Change In Income Can Affect How Much Stimulus Money You Receive

Many Americans lost their jobs or had their hours reduced dramatically, which is likely going to impact their total income for tax year 2020. This is noteworthy because your 2019 tax return may not be reflective of your current income status. For example, someone may have made $125,000 during tax year 2019, but suddenly lost their job in early April 2020 causing their total income for 2020 to take a nosedive. Unfortunately, if the IRS uses the 2019 tax return, this individual might be disqualified from receiving a COVID-19 stimulus check or will receive a greatly reduced amount. If you find yourself in this situation, make sure to file your 2020 tax return and pursue a stimulus payment rebate in 2021.

Was There A 3rd Stimulus Check

In the majority of cases, the third stimulus installments were sent to taxpayers bank accounts automatically or by mail last spring. The American Rescue Plan approved the payments in March 2021 with the intention of assisting those who were suffering financially as a result of the Covid-19 outbreak.

Read Also: Will We Get Any More Stimulus Checks

Why Did I Receive A Debit Card

The IRS issued millions of debit cards to taxpayers in lieu of second stimulus checks, but will be sending out fewer debit cards out for the third payment. The prepaid Visa debit cards, issued by MetaBank, are called Economic Impact Payment cards. Your EIP card will arrive in a white envelope with Economic Impact Payment Card in the return address. Youll need to activate the card by calling the phone number that comes with the card and choosing a 4-digit PIN number.

You can use your EIP card for purchases or use it to withdraw cash . You can also transfer the funds from your EIP card directly into your own bank account, after you register for online access.

If you use the card wisely, it will be free, but there are some fees to be aware of. If you use an out-of-network ATM or a bank teller to withdraw cash, you may need to pay a fee, and if you check the balance of the debit card, at either an in-network ATM or an out-of-network ATM, you will be charged a small fee.

The IRS has announced that the vast majority of taxpayers should receive their third stimulus payment by direct deposit this time.

Read Also: Who Qualifies For The Stimulus Check

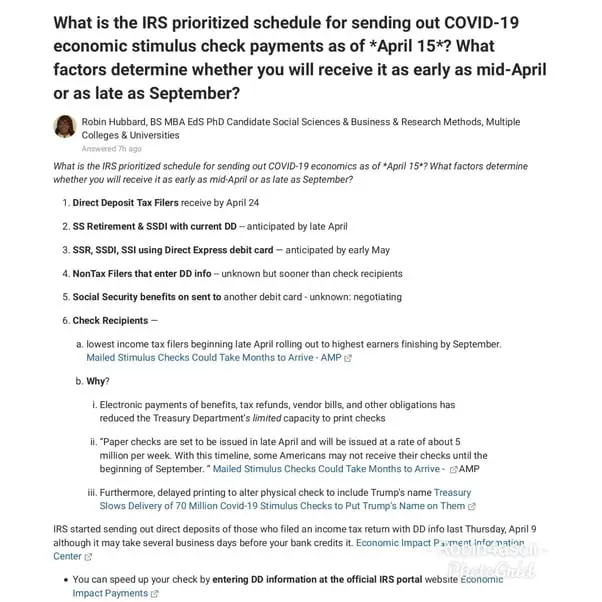

Special Reminder For Those Who Don’t Normally File A Tax Return

People who don’t normally file a tax return and don’t receive federal benefits may qualify for these Economic Impact Payments. This includes those experiencing homelessness, the rural poor, and others. For those eligible individuals who didn’t get a first or second Economic Impact Payment or got less than the full amounts, they may be eligible for the 2020 Recovery Rebate Credit, but they’ll need to file a 2020 tax return. See the special section on IRS.gov: Claiming the 2020 Recovery Rebate Credit if you aren’t required to file a tax return.

Other Help For Social Security Claimants

The Social Security Administration looks at the cost of living and makes any necessary increases to Social Security benefits.

This practice has been going on since the 1950s to offset inflation for people living on a fixed income.

The COLA increase impacts at least 70million Americans.

Despite the increases each year, high inflation has lowered Social Security claimant’s buying power by about 40 percent since 2000.

In other Social Security news, 33 states have bumped up Supplemental Security Income so recipients will get payments of $841.

Plus, we explain how to get the most out of Social Security when you retire, including ways to boost your payments.

Don’t Miss: How Much Was The Second Stimulus Check

I Received A Letter From Social Security That Says My Supplemental Security Income Payment Will Change Unless I File An Appeal How Can I File This Appeal

Date:

You can file an appeal by taking one of the following actions.

Online at SSA.gov

The quickest and easiest way to file an appeal is online at our Appeal a Decision page. Select Reconsideration and then the Request Non-Medical Reconsideration button. Follow the instructions on the screens to complete and submit the appeal electronically.

Send Us a Form by Mail or Fax

You may also download, complete, and print the form Request for Reconsideration and then mail the completed form to your local Social Security office. You can find the local office fax number and address from the Social Security Office Locator page by entering your ZIP code.

