Social Security And Oig Announce Additional Anti

The Social Security Administration and its Office of the Inspector General announced four new Cooperative Disability Investigations Units opened across the country. CDI Units identify, investigate, and prevent Social Security disability fraud, and are a very successful part of the agencys anti-fraud initiative. Four new statewide offices recently opened across the country, in Cheyenne, Wyoming Las Vegas, Nevada Manchester, New Hampshire and Omaha, Nebraska.

The CDI Program helps ensure the integrity of Federal disability programs by resolving questions of potential fraud before benefits are ever paid. The innovative initiative continues to be successful by bringing together personnel from Social Security, its OIG, State Disability Determination Services , and local law enforcement agencies to investigate and analyze suspicious or questionable Social Security disability claims. CDI Unit efforts assist disability examiners in making informed decisions, ensure payment accuracy, and generate significant taxpayer savings for both Federal and State programs.

Social Security has zero tolerance for fraud and the CDI Program serves a vital role in detecting potential fraud and preventing it, said Andrew Saul, Commissioner of Social Security. We tirelessly work at the national and local levels to stop would-be crooks and continue to be good stewards of taxpayer money by protecting the integrity of our programs.

Supplemental Security Income Recipients Will Receive Automatic Covid

The Social Security Administration announced today that Supplemental Security Income recipients will receive automatic Economic Impact Payments directly from the Treasury Department. Treasury anticipates these automatic payments no later than early May.

SSI recipients with no qualifying children do not need to take any action in order to receive their $1,200 economic impact payment. The payments will be automatic.

