I Am An Ssi Or Ssdi Recipient And I Have A Representative Payee Will I Receive The Payment Or Is It Sent To My Payee Does My Payee Have The Right To Tell Me How To Spend My Payment Or To Keep The Payment From Me

The payment will be sent direct deposit to the same bank account as your Social Security payments. This bank account is most likely controlled by your payee. However, your payee does not have legal authority over this payment, because they are not Social Security benefits. You control how this payment is spent, not your payee. Your Economic Impact Payment is not a Social Security Benefit. It is a payment issued by the IRS. If your payee tells you that you cannot have access to your Economic Impact Payment or your payee does not provide the payment to you by May, 31, 2020, please contact our office at 1-877-776-1541 or [email protected] to report this issue.

How Should I Claim Missing Stimulus Money For My Dependents

If you used the IRS Non-Filers tool from May 5 to Aug. 15, 2020, the IRS should have automatically issued a catch-up payment for your dependents in October 2020. If you received your original stimulus money by direct deposit, you should have gotten the catch-up payment the same way. Others would have received it in the mail.

If you filed for your missing dependent money by Nov. 21, 2020, the payment should have arrived by the end of 2020 in the same way you received your first payment . If you missed the deadline, your payment should be included on your 2020 tax return in 2021 if you file for a Recovery Rebate Credit.

To see the status of your or your dependents payment for the first or second payments, check your IRS account.

Am I Eligible For An In

Due to the COVID-19 pandemic, you can only enter our offices if you have an appointment. If you believe you qualify for an in-person appointment due to dire circumstances, call your local office. You can look up the phone number for your local office by accessing our office locator. Please note that appointments may not be immediately available, depending on local health and safety conditions and staffing.

Also Check: When Did The First Stimulus Check Come Out

Don’t Miss: Who To Contact About Stimulus Check Not Received

When Will I Get My Third Stimulus Payment If Im In Either The Ssi Or Ssdi Program

On Friday, the IRS said a payment date for those who receive Social Security and other federal benefits will be announced shortly. The Social Security Q& A webpage for the third stimulus payment says it will add helpful questions and answers to the page soon.

Dont Miss: How To Check For Stimulus Checks

Am I Eligible To Receive The Payment

You are eligible for an Economic Impact Payment if – – You are a United States citizen or resident – You are at least 18 years old – You have a valid Social Security number – You are not claimed as a dependent – Your annual income is below: – $75,000 if you are an individual – $112, 500 if you are the head of a household or – $150,000 if you file taxes jointly as a married couple*

*If your annual income is higher than these amounts, you may still receive a payment at a lesser amount. More eligibility details can be found at:

You May Like: How Do I Claim My Third Stimulus Check

When Could The Stimulus Payments Start

Following approval of the bill on March 11th, millions of Americans will start seeing the third stimulus payments by mid-to-late March 2021 per the estimated IRS payment schedule and official Biden administration guidance. Comments below confirm these are going out now. You can also check the IRS Get May Payment tool for the latest status of your payment. See payment FAQs from the second round of payments, which will also apply for the most part this time around.

Due to the fact that payments are going out in the middle of tax season it may be very hard to get a hold of someone in the IRS to help with payment issues and you will likely have to wait until after April 15th to follow up on issues.

Will I Get A Stimulus Check If I Havent Filed Taxes In 5 Years

For eligible individuals, the IRS will still issue the payment even if they havent filed a tax return in years. The quickest way to receive a stimulus payment is via direct deposit. Still, that can be inaccessible for some Americans. The payment will be mailed as a check or debit card to the address on the return.

Don’t Miss: Can I Still File For My Stimulus Check

Colorado: $750 Rebate Payments

Colorado is sending tax rebates of $750 to individual tax filers and $1,500 for joint filers. Colorado residents for the entire 2021 tax year who are 18 or older and filed their 2021 state income tax return are eligible for the payment.

Only physical checks will be sent out in an effort to prevent fraud. Most payments have already been mailed as of mid-August. Taxpayers who filed an extension can expect their check by January 31, 2023.