If you still have questions about filing an appeal on online, by mail, or fax, please call us at 1-800-772-1213 or call your local office. You can find the telephone number for your local office in the letter we sent you or by going to the Social Security Office Locator page and entering your zip code. We can answer your questions and send you the appropriate appeal request form to complete and send back to us.

Does The Stimulus Money Or Recovery Rebate Affect My Eligibility For Disability Benefits

For SSI eligibility purposes, the stimulus check or rebate doesn’t count as income to you, and you don’t need to report it as income to the Social Security Administration. Plus, it’s not taxable. In addition, for SSI, the stimulus money or rebate won’t count as a resource unless you still have all or part of it 12 months after receiving it.

For SSDI eligibility purposes, income and assets don’t matter, so the stimulus check will have no effect.

You May Like: How To Check Stimulus Payments

Stimulus Checks For Ssi And Ssdi: 12 Key Things To Know About Your Third Payment

If you receive Social Security or Veterans Affairs benefits, we can tell you the 411 on the latest stimulus check.

The IRS continues to send out batches of the third stimulus payments — and some are going to people who receive SSI or SSDI benefits. If you qualify for Social Security benefits and you’re one of the few who hasn’t received their check already, you might want to start tracking it down. If your benefits come on a Direct Express card, your payment should have arrived already. But you might still be waiting for your payment if it’s expected to come in the mail or by direct deposit.

If you stopped or started receiving SSI or SSDI in 2019 or 2020, or think your first or second stimulus payment is missing, you may need to request a payment trace. Also, payments started going out to those who receive benefits through the Department of Veterans Affairs last month. For those who qualify for retired railroad worker benefits, stimulus payments of up to $1,400 should be arriving soon.

If stimulus money is missing for your dependents, you might need to file a 2020 tax return, although you only have until Monday to do so. If you have kids, read more about eligibility for the new child tax credit, including if your child is a qualified dependent. You could get up to $3,600 with the revised child tax payment. You may also be able to save up to $50,000 this year with new pandemic-related credits and benefits. This story is updated regularly.

Who Is Eligible For The Third Stimulus Check

Most recipients of Social Security Disability Insurance and Supplemental Security Income are eligible for the $1,400 COVID-19 stimulus check. Couples who file joint returns are eligible for $2,800. And SSDI and SSI recipients who have dependents are eligible for an extra $1,400 per dependent .

You’re eligible for a stimulus check as long as you have a Social Security number and you are not claimed as a dependent on someone else’s tax return .

You May Like: Is Texas Giving Stimulus Money

Ssa Ended My Disability Benefits Because Of A Cdr Determination I Submitted A Request For Reconsideration To Appeal Ssas Decision But I Did Not Elect That My Disability Benefits Should Continue Can I Now Request That My Benefits Continue Until There Is A Determination On My Appeal

Date: November 6, 2020

Yes. You may, at any time, submit a late request to continue your benefits while we make a determination on your appeal. We will grant the request if you provide a good reason. We have experienced delays in processing certain requests for reconsideration of initial disability cessation determinations during the Coronavirus Disease 2019 pandemic. We will accept this delay as a good reason to resume benefit payments when you file a late request and the following apply:

- The determination notice ending your disability benefits is dated on or before August 30, 2020 and

- Your request for reconsideration of the cessation determination is still pending with us.

I Was Scheduled For A Knee Replacement My Spouse Was Supposed To Have Cataract Surgery Soon Can We Still Have These Procedures

In most places, elective surgeries and procedures are being postponed while the coronavirus outbreak is straining hospital resources nationwide. Under current guidance, you would be asked to consider postponing your knee surgery, based on whether your condition could be life-threatening in the future. Your spouse is likely to be asked to postpone cataract surgery.

The guidelines make clear that non-elective, non-coronavirus-related care, such as transplants, cardiac procedures for patients with symptoms, cancer procedures and neurosurgery, would still be provided.

Recommended Reading: Ssi Ssdi Fourth Stimulus Check

How Will I Get The Stimulus Payment

You will generally receive the automatic payment the same way you normally receive your monthly disability or pension paymentby direct deposit, Direct Express debit card, or paper check. Your stimulus payment, however, will come from the Treasury Department, not the Social Security Administration.

If you received the first or second check by direct deposit or Direct Express, you should receive your payment the same way, but there are no guarantees.

If you received your first or second payment by EIP Debit Card, you should receive a new debit card in the mail. It will arrive in a white envelope with âEconomic Impact Payment Cardâ in the return address. Youâll need to activate the card by calling the phone number that comes with the card and choosing a 4-digit PIN number. You can use your EIP card for purchases or use it to withdraw cash . You can also transfer the funds from your EIP card directly into your own bank account, after you register for online access.

If youâve moved since last filing your taxes, you should file a change of address with the IRS on Form 8822.

I Received A Second Payment But My Spouse Didnt

There have been cases where a couple submit their tax returns as married filing jointly, and both spouses are eligible for a $1,400 stimulus check, but one spouse received a payment and the other did not . This is an error on the IRSs part. Unfortunately, the spouse who didnt receive a check will have to claim a Recovery Rebate Credit on his or her 2020 tax return. See below for instructions on claiming the rebate on your tax return.