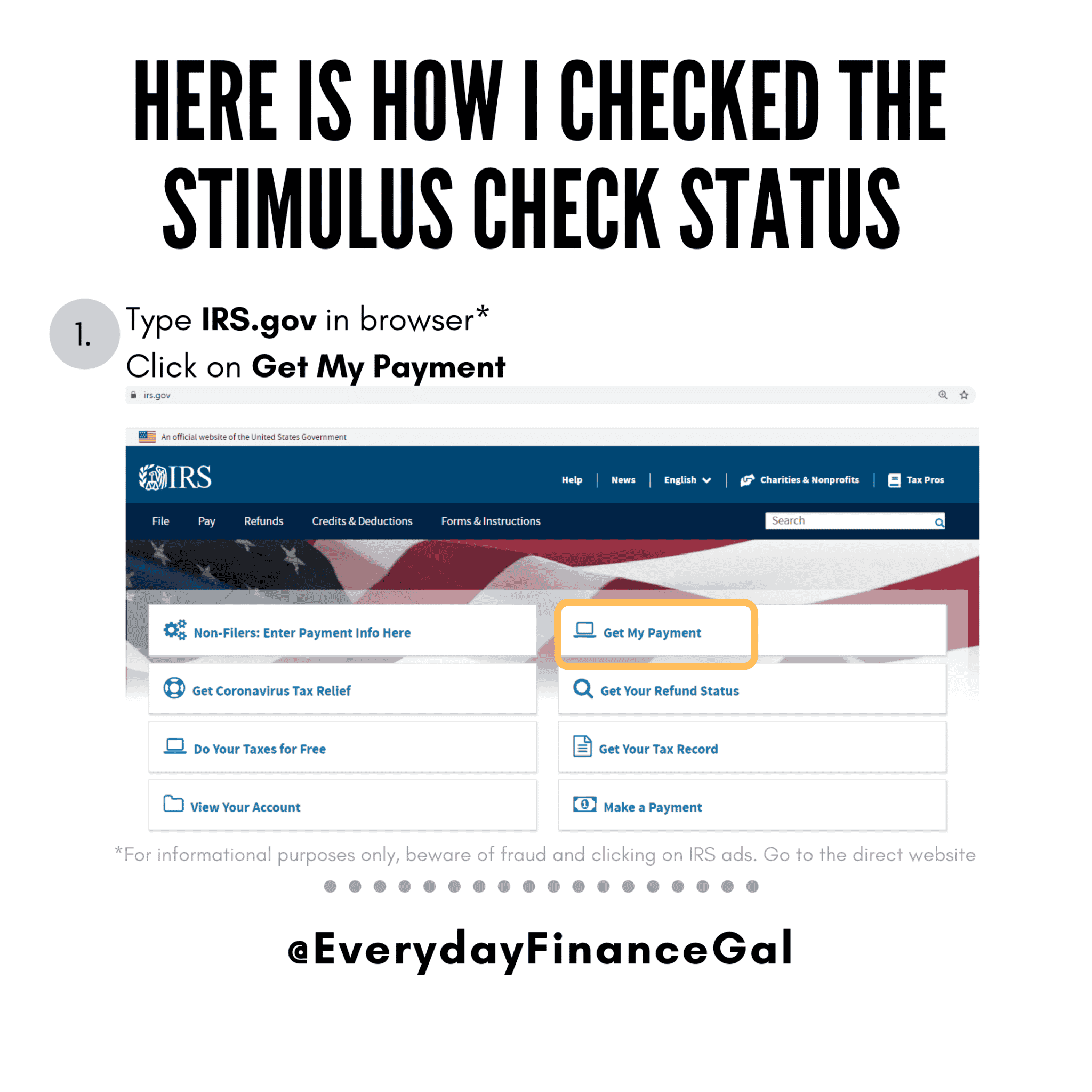

SSI recipients who have qualifying children under age 17, however, should not wait for their automatic $1,200 individual payment. They should now go to the IRSs webpage at www.irs.gov/coronavirus/non-filers-enter-payment-info-here and visit the Non-Filers: Enter Your Payment Info section to provide their information. By taking proactive steps to enter information on the IRS website about them and their qualifying children, they will also receive the $500 per dependent child payment in addition to their $1,200 individual payment. If SSI beneficiaries in this group do not provide their information to the IRS soon, they will have to wait until later to receive their $500 per qualifying child.

Social Security retirement, survivors, and disability insurance beneficiaries will also qualify for automatic payments of $1,200 from Treasury. These payments are anticipated to start arriving around the end of April.

Please note that the agency will not consider Economic Impact Payments as income for SSI recipients, and the payments are excluded from resources for 12 months.

How Will I Be Receiving My Third Stimulus Check

If you didn’t submit a 2019 or 2020 tax return or used the Non-Filers tool in 2020 and you receive your monthly Social Security benefits by Direct Express card, it’s likely your third payment will be added to your Direct Express card, according to the Social Security Administration and this informational PDF from Direct Express. Note that you’ll receive one free withdrawal in addition to your usual free monthly withdrawal for monthly benefits.

For the first two 2020 stimulus payments, most SSI and SSDI recipients received them through a non-Direct Express bank account or as a paper check if they didn’t have current bank account information on file with the IRS. The IRS said SSI and SSDI recipients should have gotten their latest round of stimulus money the same way they received their earlier payments, including Direct Express for some.

Read Also: Stimulus Check 2022 Who Qualifies

When Is The Latest Round Of Stimulus Payments Expected For Ssi Ssdi Beneficiaries And Veterans

Federal beneficiaries who filed a 2019 or 2020 tax return or used the Non-Filers tool in 2020 may have already received a stimulus payment, or could get one in a future batch of checks being sent out by the government.

For most everyone else, payments started going out on April 7 by direct deposit or on your Direct Express card. For those receiving payments through the mail, those checks began on April 9. If you have a foreign address and don’t typically file a tax return, electronic payments went out around April 21 and paper checks on April 23. Veterans who don’t file taxes ordinarily should have received their payment on April 14.

The IRS and Treasury will use the information it has on file to automatically send you a check . People who have already filed a 2020 tax return this year to claim missing stimulus money may find that the IRS will use this information instead of your 2019 details if it has processed your latest return .