Dont Miss: I Didnt Receive Stimulus Check

Ssdi Recipients Who Started Claiming On Or Before 1997

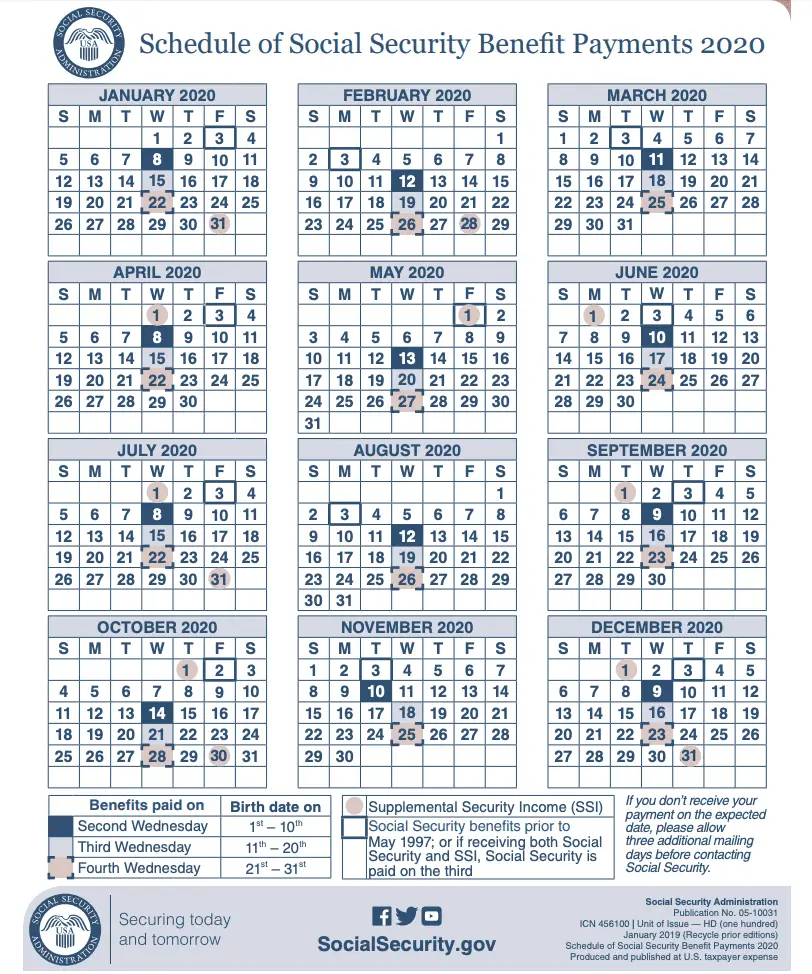

If you started receiving SSDI benefits on or ahead of 1997, you’ll get your payments on the third of every month.

If the third lands on a weekend, or an eligible holiday, you’ll get your benefits on the banking day before.

In other words, the day you were born does not matter.

The payment schedule is as follows for the remainder of 2022:

Don’t Miss: Have Not Received Stimulus Check

How And When Will I Receive The Payment

– If you filed taxes in 2018 or 2019, you can check your payment status at , and you can choose to receive your payment as direct deposit or check if the payment has not been sent yet. – If you are an SSI or SSDI recipient, your payment will come through direct deposit, Direct Express debit card, or a paper check whatever method your SSI or SSDI benefits are normally received. – You can see if your payment has been delivered and to which bank account it was sent, and when you can expect to receive your payment at. Information for SSI or SSDI recipients is not available at this site yet, but according to the federal government, those payments are expected to arrive before early May 2020.

Will Disability Get A Raise In 2022

People who get retirement or disability payments get an adjustment every year to keep up with inflation. Social Security and Supplemental Security Income recipients will see a raise in payments in 2022 the highest increase in almost four decades, according to the latest estimate from The Senior Citizens League.

