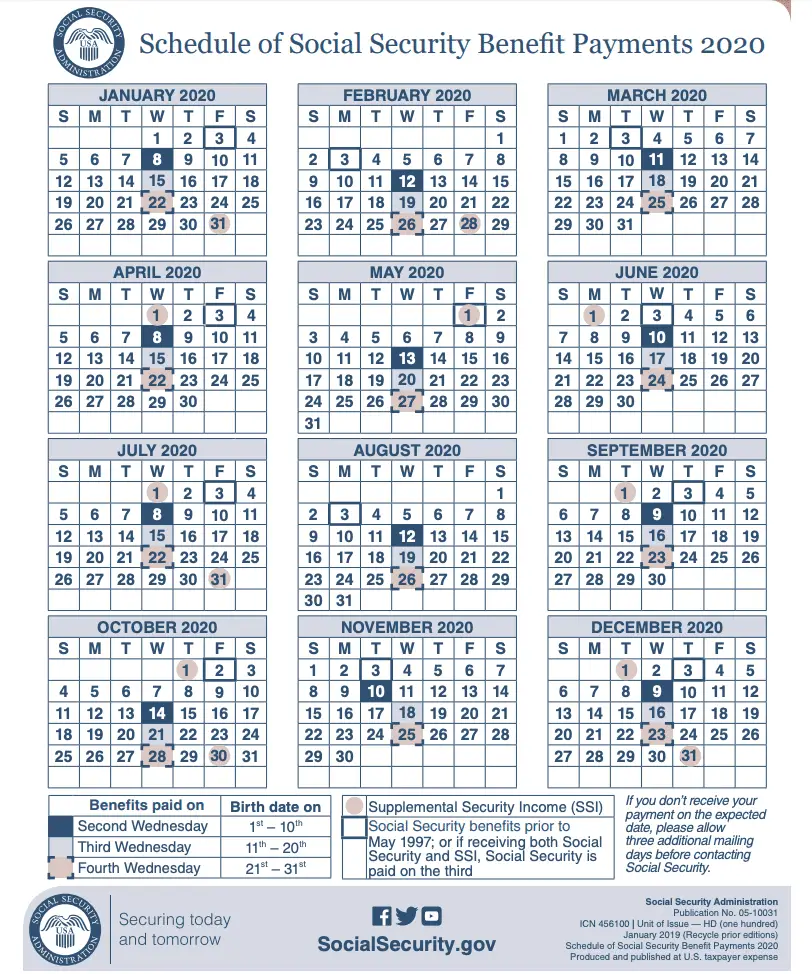

Social Security Schedule 202: Check When Benefits For November Will Arrive

Ritika KharaStimulus Check, US Local News0

Before receiving more extensive checks considerably in 2019, Social Security beneficiaries only had a few more months to make do with their 2022 installments.

The Social Security Administration stated earlier this month that the cost-of-living adjustment for 2023 will be 8.7%, the largest increase in 41 years.

However, your payout in November 2022 will still include this years 5.9% COLA, which hasnt done much to assist seniors in coping with inflation rates higher than 8%.

Check the official circular here.

I Was Scheduled For A Knee Replacement My Spouse Was Supposed To Have Cataract Surgery Soon Can We Still Have These Procedures

In most places, elective surgeries and procedures are being postponed while the coronavirus outbreak is straining hospital resources nationwide. Under current guidance, you would be asked to consider postponing your knee surgery, based on whether your condition could be life-threatening in the future. Your spouse is likely to be asked to postpone cataract surgery.

The guidelines make clear that non-elective, non-coronavirus-related care, such as transplants, cardiac procedures for patients with symptoms, cancer procedures and neurosurgery, would still be provided.