Some people may need to file a 2020 tax return, even if they don’t usually file, so the IRS has all the information needed to send payments to cover eligible dependents.

When Will I Get My Third Stimulus Payment If Im In Either The Ssi Or Ssdi Program

On Friday, the IRS said a payment date for those who receive Social Security and other federal benefits will be announced shortly. The Social Security Q& A webpage for the third stimulus payment says it will add helpful questions and answers to the page soon.

- The first group of $1,400 payments is now going out via direct deposit. When you get a new payment could depend on how you get your funds direct deposit, mailed check or EIP card.

- The IRS and Treasury will use the information it has on file to automatically send you a check. If you already filed your 2020 tax return this year to claim missing stimulus money or otherwise, the IRS will likely use this information instead, if it processed that return.

- The government will conduct an outreach program letting taxpayers know if theyre eligible for any funds, and offering help if needed.

- Any missing payment from a third check may be paid out as part of tax season 2021, a year from now. Youd likely have to file a tax return to claim it, if the IRS were to follow the same pattern for missing stimulus check money as now.

Don’t Miss: How To Check For Stimulus Checks

New Guidance About Covid

The Treasury Department launched a new web tool allowing quick registration for Economic Impact Payments for eligible individuals who do not normally file a tax return, and also announced that it would begin making automatic payments. However, for some people receiving benefits from the Social Security Administration–specifically those who have dependent children under the age of 17–it is to their advantage to go to this portal to ensure they also get the $500 per dependent Economic Impact Payment. I encourage them to do this as soon as possible, and want to provide the following details:

People who receive Social Security retirement, survivors, or disability insurance benefits and who did not file a tax return for 2018 or 2019 and who have qualifying children under age 17 should now go to the IRSs webpage at www.irs.gov/coronavirus/economic-impact-payments to enter their information instead of waiting for their automatic $1,200 Economic Impact Payment. By taking proactive steps to enter information on the IRS website about them and their qualifying children, they will also receive the $500 per dependent child payment in addition to their $1,200 individual payment. If Social Security beneficiaries in this group do not provide their information to the IRS soon, they will have to wait to receive their $500 per qualifying child.

We will continue to update Social Securitys COVID-19 web page at as further details become available.

Stimulus Checks For Ssi And Ssdi: 12 Key Things To Know About Your Third Payment

If you receive Social Security or Veterans Affairs benefits, we can tell you the 411 on the latest stimulus check.

Alison DeNisco Rayome

Managing Editor

Alison DeNisco Rayome is a managing editor at CNET, now covering home topics after writing about services and software. Alison was previously an editor at TechRepublic.

Katie Teague

Writer

Katie is a writer covering all things how-to at CNET, with a focus on Social Security and notable events. When she’s not writing, she enjoys playing in golf scrambles, practicing yoga and spending time on the lake.

Shelby Brown

Staff Writer

Shelby Brown is a writer for CNET’s services and software team. She covers tips and tricks for apps and devices, as well as Apple Arcade news.

The IRS continues to send out batches of the third stimulus payments — and some are going to people who receive SSI or SSDI benefits. If you qualify for Social Security benefits and you’re one of the few who hasn’t received their check already, you might want to start tracking it down. If your benefits come on a Direct Express card, your payment should have arrived already. But you might still be waiting for your payment if it’s expected to come in the mail or by direct deposit.

Also Check: Get My Stimulus Payment Phone Number

Latest From Direct Express

On Wednesday, Direct Express said account holders expecting funds can check their pending deposits up to two days before the payment date.

The company tweeted Wednesday: “Expecting a payment? You can check pending deposits 1-2 days prior to payment date. Call the number on the back of your card & select Opt 5.”

Expecting a payment? You can check pending deposits 1-2 days prior to payment date. Call the number on the back of your card & select Opt 5.