Recommended Reading: Never Received 3rd Stimulus Check

The Social Security Bridge Strategy

While waiting to claim your benefits to maximize them, you may want to consider a reverse mortgage to make ends meet.

According to Yahoo Finance, the average mortgage holder in the US has accessible home equity of $185,000.

This cash can be used by those who have to retire early so they dont have to claim benefits right away.

Dont Miss: When Were The Stimulus Checks Issued

What About On Social Security Or Ssdi

Social Security recipients, disability , Survivor Beneficiaries and Railroad Retirees who are not otherwise required to file a tax return will also be eligible for the stimulus payments, as long as their total income does not exceed the eligibility income limits above. The IRS in conjunction with the Treasury and Social Security Administration announced that recipients of Supplemental Security Income will automatically receive the $1200 Stimulus Check . See details here. This group of recipients will receive the stimulus check the same way they currently get their federal benefits in early May with no further action needed on their part.

However note that because the IRS has no information regarding dependent data for this group of recipients, the $500 kid dependent stimulus payment would not be automatically paid to this group. They need to use the non-filers tool on the IRS website to claim this.

Also Check: Where Can I Claim My Stimulus Check

Th Stimulus Check Update And Payment Status In 2022

This article provides updates, income qualification thresholds and FAQs on the approved and proposed stimulus checks, also known as Economic Impact payments.

While multiple rounds of payments have been made over the last two years, many are asking if the government will make another of payments to help folks cope with high inflation and the rising costs of basic goods and services.

Each round of stimulus check payments had slightly different rules so please ensure you review each payment round separately. Click the links below to jump to the relevant stimulus payment.

If you have not received one or more of your stimulus payments, then you will need to claim this as a recovery rebate via your tax filing for the relevant year. This include retroactive stimulus check payments.

Social Security Benefits Will Be Paid Monthly On One Out Of Three Wednesdays

When it comes to managing your life as a retiree, it almost goes without saying that youll need to keep abreast of the yearly Social Security tweaks and adjust your budget accordingly. However, with so much new information to keep track of, it can be easy to forget some of the smaller details, such as when benefit payments are distributedespecially considering that this answer isnt exactly clear-cut and varies from person to person. As such, we have put together a Social Security benefits payment schedule for 2023, which can be found below.

Also Check: What Were The Stimulus Payments In 2020 And 2021

Can Homeless People Get A Stimulus Check

Yes, they can get a stimulus payment. The only way to get a payment is to file a tax return with the IRS. You can do this for free. If you dont have a fixed address and you dont have a bank account, check with a local community or religious organization or with a homeless shelter to see if you have options for getting your mail from the IRS delivered there.

Keep in mind that it may take some time for the IRS to process your tax return and your stimulus payment.

What If My Spouse Or Ex

If you did not get all or some portion of your Economic Impact Payments you can file a 2020 tax return and claim these amounts on line 30 of the form. The IRS is referring to this as the recovery rebate and will allow you to claim any of the EIPs that you did not get in advance. You may get a denial letter from the IRS, but that is the opportunity to reply and explain your situation to the IRS.

Vermonters with a low income can contact us for help at the Vermont Low-Income Taxpayer Clinic by filling out our form or calling 1-800-889-2047.

Read Also: Irs 1400 Stimulus Check Tracker

Also Check: Didn’t Get Third Stimulus Check

When Could Stimulus Payments Start

Following approval of the bill on March 11th, millions of Americans will start seeing the third stimulus payments by mid-to-late March 2021 per the estimated IRS payment schedule and official Biden administration guidance. Comments below confirm these are going out now. You can also check the IRS Get May Payment tool for the latest status of your payment. See payment FAQs from the second round of payments, which will also apply for the most part this time around.

Due to the fact that payments are going out in the middle of tax season it may be very hard to get a hold of someone in the IRS to help with payment issues and you will likely have to wait until after April 15th to follow up on issues.

Ssi And Ssdi: Third Stimulus Payment Eligibility Rules

In the just-approved American Rescue Plan, people who receive SSI and SSDI will once again automatically qualify to receive a third stimulus check, for $1,400, as they did for the first and second round of payments.

