This amount is then reduced by 5% of the amount that your AGI exceeds these levels:

- $75,000 for single or married filing separately

- $112,500 for head of household

- $150,000 for married filing jointly or qualifying widower

It Is Far From Open To People Who Passed Away In 2021 Or 2022

If a person died in the first two years of his or her life and made less than $75,000 a year, the IRS has published some helpful information for people who are still alive. However, its important to remember that the credits arent available to those who died after January 1, 2021 or 2022. This info may help you estimate the credit youre due.

To calculate the credit score you must deduct the next stimulus payment from the total amount you stated. The rehabilitation rebate taxation credit history is the same as eighty-five dollars each year. Following subtracting the next stimulus settlement, the credit is equal to about $4200. Furthermore, you need a legitimate Social security number granted prior to the due time of your own 2021 tax return. If your spouse passed away in 2021 or before, the credit is available to you.

Understanding The Recovery Rebate Credit

The CARES Act provided economic relief payments, known as Economic Impact Payments or stimulus payments, valued at $1,200 per eligible adult, based on household adjusted gross income , plus $500 for each additional qualifying dependent under 17 years of age. These payments were set to continue through Dec. 31, 2020.

Eligibility for getting the payments mailed in 2020 was based, in most cases, on your 2019 or 2018 tax filings. If you did not receive your payment or the full amount due, for example, because the income on your taxes was too high and your lower income in 2020 would have qualified youor because of a change in the number of dependents in 2020 compared to 2019you could claim the amount due as a refundable tax credit on your 2020 Form 1040 or 1040-SR filed in 2021. Both Form 1040 and Form 1040-SR include a line for Recovery Rebate Credit.

Do not report the amount of any Economic Impact Payment received as income when filing your 2020 taxes. Economic Impact Payments are not taxable.

If you receive a Recovery Rebate Credit, it will either increase the amount of your tax refund or lower the amount of taxes that you owe. Since it will be treated as a refundable tax credit, that means even if you owe zero taxes, you will receive a tax refund for the amount you are owed.

Recovery Rebate Credit Questions And Answers

These updated FAQs were released to the public in Fact Sheet 2022-27PDF, April 13, 2022.

If you didn’t get the full amount of the third Economic Impact Payment, you may be eligible to claim the 2021 Recovery Rebate Credit and must file a 2021 tax return even if you don’t usually file taxes – to claim it. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund.

If your income is $73,000 or less, you can file your federal tax return electronically for free through the IRS Free File Program. The fastest way to get your tax refund is to file electronically and have it direct deposited, contactless and free, into your financial account. You can have your refund direct deposited into your bank account, prepaid debit card or mobile app and will need to provide routing and account numbers.

If you didn’t get the full amounts of the first and second Economic Impact Payments, you may be eligible to claim the 2020 Recovery Rebate Credit and must file a 2020 tax return even if you don’t usually file taxes – to claim it. DO NOT include any information regarding the first and second Economic Impact Payments or the 2020 Recovery Rebate Credit on your 2021 return.

Below are frequently asked questions about the 2021 Recovery Rebate Credit, separated by topic. Please do not call the IRS.

I Got A Letter Saying My Stimulus Payment Would Be Offset Was It A Mistake

If you received an IRS Notice CP21C saying your stimulus payment would be held back to pay an old tax bill, you can disregard it. More than 100,000 taxpayers got this letter from the IRS in error, according to the agency. Instead, they should have received letters stating that their first Economic Income Payment couldnât be distributed, and they should use the Recovery Rebate Credit worksheet to claim their payment on their taxes.