Direct Express® card

Only current Direct Express cardholders are able to receive their third stimulus payment on their cards. Those who currently don’t have a Direct Express card cannot sign up for one now in order to receive their stimulus funds, the company stated on March 23.

Stimulus payments sent to an account that is closed or no longer active “will be returned and the IRS will reissue the payment,” the company added.

Ssdi Recipients Who Started Claiming On Or Before 1997

If you started receiving SSDI benefits on or ahead of 1997, you’ll get your payments on the third of every month.

This means you should get your payment on Wednesday, August 3.

If the third lands on a weekend or an eligible holiday, you’ll get your benefits on the banking day before.

This actually happens in September, when the third falls on a Saturday, meaning you’ll get the cash on September 2 instead.

You May Like: Irs Stimulus Check Sign Up

Veteran Affairs Benefits Recipients May Not See Stimulus Payments Until Mid

The IRS and the Treasury Department finally have a payment date for the millions of Social Security recipients and most other federal beneficiaries who do not have to file tax returns.

The majority of their stimuluspayments will be sent electronically, with an official payment date of April 7, according to the announcement Tuesday.

In total, about 127 million payments worth $325 billion have been distributed over the past three weeks. The American Rescue Plan provides for payments of up to $1,400 for eligible individuals and $2,800 for couples filing joint returns. Dependents, regardless of age, also receive $1,400 each.

The IRS had said it would automatically send economic impact payments, which is what the agency calls the stimulus payments, to people who did not file returns but who receive Supplemental Security Income , Social Security retirement, survivor or disability , Railroad Retirement, or Veterans Affairs benefits. But many of these federal beneficiaries, including nearly 30 million Social Security and SSI benefit recipients, have been waiting for news about their payments.

I am a 69-year-old widow living on SSI widows benefits, a Florida woman said by email. I can use the extra money, and I hear on the news every day how many people in my area have received their third stimulus payment. What is going on? I can really use this money.

Heres a roundup of other announcements the IRS has made over the past several days.

Social Security Combined Trust Funds Projection Remains The Same Says Board Of Trusteesprojections In 2020 Report Do Not Reflect The Potential Effects Of The Covid

The Social Security Board of Trustees today released its annual report on the long-term financial status of the Social Security Trust Funds. The combined asset reserves of the Old-Age and Survivors Insurance and Disability Insurance Trust Funds are projected to become depleted in 2035, the same as projected last year, with 79 percent of benefits payable at that time.

The OASI Trust Fund is projected to become depleted in 2034, the same as last years estimate, with 76 percent of benefits payable at that time. The DI Trust Fund is estimated to become depleted in 2065, extended 13 years from last years estimate of 2052, with 92 percent of benefits still payable.

In the 2020 Annual Report to Congress, the Trustees announced:

- The asset reserves of the combined OASI and DI Trust Funds increased by $2.5 billion in 2019 to a total of $2.897 trillion.

- The total annual cost of the program is projected to exceed total annual income, for the first time since 1982, in 2021 and remain higher throughout the 75-year projection period. As a result, asset reserves are expected to decline during 2021. Social Securitys cost has exceeded its non-interest income since 2010.

- The year when the combined trust fund reserves are projected to become depleted, if Congress does not act before then, is 2035 the same as last years projection. At that time, there would be sufficient income coming in to pay 79 percent of scheduled benefits.

Other highlights of the Trustees Report include:

You May Like: Where Is My 2nd Stimulus Check

What Is The Average Social Security Benefits Amount In 2022

The average Social Security retirement benefit amount for 2022 is $1,665.18 a month.

The maximum benefit is $3,345 a month for someone who files for Social Security in 2022 at full retirement age .

Heres how the figures break down by recipient, as of March 2022.

| Type of beneficiary |

|---|

NOTE: People born on January 1 of any year, refer to the previous year.