Second $600 Stimulus Check Details

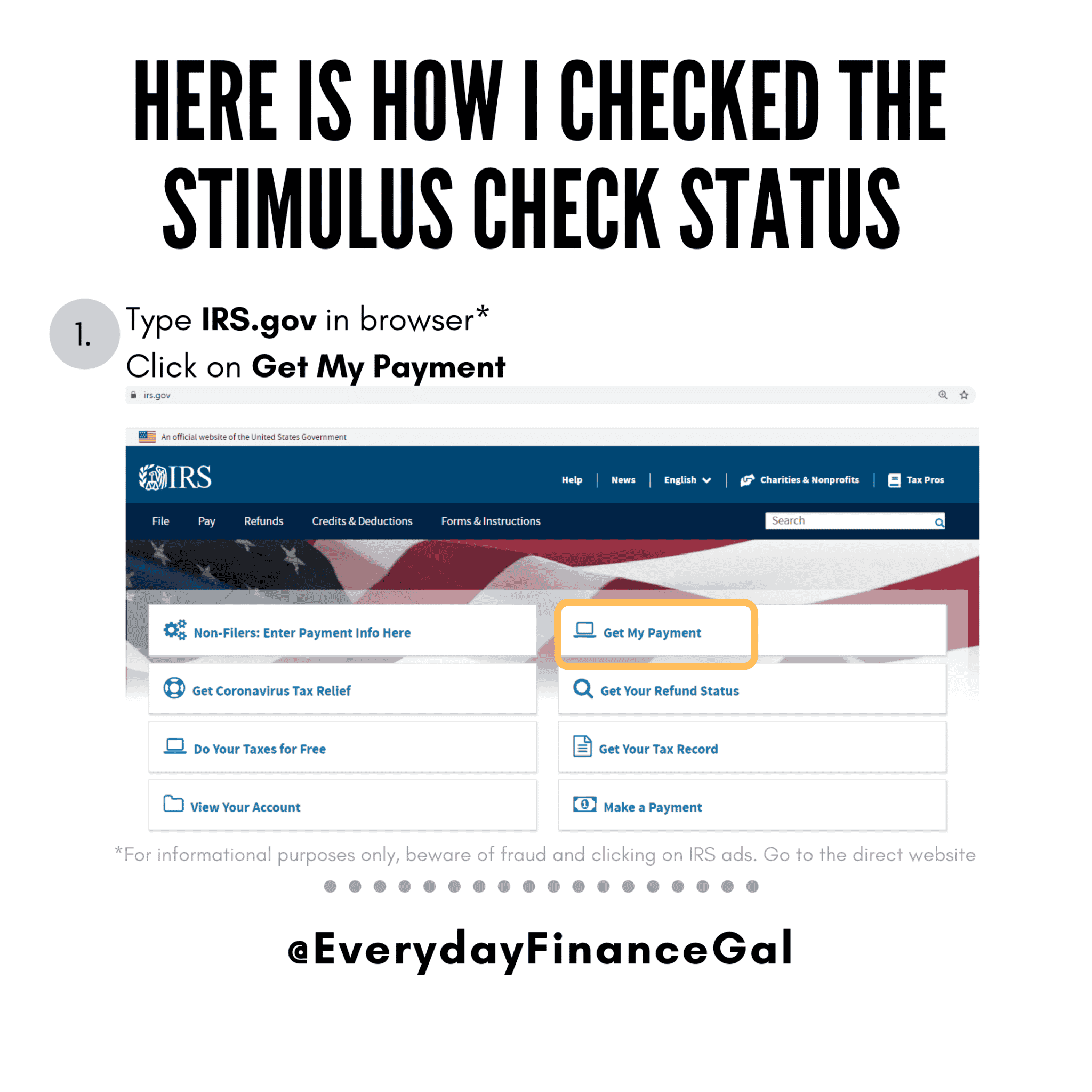

While the CAA legislation, under which the stimulus payments were funded, required that the second round of payments be issued by Jan. 15, 2021, some second round Economic Impact Payments may still be in the mail and delivered by the end of February. The IRS however has confirmed has issued all first and second Economic Impact Payments it is legally permitted to issue, based on information on file for eligible people.

Get My Payment was last updated on Jan. 29, 2021, to reflect the final payments and will not update again for first or second Economic Impact Payments.

If you havent yet received your payment and GMP is not showing payment details then the IRS is recommending you claim this via a recovery rebate credit in your 2020 tax return that you will file this year. Major tax software providers like Turbo Tax and Tax Act have updated their software to allow tax payers to claim their missing first or second stimulus payment as a recovery rebate with their 2020 tax filing.

Under the COVID-related Tax Relief Act of 2020, the IRS has delivered more than 147 million EIPs totaling over $142 billion. Due to the lower income qualification thresholds and smaller payments this was lower than the 160 million payments made via the first stimulus check.

You May Like: Wheres My Stimulus Check.gov

Colorado: $750 Rebate Payments

Colorado is sending tax rebates of $750 to individual tax filers and $1,500 for joint filers. Colorado residents for the entire 2021 tax year who are 18 or older and filed their 2021 state income tax return are eligible for the payment.