For the first two rounds, those individuals were eligible so long as they had a Social Security number and werent claimed as a dependent on someone elses tax return, and so long as their household income didnt exceed the threshold set .

The new bill that authorized the third check expands stimulus payment eligibility to dependents of all ages, including young adults age 17 to 24 and older adult dependents. It also increases the amount set aside for those dependents to $1,400 each. Another change: This time around, the checks will be more targeted than they were in the first two rounds, meaning that single taxpayers who earn $75,000 or less per year will be eligible for the full amount, while those who earn more than $80,000 per year wont get any money. That means some families could get more money, while others could get less or none at all.

Those receiving Railroad Retirement and Veterans Affairs benefits also automatically qualify for a payment, as they did in the first and second round, the IRS said.

The rules surrounding the third stimulus check can get confusing, fast.

Recommended Reading: When Were Stimulus Checks Sent Out

You May Like: How To See Stimulus Check History

What Is The Average Social Security Benefits Amount In 2022

The average Social Security retirement benefit amount for 2022 is $1,665.18 a month.

The maximum benefit is $3,345 a month for someone who files for Social Security in 2022 at full retirement age .

Heres how the figures break down by recipient, as of March 2022.

| Type of beneficiary |

|---|

NOTE: People born on January 1 of any year, refer to the previous year.

If I Owe Back Child Support Will I Still Get A Payment

Yes. If you or your spouse owes back child support, your stimulus payment cannot be garnished to pay that debt. The same is true if you owe federal or state debts: your stimulus payment cannot be garnished. Your payment wont be levied by the IRS, either.

Although the second and third stimulus payments cant be garnished for unpaid child support, the amounts can be garnished if you dont get money up front and need to claim the credits on your taxes.

You May Like: Do I Get A Stimulus Check 2021

You May Like: New Round Of Stimulus Checks

File Your Tax Returns Says Irs

Hes also encouraging taxpayers to file their tax returns as soon as possible if they havent already, even though the deadline to submit tax returns has been delayed to July 15 from April 15, so the IRS has up-to-date direct deposit information on file.

In this environment we dont want people to get checks, Mnuchin said. We want to put money directly in their account.

