Is The Irs Still Sending Out Third Stimulus Checks

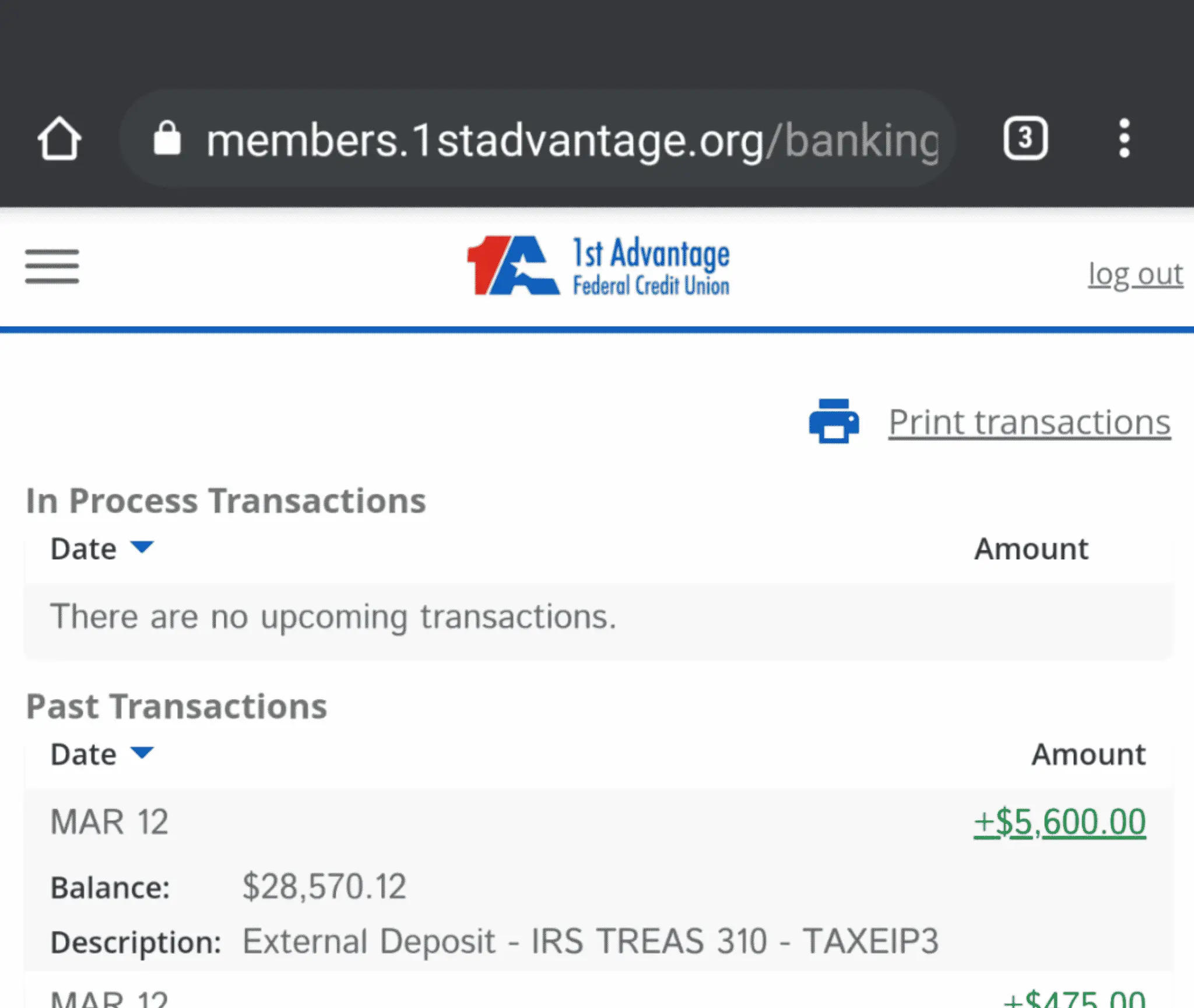

We’ll continue issuing payments throughout 2021. … While payments will be automatic for beneficiaries based on their federal benefits information, some may need to file a 2020 tax return even if they don’t usually file to provide information the IRS needs to send payments for their spouse and any qualified dependents.

How To Set Up An Irs Direct Deposit For Your Stimulus Check

The IRS has three ways to send the economic stimulus check, and direct deposit is the fastest and most convenient of them.

At this time, the IRS has only three ways to send you an economic stimulus check that is due to you, or a new one that they are going to send. These are by direct deposit, by paper check by mail, and as a prepaid EIP card by mail.