Only physical checks will be sent out in an effort to prevent fraud. Most payments have already been mailed as of mid-August. Taxpayers who filed an extension can expect their check by January 31, 2023.

Read more: Everything You Need To Know About The Colorado Stimulus Check

Who Can Claim Supplemental Security Income

Those who are over 65 years old, as well as people with a disability or blind, with little or no income, and beneficiaries qualify based on their assets.

Individuals can own up to $2,000 in assets while couples can have up to $3,000 jointly.

Among the exempt assets for the SSA we can find life insurance policies worth up to $1,500, the beneficiary’s car, burial plots for the person and their immediate family, with burial funds up to $1,500, and finally the land or home where the person lives.

You May Like: Does Stimulus Check Affect Tax Refund

Irs Sending Letters To Over 9 Million Potentially Eligible Families Who Did Not Claim Stimulus Payments Eitc Child Tax Credit And Other Benefits Free File To Stay Open Until Nov 17

IR-2022-178, October 13, 2022

WASHINGTON Starting this week, the Internal Revenue Service is sending letters to more than 9 million individuals and families who appear to qualify for a variety of key tax benefits but did not claim them by filing a 2021 federal income tax return. Many in this group may be eligible to claim some or all of the 2021 Recovery Rebate Credit, the Child Tax Credit, the Earned Income Tax Credit and other tax credits depending on their personal and family situation.

The special reminder letters, which will be arriving in mailboxes over the next few weeks, are being sent to people who appear to qualify for the Child Tax Credit , Recovery Rebate Credit or Earned Income Tax Credit but haven’t yet filed a 2021 return to claim them. The letter, printed in both English and Spanish, provides a brief overview of each of these three credits.

“The IRS wants to remind potentially eligible people, especially families, that they may qualify for these valuable tax credits,” said IRS Commissioner Chuck Rettig. “We encourage people who haven’t filed a tax return yet for 2021 to review these options. Even if they aren’t required to file a tax return, they may still qualify for several important credits. We don’t want people to overlook these tax credits, and the letters will remind people of their potential eligibility and steps they can take.”

Oregon: Direct Payments Of $600

In March 2022, the Oregon legislature voted to approve one-time $600 payments to some residents. Taxpayers who were eligible to receive the earned income tax credit on their 2020 state tax return, and who lived in Oregon for the last six months of 2020, were eligible to receive one payment per household.

The state used federal pandemic aid to provide these direct payments to low-income residents, and more than 236,000 households received a payment. All payments were distributed by direct deposit or mailed check between June 23 and July 1, 2022.

The Oregon Department of Revenue website contains FAQs for residents with concerns about receiving their payment.

Recommended Reading: How Many Stimulus Checks Have Been Sent

How Will Child Support Arrears And Payments Be Impacted With Stimulus Check

I seem to be getting a lot of comments on this question around child support. The IRS has confirmed that the stimulus check payment will NOT be offset or intercepted for those owe tax, have a payment agreement or owe other federal or state debts. It will however be OFFSET for past-due child support. This is because a court order for child support continues until it is modified or terminated. Similarly with unemployment compensation stimulus increases, your child support may be withheld from the UI payments. You will get a notice from BFS if this happens.

Why Did I Get An Extra Social Security Payment This Month 2022

Soon, the fourth batch of Social Security payments will be distributed. The cost-of-living adjustment for around 64 million Social Security recipients increased to 5.9 percent in 2022, the highest rise in over 40 years. For Social Security claimants, this rise became effective on January 1 and on December 31.

You May Like: New Round Of Stimulus Check

What Changes Are Coming To Social Security In 2022

If you are already receiving Social Security benefits, you will receive a 5.9% COLA increase to your monthly Social Security benefit. This nice increase will be somewhat offset by the increase in Part B premiums. To earn the maximum of four credits in 2022, you need to earn $6,040 or $1,510 per quarter.

Is There A Deadline To Get My Third Stimulus Check

If you will be filing a full tax return, you have until the IRS closes their tax filing software on November 20, 2021. After this date, you can still claim the third stimulus check in 2022 by filing your taxes for Tax Year 2021.