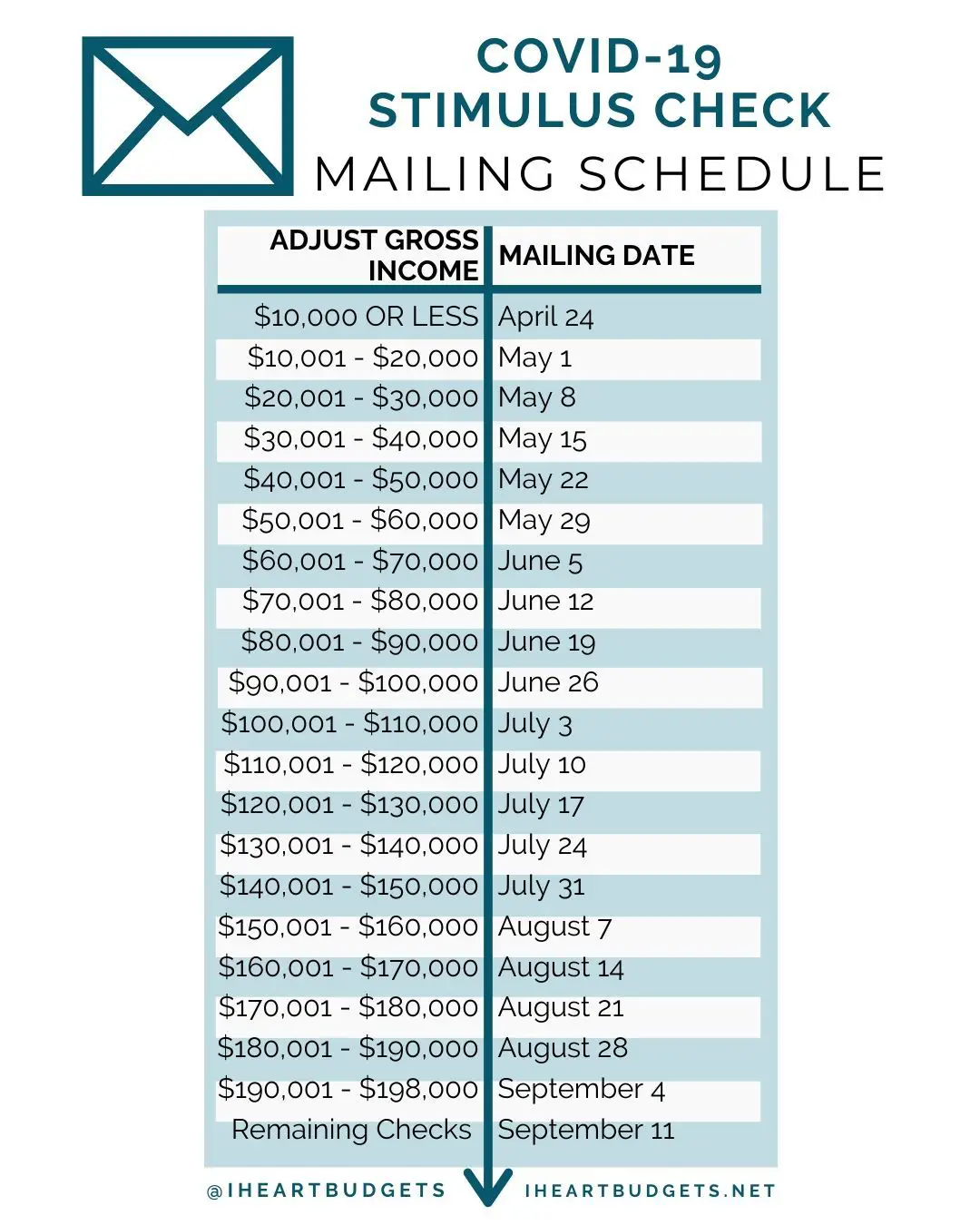

The document produced by the House committee indicates that the stimulus paymentsincluded in the $2.2 trillion economic rescue bill passed last week to combat the fallout of the coronaviruscould take months to circulate into the economy, potentially blunting the effect of a quick infusion of cash. Lawmakers have urged the IRS to process the payments quickly so that unemployed workers can use them to pay bills.

The law included payments of $1,200 for each adult earning as much as $75,000, or couples collectively making $150,000, plus $500 for each child under 17. Those amounts are reduced for people with higher incomes, and individuals with $99,000 in earnings get nothing, even if they have children.

The Treasury Department has said that Social Security beneficiaries who arent required to file a tax return dont need to do anything to receive their payment, but the House document indicates those who arent required to file taxes annually might want to submit a simple tax return and include direct deposit information if they want to receive their payments faster.

Recommended Reading: Irs.gov 2nd Stimulus Check

Do I Have To Pay Taxes On My Stimulus Payment

No. Since the stimulus check is considered a refundable tax credit, it is not classified as earned income. Hence not considered taxable income you will have to report in your 2020 tax return . It also wont affect your income for purposes of determining eligibility for federal government assistance or benefit programs.

This payment also does not have to be paid back if any over payment happens or your gross income in 2020 changes. This includes your income rising to above the qualifying thresholds. If you unexpectedly got the payment, congratulations! You get to keep it now.

Returning Incorrect Stimulus Check Payments

A few people have commented that a spouse, relative or child who died since they filed a 2018 or 2019 tax return received a stimulus check payment. The IRS has provided official guidance on this issue which states that any payments made to someone who died before receipt of the payment should be returned to the IRS in full.

The exception to this is for payments made to joint filers and one spouse who had not died before receipt of the Payment, in which case, you only need to return the portion of the Payment made on account of the decedent

Don’t Miss: How Much Was The Stimulus Check In March 2021