Of these three delivery methods, direct deposit is the fastest. In fact, with this method you could have the money weeks in advance compared to the other two.

Therefore, if you are truly in a hurry for any stimulus money owed to you, your main concern should be to set up direct deposit.

But how to do this?

When filing your tax return, on the form select Direct Deposit as your refund method, then enter your bank account and routing numbers. You can find your account and routing number on your banks website when you log in.

If you dont file taxes, but will be claiming the economic stimulus check as a Recovery Refund Credit, youll need to fill out Form 1040 or Form 1040-SR. Here youll also need to select direct deposit remittance of the economic stimulus check.

The IRS says that any refunds you get including stimulus checks owed to you can only be direct deposited in U.S. banks, and must be in your name, your spouses name, or both of your names if you filed a joint tax return.

If You Are A Social Security Recipient

The Treasury previously announced that if you are a Social Security recipient who typically is not required to file a tax return, you will automatically receive your stimulus payment directly to your bank account without having to file a tax return as long as the IRS has your direct deposit information.

You May Like: How Many Stimulus Checks Have Been Sent

How To Set Up Direct Deposit For Your Stimulus Check From The Irs

Over 80 million Americans will receive their coronavirus stimulus checks via direct deposit by Wednesday, April 15, according to Treasury Secretary Steven Mnuchin.

But the estimated 20 percent of Americans who haven’t set up direct deposit with the IRS may want to do so in order to receive their stimulus funds more quicklyit beats waiting around for a mailed check.

Those who set up an electronic funds transfer with the IRS when filing their taxes in 2018 or 2019 will have the funds automatically deposited into their accounts using whatever bank information they previously providedno further action necessary. This also applies to those who already receive Social Security retirement, disability or survivor benefits or Railroad Retirement payments through direct deposit as well.

People who filed taxes in 2018 or 2019 but who didn’t set up a direct deposit will have to wait until the government completes an app called “Get My Payment” where they can enter bank information and track their payment.

Although the app is supposed to work on phones, tablets and desktops, the webpage where the app will be available currently says “coming mid-April.” The government has said it will be active starting April 17.

Those who haven’t filed taxes in the last two years or who haven’t set up a direct deposit with the IRS in the past can do so using this web portal.

After creating an account, the website will ask you for the following personal information:

Feel Good About Getting Your Full Stimulus Payments

When you file your taxes with 1040.com, we’ll calculate your Recovery Rebate Credit in the backgroundall you have to do is answer some simple questions. The pandemic makes life hard, but we can make sure taxes don’t add to the noise.

Ready to feel good about taxes? Just or log in, and we’ll be with you every step of the way.

Don’t Miss: How Much Was The Stimulus Payments In 2021

You Can Better Manage Your Finances

Direct deposit can also help you manage your finances and save for the future. The IRS lets you split your refund across two or three accounts sending some of your refund to an account for immediate use and some for future savings. This will better help you invest in the future, if you dedicate a portion of your refund to your checking account and put the other portion into a savings account or a retirement account.

The Benefits Of Direct Deposit

Direct deposit makes sense because it eliminates the risk of cheques being lost or stolen and guarantees that you will receive the following, even if there is a postal strike or if you are sick or away from home:

- your income tax refund

- your advance payments of the tax credit for childcare expenses

- your advance payments of any tax credits respecting the work premium

- your advance payments of the tax credit for caregivers

- your advance payment of the tax credit for the treatment of infertility

- any other tax-related payments

Direct deposit registration Managing support payments

To register for direct deposit to manage your support payments, select Register in the Support payments menu in My Account for individuals.

For information on how to register for direct deposit quickly and easily in My Account, see Registering for Direct Deposit or Changing Banking Information .

End of note

Also Check: How Much Was All The Stimulus Checks

Get Your Refund Faster: Tell Irs To Direct Deposit Your Refund To One Two Or Three Accounts

Eight out of ten taxpayers get their refunds by using direct deposit. It is simple, safe and secure. This is the same electronic transfer system used to deposit nearly 98 percent of all Social Security and Veterans Affairs benefits into millions of accounts.

Combining direct deposit with electronic filing is the fastest way to receive your refund. Theres no chance of it going uncashed, getting lost, stolen, or destroyed. The IRS issues more than nine out of ten refunds in less than 21 days. Taxpayers who used direct deposit for their tax refunds also received their stimulus payments more quickly. You can track your refund using our Wheres My Refund? tool.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper. Be sure to double check your entry to avoid errors.