If youre not required to file taxes, the deadline to use GetCTC.org is November 15, 2021. You can get the Recovery Rebate Credit using GetCTC.org, a simplified tax filing portal for non-filers. GetCTC is an IRS-approved service created by Code for America in partnership with the White House and U.S. Department of Treasury. You can use the portal even if youre not signing up for the Child Tax Credit advance payments.

Read Also: Is The $1 200 Stimulus Check Taxable

When Will The New Stimulus Payments/checks Be Made

The IRS will be responsible for making these stimulus payment checks and Treasury Secretary Mnuchin, whose department oversees the IRS, said that payments go out within a week of the bill being formally approved. This means payments could hit bank accounts before the end of the year. Payments would be made in multiple batches and if all goes according to plan the first round of payments would begin on 12/28 . Processing will go until January 15th for Direct Deposit payments. Checks and Debit Cards will take until the end of January 2020 to get processed. See more on the IRS Stimulus Check Payment Schedule.

The inclusion of the one-time stimulus payment however has also meant a cut in extra unemployment benefits that are also part of the overall package. More to come as the bill gets finalized and I will post updates. See this $600 stimulus update video for a quick summary as well.

Massachusetts: Up To 7% Of Income May Be Returned

Massachusetts taxpayers will receive rebate checksbut how much theyll receive wont be officially announced until September 20. Massachusetts Governor Charlie Baker will use a 1986 law to return $3 billion to state taxpayers.

The state auditors office declared the state surplus to be some $2.3 billion. And under Chapter 62Fthe 1986-era law, tax rebates are allowed when theres a revenue surplus.

Residents are expected to receive about 7% of the amount of income tax they paid to Massachusetts in 2021. For someone with a $75,000 income, that would mean a rebate of about $250, state officials told WBUR.

Recommended Reading: When Will South Carolina Receive Stimulus Checks

Can I Claim A Stimulus Check For Someone Who Is Deceased

Yes. For the third stimulus check, people who have died on or after January 1, 2021, are eligible to receive the third stimulus check. However, for married military couples, the date of eligibility is expanded. If the person who died was a member of the military and died before January 1, 2021, the surviving spouse can still receive the third stimulus check, even if they dont have an SSN.

For the first and second stimulus check, the IRS has stated that people who died on or after January 1, 2020, are eligible to receive both payments.

If they didnt receive the stimulus payments or didnt receive the full amounts that they are eligible for, spouses or other family members can file a 2020 federal tax return and claim it as part of their tax refund or use GetCTC.org if they dont have a filing requirement. The deadline to use GetCTC.org is November 15, 2021.

Social Security: Will Those Collecting Benefits See A Fourth Stimulus Check People Are Still Pushing For One

Those collecting Social Security and SSI payments have been hopeful for a fourth stimulus check as advocacy groups push for more help.

While groups have been working tirelessly to try to get people another payment who need it most, its not likely to happen.

Inflation has only risen and continues to remain incredibly high. As Social Security recipients battle the cost of living on a fixed income, Congress isnt doing much to help.

A petition was created to try and help seniors on Social Security receive a fourth stimulus check worth $1,400. Despite the major support it got, it probably isnt going to happen.

The Senior Citizens League has been the group pushing for the one time payment worth $1,400, according to The Sun. The reason for this is because Social Security and SSI recipients are living on a fixed income. As prices rise, these individuals incomes are not rising to keep up.

A letter was sent to Congress from the Senior Citizens League detailing why the need for a fourth stimulus check existed.

The group shared that theyve received hundreds of emails detailing the struggles seniors on Social Security face. Some are cutting their medication dosage in half while others are cutting back to only eating one meal per day.

Read Also: What To Do If You Didn’t Receive Your Stimulus Check

What If My Income Is Lower Than When I Filed My Last Tax Return

If you had decreased income in 2020 due to starting disability benefits and/or losing a job, you might be eligible for the money but you might not get a third stimulus check in 2021. This might happen if you filed a tax return for 2019 income that’s above the $75,000 or $150,000 thresholds, but you made less income in 2020. You should be able to get the stimulus payment as a rebate if you file a 2020 tax return.

Was There A Stimulus Check In 2021

Stimulus Update | 2021 $1,400 stimulus payment can be claimed for dead people in 2022. BALTIMORE The American Rescue Plan signed into law by President Joe Biden in March of 2021 delivered $1,400 stimulus checks to most Americans. The money was intended to help people get through the COVID-19 pandemic.