Child Or Dependent Qualification For The $500 Payment

Several readers have asked questions around the $500 child dependent additional stimulus payment. To get this payment you must have filed a 2018 or 2019 tax return and claimed the child as dependent ANDthe child must be younger than 17-years-old at the end of 2020. They must also be related to you by blood, marriage, or adoption . There is no limit to the number of dependents who can qualify for the additional $500 in one household.

This age limit is much younger than what is used by the IRS in the qualifying child test where a child must be younger than 19 years old or be a student younger than 24 years old as of the end of the calendar year. Hence the confusion being caused by this. So just remember if your child or eligible dependent is 17 or over you cannot claim the stimulus payment for them.

College Kids and High School Seniors

The younger than 17 yr old requirement has ruled out several thousand college students and high school kids who are older than 17, but still being claimed as a dependent by their parents on their federal tax return.

However if you are a college student AND filed a recent tax return you can qualify for a standard/adult stimulus check per the above eligibility rules. But note as soon as you file a return you cannot be claimed as a dependent by others, which means they lose certain other tax benefits and credits.

Recommended Reading: How To Sign Up For The Stimulus Check

Social Security Modernizing Its Disability Programdecades Old Rule Updated To Reflect Todays Workforce

Social Security Commissioner Andrew Saul announced a new final rule today, modernizing an agency disability rule that was introduced in 1978 and has remained unchanged. The new regulation, Removing the Inability to Communicate in English as an Education Category, updates a disability rule that was more than 40 years old and did not reflect work in the modern economy. This final rule has been in the works for a number of years and updates an antiquated policy that makes the inability to communicate in English a factor in awarding disability benefits.

It is important that we have an up-to-date disability program, Commissioner Saul said. The workforce and work opportunities have changed and outdated regulations need to be revised to reflect todays world.

A successful disability system must evolve and support the right decision as early in the process as possible. Social Securitys disability rules must continue to reflect current medicine and the evolution of work.

Social Security is required to consider education to determine if someones medical condition prevents work, but research shows the inability to communicate in English is no longer a good measure of educational attainment or the ability to engage in work. This rule is another important step in the agencys efforts to modernize its disability programs.

The rule will be effective on April 27, 2020.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.

Answer A Few Questions To Check Your Eligibility

Are you wondering when you’ll receive your Social Security check each month? The date you receive your monthly disability payments depends on whether you’re receiving SSI or SSDI, or a combination of the two. If you’re receiving SSDI alone, your payment date depends on your birthday. If you get SSI, your payment date is around the beginning of the month.

Read Also: New Home Purchase Stimulus Program

Supplemental Security Income Recipients Act Now Go To Irsgov A Message From Social Security Commissioner Andrew Saul Action Needed For People Receiving Ssi With Dependents And Who Do Not File Tax Returns To Receive $500 Per Child Payment

Supplemental Security Income recipients who dont file tax returns will start receiving their automatic Economic Impact Payments directly from the Treasury Department in early May. People receiving SSI benefits who did not file 2018 or 2019 taxes, and have qualifying children under age 17, however, should not wait for their automatic $1,200 individual payment. They should immediately go to the IRSs webpage at www.irs.gov/coronavirus/non-filers-enter-payment-info-here and visit the Non-Filers: Enter Your Information section to provide their information. SSI recipients who have dependent children and did not file 2018 or 2019 taxes need to act by Tuesday, May 5, in order to receive additional payments for their eligible children quickly.

I urge SSI recipients with qualifying children and who do not normally file taxes to take action now. Immediately go to IRS.gov so that you will receive the full amount of the Economic Impact Payments you and your family are eligible for.

Lastly, a word of caution. Be aware of scams related to the Economic Impact Payments. There is no fee required to receive these payments. Dont be fooled.

Visit the agencys COVID-19 web page at for important information and updates.

Click here to view the IRS press release about this important issue.

To get more Social Security news, follow the Press Office on Twitter @SSAPress.