Dont have a check available to locate your routing and account number? A routing number identifies the location of the banks branch where you opened your account and most banks list their routing numbers on their websites. Your account number can usually be located by signing into your online banking account or by calling your bank branch.

Whether you file electronically or on paper, direct deposit gives you access to your refund faster than a paper check.

Is Direct Deposit Safe

Direct deposit is a safer alternative to paper checks because the money goes directly into your account, and theres no danger of losing a check or having it stolen. But its probably worth asking your payroll manager what happens with your bank account information after you provide it to them. Signing up for direct deposit online may reduce the risk of someone getting ahold of your information on paper.

Read Also: Are We Going To For Stimulus Check

If You Are Not Required To File Income Tax Returns For 2019

You are not required to file federal income tax returns for 2019 if:

- Your income is less than $12,200.

- Youre married and filing jointly, and together your income is less than $24,400.

- You have no income.

If you are not required to file a federal income tax return, then you will probably have to wait for the IRS to open up the Non-Filers: Enter Payments Info Here tool to submit the information to get your second stimulus payment.

The information you will need to provide includes:

- Full name, current mailing address, and an email address

- Date of birth and valid Social Security number

- Bank account number, type, and routing number if you have one

- Identity Protection Personal Identification Number you received from the IRS earlier this year if you have one. Taxpayers who previously have been issued an Identity Protection PIN but lost it must use the Get an IP PIN tool to retrieve their numbers

- Drivers license or state-issued ID if you have one

- For each qualifying child during 2019: name, Social Security number or Adoption Taxpayer Identification Number, and their relationship to you or your spouse

B People Who Did Not File A Tax Return

People who did not file a tax return for 2018 or 2019 fall into two groups. The first consists of those who receive social security benefits or VA benefits. The second consists of those who did not.

Non-Filers SSA Benefit Recipients: Anyone who receives VA compensation and pension benefits, supplemental security income or Social Security retirement, survivors, or disability benefits will receive their stimulus money automatically without taking any other action. They will get their money the same way they receive their benefits.

However, there are two instances where it will be necessary for someone to take action.

If someone only started receiving benefits in 2020, they will have to use the Non-Filers: Enter Payment Info Here web portal to provide the government with the information it will need to determine whether they are eligible and the amount of money they are entitled to receive.

If someone has a qualified dependent under age 17, their payment will not be adjusted to reflect that fact. They will have to use the Non-Filers: Enter Payment Info Here web portal to provide the information the government will need to add an extra $500 for each qualifying child.

Also Check: When Will We Get 4th Stimulus Check

What Customers Are Saying:

I really was impressed with the prompt response. Your expert was not only a tax expert, but a people expert!!! Her genuine and caring attitude came across in her response…

T.G.WMatteson, IL

I WON!!! I just wanted you to know that your original answer gave me the courage and confidence to go into yesterday’s audit ready to fight.

BonnieChesnee, SC

Great service. Answered my complex tax question in detail and provided a lot of additional useful information for my specific situation.

JohnMinneapolis, MN

Excellent information, very quick reply. The experts really take the time to address your questions, it is well worth the fee, for the peace of mind they can provide you with.

OrvilleHesperia, California

Wonderful service, prompt, efficient, and accurate. Couldn’t have asked for more. I cannot thank you enough for your help.

Mary C.Freshfield, Liverpool, UK

This expert is wonderful. They truly know what they are talking about, and they actually care about you. They really helped put my nerves at ease. Thank you so much!!!!

AlexLos Angeles, CA

Thank you for all your help. It is nice to know that this service is here for people like myself, who need answers fast and are not sure who to consult.

GPHesperia, CA

You Can Open Some Bank Or Credit Union Accounts Today Online

For most accounts you will need the following things to open your account online or in person:

- A state ID or driver’s license is required and some accept alternative IDs such as Matricula ID, foreign passports, green card, city key card, student ID, TVDL, and military IDs

- Your social security number

- A method for making a deposit or putting money in your account *

* Some financial institutions are allowing accounts to be opened without a deposit and funded with the stimulus payment. Please check with each bank directly for more details.

Once you have signed up for a bank account, you can use it to get your payment faster when you file taxes. Have your new account number and routing number before you start the process. This will allow you to receive your stimulus check as a direct deposit.

If you do not choose to open a bank account, you will be sent a paper check or prepaid card, but this will take significantly longer. Be sure to use an accurate address that is not likely to change soon.