You May Like: How To Claim 2021 Stimulus Check

Will I Get A Check If I Have Other Income

If you receive income in addition to your disability benefits that makes your combined income over $75,000, your stimulus payment will be reduced. Similarly, if you are married and file a joint return, and your income combined with your spouse’s income is over $150,000, you’ll receive a reduced payment. Your stimulus payment, including any payment for dependents, will be reduced by a percentage of the amount over those thresholds.

What income does the IRS look at to determine if your payment should be reduced? The IRS will use your “adjusted gross income” from your 2020 tax return . If you didn’t file a tax return, the IRS will use your income from your Social Security or SSI checks.

Social Security Expedites Decisions For People With Severe Disabilities Agency Adds To Compassionate Allowances List

Andrew Saul, Commissioner of Social Security, today announced five new Compassionate Allowances conditions: Desmoplastic Small Round Cell Tumors, GM1 Gangliosidosis Infantile and Juvenile Forms, Nicolaides-Baraister Syndrome, Rubinstein-Tybai Syndrome, and Secondary Adenocarcinoma of the Brain. Compassionate Allowances is a program to quickly identify severe medical conditions and diseases that meet Social Securitys standards for disability benefits.

Social Securitys top priority is to serve the public, and we remain committed to improving the disability determination process for Americans, said Commissioner Saul. Our Compassionate Allowances program gets us one step closer to reaching our goals by helping us accelerate the disability process for people who are likely to get approved for benefits due to the severity of their condition.

The Compassionate Allowances program quickly identifies claims where the applicants condition or disease clearly meets Social Securitys statutory standard for disability. Due to the severe nature of many of these conditions, these claims are often allowed based on medical confirmation of the diagnosis alone. To date, more than 600,000 people with severe disabilities have been approved through this accelerated, policy-compliant disability process. Over the last decade, the list has grown to a total of 242 conditions, including certain cancers, adult brain disorders, and a number of rare disorders that affect children.

Also Check: Could There Be Another Stimulus Check

Fourth A $1400 Stimulus Check Is To Be Issued

Although various lobbyists have called for the option of issuing a fourth stimulus check, as of July, there is no guarantee that this will happen.

In fact, at this point, we are further away from this fourth check being issued than we were at the beginning of the year when it still seemed a fairly realistic probability. However, there are no indications to suggest that this is the case.

On the other hand, corresponding cost-of-living adjustments will likely continue to accrue throughout the year. It should recall that the cost-of-living adjustment in 2022 increased by 5.9%, one of the highest in the countrys recent history.

Thus, the Social Security Administration has issued estimates that envision the possibility of an increase of even 8% next year, thus meeting the challenge of high inflation. However, we will not know this until 2023.

Therefore, it is complex that will issue a fourth stimulus check. On the other hand, if the third check has not yet been cashed, you should start the claiming process.

Remember, first of all you should contact the relevant administration. They will likely require documents such as your 2020 tax return .

Lets think that, in the case of older people, the mortality rate caused by the pandemic was very high: someone who died in 2020 was not entitled to the stimulus stub for the year 2021.

Megan Fox Age In 2007

When can social security recipients expect the 4th stimulus check 2022. A fourthstimuluscheck is being made available at the beginning of the new year. The amounts will be $2800 for couples, $1400 for single adults and $1400 for each eligible dependent per the final bill crafted 4ThStimulusCheck November 2022 E Jurnal from ejurnal.co.id..

Social Security benefits to increase in 2022 . Social Security benefits are set to increase next year by their highest rate in about 40 years, rising 5.9% from 2021 due to this years cost-of. When can social security recipients expect the 4th stimulus check 2022.

When cansocialsecurityrecipientsexpectthe 4thstimuluscheck 2021. Here is the summary of the 2021 socialsecurity changes: When your notice will arrive in the mail: Source: www.pinterest.com Socialsecurityrecipients are set to receive a 5.9% monthly increase in 2022, the largest boost in almost 40 years.. 4Th Stimulus Check 2022 For Social Security Recipients from neswblogs.com Joe manchin, a democrat from west virginia, hasnât agreed to support the build back better act, which has.. Jan 16, 2022· The third round of stimulus checks saw more than 169 million payments sent out to eligible Americans, and some are pushing for a fourth as inflation continues to bite.

top 100 contemporary christian songs

Read Also: How To Get 1400 Stimulus Check