Dont Miss: Will There Be Another Stimulus Package

You May Like: What Month Was The Third Stimulus Check

What Changes Are Coming To Social Security In 2022

If you are already receiving Social Security benefits, you will receive a 5.9% COLA increase to your monthly Social Security benefit. This nice increase will be somewhat offset by the increase in Part B premiums. To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter.

You May Like: How To Check Status Of Stimulus Check

If Someone Else Oversees My Federal Benefits Account How Will I Get My Stimulus Check

If someone, also known as a representative payee, helps manage your Social Security benefits on your behalf, that person — a relative, friend or someone appointed on behalf of an organization — should discuss your benefits with you, the beneficiary. That’s according to guidance from the Social Security Administration. So if you’d like to use your money, the person managing your account should provide you with the stimulus payment.

“Your Individual Representative Payee should have received your EIP to the same direct deposit account or Direct Express card as your monthly Social Security or SSI payment,” the SSA says on its site. “For an Organizational Representative Payee, the payee likely received the EIP electronically or by paper check in the mail.”

The SSA says representative payees aren’t required to account for the stimulus payment when they complete their annual accounting form, as it’s not considered a Social Security benefit.

You could be missing out on more stimulus money.

Also Check: When Did We Receive Stimulus Checks

Can I Request A Waiver For An Overpayment Debt Incurred During Covid

Date: December 31, 2020

Yes. Please and one of our employees will assist you. Under our rules, if you believe an overpayment was not your fault and you should not have to pay us back, you need to request a waiver of the overpayment debt. Certain debts may qualify for a streamlined waiver decision if:

- Your overpayment debt happened between March 1 and September 30, 2020 because Social Security did not process an action due to the COVID-19 pandemic and

- We identify the debt by December 31, 2020.

We developed instructions for our employees to process streamlined waiver requests. Although the are marked sensitive, this version has been redacted under the Freedom of Information Act for public release.

Medicare Is Recommending Telehealth Visits How Do I Access A Telehealth Consultation

The best way to schedule a telehealth visit is to call your doctor or other health care provider. During the pandemic, regulations for telehealth should be relaxed, so patients can get a telehealth consultation from their homes and providers and their patients can use their phones, tablets, computers and other devices. Providers can waive deductibles and copays for these appointments.

You May Like: Who Receives Third Stimulus Checks

What About On Social Security Or Ssdi

Social Security recipients, disability , Survivor Beneficiaries and Railroad Retirees who are not otherwise required to file a tax return will also be eligible for the stimulus payments, as long as their total income does not exceed the eligibility income limits above. The IRS in conjunction with the Treasury and Social Security Administration announced that recipients of Supplemental Security Income will automatically receive the $1200 Stimulus Check . See details here. This group of recipients will receive the stimulus check the same way they currently get their federal benefits in early May with no further action needed on their part.

However note that because the IRS has no information regarding dependent data for this group of recipients, the $500 kid dependent stimulus payment would not be automatically paid to this group. They need to use the non-filers tool on the IRS website to claim this.

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July 1, 2022.

You May Like: When Will The $1400 Stimulus Checks Be Mailed Out

Also Check: When Was The 3rd Stimulus Check 2021

Will There Be A Fourth Stimulus Check

A non-partisan advocacy group called Senior Citizens League has been demanding that the government issue a one-time $1,400 stimulus check for Social Security beneficiaries.

“We have received hundreds of emails from people concerned about making ends meet,” Senior Citizens League’s Shannon Benton told The Sun.

“The high cost of living adjustment, for many, just exacerbated their financial woes by bumping their income above program limits to qualify for Medicare savings programs and extra help.”

After the original stimulus checks, some lawmakers did push for another stimulus check, but the social spending plan stalled in Congress in late 2021.

Congress has not been planning to provide beneficiaries with stimulus money. However, this could happen in the event that the US experience an even tougher financial crisis.

Someone Filed An Unemployment Claim Using My Information And It Wasnt Me What Can I Do

Date: January 6, 2021

The Financial Crimes Enforcement Network has identified multiple fraud schemes in which filers submit applications for unemployment insurance benefits using other peoples information. Receiving unemployment benefits could affect the amount of monthly benefits you receive. If you believe you are a victim of this fraud scheme:

- Contact your appropriate State fraud UI hotline to report the fraud. The Department of Labor has phone numbers for each state fraud hotline.

- When you report the fraud, request that they provide you with written documentation that you have reported the alleged fraud. At a minimum, request a case number for your fraud report, and write down the case number, the name of the person you spoke to, and the time and date of your call.

- Retain this information, along with any written confirmations, to ensure you can provide evidence that you reported the fraud if you need it later.

- If you receive Supplemental Security Income benefits, and you suspect UI fraud, contact your local Social Security Office immediately.

Also Check: Who Receives The Third Stimulus Check