Read Also: What To Do If I Never Got My Stimulus Check

Can I Get More Of The Childctc In A Lump Sum When I File My 2021 Taxes Instead Of Getting Half Of It In Advance Monthly Payments

Yes, you can opt out of monthly payments for any reason. To opt-out of the monthly payments, or unenroll, you can go to the IRS Child Tax Credit Update Portal. If you do choose not to receive any more monthly payments, youll get any remaining Child Tax Credit as a lump sum next year when you file your tax return.

How Do I Set Up Direct Deposit With My Stimulus Check

Your banking information cannot be changed after your tax return has been filed and accepted.

Banking information does not go from TT to the IRS until you file your 2020 tax return and it is accepted. The IRS will begin to accept and process 2020 returns at the end of January 2021.

You enter/change banking information in the FILE section before you file your 2020 return. Changing it on the TurboTax site does not do any good until you file your return and the IRS processes your return. If they manage to start sending out stimulus checks before you can change your information, we hope the IRS provides a way for you to change it with the IRS. If your check goes to a wrong or closed account, it will be sent back to the IRS and then the IRS will mail a check to the address on your tax return.

TurboTax has NO control over your stimulus check, nor can TT track it or tell you when you will receive it. The IRS will use the same banking information for the 2nd stimulus that they used for the first one. If that account is closed then the stimulus will go back to the IRS and they will mail you a check. See this information from the IRS:

Recommended Reading: Is There More Stimulus Money Coming Out

Why Have I Not Received My 3rd Stimulus Check

If you still haven’t received your payment, or got less than you were eligible for, you can claim the money on your 2021 tax return by using the Recovery Rebate Credit. If you’re eligible, you’ll need to file a 2021 tax return, even if you don’t usually file a tax return, the IRS said in a statement.

Homeowners Are Advised To Take Advantage Of A New Mortgage Stimulus Program Before Its Gone This Is Likely To Be The Largest Benefit Program American Homeowners Have Seen This Covid

- Who gets the check in 2022? Eligible parents who welcomed a newborn into their family during the 2021 calendar year. The $1,400 payments sent out earlier this year were

- Who is eligible for these stimulus checks in Minnesota? According to the Minnesota Frontline Worker Pay Program ‘s official website, in order to be eligible for the payment the applicant must have …

- Stimulus check update: $3,600 is coming in 2022 and you might qualify to get it At this point in 2022, the stimulus check story is actually proceeding down two tracks. The first one to note is

- Feb 03, 2022 · President Biden signed the American Rescue Plan Act on March 11, 2021. Provisions in the bill authorized a third round of stimulus checks worth $1,400 for each eligible person ($2,800 for couples …

- Jul 04, 2022 · The first stimulus payment of $1200 was issued in April 2020. There were eligibility criteria for each stimuluscheck, and you should check your eligibility if you have not received the first stimuluscheck. The second stimulus payment was issued in December 2020 and January 2021. The payment contains $600.

Read Also: Get My Stimulus Payment 1400

What Is Direct Deposit

You may be used to receiving a check on payday, then going to a bank to deposit the money into your account. But direct deposit puts the money straight into your account, so you don’t have to keep track of a check or find time to visit a bank or ATM.

When you set up direct deposit, money automatically goes into your account digitally when it’s time to get paid. You don’t need to take any extra steps on payday, like approving the funds with your bank first.

Direct deposit is commonly used for your paychecks. But you can also set up direct deposit to receive your tax refunds, government stimulus checks, unemployment checks, and other types of payments.

In many cases , you can choose to split your direct deposit into multiple accounts. For example, you may tell your employer to automatically deposit 80% of each paycheck into your checking account and 20% into savings.

The Get My Payment Irs Tool And How To Provide Current Bank Information

The Treasury has created an online tool where direct deposit information can be supplied to the IRS. Here is what you should do:

- On April 15, 2020, the IRS set up this online tool that allows you to track the status of your stimulus payment, and it allows you to provide your direct deposit information.

- Add the bank account number of your account.

- Add the routing number of your bank.

- Do not include a check number.

- Double-check that you have entered the correct numbers entering an incorrect number could result in a significant delay of payment.

You can use the Get My Payment tool to find out the projected date for when your deposit is scheduled to arrive in your bank account. The Get My Payment tool will also tell you if youre set to receive payment by paper check, along with a scheduled arrival date in the mail.

The tool, however, doesnt always work, and your inquiry may result in a Payment Status Not Available message, or it may need to be modified to take into account the second stimulus payment.

While Get My Payment allows you to give direct deposit information to the IRS, you cannot change bank information with the IRS if it already has an account for you on file. This is to help protect against potential fraud. You also cant change your form of payment if the IRS has already scheduled it for delivery.

You May Like: Who Is Eligible For 4th Stimulus Check